| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-06-23 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- 5 points to be considered before buying or selling any stocks

5 points to be considered before buying or selling any stocks

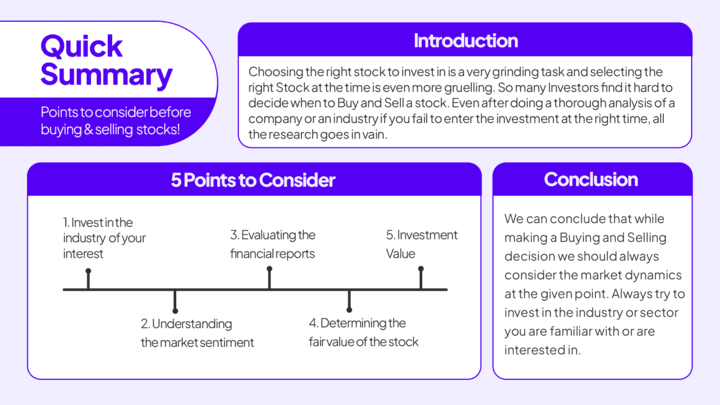

Choosing the right stock to invest in is a very grinding task and selecting the right Stock at the time is even more gruelling. So many Investors find it hard to decide when to Buy and Sell a stock. Even after doing a thorough analysis of a company or an industry if you fail to enter the investment at the right time, all the research goes in vain. Similarly, not exiting from the Stock at the right time can also result in losses. So, what to do in that case?

5 Points to Consider Before Buying and Selling

Below We have mentioned five such points that could help you to make Buying and Selling decisions timely. So that you could invest in the stock market with ease.

1. Invest in the industry of your interest:

- The first step for anybody, when they start investing in the stock market, is choosing the right industry. Choosing the right industry, sector or business is the core foundation for building a strong portfolio.

- Legends like Warren Buffet always suggest investing in companies in which you have an interest or you are familiar with their business. It encourages you to regularly update yourself on the company’s performance.

- To make an appropriate Buy or Sell decision it is very important to be updated with the company’s performance. When you are familiar with a company, or industry and know how the price reacts to market dynamics, it becomes simple to ignore unnecessary news and stick to your target.

Therefore, it is always suggested to invest in companies that you know well. Who’s business model excites you and you are willing to hold the stock for a longer period?

2. Understanding the Market sentiment:

For example,

We have seen that during COVID-19 the markets were affected badly because of fear among the people. At that time the market had a bearish sentiment, the stocks of so many companies were at a price lower than their actual value. Which was a very good buying opportunity in certain specific sectors like FMCG, Healthcare, etc.

3. Evaluating the financial reports:

Understanding and interpreting the company’s financial reports helps you to have a clear viewpoint on Buying and Selling decisions. The financial reports of the company consist of the balance sheet, profit and loss statement and the cash flow statement.

- A Balance Sheet is a concise summary of the company’s current market standing. Showing what all the company’s assets and liabilities are and how are they financing their operations.

- The Profit and Loss Statement depicts the performance of the company during a financial year. It shows how effectively the company is using their resources to generate revenue and how much expense they are incurring.

- Cash is considered to be the lifeline of any business. Having a positive cash flow is a big green flag for any company. The Cash Flow Statement shows the net flow of cash in the business during a financial year, from the operating, financing and investing activities of the business.

Being able to read and understand the financial reports of the company helps the individual to make optimum buying and selling decisions.

Financial reports provide you with insight into the sales growth, gross and net margins, and profitability of the company which helps you to determine whether the company is making any progress or not.

4. Determining the fair value of the stock:

Evaluating the fair price of the share is very important before buying or selling it. Many financial ratios help you assess that if the share is fairly valued or not, on the stock exchange.

Three Important ratios that you can look at

- P/E Ratio

- Debt to Equity Ratio

- Intrinsic value

Let’s briefly understand each one of them-

- P/E Ratio:

The P/E ratio shows the relation between the stock price and the company’s earnings. It is calculated by dividing the current market price of the stock by the earnings per share.

- Debt to Equity Ratio:

The debt-to-equity ratio is a financial ratio that is used to assess how much proportion of debt to equity a company is using to finance its assets.

Debt is the creditor or debt holders’ money that is invested in the company against which they receive a payment in the form of interest regularly.

- Intrinsic value:

Intrinsic value is the anticipated value of any stock. Based on specific parameters the IV of any stock is calculated. Taking into consideration both tangible and intangible factors.

Intrinsic value = Future cash flows(1+ discount rate)#of periods

5. Investment goal

While investing in the stock market or building your portfolio it is very important to set your financial investment goals. Some Goals are short-term, and some are long-term. It is very important for an individual to correctly pre-define them to make the buy and sell decision at the right time.

Various factors determine one’s investment goals like the need for money in the coming years. A person who might not need his money for a decade can invest in more riskier assets. On the other hand, a person who might need his money in the coming years will invest in more liquid assets.

Read Also: What is a good rule for investing in stocks?

Conclusion

Summarising the above article We can conclude that while making a Buying and Selling decision we should always consider the market dynamics at the given point. Always try to invest in the industry or sector you are familiar with or are interested in. We have also seen that even at Rs.1000 a stock could be undervalued. Whereas, a stock trading at Rs.50 could be overpriced for what the company is offering.

And remember at the end of the day, investing in the stock market is a very whelming experience and you should always have control over your emotions. Often people get carried away with their emotions and end up making rash decisions and having to bear the consequences over the years.

FAQs (Frequently Asked Questions)

How to start buying and selling stocks?

To start buying and selling stocks, you first need to have a Demat account. There are several brokers present online, so it becomes complicated to choose the right one. Now. you can open a Demat account using Pocketful’s app within a few seconds.

Which are the best apps for buying and selling stocks?

There are many applications present online which facilitate the buying and selling of stocks. It depends on the use case and preference of the customer. Pocketful offers a trading platform for both your investing and trading needs. Simple interface combined with modern technology to make your finance journey smooth.

What are the buying and selling of stocks?

When you buy a stock you are not buying it with the company but the shareholder. Similarly, when you sell a stock the company is not buying it but some other investor.

What points should one consider before buying and selling stocks?

In the above article, five key points are mentioned that you should consider before buying and selling stocks. Never buy a stock in a company or industry, you do not know about. Analyze what the market dynamics are and how other investors are reacting.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle