| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-27-24 | |

| Add new links | Nisha | Apr-10-25 |

- Blog

- adani enterprises case study

Adani Enterprises Case Study: Business Model And SWOT Analysis

Imagine a single company controlling everything from the coal to the airport. That is the vast reach of Adani Enterprises. It has been a major force in the Indian economy, with a presence in sectors such as diverse coal mining, energy grids, and even airports. But how did this company rise to such prominence?

In this blog, we will discover the fascinating story of Adani Enterprises, its key strengths, business model, rich history, etc.

Adani Company Overview

Adani Enterprises is an Indian multinational conglomerate headquartered in Ahmedabad, Gujarat. It is considered the flagship company of the Adani Group. Adani Enterprises is primarily involved in infrastructure development and management, including ports, airports, logistics, power generation, transmission, mining resources, data centres, and solar cell manufacturing.

Adani Enterprises History

Adani Enterprises was founded in 1988 by Gautam Adani as a partnership firm called Adani Exports, a commodity trading company focused on agricultural commodities.

In 1990, the Adani Group established its proprietary port in Mundra to facilitate the expansion of its trading activities. Subsequently, in the same year, Adani Exports transformed into a limited company called Adani Enterprises.

Today, Adani Enterprises is recognized as the largest business incubator in India. Its focus is on four core sectors: energy and utility, transportation and logistics, consumer goods, and primary industry.

Since 1988, the company has successfully developed and listed six successful companies:

- Adani Ports and Special Economic Zone Limited

- Adani Power Limited

- Adani Transmission Limited

- Adani Green Energy Limited

- Adani Total Gas Limited

- Adani Wilmar Limited.

Read Also: Tata Power Vs Adani Power: Comparison Of Two Energy Giants

Adani Company Business Model

Adani Enterprises strategically employs a diversified business model to generate revenue across various sectors effectively. The company’s revenue majorly comes from the following selling various products and services in multiple sectors. These include Energy & Utility, Data Centres, Infra, Transport and Logistics, FMCG, Contract Mining, Resource Management, etc.

The trading and export activities involve the earning income by purchasing goods such as coal and edible oils at competitive prices in international markets, and selling them domestically at a profit.

Adani Enterprises generates substantial revenue through project development and efficient management of major infrastructure projects, including ports, roads, and power plants. Furthermore, the company also receives orders from the government, especially in the defence and aerospace sectors.

The company’s revenue is divided between the product sales, which account for 86% of its total revenue, and services, which contribute 14%.

SWOT Analysis of Adani Enterprises

Strengths

⦁ The company possesses a robust presence in various sectors, such as coal mining, energy generation, infrastructure, and renewables. This diversification reduces risk, and offers growth opportunities.

⦁ The Adani brands hold a strong brand recognition in India, symbolising trustworthiness, and expertise.

⦁ The company has strategically invested in cutting-edge technologies and renewable energy projects to position itself as a forward-thinking leader in sustainability.

Weakness

⦁ Managing a portfolio of immense magnitude and diversity requires strong operational efficiency. Delays in project execution can impact profitability.

⦁ A substantial portion of revenue is generated from India, making the company vulnerable to domestic economic and political changes.

⦁ The company’s high debt level may constrain its capacity to pursue new business opportunities.

Opportunities

⦁ The government’s emphasis on clean energy presents an opportunity for Adani Green Energy, the company’s renewable energy arm.

⦁ Adani’s recent entry into the airport sector can be a good opportunity to capitalise on the anticipated growth in air traffic in India.

⦁ By focusing more on international exposure, the company can create opportunities for growth while maintaining a strong foundation in its domestic operations.

Threats

⦁ The demand for its services and products may be affected by global or domestic, economic downturns.

⦁ The impact on the profitability of its energy and mining businesses could be considerable due to the volatility in the prices of commodities such as coal and oil.

⦁ Adani operates in multiple sectors within the Indian market, many of which face tough competition from various players.

