| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-19-23 |

- Blog

- best alternatives to fixed deposits

Best Alternatives To Fixed Deposits

Tired of investing in FDs, and looking for another option to invest?

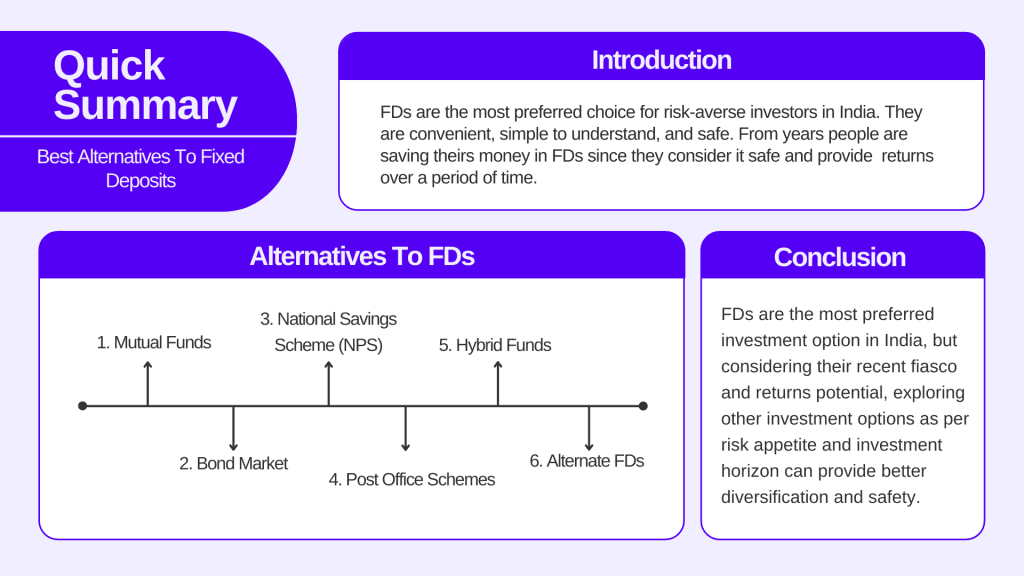

FDs are the most preferred choice for risk-averse investors in India. They are convenient, simple to understand, and safe….wait, are they really safe? It may or may not.

After the recent fiasco of Yes Bank and PMC Bank, it can be understood that FDs are not 100% safe. Further, there are a few drawbacks, such as penalty for premature withdrawal, not so-flexible tenure, etc.

What is the safest investment then? What are the other options that provide more flexibility or tax efficiency than Fixed Deposits? In this blog, we will explore answers to all such questions.

Alternatives to FDs

Let’s explore the options available to Investors:

1. Mutual Funds

These are pooled investments managed by a professional fund manager. There’s an entire universe of mutual funds.

Check out our blog to learn more: Mutual Funds: Meaning, Types, Features, Benefits and How They Work.

Broadly, there are Equity and Debt mutual funds. While equity mutual funds are riskier and more volatile, debt funds can be an alternative to fixed deposits. In finance, there’s one simple rule: The higher the returns, the higher the risk.

Debt funds are classified on the basis of:

1. Duration: The longer the duration, higher the sensitivity of change in price of the bond.

2. Types of investment: Debt funds invest money in several instruments ranging from money market instruments to corporate bonds. Gilt funds carry less default risk than credit-risk funds.

Check out our blog to learn more: What is Debt Mutual Funds: Invest in the Best Debt Funds in India

2. Bond Market

Another method to get exposure to bonds is to directly invest in bonds. There are several methods to do so. You can directly place bids for various new offerings via brokers. Further, RBI recently launched a Retail direct platform to facilitate investment in govt. securities – Treasury bills, Central / State govt. Bonds, etc. However, direct investing in bonds requires thorough research and carries more risks. For newbies, investing in debt funds is ideal.

Fact: Government securities offer the maximum safety as they carry the Sovereign Guarantee.

3. National Savings Scheme (NPS)

It is a defined contribution voluntary pension scheme launched by Govt. of India. It is a low-cost product that can provide attractive market-linked returns. They invest in equity, bonds, and govt. securities and are managed by fund managers. Further, tax benefit upto INR 50,000 is available under this scheme. However, this is a pension scheme. Therefore, it comes with a lock-in period until the age of 60.

3. Floating Rate Saving Bonds (FRSB)

FRSBs are issued by the Reserve Bank of India (RBI) on behalf of Govt. of India. As the name suggests, coupon rate is not fixed in FRBs like bonds. The coupon is linked to the National Savings Certificate (NSC) + 35 bps spread. They have a maturity of 7 years and do not provide any tax benefit, but coupon rate is generally higher.

