| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-18-24 | |

| Update meta tags | Nisha | Feb-18-25 | |

| Update meta tags | Nisha | Feb-18-25 | |

| Update meta tags | Nisha | Feb-18-25 | |

| Update meta tags | Nisha | Feb-18-25 | |

| Update meta tags | Nisha | Feb-18-25 | |

| Update meta tags | Nisha | Feb-18-25 |

- Blog

- best ai stocks in india

Best Artificial Intelligence (AI) Stocks In India 2025

Artificial Intelligence (AI) is now a reality and is no longer confined to the realms of science fiction. It is rapidly transforming industries and shaping our daily lives. A good investor always identifies opportunities before others, and artificial intelligence is one industry that can deliver exceptional returns in the future.

Many Indian companies are driving the AI revolution, and the best part is that the general public can also invest in them through stock markets. In today’s blog, we will explore the best Artificial Intelligence stocks in India based on their market capitalization and their recent returns. We will also discuss the services offered by these companies and the future of the AI industry.

Overview of AI industry in India

India’s AI market is expected to reach $17 billion by 2027, with a CAGR of 25% to 35%. India is a major contributor of AI talent worldwide, with 16% of the world’s AI talent coming from India. This ranks India as one of the top three talent markets. The demand for customization and integration of business processes creates a prime opportunity for companies to deliver professional services tailored to integrate them with existing systems and data. AI could greatly contribute to India’s economy. Estimates show it can add $1 trillion by 2035.

Additionally, data privacy and security are of utmost importance when adopting AI, and India should have strong regulations to ensure the responsible development of AI.

Top AI Stocks Based on the Market Capitalisation

The top AI stocks in 2025 are:

| S.No. | AI Stocks |

|---|---|

| 1 | Tata Consultancy Services (TCS) |

| 2 | Infosys |

| 3 | HCL Technologies |

| 4 | Wipro |

| 5 | Tech Mahindra |

The AI stocks have been listed in descending order based on their market capitalization in the table below:

| Company | Current Market Price (INR) | Market Capitalisation (in INR crore) | 52-Week High | 52-Week Low |

|---|---|---|---|---|

| TCS | 4,178 | 15,11,800 | 4,255 | 3,311 |

| Infosys | 1,726 | 7,16,661 | 1,738 | 1,305 |

| HCL Tech | 1,570 | 4,25,923 | 1,697 | 1,095 |

| Wipro | 560 | 2,92,750 | 567 | 375 |

| Tech Mahindra | 1,516 | 1,48,267 | 1,528 | 1,082 |

Best AI Stocks in India Based on Market Capitalization – An Overview

The best AI stocks in India are given below, along with a brief overview of the services they provide:

1. Tata Consultancy Services (TCS)

Tata Consultancy Services is an Indian multinational IT services and consulting company. TCS is headquartered in Mumbai, India. TCS has over 603,305 trained consultants in 55 countries.

TCS was founded in 1968 when Mr Fakir Chand Kohli brought together a young team of IT professionals. TCS offers a range of IT services in the following domains:

- Artificial Intelligence

- Cloud services

- Consulting

- Cybersecurity

2. Infosys

Infosys is a global IT services and consulting company that offers digital services and consulting. The company was established in 1981 in Pune by seven engineers with a capital of $250. It currently operates with 317,240 employees and has a presence in over 56 countries. It is headquartered in Bangalore, India.

Initially, the company focused on providing software consulting and development services to US clients. With time, the company pioneered the Global Delivery Model (GDM), which allowed remote execution with cost advantage. The tech giant went public in 1993. Infosys offers a range of IT services in the following domains:

- Next-Generation Integrated AI Platform

- Infosys Consulting

- Cloud-based services

- Blockchain

3. HCL Technologies

Earlier known as Hindustan Computers Limited, it is another key player in the Indian technology industry. The company is headquartered in Noida, India and has an employee strength of over 227,481.

HCL Technologies offers a range of tech services, which include:

- Helping clients incorporate AI in their business processes.

- Digital solutions to increase the efficiency of the client’s business.

- R&D services to accelerate product development and increase returns.

- Cloud Services

4. Wipro

Wipro is a leading technology services and consulting company that builds innovative solutions that address clients’ most complex digital transformation needs. It has over 225,000 employees.

