| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-16-24 |

- Blog

- a guide to fixed deposits exploring types and interest rates

A Guide To Fixed Deposits: Exploring Types And Interest Rates

If you are someone who is looking for hassle-free and low risk investment options, then you have come to the right place. We will uncover the Fixed Deposits – types and factors affecting them in this blog.

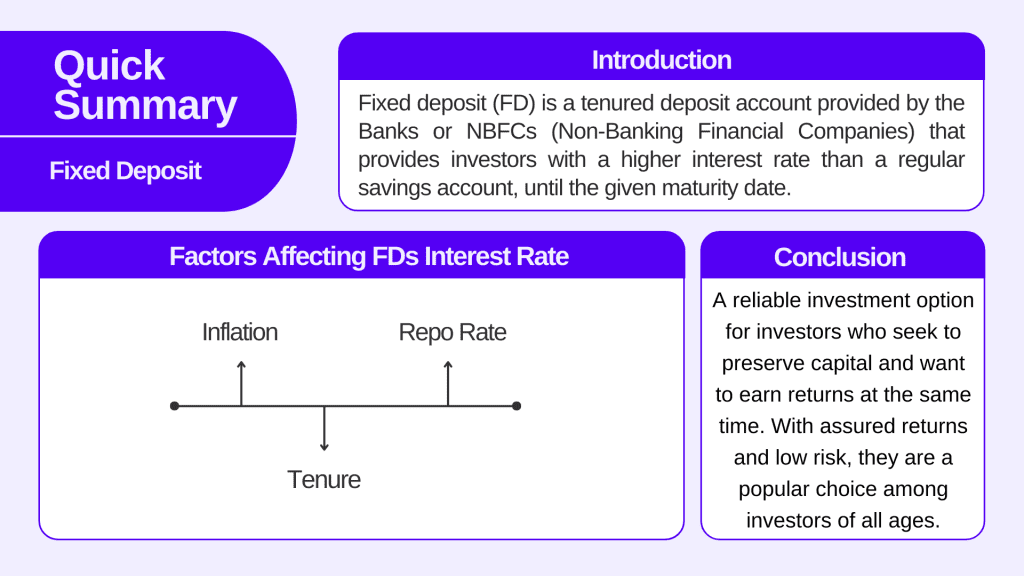

What is a Fixed Deposit?

Fixed deposit (FD) is a tenured deposit account provided by the Banks or NBFCs (Non-Banking Financial Companies) that provides investors with a higher interest rate than a regular savings account until the given maturity date. Most of the FDs offered by banks don’t allow premature withdrawal. However, some banks allow premature withdrawal under certain situations subject to penalties. Investment in fixed deposits is considered a risk-free investment.

Did you know?

Your bank FD is secured up to 5 lakhs by DICGC* (Deposit Insurance and Credit Guarantee Corporation).

DICGC is a specialised division of the Reserve Bank of India.

Types of Fixed Deposits

There are multiple types of Fixed Deposits available to invest:

Regular Fixed Deposits

Regular FDs are the most basic fixed deposits. You deposit a lump sum for a fixed tenure, and earn an interest at a fixed rate. These are suitable for people who are not willing to take risks and looking for a safe and secure investment option.

Senior Citizen Fixed Deposit

It is a special type of fixed deposit account that offers 0.25% to 0.50% higher interest rate than regular FDs for individuals aged 60 and above. For a steady income, you have the option to receive the interest pay-out on a regular basis.

Tax-saver Fixed Deposit

Tax-saver fixed deposits allow you to save on taxes while you earn interest on your regular investments. It comes with a lock-in period of 5 years and provides you with a tax deduction of up to INR 1.5 lakh per year under Section 80 (C) of the Income Tax Act.

Interest in tax-saver FD is paid out on regular intervals and is taxable as per your income tax slab. Tax-saver FDs can be a good option for individuals who want to save on taxes while earning a guaranteed return.

Flexi Fixed Deposit

A flexible fixed deposit is an account that offers you the features of both a savings account and an FD account. Unlike regular FDs, you can partially withdraw funds from your Flexi FD account without a penalty, but only up to a defined limit. However, this provision varies from bank to bank. You can also make additional deposits to your existing Flexi FD account to increase your returns. Flexi fixed deposits are suitable options for investors with short-term financial goals.

Cumulative Fixed Deposit

In a cumulative fixed deposit, the interest earned is not periodically paid out to the investor instead, it gets added to the principal amount. Also, the interest earned is compounded annually. Cumulative FDs offer a lump-sum payout on your maturity date.

