| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-01-24 | |

| Add internal links | Nisha | Feb-18-25 | |

| Add internal links | Nisha | Feb-18-25 | |

| Stocks Data Updated | Ranjeet Kumar | Apr-15-25 |

- Blog

- best air conditioner stocks in india

Listed AC Manufacturing Companies in India

Summers are around the corner, hotter than ever, and nowadays you cannot sit without an air conditioner, but have you ever thought of making profits in this summer season while enjoying your soft drinks? Yes, you can achieve this by investing in a listed AC manufacturing company in India with a strong market presence.

In this blog post, we’ll provide you with all the information you need about India’s top five air conditioner manufacturers.

What are Air Conditioner Stocks?

AC manufacturing firms are those that design, develop, and manufacture commercial air conditioners, room air conditioners, and other cooling equipment. Suppliers of AC unit parts, such as compressors and condensers, are also included in this industry. Additionally, some businesses distribute air conditioners and sell the units to merchants.

List of Best AC Stocks in India

- Voltas Ltd.

- Blue Star Ltd.

- Amber Enterprises India Ltd.

- Johnson Controls

- EPACK Durable Ltd.

Explore the top air conditioner stocks in India with this comprehensive list of the best-performing AC companies to invest in for steady growth.

1. Voltas Limited

In 1954, the company was established in partnership with Volkart Brothers and became a member of the Tata Group. The company’s name comes from the union of its two original names, Volkart’s “Vol” and Tata Sons’ “Tas.” The company started off selling air conditioners, but later on, they added air coolers, water dispensers, and commercial refrigeration to their line of products. To manufacture household appliances, the company recently partnered with the Ardutch, which is controlled by the Koc Group which makes the Beko brand of appliances, and started manufacturing appliances under the name of “Voltas Beko”. The Ministry of Finance awarded the company “The Most Energy Efficient Appliance of the Year in Air Conditioners” in 2021. The company’s headquarters are located in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -1.43% | 0.34% | 152.17% |

2. Blue Star Limited

In 1943, Blue Star Limited was established by Mohan T. Advani. The company’s first concentration is on air conditioner and refrigerator repair and reconditioning. The company worked along with a US-based company to manufacture air conditioners. The company employs 765 service associates and has 5000 stores and has presence in 18 countries. The company owns and operates manufacturing plants in Dadra, Kala Amb,Wada and Ahmedabad. The company’s headquarters are located in Mumbai.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 46.31% | 250.22% | 721.12% |

3. Amber Enterprises India Ltd.

The company was founded in 1990, and its main office was located in Gurugram, Haryana. In 2004, they also began producing room air conditioners and sheet metal components. The business was listed on a stock exchange in 2018. They employ more than five thousand people. To support the strategic expansion of their business, they have completed several well-considered acquisitions, including those of PICL India Pvt. Ltd. and IL JIN Electronics India Pvt. Ltd.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 90.04% | 93.54% | 582.77% |

4. Johnsons Control India

The company is a part of Johnson Controls International PLC. The company offers a range of products, including heating, ventilation, and air conditioning systems. The business set up a shop in India in 1995 and bought HVAC automation equipment for the populace there. In an attempt to broaden its product line in India, the business merged with Tyco International, a firm that offers fire safety and security solutions.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 55.00% | -16.15% | -19.02% |

5. EPACK Durable Limited

This Indian business produces a broad variety of long-lasting consumer goods. It was established as “EPACK Durable Solutions Private Limited” as a private company. The company started to expand its line of products to include consumer durables like refrigerators, air conditioners, and other household appliances. The business changed its name to “EPACK Durable Limited”, a public limited company in June 2023. The company is acknowledged as India’s second-largest manufacturer of original room air conditioner designs.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 117.69% | 77.90% | 77.90% |

Read Also: List of Best Tobacco Stocks in India

Comparative Study of AC Companies Stocks

Market Capitalization

| Company | Share Prices (In INR) | Market Capitalization (In crores) | 52 Week High Price(In INR | 52-Week Low Price(In INR |

