| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-05-24 | |

| Add new links | Nisha | Apr-10-25 |

- Blog

- bandhan bank case study

Bandhan Bank Case Study: Business Model, Financial Statement, SWOT Analysis

In a country where achieving financial inclusion remains a challenge, Bandhan Bank has brought hope to millions. From its humble beginnings as a microfinance initiative, it has grown into a fully-fledged universal bank, catering to the unbanked sections of India with great dedication.

Today’s blog presents a case study on Bandhan Bank from its grassroots beginnings, business model, and SWOT analysis to understand the factors driving its growth.

Company Overview and History

Bandhan Bank is an Indian commercial bank that mainly caters to underpenetrated markets. It started as a not-for-profit entity, grew to become India’s biggest microfinance institution, and now it is one of the fastest-growing banks in the country.

In 2001, the journey began as a society dedicated to promoting financial inclusion and women’s empowerment by creating sustainable livelihood in rural Bengal. Bandhan Bank recognized the opportunity to reach more people and acquired an NBFC in 2006. This allowed them to grow their operations and reach more customers. In 2010, Bandhan became the largest microfinance institution in India. In a historic move, Bandhan secured a banking license from the Reserve Bank of India in 2015. The company changed from a microfinance organization to a universal bank. This allowed it to provide a broader selection of financial products and services to its customers.

Read Also: Bandhan Long Duration Fund NFO: Objective, Benefits, Risks, and Suitability Explained

Business Model of Bandhan Bank

The bank now serves more than 3.50 crore customers across India through more than 6,250 banking outlets. Bandhan Bank believes in building trust and long-term relationships with customers through personalized service. It tries to reach out to underserved populations through a strong branch network.

Product Portfolio of Bandhan Bank

The bank provides numerous services, which include the following:

- Digital banking – The bank offers feature-rich internet banking services to customers to help them meet their everyday banking needs.

- Housing Finance – The Bank offers individuals home and property loans, including loans for the purchase, construction, repair, renovation, or extension of dwelling units. It also provides Loan Against Property (LAP) on self-occupied residential property and loans against rent receivables on commercial property.

- Retail Liabilities & Retail Assets – This segment offers gold loans, personal loans, auto loans, etc.

- Agri-Business Loan – Under this segment, the bank offers a wide range of credit for agricultural activities to all consumers involved in the agri value-chain system.

- MSME Lending – It offers an array of loan products at competitive interest rates to cater to the needs of micro, small, and medium enterprises (MSMEs).

- Commercial LAP – Catering to various entities such as proprietorships, partnerships, private limited and non‑listed public limited companies, and individual borrowers for loans against property (LAP).

- Third-Party Products – This segment covers insurance products, mutual funds, etc.

Market Data of Bandhan Bank

| Current Market Price | INR 212 |

| Market Capitalization | INR 34,112 crores |

| 52 Week High | INR 263 |

| 52 Week Low | INR 169 |

Financial Statements of Bandhan Bank

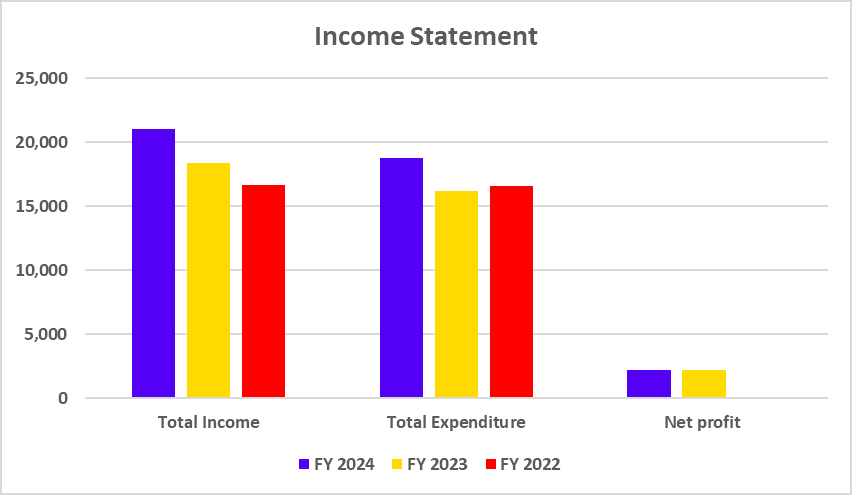

Income Statement

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Income | 21,034 | 18,373 | 16,693 |

| Total Expenditure | 18,804 | 16,178 | 16,568 |

| Net profit | 2,230 | 2,195 | 126 |

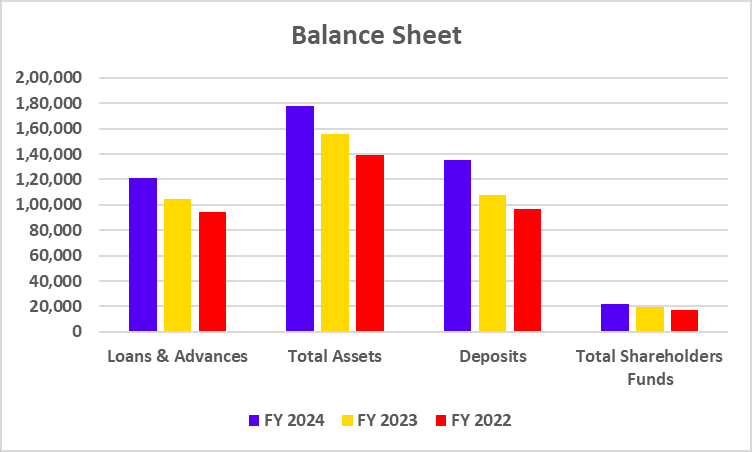

Balance Sheet

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Loans & Advances | 1,21,136 | 1,04,756 | 93,974 |

