| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-24-24 | |

| Add new link Heading Optimize | Nisha | Feb-12-25 | |

| Add new Link | Nisha | Feb-12-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- a guide to investing in gold in india

A Guide To Investing In Gold In India

You must have seen ladies in your house wearing gold. Well, have you ever thought that gold can be a great source of diversification in your portfolio?

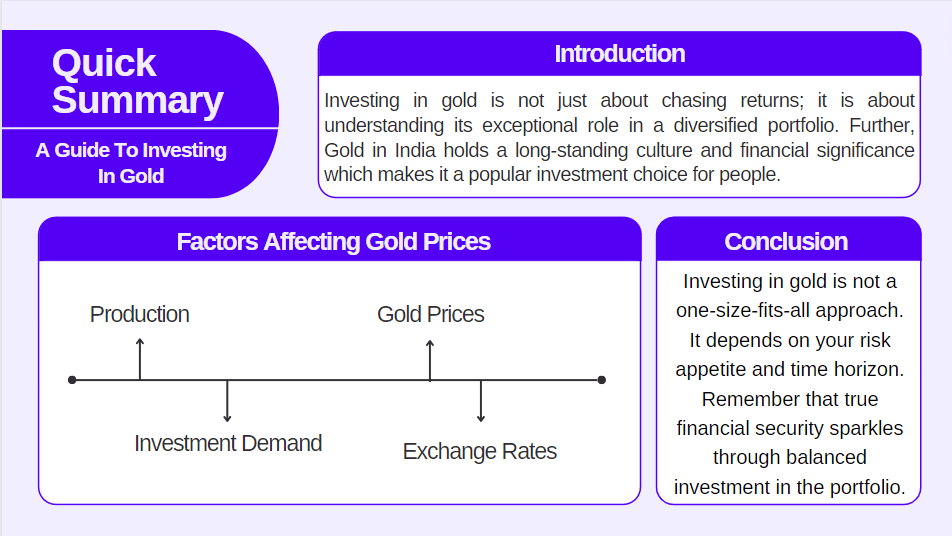

Investing in gold is not just about chasing returns; it is about understanding its exceptional role in a diversified portfolio. In our today’s blog, we will help you understand the gold as an investment option in India.

Gold in India holds a long-standing culture and financial significance, which makes it a popular investment choice for people.

Why Gold Matters?

- Gold acts as a hedge against inflation and acts as a store of value since gold prices tend to rise when inflation increases, protecting your wealth.

- Gold is often considered a haven asset for investment during economic or political uncertainties.

- Gold can help you diversify your portfolio and reduce the overall risk because the price of gold is not positively correlated with the stock market, which means, it does not always move in the same direction as the price of securities in the stock market.

- Gold is a liquid asset and can be bought and sold as and when required. You can convert your gold easily into cash if you need to.

Did you know?

Gold received from a relative as a gift during marriage is tax-free. However, gold received as a gift or inheritance from any other person over INR 50,000 is taxable.

Factors Affecting Gold Prices

There are certain factors globally and locally that affect the gold prices:

Mine production

The amount of gold mined each year has a significant impact on its price. If there is a decline in mine production, gold will become scarce, and its price will rise and vice versa.

Gold Reserves

Central Banks around the world hold large reserves of gold. When they buy or sell gold, it can affect gold prices. Say, if a central bank sells some of its gold reserves, it could flood the market and push the gold prices down.

Investment Demand

When there is a lot of uncertainty in the market, such as during a recession, the demand for gold can increase and hence the prices.

Exchange Rates

Gold is priced in US dollars. When the dollar is strong, it makes gold more expensive for investors who hold other currencies, which leads to a decrease in demand for Gold and a fall in its price. Conversely, when the US dollar is weak, it makes gold cheaper for investors.

Read Also: Types of Investment in the Stock Market

How to Invest in Gold in India

There are multiple ways to invest in the gold. Some of the widely used options are mentioned below:

Physical Gold

- Gold Bullion – Investors can buy physical gold in the form of bars / coins. Bullion is valued based on its weight and purity.

- Gold Jewellery – Jewellery is generally worn for adornment; it is often considered as a source of investment. However, the returns may be influenced by the craftsmanship and design of the ornament because of making charges and its related costs.

