| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-21-25 |

- Blog

- best fmcg penny stocks list

10 Best FMCG Penny Stocks in India to Buy in 2025

The FMCG sector forms the backbone of the Indian economy as the products manufactured by companies in this sector are used by almost everybody. Are you interested in investing in penny stocks of the FMCG sector? If yes, then you are in the right place. In this blog, we will look at the top 10 penny stocks in India’s FMCG industry, their overviews, KPIs, and key points that every investor should consider before investing.

These stocks are some of the best performing FMCG penny stocks in India for anyone looking to begin investing with small capital in the stock market. The Pocketful app and website make it simple to search, analyze and invest in these penny stocks.

What is an FMCG penny Stock?

FMCG penny stocks refers to shares of companies in the Fast Moving Consumer Goods (FMCG) sector which are low-priced, usually below ₹20. These companies sell products of everyday use, which includes food, drinks, toiletries, etc. Their low trading price makes them a go-to option for investors searching for significant growth prospects with low capital.

Top 10 FMCG Penny Stocks List With Price

Here’s a list of top FMCG penny stocks under ₹10 & ₹20:

| Company Name | Current Price (₹) | Market Capitalization (₹ Crores) | 52-Week High (₹) | 52-Week Low (₹) |

|---|---|---|---|---|

| HMA Agro Industries Ltd | 32 | 1,602 | 66.4 | 27.50 |

| BCL Industries Ltd | 39.7 | 1,172 | 68.90 | 33 |

| AVT Natural Products Ltd | 61 | 929 | 103 | 51 |

| Sarveshwar Foods Ltd | 6.93 | 678 | 12.3 | 5.62 |

| Mishtann Foods Ltd | 5 | 539 | 19.7 | 4.28 |

| MK Proteins Ltd | 7 | 263 | 15.00 | 5.37 |

| JHS Svendgaard Laboratories Ltd. | 14 | 120 | 32.9 | 11 |

| Tasty Dairy Specialities Ltd | 7.67 | 15.7 | 16.50 | 6.28 |

| Future Consumer Ltd | 0.52 | 104 | 1.26 | 0.46 |

| ANS Industries Ltd | 10.2 | 9.49 | 14.2 | 8.27 |

Note: Some of the stocks mentioned above have a share price above ₹10 & ₹20. However, these stocks belong to small-cap FMCg companies with similar high-growth characteristics.

Overview of the Top 10 FMCG Penny Stocks

1. HMA Agro Industries Ltd

Specializing in the meat processing and exports since 2008, HMA Agro Industries Ltd is involved in the frozen meat industry. The company deals with frozen buffalo meat, vegetables, fish and other agro products, vegetables and cereals.

HMA Agro exports their produced goods under the brand name Black gold, Kamil, HMA, Fresh Gold, and Green Gold to around 50 different countries. The company is recognized as a three star export house and is valued for versatile export products.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -50.92% | -48.27% | -48.27% |

2. BCL Industries Ltd

BCL Industries Ltd, incorporated in 1976, is located in Punjab and undertakes edible oil refining, distillery activities, and real estate. The firm is a leading manufacturer of mustard, soybean, and rice bran oils and sells them under several brands.

Additionally, the company runs one of the largest grain-based distilleries in India, producing ENA and ethanol. BCL also focuses on sustainability and has zero-liquid discharge distilleries. The company diversified into real estate by constructing residential and commercial buildings in Punjab.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -30.00% | -14.48% | 215.95% |

3. AVT Natural Products Ltd

AVT Natural Products Ltd is one of the most prominent producers of food, beverage and livestock nutrition as well as nutraceuticals plant extracts and natural ingredient solutions. Capitalizing on over 25 years of experience, the firm manufactures and sells oleoresins, value-added animal nutrition products, and tea.

The company operates within one segment, which is solvent-extracted products, and earns most of its revenue from the international markets such as the USA, UK, and UAE. The company seeks to offer goods that are sustainable and natural.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -29.34% | -50.27% | 98.12% |

4. Sarveshwar Foods Ltd

Holding over 130 years of experience, Sarveshwar Foods Ltd is into the processing and trading of basmati rice. The company provides a complete assortment of traditional Indian basmati rice, including Basmati Rice, Pusa Basmati Rice, and Sharbati Rice.

