| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-29-24 | |

| Infographic Update | Default Author | Apr-03-25 | |

| Add new links | Nisha | Apr-10-25 |

- Blog

- apollo hospitals case study

Apollo Hospitals Case Study : Business Model, Financial Statements, And SWOT Analysis

Apollo Hospitals is touching lives with its mission of delivering compassionate and innovative healthcare, its focus on advanced medical technologies, and its commitment to shaping the future of the healthcare industry while making a meaningful impact on patients’ lives.

In this blog, we will discuss Apollo case study, its business model, and its services. Moreover, we will go over their financial information and conduct a SWOT analysis.

Apollo Hospitals – An Overview

Apollo Hospitals was founded in 1983 by Dr. Prathap C. Reddy with the vision of making quality healthcare available in India. It was a time when Indians often traveled abroad for advanced medical treatments. Apollo made these services available in India, focusing on both quality and affordability. As the nation’s first corporate hospital, Apollo Hospitals is acclaimed for establishing the private healthcare revolution in the country. Apollo Hospitals has emerged as Asia’s primary integrated healthcare services provider and has a strong presence across the healthcare ecosystem, including hospitals, pharmacies, primary healthcare & diagnostic clinics, etc. It has a strategic focus on several areas, including:

- Specialized Services: Apollo has developed several specialist healthcare services in cardiology, oncology, neurology, orthopedics, and transplant services. These specialized services attract patients from India and abroad and encourage medical tourism.

- Digital Healthcare Services: Apollo recognized the potential of digital healthcare services after COVID-19 and launched its online platform Apollo 24/7, which allows patients to access healthcare services online. The company increasingly focuses on integrating AI, telemedicine, and data analytics to improve patient experiences.

- Franchising: Apollo has expanded into tier 2 and tier 3 cities through a mix of owned and franchised hospitals, helping to promote its brand and provide healthcare services in underserved and untapped areas.

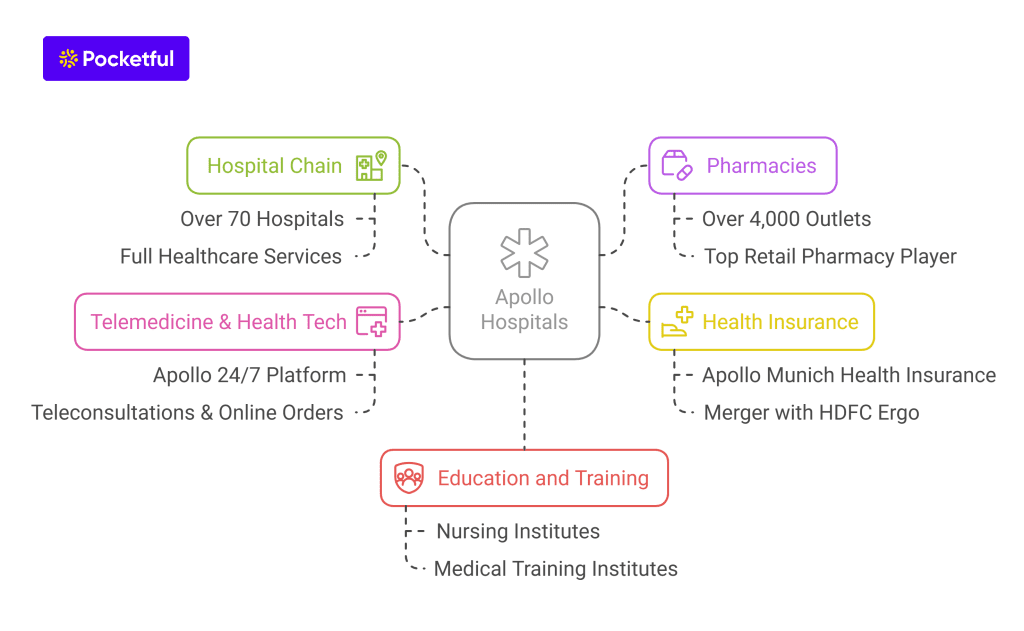

Business Model and Services of Apollo Hospitals

Apollo business model revolves around a multi-specialty healthcare model, offering a wide range of services across hospitals, pharmacies, diagnostics, and even telemedicine, including:

- Hospital Chain: Apollo has one of the largest hospital chains in India, with over 70 hospitals across the country. These hospitals provide a full range of healthcare services, from routine health checkups to complex surgeries.

