| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-11-24 |

- Blog

- bank of baroda vs sbi bank

Bank of Baroda vs SBI Bank: Which is Better?

In today’s world, it can be a challenging task to select the best bank to keep your excess funds and invest in. Numerous public and private-sector banks offer individuals a wide variety of products and services to choose from.

In today’s blog article, we will compare the State Bank of India and the Bank of Baroda.

Bank of Baroda Overview

Maharaja Sayajirao Gaekwad, the king of Baroda, founded the bank in 1908 to support the local economy. The bank and other commercial banks were nationalized by the Indian government later in 1969. Between 1970 and 1990, the bank witnessed a period of expansion. The bank established branches in the United States and a few other locations, including London, Dubai, Hong Kong, and New York. Bank of Baroda is India’s third-largest public sector bank after merging with Dena Bank and Vijaya Bank in 2019. With more than 11,000 ATMs and 8200 branches nationwide, the company is active in more than 17 countries. In addition to providing essential banking services, the bank offers loans to nearly every sector of the economy. The bank’s main office is in Vadodara, Gujarat.

SBI Overview

SBI is India’s most significant public sector bank and a giant of the country’s banking industry, with an extensive history of over 200 years. The headquarters of SBI is in Mumbai.

The Bank of Calcutta, the first joint stock company in British India, was established in 1806, marking the beginning of SBI. In British India, three distinct presidential banks—the Bank of Bengal, the Bank of Bombay, and the Bank of Madras—emerged. In 1921, the three presidential banks united to establish the Imperial Bank of India.

The Imperial Bank of India was nationalized by the Indian government in 1955 and was renamed the State Bank of India. Later, SBI bought several commercial and state-affiliated banks.

In 2017, the State Bank of India merged with its five affiliated banks—State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, and State Bank of Travancore. This merger increased the banks’ efficiency and demonstrated the significant contribution SBI has made in the expansion of banking services into rural areas. SBI currently has a robust distribution network with 65,627 ATMs and 22,405 branches.

Comparative Company Study

| Particular | Bank of Baroda | State Bank of India |

|---|---|---|

| Current Share Price | INR 250 | INR 816 |

| Market Capitalization (In INR Crores) | 1,29,362 | 7,27,936 |

| 52-Week High Price | INR 300 | INR 912 |

| 52-Week Low Price | INR 186 | INR 543 |

| FIIs Holdings (%) | 11.45 | 11.15 |

| DIIs Holdings (%) | 16.03 | 23.64 |

| Book Value Per Share | INR 231 | INR 465 |

| PE Ratio (x) | 6.83 | 9.94 |

Read Also: Bank of Baroda vs Canara Bank

Financial Statements Comparison

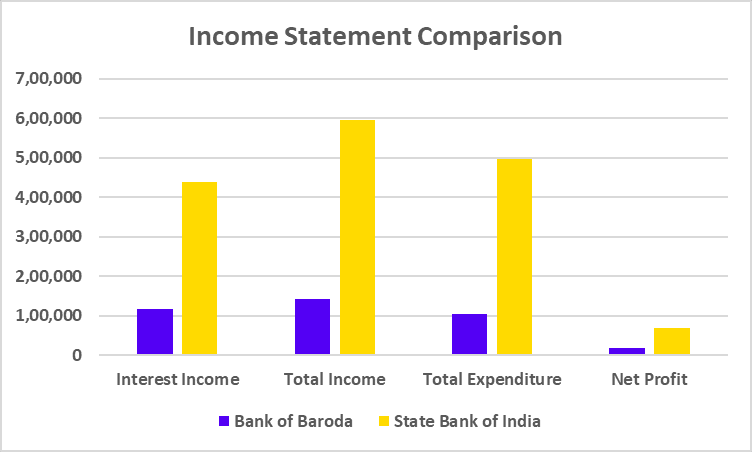

Income Statement Comparison (FY 2024)