Sarveshwar Foods has both domestic and international operations with a large share of revenue coming from domestic sales. The company blends age-old values and traditional farming with modern manufacturing techniques and advanced quality systems.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -22.54% | 366.00% | 1,786.10% |

5. Mishtann Foods Ltd

Mishtann Foods Ltd is among the leaders in agro-products, as the company was started back in 1981 and still stands strong with its headquarters in Ahmedabad. The company manufactures basmati rice, wheat, dal, salt and other food grains, and also deals in the processing and trading of these products. Their portfolio also boasts premium brands of basmati rice such as Snowflake and Pristino, alongside midrange Jasper and Rozana, value-for-money brands.

The company is devoted to integrating flavour, nutrition, and customer satisfaction while working towards becoming a dependable Indian brand in agro products across the globe.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -74.68% | -64.73% | 74.81% |

6. MK Proteins Ltd

MK Proteins Ltd undertakes the refining and trading of vegetable oils and oil by-products. Their factory at Ambala, Haryana is capable of oil refining up to 250 tons per day.

The company handles the refining of rice bran, sunflower, cottonseed, soybean, palm, and canola oils. Further, the company also undertakes high quality edible oil production by maintaining cleaning, storage and monitoring systems.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -34.46% | 228.99% | 784.79% |

7. JHS Svendgaard Laboratories Ltd

An established company in the field of Fast Moving Consumer Goods, JHS Svendgaard Laboratories Ltd has specialized in the development of innovative oral care products. Its manufacturing units in Himachal Pradesh make a variety of personal care items that include toothbrushes, toothpaste, mouthwash, and talcum powder.

The company operates domestically and abroad with a strong presence in the UAE, Italy, Nepal, Russia, and the USA. JHS Svendgaard prides itself in the innovative manufacturing solutions offered in the high quality personal care products industry.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -18.60% | -43.55% | 25.56% |

8. Tasty Dairy Specialities Ltd

Tasty Dairy Specialities Ltd is a dairy processing company that started operations in 1992 and is located in Kanpur, India. The company’s product line includes liquefied ghee, butter, cream, pasteurized milk, milk powder, paneer, and other dairy products, in addition to Indian sweets like gulab jamun mix and peda.

The company sells products under UJJWAL, SHIKHAR, VERIFRESH, CIMA, and MITHAI MASTER brands.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -25.15% | -65.17% | 60.00% |

9. Future Consumer Ltd

Future Consumer Ltd is an FMCG 2.0 driven data and technology company. It specializes in the sourcing, manufacturing, branding, marketing, and distribution of fast-moving consumer goods, including food and processed food products, and health and personal-care products. Some of the brands under Future Consumer are Golden Harvest, Tasty Treat, Karmiq, Desi Atta Company, Mother Earth, Voom, Cleanmate, and Caremate. The company uses real time customer data to improve efficiency and scale in its operations.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -45.26% | 88.82% | 93.58% |

10. ANS Industries Ltd

ANS Industries Ltd was established in 1994 and is involved in the business of frozen fruits and vegetables. The company has an installed capacity of 8,000 tonnes per annum and utilizes Individual Quick Freezing (IQF) technology.

ANS Industries products include Cauliflower, French beans, sweet corn, spinach, mangoes, red cherries, mushrooms, and papaya. The company has a processing and packaging facility situated at Karnal, Haryana and its head office is located in New Delhi.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 4.17% | 7.89% | 57.29% |

Key Performance Indicators (KPIs)

| Company Name | Net Profit Margin (%) | ROE(In %) | ROCE(In %) | Debt to Equity Ratio |

