| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-12-24 | |

| Add new links | Nisha | Apr-10-25 |

- Blog

- bajaj auto case study

Bajaj Auto Case Study: Business Model, Product Portfolio, and SWOT Analysis

India is one of the biggest automobile markets in the world, and many automobile companies are trying to gain market share. One such company is Bajaj Auto, but have you ever wondered how it became one of the dominant forces in the global two-wheeler and three-wheeler market?

The following case study looks at the incredible journey of Bajaj Auto from being a very small-scale company to becoming a household name, not only in India but all over the world.

Bajaj Auto Company Overview

Bajaj Auto Ltd. is a major player in the Indian automobile industry and was established in 1945. It was previously known as M/s Bachraj Trading Corporation and initially imported and sold two-wheelers and three-wheelers. In 1959, the company obtained a license from the Government of India and partnered with Piaggio to manufacture Vespa scooters in India. Today, it is one of the major manufacturers and distributors of motorcycles, scooters, and auto rickshaws. The company is now selling its products in more than seventy countries, making Bajaj Auto a global company. The company’s headquarters is in Pune.

Business Model of Bajaj Auto

Bajaj Auto’s business model focuses on cost efficiency, scale, and strategic expansion into new markets. It manufactures competitively priced products and caters to different consumer segments. Partnerships and joint ventures with prominent automobile manufacturers, such as KTM and Triumph, help the company manufacture better automobiles and reach new markets. Bajaj Auto invested INR 57 core in bicycle and electric scooter rental startup Yulu. The company will also manufacture electric vehicles for Yulu.

Business Products and Services

Bajaj Auto’s product portfolio includes some of the most popular motorcycle brands, such as Pulsar, Dominar, Avenger, Platina, etc. The company targets a wide customer base through an array of product categories ranging from entry-level commuter bikes to premium bikes. In the three-wheelers, the company leads with products like RE and Maxima, targeting passenger and goods transport. Bajaj Auto entered the electric vehicle segment with the launch of Chetak.

Market Details of Bajaj Auto Limited

| Current Market Price | INR 11,430 |

| Market Capitalization (In INR Crores) | 3,19,192 |

| 52 Week High | INR 11,498 |

| 52 Week Low | INR 4,766 |

| P/E Ratio (x) | 39.9 |

Read Also: D Mart Case Study: Business Model and Marketing Strategy

Financial Statements of Bajaj Auto Limited

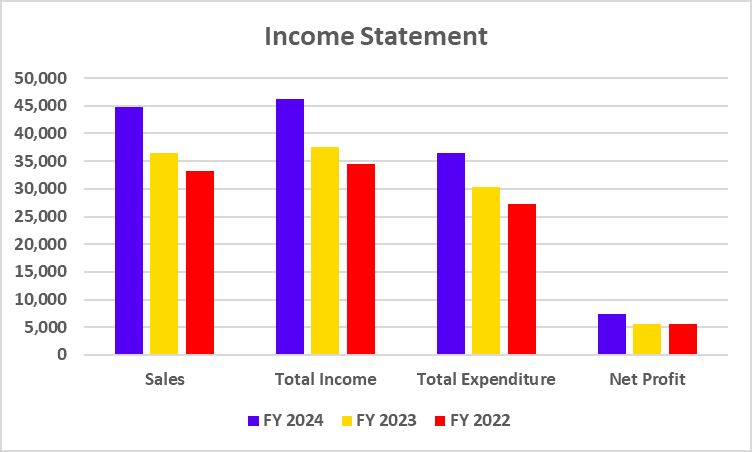

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Particulars | FY 2024 | FY 2023 | FY 2022 |

| Sales | 44,870 | 36,455 | 33,144 |

| Total Income | 46,306 | 37,642 | 34,428 |

| Total Expenditure | 36,473 | 30,290 | 27,348 |

| Net Profit | 7,440 | 5,530 | 5,586 |

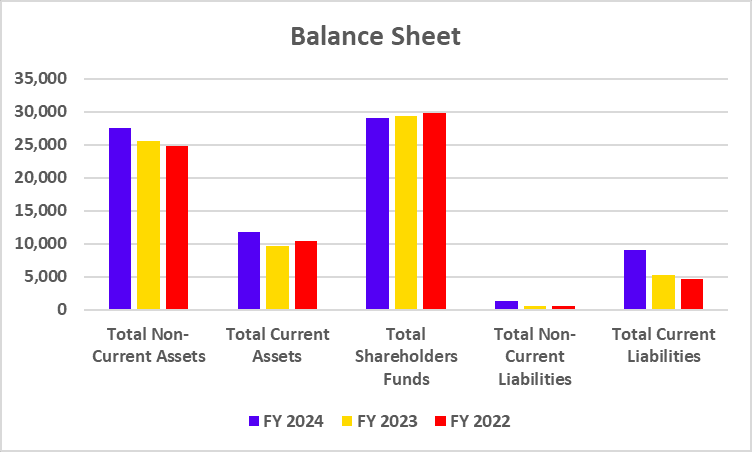

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Particulars | FY 2024 | FY 2023 | FY 2022 |