The company was founded in 1945 by M.H. Hasham Premji. It initially emphasized selling consumer goods and vegetable oils. In 1981, Wipro diversified its operations into the IT business under the leadership of Azim Premji, who is still a respected figure in the Indian IT industry.

Wipro offers a range of IT services which includes:

- Helping businesses migrate to the cloud and leverage its benefits for scalability and efficiency.

- Providing consulting and implementation services to help companies adapt to the digital age.

- Creating and maintaining custom software applications for several needs.

- Developing and implementing AI-powered solutions and integrating robotic automation for advanced functions.

- Managing and optimizing non-core business processes for cost savings and improved efficiency.

5. Tech Mahindra

Tech Mahindra is a part of the Mahindra Group and was founded in 1986. The company employs 138,000 employees and is present in over 90 countries. The company offers innovative and customized information and technology services that help enterprises, associates, etc.

The company offers a range of services in the following domains:

- Artificial Intelligence

- Digital Enterprise applications

- Cloud & Infrastructure services

- Strategy & Consulting

Top AI Stocks Based on 1 Year Return

The top AI stocks in 2025 are:

| S.No. | AI Stocks |

|---|---|

| 1 | Oracle Financial Services Software Ltd. |

| 2 | Bosch Ltd. |

| 3 | Kellton Tech Solutions Ltd. |

| 4 | Zensar Technologies Ltd. |

| 5 | Cyient Ltd. |

The AI stocks have been listed in descending order based on their 1 year returns in the table below:

| Company | 1 Year Return |

|---|---|

| Oracle Financial Services Software Ltd | 182.04% |

| Bosch Ltd | 79.55% |

| Kellton Tech Solutions Ltd | 74.24% |

| Zensar Technologies Ltd | 54.47% |

| Cyient Ltd. | 23.90% |

Read Also: Best Artificial Intelligence (AI) Smallcap Stocks

Best AI Stocks in India Based on 1 Year Return – An Overview

The best AI stocks according to 1 year return are given below, along with a brief overview of the services they provide:

1. Oracle Financial Services Software Ltd.

Oracle Financial Services Software Ltd. (OFSS) is a subsidiary of Oracle Corporation and has its headquarters in Mumbai. It helps financial institutions such as banks launch new products and build customer-centric digital solutions with the help of Oracle’s AI-driven applications and cloud services. It has been using machine learning to improve detection, deep learning to find patterns and natural language processing (NLP) to extract data. It offers a range of services listed below:

- Anti-money laundering & Financial Crime Compliance

- Cloud Infrastructure

- Risk and Finance

- Payments

- Corporate Banking

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 9.82% | 143.97% | 203.28% |

2. Bosch Ltd.

Bosch is a German multinational company headquartered in Gerlingen, Germany. It was established in 1886 and has offices worldwide. It has the largest development center in India outside Germany for the development of engineering and technology solutions. Bosch Center of Artificial Intelligence is an important part of Bosch Research and specializes in deploying AI technologies into products & services. Bosch also offers services in the following areas:

- Neuro – Symbolic AI

- Deep Learning

- Natural Language Processing

- Probabilistic Modeling

- Reinforcement Learning

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -5.22% | 68.77% | 81.02% |

3. Kellton Tech Solutions Ltd.

Kellton Tech Solutions Ltd. ((KTSL) is an Indian multinational company with its headquarters in Hyderabad, India. It provides AI and ML solutions, which can be used to process data and extract insights at a great pace. It offers Utilitarian AI, which can be used to convert computer vision to text. Other services offered include:

- Predictive analytics

- Generative AI

- Machine Learning

- NextGen Services

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 16.51% | 32.86% | 626.48% |

4. Zensar Technologies Ltd.

Zensar Technologies is a major player in the Indian AI industry and is a subsidiary of the RPG group. It is headquartered in Pune, India and has offices in 33 global locations. Zensar’s AI/ML-driven Smart Advisor enables users to navigate market data with exceptional speed and accuracy. It analyzes market news, interprets positive and negative sentiments and provides a future outlook. It provides great value in incorporating ESG risk scores into decision-making processes. The company also offers services in the following domains:

- AI engineering buddy

- Accelerated generative AI

- Cloud strategy

- Automation

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 49.49% | 116.84% | 466.15% |