|---|---|---|---|---|

| HMA Agro Industries Ltd | 2.08 | 14.03 | 19.04 | 0.68 |

| BCL Industries Ltd | 4.50 | 13.86 | 17.13 | 0.73 |

| AVT Natural Products Ltd | 10.30 | 11.34 | 16.08 | 0.08 |

| Sarveshwar Foods Ltd | 1.99 | 7.27 | 17.91 | 1.29 |

| Mishtann Foods Ltd | 26.86 | 62.82 | 62.85 | 0.08 |

| MK Proteins Ltd | 4.56 | 18.35 | 26.54 | 0.31 |

| JHS Svendgaard Laboratories Ltd. | -5.73 | -2.38 | -1.70 | 0.02 |

| Tasty Dairy Specialities Ltd | -127.47 | 0 | -409.16 | -2.59 |

| Future Consumer Ltd | -35.72 | 0 | 5.14 | -1.34 |

| ANS Industries Ltd | 0 | -7.19 | -5.79 | 0.31 |

Read Also: Top Sugar Companies In India

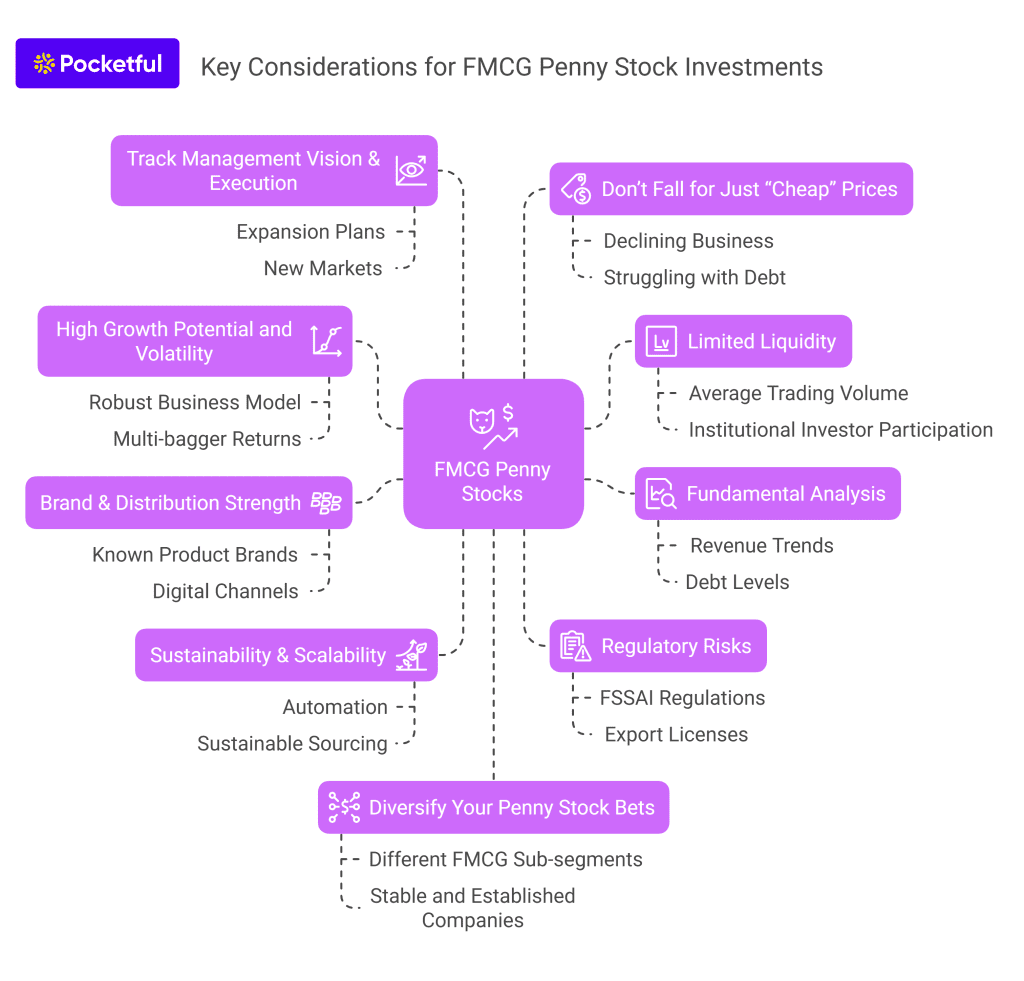

Key Points for Investors While Investing in FMCG Penny Stocks

Investing in FMCG penny stocks can be a high risk, high reward opportunity. These FMCG penny stocks are generally priced under ₹20. However, one should be aware that the low price point and small market cap of these stocks demand careful consideration.

Here are the key takeaways every investor should keep in mind before investing in FMCG Penny Stocks:

1. High Growth Potential and Volatility

If you buy penny stocks in the FMCG sector, they will typically be companies in their initial years of operations or an established company in the past now on a comeback trail. They can have:

a) Relatively low current revenues, but a very robust business model.

b) Branding or export plans.

If they stabilize the business and demand grows, they can offer multi-bagger returns.

Warning: There is a high level of volatility that may lead to wide price movements driven by the market events.

2. Limited Liquidity

Most of the penny stocks in FMCG have trading volume that is significantly lower than average FMCG stock. Purchasing or selling large quantities may be difficult in a short time period. Further, due to the lack of participation from institutional investors, sharp (up or down) movements are frequent.