| Particular | Bank of Baroda | State Bank of India |

|---|---|---|

| Interest Income | 1,18,379 | 4,39,188 |

| Total Income | 1,41,778 | 5,94,574 |

| Total Expenditure | 1,04,174 | 4,95,543 |

| Net Profit | 18,471 | 68,224 |

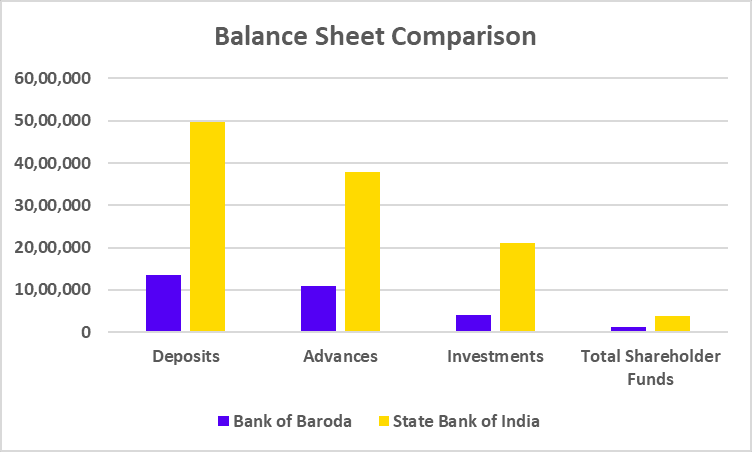

Balance Sheet Comparison (FY 2024)

| Particular | Bank of Baroda | State Bank of India |

|---|---|---|

| Deposits | 13,51,801 | 49,66,537 |

| Advances | 10,88,983 | 37,84,272 |

| Investments | 4,07,136 | 21,10,548 |

| Total Shareholder Funds | 1,18,676 | 3,86,491 |

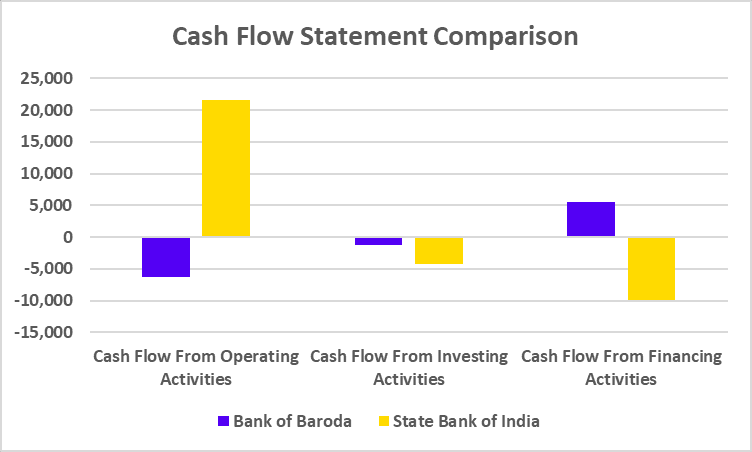

Cash Flow Statement Comparison (FY 2024)

| Particular | Bank of Baroda | State Bank of India |

|---|---|---|

| Cash Flow From Operating Activities | -6,273 | 21,632 |

| Cash Flow From Investing Activities | -1,285 | -4,251 |

| Cash Flow From Financing Activities | 5,475 | -9,896 |

Key Performance Indicators

| Particular | Bank of Baroda | State Bank of India |

|---|---|---|

| Net Interest Margin (%) | 2.92 | 2.66 |

| Net Profit Margin (%) | 15.55 | 15.51 |

| ROE (%) | 15.67 | 17.31 |

| ROCE (%) | 2.38 | 1.63 |

| CASA (%) | 38.58 | 39.92 |

Read Also: PNB vs Bank of Baroda

Conclusion

In conclusion, major players in the banking industry, such as the State Bank of India and Bank of Baroda, provide several services to customers. From the data above, we can see that SBI has a higher net profit than Bank of Baroda, but Bank of Baroda has a slightly higher net interest margin. Before making any financial decisions, you should take your risk tolerance into account, even if SBI has a greater number of branches around the nation.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | HDFC Bank vs Axis Bank |

| 2 | SBI vs ICICI Bank |

| 3 | PNB vs SBI |

| 4 | HDFC vs SBI |

| 5 | Axis Bank vs ICICI Bank |

Frequently Asked Questions (FAQs)

Which bank, State Bank of India or Bank of Baroda, has a larger market capitalization?

Compared to the Bank of Baroda, the State Bank of India has a larger market capitalization.

Where is the State Bank of India’s headquarters located?

The State Bank of India’s headquarters is situated in Mumbai.

Which bank is more profitable: Bank of Baroda or SBI?

SBI is more profitable than Bank of Baroda, as SBI reported a net profit of 68,224 crores as compared to a net profit of 18,471 crores for Bank of Baroda for FY 2024.

Which bank has the most branches: Bank of Baroda or SBI?

SBI has 22,405 branches, which is more than Bank of Baroda’s 8,200 branches.

Who is the chairman of the State Bank of India?

As of 30 August 2024, Mr. Challa Sreenivasulu Setty has been serving as the chairman of the State Bank of India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.