5. Cyient Ltd.

Cyient Ltd. is an Indian multinational technology company with its headquarters in Hyderabad, India. It was founded in 1991 as Infotech Enterprises Ltd and was later renamed Cyient in 2014. In 2023, Cyient collaborated with Microsoft to make a product named “EnGeneer”, which will help in automating engineering processes. Cyient aims to use the Microsoft Azure OpenAI Service to deliver products in the future. It also provides services in the following domains:

- Generative AI

- Cybersecurity

- Cloud services

- Asset insights

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -29.74% | 64.71% | 226.95% |

Key Performance Indicators (KPIs)

| Company | ROE (%) | ROCE (%) | Debt to Equity | P/E | P/B |

|---|---|---|---|---|---|

| TCS | 50.73 | 63.51 | 0 | 32.25 | 16.71 |

| Infosys | 29.77 | 36.81 | 0 | 27.32 | 9.59 |

| HCL Tech | 23 | 27.92 | 0.03 | 27.13 | 6.87 |

| Wipro | 14.81 | 17.86 | 0.19 | 26.5 | 3.93 |

| Tech Mahindra | 8.84 | 11.7 | 0.06 | 62.89 | 5.55 |

| Oracle Financial Services Software Ltd. | 28.24 | 35.24 | 0.00 | 42.28 | 13.95 |

| Bosch Ltd. | 20.66 | 19.48 | 0.00 | 40.34 | 9.41 |

| Kellton Tech Solutions Ltd. | 14.43 | 18.3 | 0.29 | 21.36 | 3.03 |

| Zensar Technologies Ltd. | 18.66 | 23.63 | 0.00 | 25.48 | 6.3 |

| Cyient Ltd. | 16.03 | 20.61 | 0.11 | 29.75 | 6.49 |

Read Also: What is AI Washing? Definition, Tips, Evolutions & Impact

Benefits of Investing in AI Stocks

AI stocks can be a valuable addition to the portfolio due to the following benefits:

- Future Growth: The artificial intelligence industry is expected to grow multifold in the coming years, which will cause a rise in the prices of AI stocks.

- Diversification: AI stocks provide diversification benefits and protect investor portfolios from market fluctuations.

- Multiple revenue sources: Artificial intelligence has applications in many industries that provide numerous revenue sources for AI companies.