Tip: Determine the average trading volume per day and avoid stocks that are too hard to sell.

3. Fundamental Analysis

Due diligence is a must in FMCG Penny Stocks. Look at:

- Revenue trends and margins.

- Debt levels.

- Promoter holding and past records.

- Audit quality and governance standards.

Tip: It is a red flag if a company frequently changes auditors or delays release of financial reports.

4. Brand & Distribution Strength

In FMCG, brand recognition and presence is everything. Ask:

- Does the company have any known product brands?

- Is it present in modern retail chains or exports?

- Is it leveraging digital and D2C channels?

A recognizable brand, even in niche segments (like herbal extracts or dairy), can be a big plus for a company.

5. Sustainability & Scalability

Many FMCG penny stocks work in traditional sectors like dairy, rice, edible oils, or processed foods. You should ask:

- Is their business model scalable?

- Are they adopting automation or sustainable sourcing of raw materials?

These factors improve long-term growth prospects and investor appeal.

6. Regulatory Risks

FMCG companies, especially in food, agro, and meat exports, face high compliance standards, which include:

- FSSAI regulations, packaging norms, and export licenses are key.

- Any failure here can severely impact operations and investor trust.

Investors should keep an eye on legal disclosures and regulatory updates.

7. Track Management Vision & Execution

Management’s vision is crucial in the financial performance of small FMCG firms. Ask:

- Are there expansion or product diversification plans?

- Are they entering new markets (e.g., Middle East, Africa, or e-commerce)?

- Does the management deliver what it promised in earlier investor communications?

A competent, transparent leadership team can make all the difference.

8. Don’t Fall for Just “Cheap” Prices

A stock priced around ₹20 isn’t necessarily undervalued, the company may be:

- Facing a declining business

- Struggling with debt

- Or burning cash quarter after quarter.

Focus on value, not price. Even a ₹90 penny stock can be more valuable than a ₹10 one, depending on the business model of the company.

9. Diversify Your Penny Stock Bets

Don’t put all your money into one or two penny stocks. Instead:

- Pick 4-5 with different FMCG sub-segments (e.g., dairy, oral care, meat exports).

- Invest in stable and established FMCG companies along with high-potential emerging ones.

This spreads your risk and increases chances of catching a potential winner.

10. Stay Patient, Think Long-Term

Small FMCG companies take time to grow. If the fundamentals are intact, give your investment:

- Time to compound and overcome short term price declines

- Trust in your vision

Penny stocks are not for making a quick profit, rather they reward the patient investors.

Read Also: 10 Most Undervalued Stocks in India

Conclusion

FMCG penny stocks in India present a unique opportunity for investors looking to enter the fast moving consumer goods space at a lower price point. With consistent demand across urban and rural markets, the FMCG sector holds strong growth potential. However, when dealing with penny stocks, the promise of high returns comes with equally high risk.

The companies that we have discussed in this blog operate across diverse sectors such as rice, dairy, personal care, oils, and meat exports. Each one has its own growth story and challenges. Some are well established in regional markets, while others are actively expanding their operations globally.

As an investor, it’s essential to look beyond the stock price and focus on business fundamentals, management integrity, and scalability. A diversified approach, combined with thorough research can turn these small cap opportunities into significant wealth creators.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | 10 Best Bank Penny Stocks List |

| 2 | Top 10 Highest Dividend Paying Penny Stocks in India |

| 3 | 5 Top Artificial Intelligence Penny Stocks in India 2025 |

| 4 | Top 10 IT Software Penny Stocks in India |

| 5 | 5 Top EV Penny Stocks in India 2025 |

Frequently Asked Questions (FAQs)

Are FMCG penny stocks safe to invest in?

While FMCG as a sector is known for stability, penny stocks carry higher risk due to lower liquidity, limited financial track records, and smaller market capitalization. Investing in them requires thorough research and a long term view.

How do I evaluate a good FMCG penny stock?

There are certain checks that one needs to look for, such as consistent revenue growth, low debt levels, transparent management, increasing institutional investor interest, etc.

Can FMCG penny stocks become multibagger?

The short answer is Yes, some FMCG penny stocks can deliver multifold returns if the company successfully scales its operations and maintains profitability. However, this is rare and requires patience.

How much should I invest in penny stocks?

It’s advisable to limit your exposure to penny stocks to a small percentage of your overall portfolio, generally no more than 5-10%. One should diversify across sectors and avoid investing everything in a single stock or sector.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.