- Pharmacies: Apollo’s massive pharmacy chain includes over 4,000 outlets. It is one of the top players in the retail pharmacy sector in India.

- Health Insurance: Apollo entered the health insurance business with Apollo Munich Health Insurance, which later merged with HDFC Ergo General Insurance, broadening its impact on the healthcare ecosystem.

- Telemedicine & Health Tech: The Apollo 24/7 platform offers teleconsultations, online pharmacy orders, and health monitoring, positioning it as an online health-tech leader.

- Education and Training: Apollo has set up numerous nursing and medical training institutes to ensure a constant supply of skilled medical professionals.

Financial Statements of Apollo Hospitals

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 19,059 | 16,612 | 14,662 |

| Total Income | 19,165 | 16,702 | 14,740 |

| Total Expenditure | 17,353 | 15,178 | 12,784 |

| Net Profit | 917 | 887 | 1,101 |

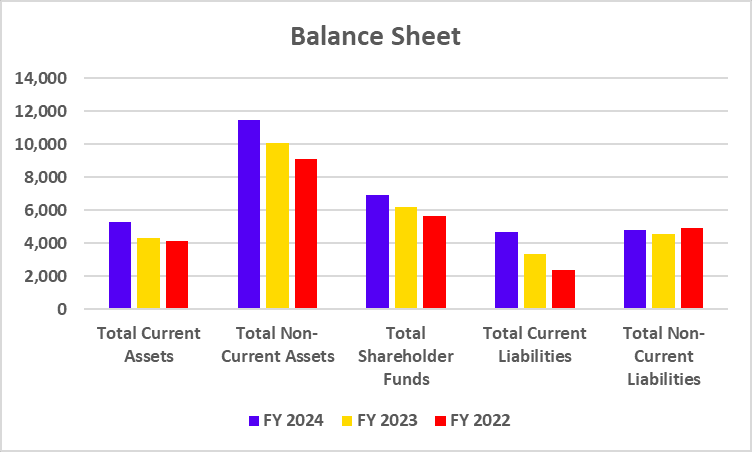

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Current Assets | 5,280 | 4,337 | 4,122 |

| Total Non-Current Assets | 11,473 | 10,091 | 9,071 |

| Total Shareholder Funds | 6,935 | 6,197 | 5,623 |

| Total Current Liabilities | 4,665 | 3,325 | 2,383 |

| Total Non-Current Liabilities | 4,768 | 4,572 | 4,931 |

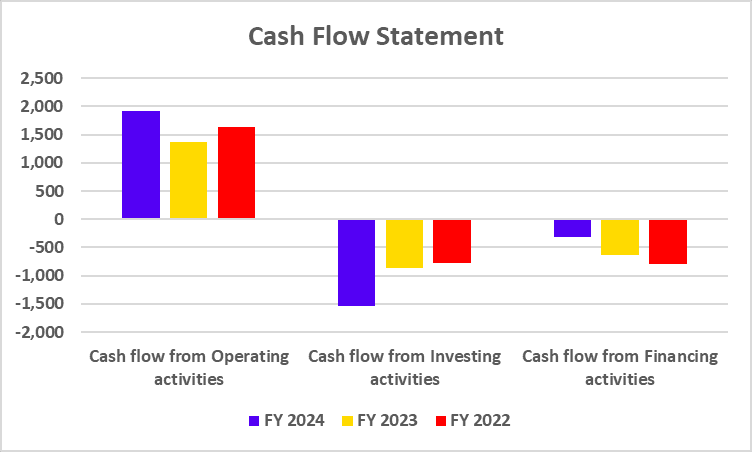

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash flow from Operating activities | 1,920 | 1,376 | 1,628 |