|---|---|---|---|---|

| Voltas Ltd. | 1,282 | 42,423 | 1,946 | 1,135 |

| Blue Star Ltd. | 2,024 | 41,616 | 2,420 | 1,350 |

| Amber Enterprises India Ltd. | 6,896 | 23,325 | 8,177 | 3,310 |

| Johnson Controls | 1,762 | 4,792 | 2,621 | 1,109 |

| EPACK Durable Ltd. | 393 | 3,771 | 674 | 158 |

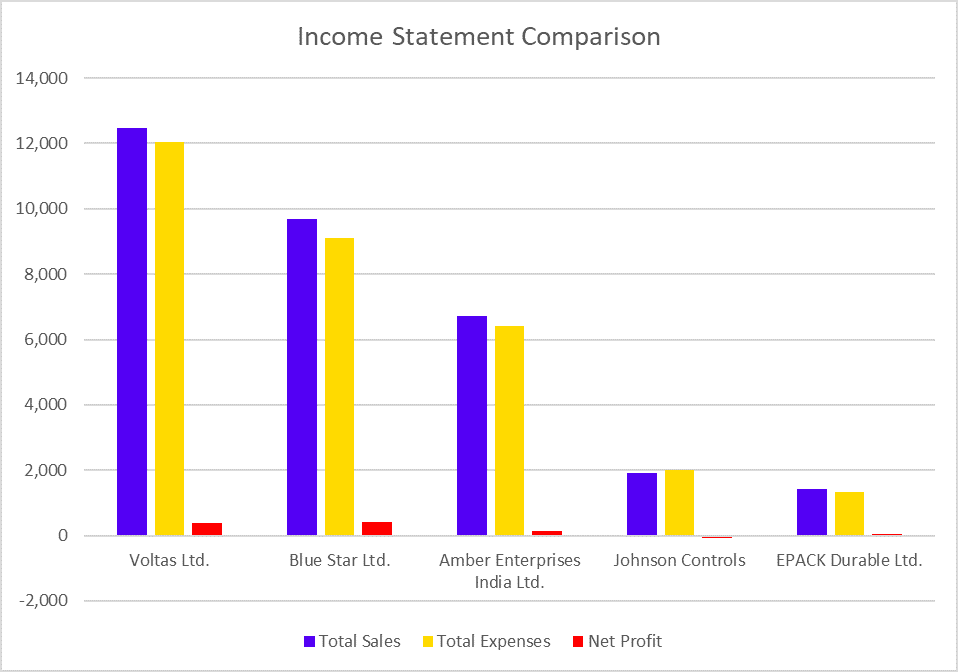

Income Statement Comparison (FY 2024)

| Company | Total Sales | Total Expenses | Net Profit |

|---|---|---|---|

| Voltas Ltd. | 12,481 | 12,054 | 386 |

| Blue Star Ltd. | 9,685 | 9,118 | 413 |

| Amber Enterprises India Ltd. | 6,729 | 6,423 | 141 |

| Johnson Controls | 1,918 | 2,011 | -75 |

| EPACK Durable Ltd. | 1,419 | 1,338 | 36 |

According to the above statistics, Voltas Ltd.. reported the greatest profit of INR 414.31 crores and had the highest sales of INR 12734 crores.

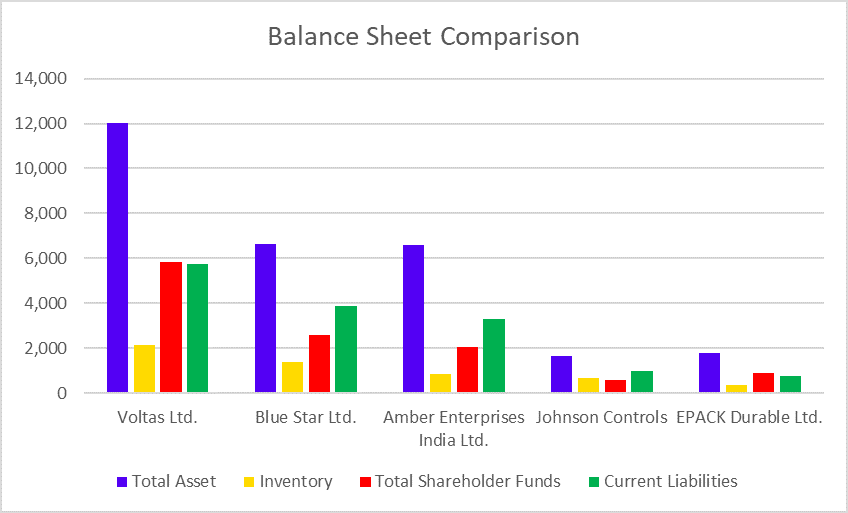

Balance Sheet Comparison (FY 2024)

| Company | Total Asset | Inventory | Total Shareholder Funds | Current Liabilities |

|---|---|---|---|---|

| Voltas Ltd. | 12,035 | 2,135 | 5,820 | 5,756 |

| Blue Star Ltd. | 6,618 | 1,407 | 2,609 | 3,879 |

| Amber Enterprises India Ltd. | 6,593 | 840 | 2,063 | 3,285 |

| Johnson Controls | 1,657 | 656 | 582 | 968 |

| EPACK Durable Ltd. | 1,767 | 378 | 891 | 752 |

According to the above table, EPACK Durable has the least amount of assets, while Voltas has the most.