| Total Non-Current Assets | 27,545 | 25,486 | 24,745 |

| Total Current Assets | 11,798 | 9,650 | 10,365 |

| Total Shareholders Funds | 28,962 | 29,362 | 29,859 |

| Total Non-Current Liabilities | 1,290 | 504 | 563 |

| Total Current Liabilities | 9,091 | 5,271 | 4,689 |

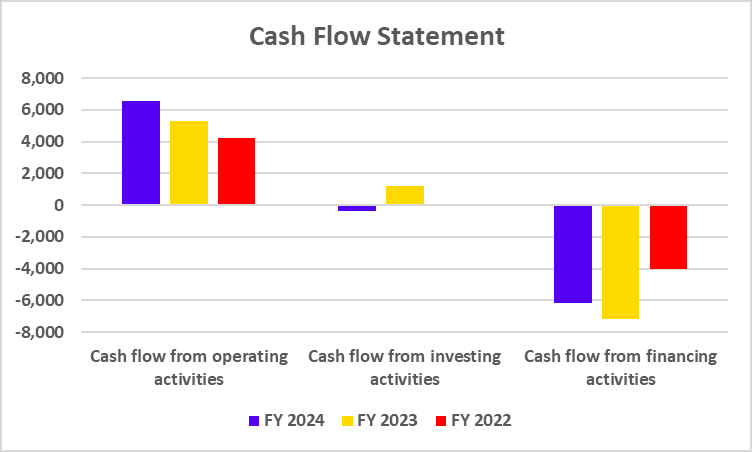

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Particulars | FY 2024 | FY 2023 | FY 2022 |

| Cash flow from operating activities | 6,558 | 5,277 | 4,197 |

| Cash flow from investing activities | -343 | 1,199 | -80 |

| Cash flow from financing activities | -6,167 | -7,180 | -4,056 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Particulars | FY 2024 | FY 2023 | FY 2022 |

| Operating Profit Margin (%) | 21.91 | 20.16 | 18.89 |

| Net Profit Margin (%) | 16.58 | 15.17 | 16.85 |

| Return on Net Worth/Equity (%) | 26.61 | 20.63 | 20.64 |

| Return on Capital Employed (%) | 32.50 | 24.61 | 20.59 |

| Current Ratio | 1.30 | 1.83 | 2.21 |

| Debt to Equity Ratio | 0.06 | 0.00 | 0.00 |

SWOT Analysis of Bajaj Auto

The Bajaj Auto SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.

Strengths

- Strong Brand Recognition: Bajaj Auto is a well-established brand with a presence in over 70 countries, making it amongst the most recognized Indian automotive brands globally. Its flagship products, such as Pulsar and RE auto-rickshaw, have strong brand loyalty.

- Product Diversification: It offers a wide range of two- and three-wheelers, which appeal to all segments: commuter, sports, and commercial vehicles. It helps the company reach a wider customer base.

- Economies of scale: It benefits from economies of scale in manufacturing, with an annual capacity to manufacture more than 6 million vehicles.

Weaknesses

- High Dependence on Exports: Heavy dependence upon exports exposes Bajaj Auto to geopolitical and currency exchange risks, which can impact profitability.

- Low Penetration in Electric Vehicles: Bajaj Auto, even with the launch of the Chetak electric scooter, has relatively few electric vehicle offerings compared to competitors that are aggressively launching a variety of electric vehicles.

- Fluctuating Demand for Products in the Market: The performance of the company largely depends on the economic cycles of its key markets. Hence, demand for vehicles, especially in price-sensitive categories, varies cyclically.

Opportunities

- Expansion in Electric Vehicles: Increasing demand for ‘greener’ transport opens up great avenues for Bajaj Auto to expand its range of electric vehicles and tap a sizable chunk of the EV market.

- Rural Market Penetration: With increasing disposable incomes and improving roads in rural areas, Bajaj Auto’s quest to enhance market penetration can be supplemented by offering reasonably priced but effective mobility solutions that exactly address the needs and priorities of rural consumers.

- Investment in Technology: Developing advanced technologies can give Bajaj Auto an edge over its competitors and attract new customers.

Threats

- Intense Competition: Two- and three-wheeler segments are very competitive due to the presence of prominent automobile companies such as Hero MotoCorp and TVS. New EV companies are aggressively trying to gain market share.

- Regulatory Challenges: Increasing environmental regulations and safety standards require continuous investment in R&D and compliance, thereby straining resources and affecting profit margins.

- Economic Slowdowns: Economic slowdowns, both within the home country and globally, can have a major impact on the revenues of Bajaj Auto.

Read Also: Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

Conclusion

Bajaj Auto Ltd. has established itself as a major player in the automobile sector due to its strategy, product portfolio, and global reach. Bajaj Auto manufactures a wide range of automobiles that cater to different customer segments. Moreover, due to exceptional product quality and reliability, the company has become a household name in India. The company is also expanding operations in the EV segment with the launch of the Chetak electric scooter. The company must continuously innovate and develop superior products to beat competitors and increase its market share. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What partnership does Bajaj Auto have?

Bajaj Auto has partnership agreements with world brands such as KTM and Triumph, which will significantly enhance its product offerings.

What are the strengths of Bajaj Auto?

Bajaj Auto’s strengths include well-established brand recognition, a diversified product portfolio, strategic partnerships, and a strong export business.

What are the key challenges faced by Bajaj Auto?

Key challenges faced by Bajaj Auto include high competition, regulatory pressures, and economic slowdowns. Moreover, the company’s limited presence in the electric vehicle market is also a challenge.

Does Bajaj Auto manufacture electric vehicles?

Yes, Bajaj Auto launched the Chetak electric scooter in 2020 and plans to manufacture electric vehicles in the future.

What are Bajaj Auto’s future growth plans?

Bajaj Auto plans to grow by expanding its electric vehicle line-up, penetrating the rural markets, and investing in the latest technology to produce efficient products with better features.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.