Read Also: Reliance Power Case Study: Business Model, Financial Statements, And SWOT Analysis

Adani Enterprises Financial Statements

Let’s have a look at the financial statement of Adani Enterprises:

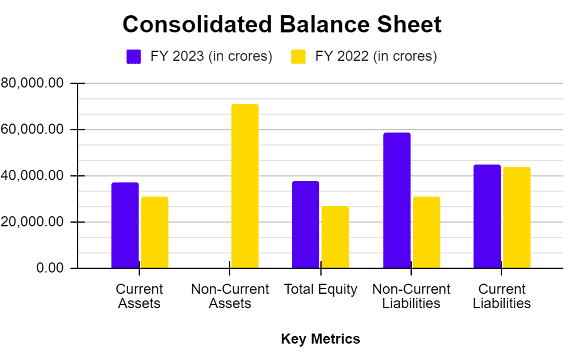

Consolidated Balance Sheet

| Key Metrics | FY 2023 (in crores) | FY 2022 (in crores) |

|---|---|---|

| Non-Current Assets | 1,04,366.09 | 70,814.80 |

| Current Assets | 37,021.73 | 30,945.39 |

| Total Equity | 37,890.05 | 26,928.37 |

| Non-Current Liabilities | 58,794.72 | 30,982.04 |

| Current Liabilities | 44,803.05 | 43,849.78 |

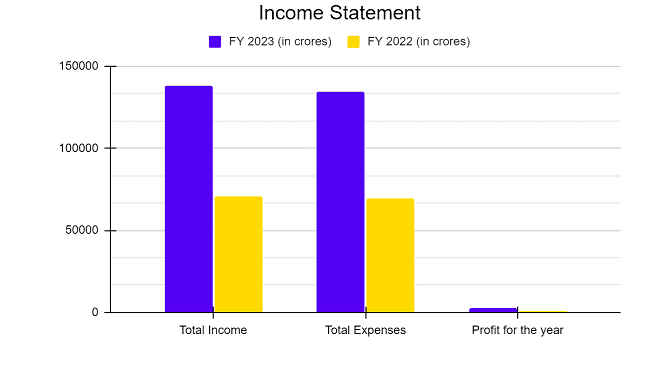

Income Statement

| Key Metrics | FY 2023 (in crores) | FY 2022 (in crores) |

|---|---|---|

| Total Income | 1,38,175.12 | 70,432.69 |

| Total Expenses | 1,34,555.90 | 69,480.64 |

| Profit for the year | 2,421.60 | 787.7 |

Cash Flow Statements

| Key Metrics | FY 2023 (in crores) | FY 2022 (in crores) |

|---|---|---|

| Net Cash generated from / (used in) Operating Activities | 17,626.46 | 1,385.28 |

| Net Cash generated from / (used in) Investing Activities | -16,860.09 | -17,487.38 |

| Net Cash generated from / (used in) Financing Activities | -1,197.52 | -15,901.42 |

| Cash and Cash Equivalents at the end of the year | 1,882.33 | 912.23 |

Conclusion

The company has a robust track record, holds a diversified portfolio, and maintains a clear vision for the future. However, high dependence on coal, elevated levels of debt, and the continuously evolving regulatory environment present considerable challenges. As India grows, Adani Enterprises is poised to play a significant role.

Whether the company becomes a true giant or struggles under its own weight will depend on how well it handles challenges and takes advantage of future opportunities. Further, we recommend consulting with your financial advisor before making any investment decision.

Frequently Asked Questions (FAQs)

What are Adani Enterprises’ main sectors?

Coal mining, ports and logistics, power generation (thermal and renewable), airports, and edible oils are some of the Adani Group’s main sectors.

Is Adani Enterprises a good investment?

This depends on your investment goals and risk tolerance. Adani has a strong track record but also faces challenges like higher debt, and dependence on coal.

Is Adani publicly traded?

Yes, Adani Enterprises is listed on the BSE and NSE. As of May 2024, its share price is trading at INR 3,330 and its market capitalisation is INR 3.80 lakh crores.

When was Adani Enterprises established?

The company was established in 1988 by Gautam Adani. Initially, the company started operations in commodity trading.

When was the Adani Enterprise’s first stock issued?

On September 12, 1994, Adani Enterprises launched an IPO of 1,261,900 shares which was 25x oversubscribed.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.