| Total Assets | 1,77,841 | 1,55,769 | 1,38,866 |

| Deposits | 1,35,201 | 1,08,069 | 96,330 |

| Total Shareholders Funds | 21,609 | 19,584 | 17,381 |

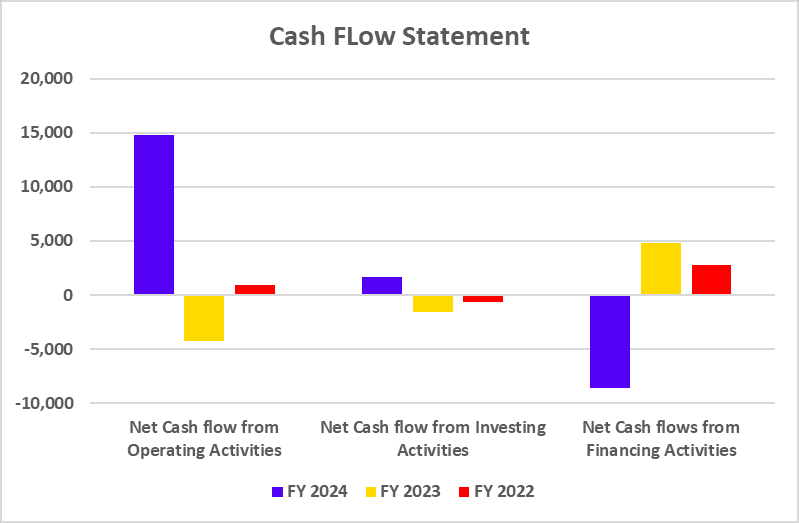

Cash Flow Statement

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Net Cash flow from Operating Activities | 14,808 | -4,244 | 902 |

| Net Cash flow from Investing Activities | 1,690 | -1,617 | -611.83 |

| Net Cash flows from Financing Activities | -8,578 | 4,791 | 2,802 |

Key Performance Indicators (KPIs)

| Key Metrics | FY 2023-24 | FY 2022-23 | FY 2022-21 |

|---|---|---|---|

| ROCE (%) | 3.83 | 4.65 | 5.99 |

| Net Interest Margin (%) | 5.80 | 5.94 | 6.27 |

| Net NPA (in %) | 1.11 | 1.17 | 1.66 |

Read Also: Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

SWOT Analysis of Bandhan Bank

The Bandhan Bank SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.

Strengths

- Bandhan Bank has a strong brand image and is committed to bringing financial services to rural and semi-urban areas.

- It has many branches, which helps it reach a wide customer base and understand the needs and preferences of its target market.

- The bank is led by experienced professionals with a proven track record in the microfinance and banking industry.

Weaknesses

- The bank has trouble managing its assets, especially in its microfinance portfolio.

- Relying too much on microfinance can limit growth and expose the bank to risks specific to that sector.

- Many of Bandhan Bank’s branches are rented, which could affect profits and long-term sustainability.

Opportunities

- Expanding its presence in the untapped markets can increase the customer base and help mitigate risks of geographical concentration.

- The bank can offer more products to serve customers, including individuals and businesses.

- Acquiring other companies can help the business grow faster, increase its market share, and reach new customer groups.

Threats

- Economic recessions can cause increased loan defaults, lower asset quality, and reduced consumer spending.

- Intense competition from both the traditional and new-age banks can erode market share and profitability.

- Operational failures, like system breakdowns or cyber-attacks, can harm the bank’s reputation and cause financial losses.

Conclusion

Bandhan Bank has made great progress in the Indian banking industry, especially in terms of financial inclusion. Its focus on microfinance and its move into universal banking makes it a major player in the market. However, challenges such as asset quality and technological adoption need to be addressed to ensure sustained growth. Bandhan Bank must focus on its strengths and address its weaknesses to succeed in the competitive banking industry. The bank can further fortify its market position by capitalizing on opportunities such as digital banking and geographical expansion.

Frequently Asked Questions (FAQs)

When was Bandhan Bank founded?

Bandhan Bank’s roots trace back to 2001, when it started as a non-profit microfinance organization. It received its banking license and commenced operations as a bank in 2015.

Is Bandhan Bank listed on the Indian stock exchanges?

Yes, it is listed on the NSE and BSE.

What is Bandhan Bank’s current market price and market capitalization?

The market price of the Bandhan Bank stands at INR 212, and the market capitalization is INR 34,201 crores on 2 August 2024.

How has Bandhan Bank performed financially?

Bandhan Bank has shown decent growth in recent years, expanding its branch network and customer base.

Is Bandhan Bank a good investment option?

Investing in banks needs a long-term outlook because of market fluctuations and economic cycles. Like any other bank, Bandhan Bank carries inherent risks, and investors should analyze their risk appetite before investing.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.