| Cash flow from Investing activities | -1,537 | -870 | -778 |

| Cash flow from Financing activities | -311 | -633 | -792 |

Key Performance Indicators

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Net Profit Margin (%) | 4.81 | 5.34 | 7.50 |

| ROE (%) | 12.95 | 13.21 | 18.77 |

| ROCE (%) | 14.97 | 13.73 | 15.38 |

| Current Ratio | 1.13 | 1.30 | 1.73 |

| Debt to Equity Ratio | 0.46 | 0.44 | 0.47 |

Read Also: Apollo Hospitals vs Fortis Healthcare: Which is Better?

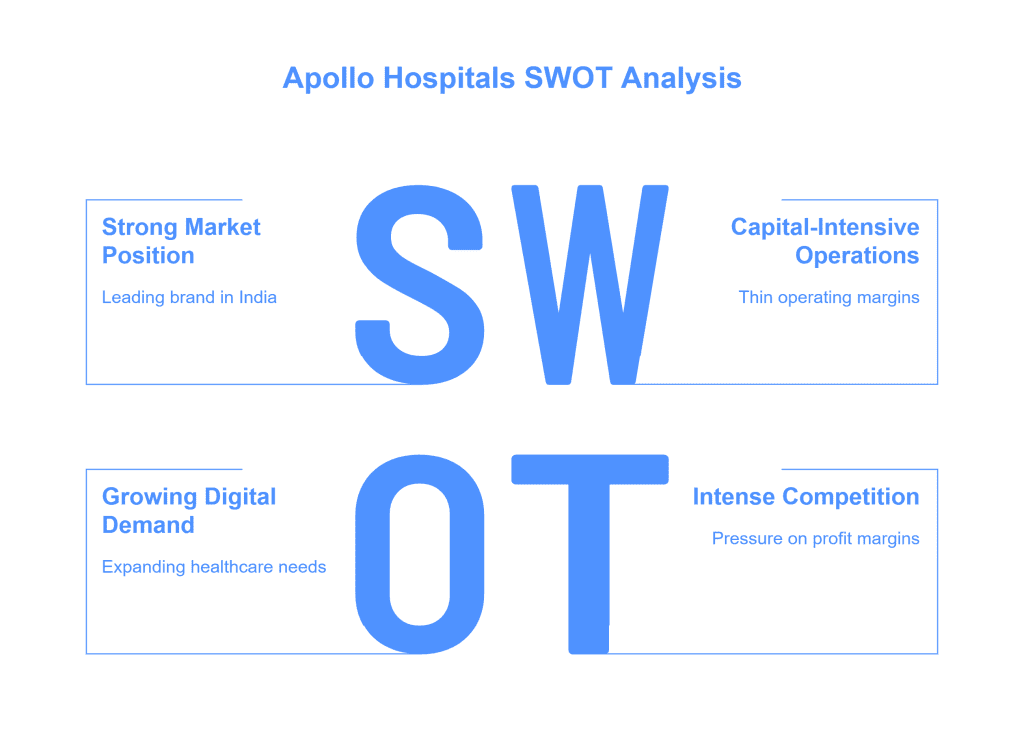

SWOT Analysis of Apollo Hospitals

The Apollo SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.

Strengths

- Apollo Hospitals has a strong market position and brand recognition and is one of the leading hospitals in India with a significant market share.

- It has a large network of 70 hospitals across the country, as well as several pharmacies and diagnostic centers.

- It has medical expertise and provides healthcare services in key medical fields like cardiology, neurology, and organ transplants.

- It is a key healthcare service provider and attracts patients from across the globe due to its low cost and high-quality services.