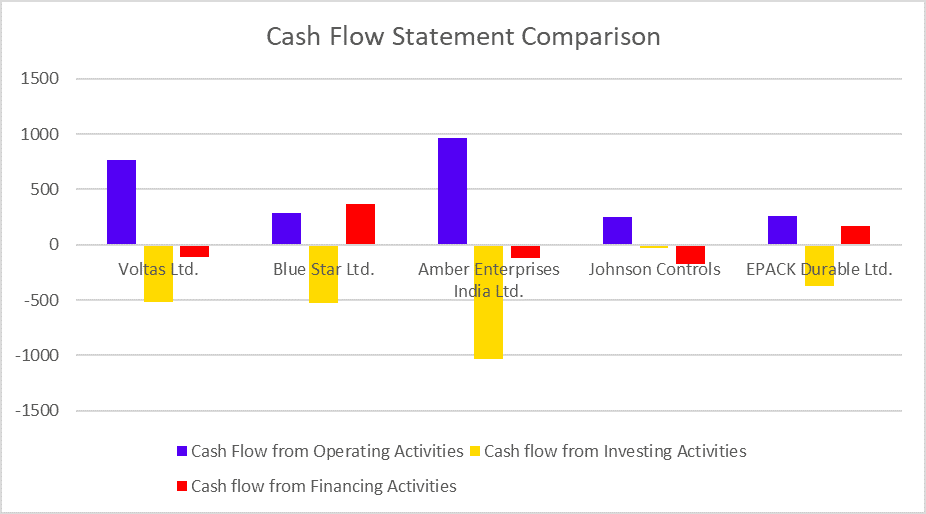

Cash Flow Statement Comparison (FY 2024)

| Metric | Voltas Ltd. | Blue Star Ltd. | Amber Enterprises India Ltd. | Johnson Controls | EPACK Durable Ltd. |

|---|---|---|---|---|---|

| Cash Flow from Operating Activities | 761 | 289 | 964 | 254 | 256 |

| Cash flow from Investing Activities | (522) | (524) | (1034) | (32) | (376) |

| Cash flow from Financing Activities | (116) | 364 | (121) | (172) | 166 |

Among the above-mentioned companies, all companies have negative cash flows from investing activities, whereas only Blue Star and EPACK durables have positive cash flows from financing activities.

Key Performance Indicators

| Particular | Voltas Ltd. | Blue Star Ltd. | Amber Enterprises India Ltd. | Johnson Controls | EPACK Durable Ltd. |

|---|---|---|---|---|---|

| Net Profit Margin (%) | 3.09 | 4.27 | 2.10 | -3.94 | 2.56 |

| ROCE (%) | 10.83 | 22.44 | 10.90 | -8.05 | 8.8 |

| Current Ratio (x) | 1.34 | 1.30 | 1.02 | 1.20 | 1.33 |

| P/E (x) | 194.76 | 77.6 | 92.81 | -34.32 | 33.78 |

| P/B (x) | 8.44 | 10.01 | 5.97 | 4.44 | 1.62 |

Of the companies listed above, Blue Star has the highest ROCE while Johnson Controls has a negative ROCE.

Read Also: Top 10 Most Expensive Stocks in India

Reasons to Invest in Air Conditioning Stocks

- Due to hot climatic conditions, the demand for air conditioners will be on the higher side, resulting in higher revenues and profits. AC stocks can be considered as a good investment opportunity.

- The introduction of innovative technologies such as inverter ACs or energy-efficient ACs creates an opportunity for companies to introduce new products to the market and increase their revenue.

The Risk Associated with AC Stocks

The risks associated with investing in AC company stocks are as follows-

- Due to intense competition between various players in the industry can lead to price competition and lower profit margins.

- If the disposable income of the people decreases due to economic conditions, the demand for such products will be affected negatively.

- The sales of AC are seasonal, which will lead to fluctuation in the stock prices, hence not suitable for investors who are looking for long-term gains.

Future of AC Stocks in India

India’s need for air conditioners is predicted to rise as a result of rising disposable income and urbanization. Additionally, as a result of the rising temperatures, more people are eager to get air conditioners, which will boost business revenue. Numerous other variables, including government programs and energy efficiency legislation, also have an impact on this sector’s growth. As a result of the increasing popularity of energy-efficient and creative technologies like inverter air conditioners, companies can increase the manufacturing of these kinds of products.

Read Also: List of Best Chemical Stocks in India

Conclusion

In conclusion, urbanization, temperature rise, and rise in disposable income present growth opportunities for investing in AC stocks. However, there are several other elements you should take into account before investing, including the company’s finances, product innovation, general economic conditions, etc., all of which could have an impact on the performance of the firm. Therefore, before making any investing decisions, it is advisable to take all of these issues into account and consult with your financial advisor.

Frequently Asked Questions (FAQs)

Which is the largest AC company in India?

Based on market capitalization and market share, Voltas is the biggest AC company. Its market capitalization is about 49133 crores, and its market share is approximately 35%.

What are some of the biggest air conditioner stocks in India?

Some of the leading air conditioner stocks include Voltas Ltd., Blue Star Ltd., Amber Enterprises India Ltd, and Johnson Controls Ltd.

How can I invest in air conditioner stocks?

You can invest in air conditioner stocks by choosing a brokerage firm and opening a demat account with them.

What factors should I consider before investing in air conditioner stock?

There are various factors, such as economic conditions, seasonal demand, financials of the company, its market share etc.

Should I invest in air conditioner stocks?

The growth of air conditioner companies depends on the climatic conditions in a region or country; as in India, the temperature is rising continuously, and along with this, disposable income is also increasing. One can consider investing in these stocks after consulting their investment advisor.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.