Non-Cumulative Fixed Deposits

In a non-cumulative FD, interest is regularly paid out to the investor instead of being re-invested and compounded. This makes it a suitable option for investors who seek regular income from their investments.

Corporate FD

Corporations and Non-Banking Financial Companies (NBFCs) accumulate deposits for a fixed period from investors. These deposits, like Bank FDs, are collected at predetermined interest rates and are known as Corporate Deposits. Similar to Bank FDs, Corporate FDs offer varying investment periods and assured returns. Additionally, they offer higher interest rates as compared to Bank FDs.

Interest rates in corporate FDs are primarily based on the credit quality of the issuer. The lower the rating, the higher the credit default risk; therefore, to compensate for this, they offer higher interest rates as compared to Corporate FDs having high credit ratings.

Difference between Bank FD & Corporate FD

While investors can choose either of the FDs based on their needs, knowing the difference between the two is necessary to make an informed decision.

Below are some key points based on which you can easily distinguish between Corporate FDs and Bank FDs.

- Unlike bank FDs, Corporate FDs offer a higher interest rate of 7% to 8.5%. Bank FDs offer lower interest rates depending upon the period chosen by the investor.

- It is a common practice among investors to withdraw their fixed deposit amount. If you do the same thing, keep in mind that corporate FDs levy additional charges on premature withdrawals, which is comparatively higher than regular Bank FDs.

- Corporate FDs are monitored by credit rating agencies like CRISIL, ICRA, etc., for compliance whereas Bank FDs are secured under the guidelines of the RBI.

- Bank FDs are a safer option to invest since they are backed by RBI while corporate FDs carry higher risk, and their safety depends upon the creditworthiness of the issuing company. Further, as discussed above, bank FDs are secured up to INR 5 lakhs by DICGC.

Tips for maximising FD Returns

- Choose the right kind of FD depending on your financial needs and objectives.

- Compare the interest rates across banks and NBFCs to find the most competitive rates before you invest.

- If you do not need regular interest income, consider choosing cumulative FDs. As explained earlier, cumulative FDs provide you the benefit of compound interest, thus resulting in higher returns.

- Instead of investing your money in a single FD, consider creating a ladder by spreading your investments across FDs with different tenures and FDs mature, and reinvest them in other FDs with higher interest rates. This will help you maximise the returns generated.

- Be mindful of the penalties linked with the FDs before you withdraw your invested amount.

- Interest earned on FDs is taxable. Consider the tax implications and plan your investments to minimise your burden of the tax.

Read Also: Why Debt Funds Are Better Than Fixed Deposits of Banks?

Factors Affecting FD Interest Rates

There are several factors that impact the Interest rate offered by Fixed Deposits. Some of the important factors are as follows:

Inflation

When inflation is high, banks generally offer high-interest rates on fixed deposits to compensate for the decline in the purchasing power of money.

Repo Rate

The repo rate is the rate at which the banks borrow money from the Reserve Bank of India (RBI). When the RBI increases the repo rate, the lending rates and fixed deposit rates of the banks also increase, and vice versa. In case of increasing interest rate scenario, consider investing in short-term investments.

Tenure

Generally, long-term FDs offer higher interest rates than short-term FDs because, in the case of long-term FDs, banks can use the FD amount invested with them for a longer horizon and can earn good returns on their investments.

How to choose the right FD

Choosing the right FD for your needs involves assessing several factors to ensure that you receive the best returns. Consider below mentioned points when choosing FD:

- Analyse your goals and compare the interest rates offered by different banks and NBFCs.

- Choose an investment tenure that best aligns with your financial goals.

- Go for FDs issued by recognised and well-established banks. In the case of Corporate FDs, check the credit rating of the issuer to ensure a margin of safety.

Read Also: Best Alternatives To Fixed Deposits

Conclusion

Fixed deposits are considered a reliable investment option for investors who seek to preserve capital and want to earn returns at the same time. With assured returns and low risk, fixed deposits are a popular choice among investors of all ages.

FAQs

What is FD?

Fixed deposit (FD) is a tenured deposit account provided by banks or NBFCs (non-banking financial companies), which provides investors with a fixed interest until the given maturity date.

Are interest rates of FD similar in every bank?

Interest rates of FDs vary from bank to bank. Generally, they are in a similar range.

What is Repo Rate?

The repo rate is the rate at which the banks borrow money from the RBI.

Does the bank levy a penalty on pre-mature withdrawal of FDs?

Yes, different banks have different penalty provisions.

What is the lock-in period of Tax Saving FDs?

Tax saving FDs come with a lock-in period of 5 years from the date of deposit.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.