| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-04-24 |

- Blog

- asian paints case study business segments kpis financials and swot analysis

Asian Paints Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

Asian Paints was established in 1942 and is currently the leading paint company in the country. Many of us will be able to recall the brand’s famous tagline, “Har Ghar Kuch Kehta,” but very few know about its success story. So, today’s blog will cover all the essential aspects of the company, like business segments, KPIs, financials, and SWOT analysis.

Asian Paints Overview

This company is a Mumbai-based Indian multinational paint company and one of the key global players in the paint industry. The company is well known for its expertise in developing a wide range of paints for both decorative and industrial purposes. Asian Paints manufactures and distributes paints, home-related products, wall coverings, waterproofing solutions, adhesives, and painting equipment. The company has a large footprint, reaching over 1,60,000 contact points nationwide. Here is the overview of the company:

| Company Type | Public |

| Industry | Chemicals and Paint Industry |

| Founded | 1942 |

| Headquarters | Mumbai, Maharashtra, India |

| Area served | Worldwide |

Mission

Asian Paints aspires to become one of the top five global companies in the paint industry by expanding its abilities to emerging economies. Some of its core missions are:

- The company’s mission is to offer paints to satisfy market demand while ensuring the desired level and quality of customer satisfaction.

- The company ensures environmental compliance and sustainability by focusing on waste minimization and water conservation across India.

Competitors

The company has many competitors in different markets from an array of domestic and international players:

- Kansai Nerolac Paints

- Sherwin-Williams

- Nippon Paint

- PPG Industries

Asian Paints Products and Services

Products

The company assists its customers with end-to-end home decor solutions that help strategically expand into the home décor industry. It helps transform their customers’ homes into lovely spaces. Their products are:

- Paints

- Adhesives

- Wall Coverings

- Modular Kitchens

- Wardrobes

- Textures

- Painting Aid

- Bath fittings

- Waterproofing

- Wall Stickers

- Door Systems

- Mechanised Tools

Services

- The ‘Beautiful Homes Service’ is an exclusive, end-to-end solution that offers customers a personalized interior design service, complete with professional execution, to assist them in creating their dream homes.

- The company offers its customers a ‘Safe Painting’ service that guarantees hassle-free and reliable painting solutions with the highest safety standards.

Read Also: List Of Best Paint Stocks in India 2025

Asian Paints Market Data

Here are some essential market data of Asian Paints Ltd:

| Market Cap | ₹ 2,74,901 Cr. |

|---|---|

| TTM P/E | 50.52 |

| ROCE | 36.98 % |

| Book Value | ₹ 166.73 |

| ROE | 28.19 % |

| 52 Week High / Low | ₹ 3,568 / 2,708 |

| Dividend Yield | 0.90 % |

| Face Value | ₹ 1.00 |

Read Also: Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

Asian Paints Financial Highlights

Balance Sheet

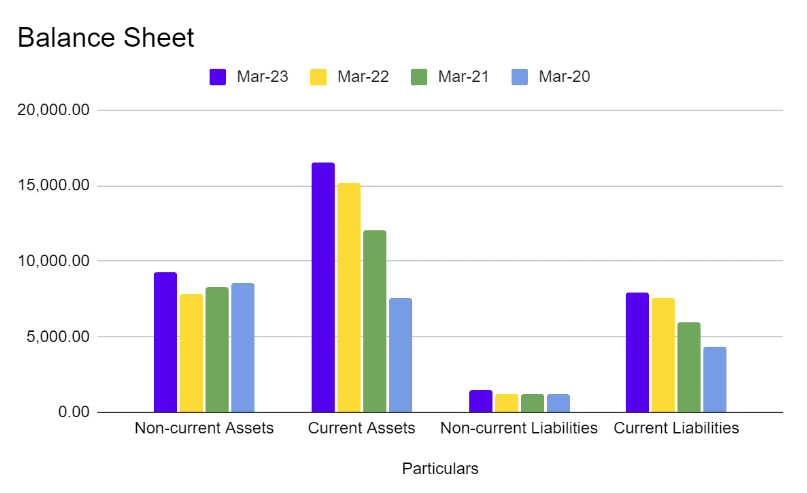

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Non-current Assets | 9,244.17 | 7,806.10 | 8,328.74 | 8,557.86 |

| Current Assets | 16,535.16 | 15,144.20 | 12,013.11 | 7,566.25 |

| Non-current Liabilities | 1,437.51 | 1,188.35 | 1,200.33 | 1,223.90 |

| Current Liabilities | 7,895.93 | 7,570.99 | 5,925.86 | 4,380.38 |

The balance sheet shows an increasing trend in total assets, which is driven primarily by current assets. This increase in current assets is financed mainly with current liabilities, which indicates a healthy financial position.