Digital Gold

Investment through Online Platforms – various online platforms help investors with buying and selling digital representations of gold without physical possession. These digital gold options offer a convenient way to invest in gold without the need for physical storage.

Sovereign Gold Bonds (SGBs)

SGBs are government-backed securities denominated in grams of gold. It is an alternative to holding physical gold. SGBs guarantee capital preservation and offer tax benefits. The minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals and 20 kg for trusts.

Apart from capital gains arising from an increase in the value of the gold, SGBs also provide a 2.5% interest p.a. on the invested amount.

Gold Mutual Funds

- Gold ETFs – Gold ETF is an exchange-traded fund to track the domestic physical gold price. Gold ETFs are listed on the NSE and BSE and can be easily traded like a stock. Buying Gold ETF implies that you are holding gold in electronic form.

- Gold Fund of Funds (FOFs) – Similar to gold ETFs, gold FOFs invest in a basket of other gold funds and offer further diversification but add another layer of fees.

Taxation of Gold in India

Sovereign Gold Bonds

No capital gains tax on SGBs if you redeem at maturity, i.e., after 8 years, and if in case you wish to redeem early, you have to pay:

- LTCG – If you redeem the investment after 3 years, then capital gains are taxed at a rate of 20% along with indexation benefit. Indexation means your gains are adjusted for inflation.

- STCG – If you redeem your investment within 3 years, then capital gains are taxed as per your income tax slab.

Further, interest received on SGBs is taxed as per the investor’s tax slab.

Gold ETFs

Taxation of Gold ETFs is similar to that of debt taxation in India. Investors are eligible to pay both STCG and LTCG. Long-term capital gains tax is levied at 20% after indexation benefits on gold ETFs held for more than 3 years.

For investment held up to 3 years will be considered a short-term capital gain (STCG) and will be levied according to the applicable tax slab of the investor. No security transaction tax (STT) is charged on Gold ETFs.

Physical Gold

Investors possessing physical gold in the form of jewellery, coins, etc., are liable to pay 3% GST on the total buy value. If held for less than 3 years, then capital gains are taxed as short-term capital gains, which is as per your tax slab, and if investment held for more than 3 years, then long- term capital gains will apply at 20% and additional 4% cess, means effectively LTCG is 20.8%.

Risks of Investing in Gold

- Gold prices can fluctuate significantly, and short-term movements can be unpredictable.

- Rising interest rates may lead to a decline in the price of the gold.

- Physical Gold has low liquidity and high transaction costs compared to Gold ETFs, which makes it harder to sell.

- Physical gold also requires secure storage as there are chances of risks of theft or damage.

- Global financial markets and geopolitical events influence gold, and any kind of turbulence in gold-producing countries can impact its price.

Read Also: What is a good rule for investing in stocks?

Conclusion

Gold’s charm in India is unquestionable, woven into cultural threads and paired with financial strategies. Unlike stocks and bonds, gold is a tangible asset. Adding gold to your portfolio can help you diversify your portfolio, reduce risk, and balance your financial landscape.

To sum it up, investing in gold is not a one-size-fits-all approach. It depends on your risk appetite. Before taking a plunge into your investment in a gold basket, seek professional suggestions. Keep in mind that gold may glitter, but true financial security sparkles through balanced investment strategies.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Frequently Asked Questions (FAQs)

How much should I invest in Gold?

The investment amount completely depends on individual circumstances and financial objectives. As per the experts, a 10-20% allocation to gold is ideal.

What are the minimum and maximum limits for investing in SGBs?

The SGBs in India are issued in the denomination of one gram of gold. The minimum investment is one gram and the maximum is 4 Kg for individuals.

Which option is best to buy gold in India?

It depends on your preference whether you want to buy physically or digitally, however, SGBs are considered an ideal option if you don’t need physical gold and are buying for a long tenure.

Can I invest in Gold through my regular savings account?

Yes, some banks offer gold-saving schemes where you can collect gold units based on your deposits. Further, many banks provide the facility for buying SGBs.

Is TDS applicable to SGBs?

No, TDS does not apply to SBGs.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle