| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-23-25 |

- Blog

- best penny stocks in india

Top 10 Penny Stocks in Indian Real Estate for 2025

The real estate sector is a critical component of any economy, driving growth through residential, commercial, and industrial developments. Companies operating in this sector are essential for shaping urban landscapes, creating jobs, and fostering economic activity. Their contributions to infrastructure, housing, and investment markets make them key players in national economic development and wealth generation.

As the real estate sector continues to evolve with urban expansion and infrastructure development, penny stocks in real estate provide a chance to invest in emerging players that could deliver significant returns. Penny stocks are inexpensive shares of small cap companies, typically trading for less than ₹20. They represent companies with small market capitalizations and have a reputation for being highly risky and volatile while offering the chance for exponential growth.

In this blog, we will give you an overview of the top 10 real estate penny stocks in India, their advantages and disadvantages, factors to consider before investing in them and their Key Performance Indicators (KPIs).

What are Real Estate Penny Stocks?

Real estate penny stocks refer to shares of smaller real estate companies that trade at a market price of less than ₹20. Due to their low prices, investors have the opportunity to purchase shares of these companies at a low price and make significant gains if the company successfully expands its operations and increases its profitability. These stocks are especially attractive because of the infrastructure boom in India.

Top 10 Real Estate Penny Stocks in India

| Company Name | Stock Price (₹) | Market Capitalization (₹ Crores) | 52 Week High (₹) | 52 Week Low (₹) |

|---|---|---|---|---|

| Unitech Ltd. | 6.64 | 1,737 | 13.2 | 5.56 |

| Nila Spaces Ltd. | 11.1 | 436 | 19.4 | 6.95 |

| Nila Infrastructure Ltd. | 10.2 | 401 | 17.3 | 8.12 |

| KBC Global Ltd. | 0.49 | 256 | 1.28 | 0.45 |

| Housing Development & Infrastructure Ltd | 3.94 | 187 | 5.16 | 2.52 |

| Newtime Infrastructure Ltd | 3.10 | 163 | 21.9 | 3.04 |

| Vipul Ltd. | 11.9 | 168 | 53 | 9.94 |

| Sanmit Infra Ltd. | 9.30 | 147 | 20.6 | 7.55 |

| LA Tim Metal & Industries Ltd. | 9.19 | 120 | 19.3 | 8.50 |

| Future Market Networks Ltd. | 15 | 91 | 28.2 | 5.55 |

Overview of Top 10 Real Estate Companies in India

An overview of the top 10 real estate companies in India is given below:

1. Unitech Ltd

Unitech Ltd is known for developing large-scale residential, commercial, and retail properties. It was once one of the leading giants in India’s real estate market. The company had run into some financial and legal issues a few years ago, but it is still undergoing restructuring processes. Despite this, the firm owns key land parcels in major cities which makes it a valuable penny stock.

Its investors believe in the turnaround story of Unitech, provided the real estate market remains steady. Unitech’s focus on project completion and resolving its legal issues has kept the company on the watchlist of high-risk, high-reward investors.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -41.18% | 170.83% | 333.33% |

2. Nila Spaces Ltd

This real estate company specializes in designing and developing urban infrastructure and affordable housing projects with a focus on Gujarat. They captured this market due to their emphasis on value purchasers and government-subsidized housing programs. The firm’s strong business model and consistent execution has kept it afloat in the penny stock segment.

Nila Spaces is also notable for its involvement in Public Private Partnership (PPP) programs which has a social impact alongside growth. Most investors looking to capitalize on the affordable housing boom can find Nila Spaces as an appealing choice.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 33.14% | 174.39% | 1,306.25% |

3. Nila Infrastructures Ltd

Nila Infrastructures Ltd has diversified operations in the real estate and civic infrastructure sectors. They have also completed some of the publicly funded works like bus terminals, affordable housing, and roads. The company has a strong foothold in Gujarat and Rajasthan. Because of its reputation for timely delivery and consistently securing project contracts, Nila is regarded as a stable penny stock in the real estate sector that is appreciating. The company also has a strong public sector clientele which provides a level of income certainty that is atypical in this sector.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -9.20% | 42.24% | 228.06% |

4. KBC Global Ltd

KBC Global Ltd has its head office located in Nashik, Maharashtra and deals with the development of residential and commercial properties. The company focuses on creating affordable housing for the value conscious middle income segment. With decades of experience in real estate, KBC has over 25 projects under its belt. It aims to pursue projects in Tier-2 and Tier-3 cities experiencing a sustained increase in urban housing demand. The company’s growth path positions it favorably among low-priced real estate stocks.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -48.72% | -90.61% | -56.73% |

5. Housing Development & Infrastructure Ltd (HDIL)

Historically, HDIL was one of the major beneficiaries of real estate development in Mumbai with their slum rehousing and affordable housing schemes. However, in the last few years, operational and legal challenges affected the company, but they continue to have a significant land bank in the Mumbai Metropolitan region (MMR). Previously, they had a track record of constructing more than 100 million sq. ft. of residential and commercial spaces. If these issues are resolved, HDIL can potentially be a strong candidate for a turnaround story. In India’s real estate space, it’s still one of the most high-risk, high-reward, penny stocks.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -12.00% | -44.62% | 111.76% |

6. Newtime Infrastructure Ltd

Newtime Infrastructure Ltd is focused on urban real estate development and construction. Although not particularly renowned, it focuses on niche residential and mixed-use infrastructure developments in emerging cities. The company is actively working to strengthen its presence in Northern India. The investors have a keen interest in this stock due to the growth potential in underserved real estate markets. Newtime Infrastructure is a speculative play but one with longer-term growth potential.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -83.42% | -73.52% | -73.52% |

7. Vipul Ltd

Vipul Ltd operates in the residential, commercial, and retail sectors in Gurgaon, Bhubaneswar, and Ludhiana. The company’s business approach features design aesthetics coupled with a customer-first approach, striving to offer smart living spaces.

Vipul Ltd has launched several mid-range to premium housing projects, actively seeking to expand its footprint in commercial real estate. Real estate penny stocks stand out due to Vipul Ltd’s diversified portfolio and long-standing experience. The company’s reputation has been greatly bolstered by positive and constructive customer feedback regarding its projects.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -60.94% | -45.25% | -27.91% |

8. Sanmit Infra Ltd

Sanmit Infra Limited is concentrating on the development of infrastructure and selected real estate projects focusing on the western part of India. Their vision coincides with urban modernization and sustainable growth. The company undertakes projects like residential colonies, roads, and drainage systems which aids in long-term city planning. The company’s growing interests in real estate and public infrastructure construction are balanced. Sanmit Infra is a company that is poised to attract those interested in progressive infrastructure and real estate investments.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -42.48% | -73.19% | 25.55% |

9. LA Tim Metal & Industries Ltd

LA Tim Metal & Industries Ltd is still maintaining its core operations in the metals and alloys space, but has made a foray into real estate to diversify its income streams. This move makes sense due to India’s ever-growing urban population and housing demand. With the company’s industrial pedigree, investors hope the company will experience the same success in delivering quality real estate infrastructure. Such a diversification plan may stimulate new investor interest as well as create new revenue streams. The company is still early in its real estate journey, and thus represents a penny stock of a company with diversified operations.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -46.20% | -45.00% | 234.07% |

10. Future Market Networks Ltd

Future Market Networks Ltd (FMNL) is a business at the crossroads of real estate and retail infrastructure. It specializes in the development and management of commercial properties such as shopping malls, logistics parks, and retail centers. The consumption of the Indian population has been steadily growing, thus, the demand for modern retail space is also increasing, which strategically favors FMNL. The company’s vision of creating infrastructure projects that are futuristic tends to align with urban growth patterns in the long term. Here is a company with a penny stock that offers exposure to two highly lucrative sectors, retail infrastructure featuring mall and shopping centres as well as infralogistics markets featuring large-scale warehousing facilities.

Know the Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 151.87% | 134.70% | 9.86% |

Read Also: List of Best Cement Stocks in India

Key Performance Indicators (KPIs)

| Company Name | Operating Margin(%) | ROE(%) | ROCE(%) | Debt to Equity Ratio |

|---|---|---|---|---|

| Unitech Ltd. | -153.96 | 0.00 | 15.27 | -1.72 |

| Nila Spaces Ltd. | 23.01 | 10.52 | 15.95 | 0 |

| Nila Infrastructures Ltd. | 12.72 | 7.82 | 13.09 | 0.24 |

| KBC Global Ltd. | -126.14 | -21.49 | -2.56 | 0.45 |

| Housing Development & Infrastructure Ltd | -509.71 | 0.00 | 0.45 | -1.08 |

| Newtime Infrastructure Ltd | 72.09 | -23.81 | 7.76 | -0.19 |

| Vipul Ltd. | 151.99 | 66.52 | 85.34 | 0.54 |

| Sanmit Infra Ltd. | 7.54 | 12.52 | 19.07 | 0.25 |

| LA Tim Metal & Industries Ltd. | 4.16 | 14.36 | 16.08 | 0.86 |

| Future Market Networks Ltd. | 19.88 | -27.73 | 14.50 | 4.16 |

Factors to Consider Before Buying Indian Top Real Estate Penny Stocks

In investment considerations for penny stocks in real estate, take note of the following:

- Financial Health: Evaluate the financial health of the business by analyzing financial statements.

- Market Position: Determine the factors influencing the real estate industry and the market competition the company faces.

- Growth Potential: Consider the business expansion strategies and operational growth capabilities of the company.

- Management: Experienced management can take key strategic decisions timely, which can raise the company’s performance.

- Regulatory Environment: Policies changes related to the real estate industry by the government authorities must be closely monitored.

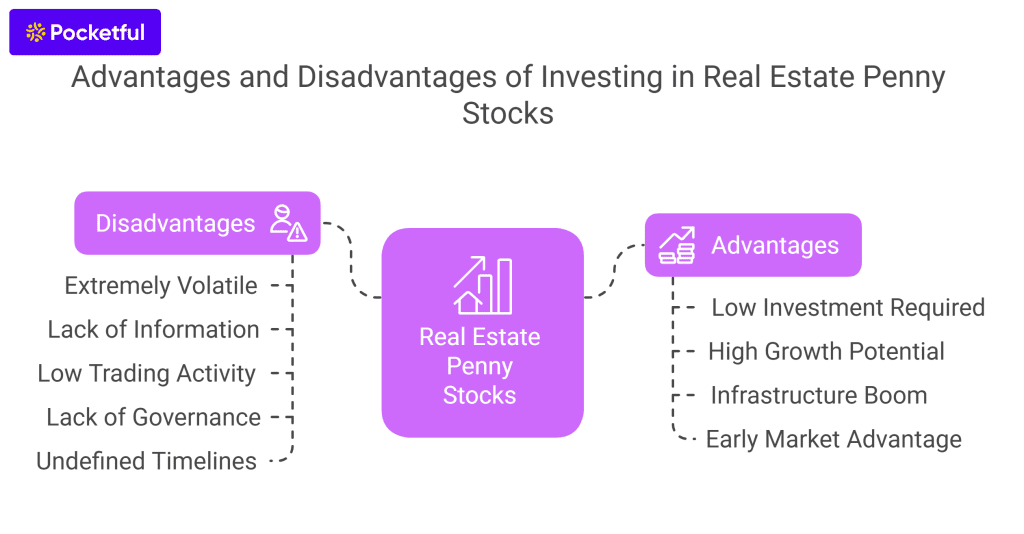

Advantages and Disadvantages of Investing in Real Estate Penny Stocks

Advantages

- Low Investment Required: At such low prices, these shares can be easily bought by small-scale investors. With a small investment, diversification can be achieved as all have share prices below ₹20. This stimulates interest from retail investors, particularly in the Tier 2 and Tier 3 cities where property development is on the rise.

