| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-29-23 |

- Blog

- asset management companies amc in india

Asset Management Companies (AMC) in India

If you are looking forward to beginning your journey in mutual funds and are not familiar with the term AMC or Asset Management Company, you have come across the right place!

What is AMC?

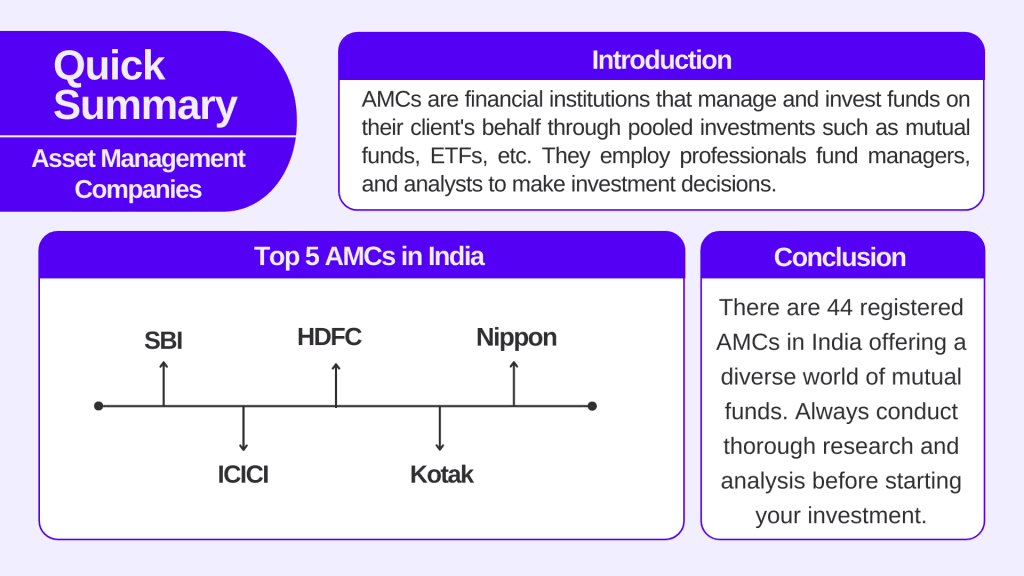

AMC stands for Asset Management Company. AMCs are financial institutions that manage and invest funds on their client’s behalf through pooled investments such as mutual funds, ETFs or other financial instruments.

AMC employs professionals fund managers, and analysts to make investment decisions. These professionals research and analyse the market conditions to fulfil the fund’s choices and investment needs.

And for all these services, they charge fees for managing the funds. The fees include a management fee, a performance fee and other miscellaneous expenses. The fees are the percentage of the assets under management (AUM) – It is the total value of the investments managed by the AMC.

In India, AMCs are regulated by the Securities & Exchange Board of India (SEBI). Further, AMCs are also passively regulated by the Association of Mutual Funds in India (AMFI).

Now, you must be thinking about how these AMCs operate. AMCs invest the pooled money in professionally managed funds based on the investor’s financial goal, investment horizon and risk appetite. They rebalance these funds on different frequencies, such as quarterly or annually to maintain the desired asset allocation.

AMCs distribute these funds through various channels including banks, online platforms, NBFCs, distribution houses, agents, etc. The revenue of an AMC primarily comes from the fees it charges from the investors.

Indian Mutual Fund Industry Analysis

Assets Under Management (AUM) of the Indian Mutual Fund Industry stood at INR 49.05 lakh crores as of 30 November 2023.

The AUM of the Indian Mutual Fund Industry has grown from ₹8.90 trillion as of 30 November 2013 to ₹49.05 trillion as of November 30, 2023, more than a 5-fold increase in 10 years.

The proportionate share of equity-oriented schemes is 54.9% and for debt-oriented schemes it is 18.5% of the industry’s assets. Individual investors hold a relatively higher share of industry’s assets, i.e., 59.2% in November 2023.

Institutional investors account for 40.8% of the assets, of which corporates are 95%. The rest are Indian and foreign institutions.