Factors to Consider Before Investing in AI Stocks

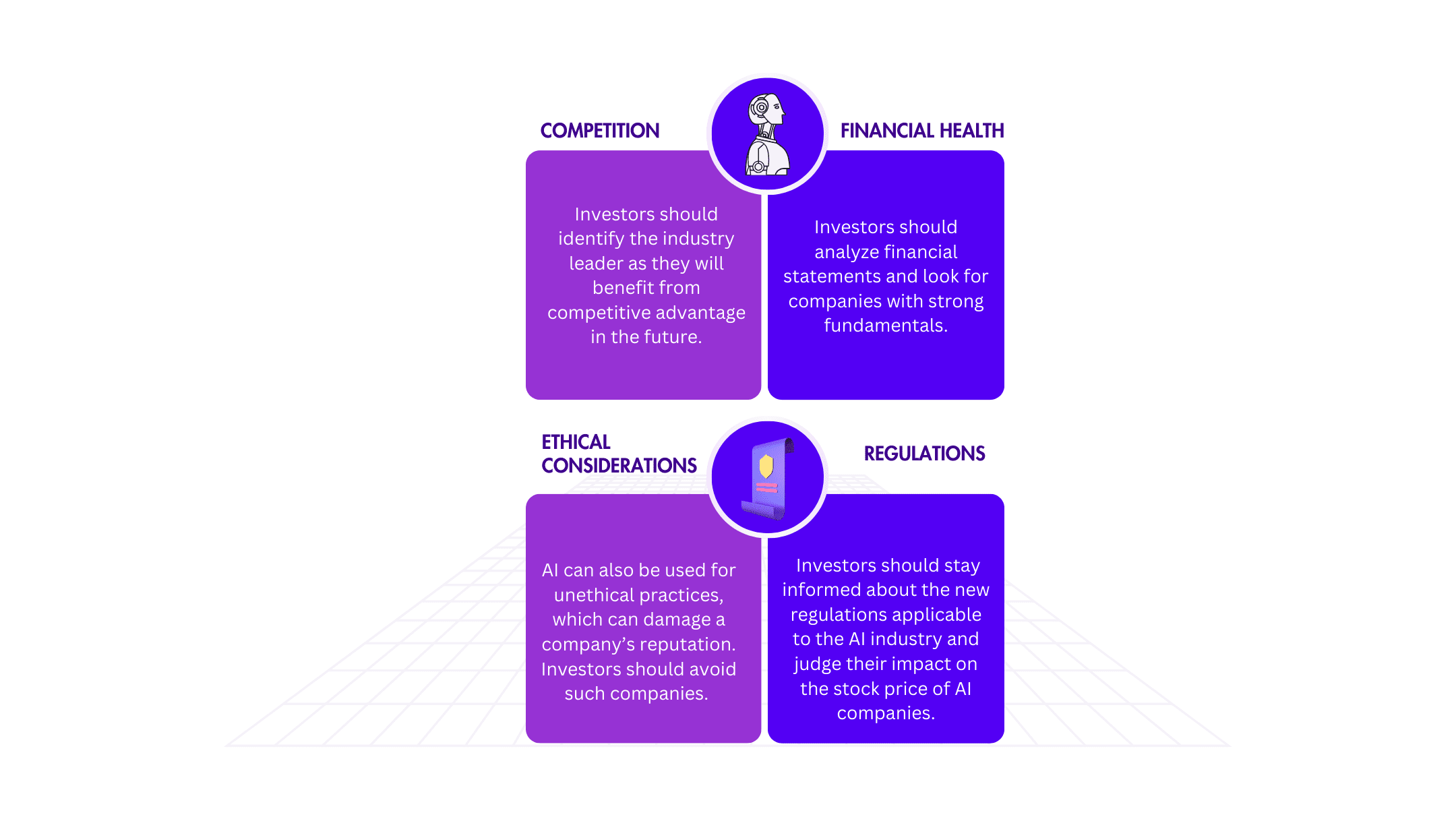

Artificial intelligence is a fairly new industry, and there is a lot of uncertainty surrounding it. Investors must be cautious and consider the following factors before investing in AI stocks:

- Competition: Investors should identify the industry leader as they will benefit from competitive advantage in the future.

- Financial Health: Investors should analyze financial statements and look for companies with strong fundamentals.

- Ethical Considerations: AI can also be used for unethical practices, which can damage a company’s reputation. Investors should avoid such companies.

- Regulations: Investors should stay informed about the new regulations applicable to the AI industry and judge their impact on the stock price of AI companies.

Future of the AI Industry

The future of the AI industry looks bright due to the following factors:

- The development of more powerful and affordable computer chips, especially those designed for AI applications, is helping create more effective AI models.

- The exponential growth of data is driving the rapid advancement of AI technology. AI algorithms need large amounts of data to learn and enhance their capabilities.

- Investments in AI are increasing from both private and public sectors, which helps fund research and development and create new AI applications.

- Nowadays, businesses are looking for methods to automate tasks, and AI is considered an important technology for achieving this.

Read Also: 5 Top Artificial Intelligence Penny Stocks in India

Conclusion

The AI industry in India is growing rapidly because of a large talent pool, consistent government support, and expanding digital infrastructure. However, the road ahead has hurdles. The industry needs more skilled workers and stronger regulations because of data privacy concerns. Even though there are certain challenges, the benefits of AI are undeniable, and as far as AI stocks are concerned, they offer a great avenue for investment. It is important to consider several factors, such as market volatility, competition, etc. and consult a financial advisor before making any investment decision.

Frequently Asked Questions (FAQs)

What is AI?

Artificial intelligence is a field that uses technology to perform advanced tasks like learning and problem-solving.

Why would AI stocks be a good investment?

AI stocks are good investment options because of the high demand for AI solutions, the potential for technological breakthroughs and increased government support.

How can we ensure responsible AI development?

Open discussions, addressing ethical concerns, and strong regulations are important for responsible AI development.

Will AI take away all our jobs?

While some jobs might be automated, AI is also expected to create new opportunities in different work areas.

What are some other AI stocks in India?

AI stocks in India are TCS, Infosys, Wipro, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.