Income Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Operating Revenue | 34,488.59 | 29,101.28 | 21,712.79 | 20,211.25 |

| Total Income | 34,875.07 | 29,481.29 | 22,015.84 | 20,515.56 |

| EBITDA | 6,259.84 | 4,803.61 | 4,855.60 | 4,161.77 |

| EBIT | 5,401.82 | 3,987.25 | 4,064.33 | 3,381.27 |

| Profit before Tax | 5,688.83 | 4,187.72 | 4,304.35 | 3,633.99 |

| Consolidated Profit | 4,106.45 | 3,030.57 | 3,139.29 | 2,705.17 |

The graph above indicates a healthy trend in the income statement as revenue grew continuously, which translated to higher profitability each year.

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | 4,193.43 | 986.49 | 3,683.35 | 3,038.15 |

| Cash Flow from Investing Activities | -1,274.64 | -321.69 | -547.79 | -521.42 |

| Cash from Financing Activities | -2,140.05 | -1,807.61 | -650.40 | -2,871.46 |

The company’s cash flow situation is somewhat consistent as cash from operations has majorly seen an uptrend, except for FY22. The investing and financing activities have been negative for the past few years. This indicates a steady trend of modifying capital structure.

Probability Ratios

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| ROCE (%) | 36.98 | 30.88 | 37.19 | 36.31 |

| ROE (%) | 8.19 | 23.19 | 27.96 | 28.36 |

| ROA (%) | 17.22 | 14.24 | 17.57 | 17.16 |

| EBIT Margin (%) | 15.66 | 13.70 | 18.72 | 16.73 |

| Net Margin (%) | 12.03 | 10.46 | 14.57 | 13.55 |

| Cash Profit Margin (%) | 12.30 | 11.35 | 15.71 | 15.27 |

The company’s profitability ratios majorly signify consistent margins, which is considered to be a healthy sign for the company’s financial health.

Read Also: Tata Steel vs. JSW Steel: A Comparative Analysis Of Two Steel Giants

Asian Paints SWOT Analysis

Strengths

- Asian Paint has captured a large market share in the paint industry. The company has over 59% of the market share in the sector, far greater than any other paint manufacturer in the country.

- The company has maintained a steady growth in the market share.

- It has a wide presence as it operates in 15 countries and has 27 manufacturing units.

Weaknesses

- The company has performed below average in some overseas countries, except for Bangladesh, Nepal, and the UAE.

- The industry is heavily reliant on economic cycles, and the looming threat of recession can substantially impact its bottom line figures.

Opportunities

- As per the current scenario, Asian Paints has an immense opportunity to boost its market share in both the Industrial and the Auto Paint sectors, as the industry category requires high-class technology that the company can easily afford.

- Asian Paints can achieve greater success by focusing on emerging markets and economies. The company’s brand positioning will help to give it an edge in the market competition.

Threats

- The paint industry is volume-based, which signifies that companies have to update to sustain themselves in the market regularly.

- Any economic slowdown will negatively influence the construction industry and simultaneously affect the paint industry.

Conclusion

Asian Paint Ltd. became the leading company in the paint industry and also has strong financial performance. The company stands out as a dominant force in the paint industry, boasting a significant market share and a robust global presence. However, it is necessary to perform your analysis before investing your hard-earned money.

Frequently Asked Questions (FAQs)

When did Asian Paints start?

Asian Paints began its operations in 1942 as a partnership firm.

What is the market share of Asian Paints?

Asian Paints currently holds 59% of the market and emerges as a market leader.

What makes Asian Paints unique?

Asian Paints is unique because it offers a variety of products and services such as Paints, Adhesives, Wall Coverings, Modular Kitchens, Wardrobes, Textures, and Painting Aids.

What is Asian Paints’ competitive advantage?

Asian Paints’ competitive advantage is its distribution strength.

What is the market cap of Asian Paints?

As of 3rd April 2024, the market cap of Asian Paint Ltd. is ₹ 2,74,901 Cr.

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.