- It has integrated operations across the entire business model, such as hospitals, pharmacies, health insurance, etc.

- It has digital health platforms offering teleconsultations and online pharmacy services.

Weaknesses

- Apollo Hospitals operates in a capital-intensive industry with significant investments in infrastructure, technology, and skilled personnel, which leads to thin operating margins.

- Generally, super specialty and specialty hospitals face the staffing challenge as they continuously require a highly skilled workforce, and it’s challenging to attract, retain, and manage skilled healthcare professionals.

- A big portion of revenues is generated through high-end specialized procedures. Hence, it is dependent on premium healthcare services for revenues.

Opportunities

- With increasing demand for online healthcare services, Apollo’s digital ventures are expected to grow. The company invests heavily in artificial intelligence (AI) to improve diagnostics and treatment protocols.

- Because of the expanding population, there is a growing demand for healthcare services.

- The healthcare industry is poised to grow because of medical tourism, which attracts international patients because of its low cost and superior services.

- It has formed several partnerships with international medical institutions, further enhancing its capabilities.

- Apollo is exploring ways to reduce its environmental impact by adopting sustainable practices such as energy-efficient infrastructure designs and waste management projects.

Threats

- The hospital industry is highly competitive as it operates on thin margins. Other hospital chains like Fortis Healthcare, Max Healthcare, and Narayana Health are competing for market share, especially in metro cities.

- The healthcare industry is highly regulated; hence, it is subject to intense regulation related to pricing, medications, devices, availability of drugs, and hospital services.

- The government’s push for affordable healthcare through schemes like Ayushman Bharat puts pressure on hospital chains to maintain low-profit margins.

- Managing operational costs while maintaining high-quality services remains a constant challenge as the industry is capital-intensive, requiring regular investments in medical equipment, technology, infrastructure upgrades, and skilled professionals.

- Healthcare is a human resource-intensive sector, and it comes with the challenge of hiring, training, and retaining medical professionals, which is an ongoing and costly process.

- The economic slowdown leads to a shift towards affordable public healthcare options rather than premium healthcare.

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Conclusion

Apollo Hospitals is a brand in itself known for its world-class healthcare services. It continuously invests in digital innovation, which gives it a competitive edge. However, it faces challenges like high operational costs and competition. However, it also has ample opportunities for expansion because of population outbursts, untapped markets in tier 2 and tier 3 cities, medical tourism, and digital healthcare services. There are stringent regulatory policies in place that should be adhered to as patients are involved, like patient safety, privacy, and data security. These challenges should be handled carefully and are crucial for Apollo’s sustained growth and success.

Frequently Asked Questions (FAQs)

What is Apollo Hospitals’ competitive advantage?

Apollo Hospital’s competitive advantage is its strong branding due to its wide hospital network, leadership in specialized healthcare services, integrated healthcare ecosystem, and early implementation of digital healthcare services.

How has Apollo Hospitals adapted to the COVID-19 pandemic?

During the pandemic, Apollo expanded its digital healthcare services through its telemedicine offerings. Also, it provided COVID-19 treatment and vaccination services and strengthened its healthcare infrastructure to meet the surge in demand for critical healthcare.

How can I invest in Apollo Hospitals shares?

One can invest in Apollo Hospitals shares by purchasing them through a stockbroker or an online trading platform. It is listed on both the stock exchanges, BSE and NSE, under the ticker symbol “APOLLOHOSP.”

What are Apollo Hospitals’ key growth strategies?

Apollo’s growth strategies include expanding its hospital network into rural areas along with tier 2 and tier 3 cities, scaling up its digital health services (Apollo 24/7), investing in specialized healthcare services, and attracting international patients through quality services and medical tourism.

Who established Apollo Hospitals?

Apollo Hospitals was founded in 1983 by Dr. Prathap C. Reddy.

Who is the CEO of Apollo Hospital?

Madhu Sasidhar

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.