4. Post Office Schemes

There are multiple post office schemes available to investors:

1. Public Provident Fund (PPF) – A long term tax-saving investment option where the lock-in period is 15 years.

2. Sukanya Samriddhi Account (SSA) – A govt. of India initiative targeted to the parents of girl children.

3. National Savings Certificate (NSC) – A government savings bond scheme targeted to investors looking for tax savings. NSC has a lock-in period of five years.

5. Hybrid Funds

As the name suggests, they are a mix of equity and debt. They are further classified in the Aggressive or Conservative approach. Aggressive invests more in equity and less in debt instruments, while Conservative hybrid funds take more exposure in debt. Taxation of it depends on the equity exposure of the fund.

Check out our blog on taxation to learn more: Decoding Mutual Funds Taxation In India

6. Alternate FDs

There are multiple types of Fixed Deposits available to investors, however, only bank FDs are common. List of other FDs that one can consider investing in:

1. Corporate FD – These FDs are issued by companies. Generally, they provide higher returns than Bank FDs. The interest rate of FDs can be significantly influenced by the credit rating of the FDs issued. The lower the rating, the higher the interest rate.

However, direct investing in them is more-riskier, they are not insured by Deposit Insurance and Credit Guarantee Corporation (DICGC). Investing via debt funds is the ideal route.

2. Senior Citizen FDs: Investors aged more than 60 years are eligible to invest in Senior citizen FDs. They carry higher interest than regular FDs.

3. Tax Saving FDs: Unlike regular FDs, they provide tax benefit of up to INR 1,50,000 under section 80C but comes with a lock-in period of five years.

Options for Senior Citizens

1. Senior Citizen Savings Scheme (SCSS): SCSS is a post office scheme offered to senior citizens, i.e., 60 years and above. The interest rate in SCSS is higher as compared to other options, and also tax benefit under section 80C is there. However, a maximum of INR 30 lakhs can be invested in this, and they come with a lock-in period of five years.

2. Bank FDs: As the name suggests, senior Citizen FDs are targeted to senior citizens only. They offer higher interest rates and flexible tenure as compared to regular bank FDs. However, no tax benefit is available in such FDs.

Read Also: A Guide To Fixed Deposits: Exploring Types And Interest Rates

Why Alternate Options?

Now, you will ask why all this when one can simply invest in FDs, well there are multiple reasons:

1. Taxation: Capital gains from fixed deposits are taxed as per your income slab rate. If you fall in the bracket of 30%, then it might not be efficient for you.

2. Maturity: For long-term investment, FDs provide fewer options. In Bonds, you can even invest for 40 years.

3. Safety: After recent cases of PMC and Yes Bank, we can say that FDs are not 100% safe and so are the other investment option. Generally, the central govt. issued securities like Treasury Bills, Bonds are the safest instrument to invest as they are backed by Sovereign Guarantee. If such securities give higher returns, then investment in these is preferred over regular FDs.

Fact: Bonds issued by State Government / State Development Loans (SDLs) generally provide higher returns than regular bank FDs.

4. Withdrawal: In case of premature withdrawal in FDs, one has to pay penalties. However, in the case of instruments like bonds, you can sell in open market as well, even before the maturity (considering enough liquidity is available). Further, if market conditions are in favour of you, then apart from fixed coupons, you can also get capital gains.

Read Also: Which is Better: Fixed Deposit or Residential Property Investment

Conclusion

FDs are the most preferred investment option in India, but considering their recent fiasco and returns potential, exploring other investment options as per risk appetite and investment horizon can provide better diversification and safety. Few can give you better returns, and few instruments are more tax efficient.

Consider the risk profile, investment horizon, and financial goal, then select the best available option that aligns with your goal and invest money there.

Frequently Asked Questions (FAQs)

Which is more liquid: Liquid funds or Short duration funds?

Liquid funds.

What is the maximum limit to invest in Senior Citizen Savings Scheme (SCSS)?

One can invest up to INR 30,00,000 in SCSS.

What are the investment options in which tax benefit under section 80C is available?

Tax Savings FDs, National Savings Certificate (NSC), ELSS Funds, SCSS for Senior citizens, etc.

Are Fixed Deposits insured in India?

Fixed deposits in India are secured till INR 5,00,000 by Deposit Insurance and Credit Guarantee Corporation (DICGC).

Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.