- High Growth Potential: The penny stocks of these companies can deliver significant price appreciation if it performs excellently because these businesses usually are in the growth phases of their life cycle or work in developing regions. Even minor improvements in project execution or the level of demand can result in drastic increases in share prices. Completing a project successfully can greatly enhance the reputation of the company.

- Benefit from the Infrastructure Boom: Increased infrastructure development in India can create expansion opportunities for the real estate companies. Due to the immense focus by the government on housing, smart cities, and urban infrastructure, real estate companies can capitalize on new housing and infrastructure projects. Moreover, the price appreciation of real estate will increase the asset base of these companies, which will increase stock value.

- Early Market Advantage: Identifying the right company for investment during its formative stages can lead to substantial profits. Being an early stage investor in an undervalued real estate company gives you a head start before institutional money comes rushing in. If the firm lands high-profile projects or secures funding, your investment will multiply over time.

Disadvantages

- Extremely Volatile: The stock prices of the real estate company have a tendency to fluctuate greatly. This results in extreme volatility due to low market capitalization and highly speculative interest. These stocks can react sharply to news, rumors, or overall market sentiment, making them a bad choice for short-term positions and large allocations.

- Lack of Information: Public information and coverage about penny stock companies is scarce. These companies are usually overlooked by investors and analysts due to which there is limited information about them available on the internet, which inhibits investors from determining the company’s actual financial standing, project pipeline, or management credibility.

- Low Trading Activity: Lower trading volumes can make it difficult to buy or sell shares. This lack of liquidity means you may not be able to exit at your desired time or price which means you could be locking in capital unnecessarily due to market corrections.

- Lack of Governance: Numerous penny stock real estate companies have weak corporate governance standards. Concerns regarding the transparency, misuse of funds, and communication with shareholders can raise the risk of fraudulent activities, related party transactions, or misrepresentation of projects that damages shareholder trust.

- Undefined Timelines for Projects: Many projects fall behind schedule due to extended waiting periods on permit approval, funding, or logistical issues. Prolonged slowdown directly affects revenue inflow, cash flow, decline in profit margins and overall profitability. For underfunded real estate companies, extensive delays means putting the project on hold and accruing debt.

Conclusion

These are lesser-known real estate industry stocks operating in India that exhibit great profit potential even if they don’t seem like a worthwhile investment currently. Real estate penny stocks, while volatile, offer a great entry opportunity to diversify your investment portfolio and the chance for substantial profit in the long term.

Prior to making an investment, it is crucial to conduct thorough research, study the industry trends, and the fundamentals that govern each company. For those seeking an effortless method to track, analyze, and even invest in penny stocks, the Pocketful app will be a perfect fit. Pocketful presents data that is helpful for making informed decisions.

Download Pocketful today and start your investing journey!

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Top 10 Cement Penny Stocks in India |

| 2 | Top 10 Highest Dividend Paying Penny Stocks in India |

| 3 | 5 Top Artificial Intelligence Penny Stocks in India |

| 4 | Best FMCG Penny Stocks in India |

| 5 | 5 Top EV Penny Stocks in India |

Frequently Asked Questions (FAQs)

Should real estate penny stocks be considered by the investors in India?

Yes, investors shall consider real estate penny stocks in India because of their low entry cost and future growth potential due to the increasing population and booming real estate industry. With government schemes like Pradhan Mantri Awas Yojana (PMAY) many of these companies can benefit in coming years.

Are real estate penny stocks risky?

Investing in real estate penny stocks can be risky due to limited financial information, low liquidity & high volatility. Their performance is also vulnerable to real estate cycles and changes in regulatory policies.

How can one find the best real estate penny stock?

You can find the best real estate penny stock by conducting a thorough fundamental and technical analysis. Moreover, it is advised to consult a financial advisor before investing.

Can long-term investment be done in real estate penny stocks?

These stocks can be part of a high-risk, high-reward strategy which suits long-term investors who have a high risk tolerance. However, diversification and smart stock selection are essential for success.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.