From the above data, we can interpret that AMCs have experienced steady growth over the years, reflecting investors’ participation in the mutual fund industry. Rise in disposable incomes and increasing financial awareness are key factors leading to the growth of the mutual fund industry in India.

Read Also: Top 5 AMC Stocks in India 2025 – Overview and Insights

Emerging Trends in the Indian Mutual Fund Industry

We all understand the financial landscape of India, which is continuously evolving and AMCs are launching new schemes every year. In the calendar year 2023, AMCs in India launched 198 New Fund Offers (NFOs).

Some of the key emerging trends in the mutual Fund industry are:

- Fintech and Robo-advisors are playing an important role in managing investments. Robo-advisors use algorithms to provide automated suggestions on your investments are continuously gaining attention.

- Investors these days generally look for investment opportunities that align with their values. Thematic and Overseas funds play a major role by providing sector-focused and global investments opportunities respectively.

- ESG investing or environmental, social and governance factors are crucial for new-generation investors. AMCs that curate ESG-friendly funds are attracting ample inflows.

- Direct investment platforms are gaining traction because of their low expense ratio and easy registration process.

Broadly, there are two types of mutual funds – direct funds and regular funds. Their expense ratio is the primary distinction between them. Regular mutual funds are chosen by investors who prefer investing with financial advisors, whereas Direct mutual funds are meant for those investors who make their own investment decisions.

Top Asset Management Companies of India

As of December 2023, there are 44 registered Asset Management Companies in India. The top 5 AMCs in India are:

1. SBI Asset Management Company

SBI mutual fund is a leading AMC in India. It was established in the year 1987 and has 36 years of experience in the fund management. It is a joint venture between the State Bank of India and Amundi Asset Management company. State Bank of India currently holds a 63% stake in the SBI mutual fund, and Amundi Asset Management company holds a 37% stake through a wholly owned subsidiary.

SBI currently manages 306 open-ended and 215 close-ended funds with an AUM of INR 828,152 crores as of September 2023.

2. ICICI Prudential Asset Management Company

ICICI is another major player in the Indian Mutual Fund Industry. It was established in 1998 and is a joint venture between ICICI Bank and Prudential Plc, a leading Pan-Asia & Africa-focused group that provides health protection and saving solutions.

ICICI AMC manages 436 open-ended and 17 close-ended funds with an AUM of INR 594,204 crores.

3. HDFC Asset Management Company

Established in the year 2000, HDFC is also a major player in the mutual fund industry with a strong track record and robust product portfolio.

HDFC AMC is a joint venture between HDFC Limited & ABRDN Investment Management Limited (formerly known as Standard Life Investments Limited).

HDFC AMC manages 277 open-ended and 57 close-ended funds with an AUM of INR 518,132 crores.

4. Kotak Asset Management Company

Kotak AMC is the wholly owned subsidiary of Kotak Mahindra Bank Ltd., which started operations in the year 1998 and holds a large investor base of over 8.1 million.

It currently manages 237 open-ended and 34 close-ended funds with an AUM of INR 330,703 crores.

5. Nippon Asset Management Company

Nippon India Mutual Fund (NIMF) is one of the fastest-growing mutual funds in India and was established in the year 1995. NIMF was previously known as Reliance Mutual Fund.

Nippon currently manages 441 open-ended and 24 close-ended funds with an AUM of INR 329,831 crores.

Read Also: Top AMCs in India

Conclusion

To wrap it up, there are 44 registered AMCs in India offering a diverse world of mutual funds. Remember, even though the Indian asset management industry is poised for consistent growth in the coming years, always conduct thorough research and analysis before starting your investment journey and consult with financial advisors.

Also, if you are a keen investor and want to update yourself on the taxation of different mutual funds in India, checkout our blog: Decoding Mutual Funds Taxation In India

Frequently Asked Questions (FAQs)

What is the full form of AMC?

Asset Management Company.

Does AMC charge fees from investors?

Yes.

Who regulates AMCs?

Securities & Exchange Board of India.

How many registered AMCs are there in India?

As of December 2023, there are 44 registered AMCs.

What is Assets Under Management (AUM)?

It is the total value of the investments managed by the AMC.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.