| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-09-25 |

- Blog

- best stock market simulators

10 Best Stock Market Simulators for Beginners – Platforms and Apps

Are you a newbie trader and searching for the ideal stock market simulator that lets you practice trading without compromising real money? Then you are in the right place. No matter if you are an intraday trader or swing trader, utilizing a stock market simulator app will help you learn the functioning of the market.

In this blog, we will give you an overview of the 10 best stock market simulators to help you practice trading safely without risking real money. Moreover, we will also discuss factors to consider before using stock market simulators, their advantages and disadvantages.

What is a Stock Market Simulator?

Stock Market Simulator apps let traders experiment with their strategies, understand the basics of trading, and learn how to invest in the market. Further, these simulators serve as a digital platform that mirrors real world market scenarios, resulting in better understanding and clarity without using the actual money.

These simulators emulate real-life stock market conditions, including pricing trends, changes caused by news events, and delays in trades. Numerous platforms have begun offering engaging and educational features, such as paper trading options, leaderboards, and analytics.

Top 10 Best Stock Market Simulators for Beginners

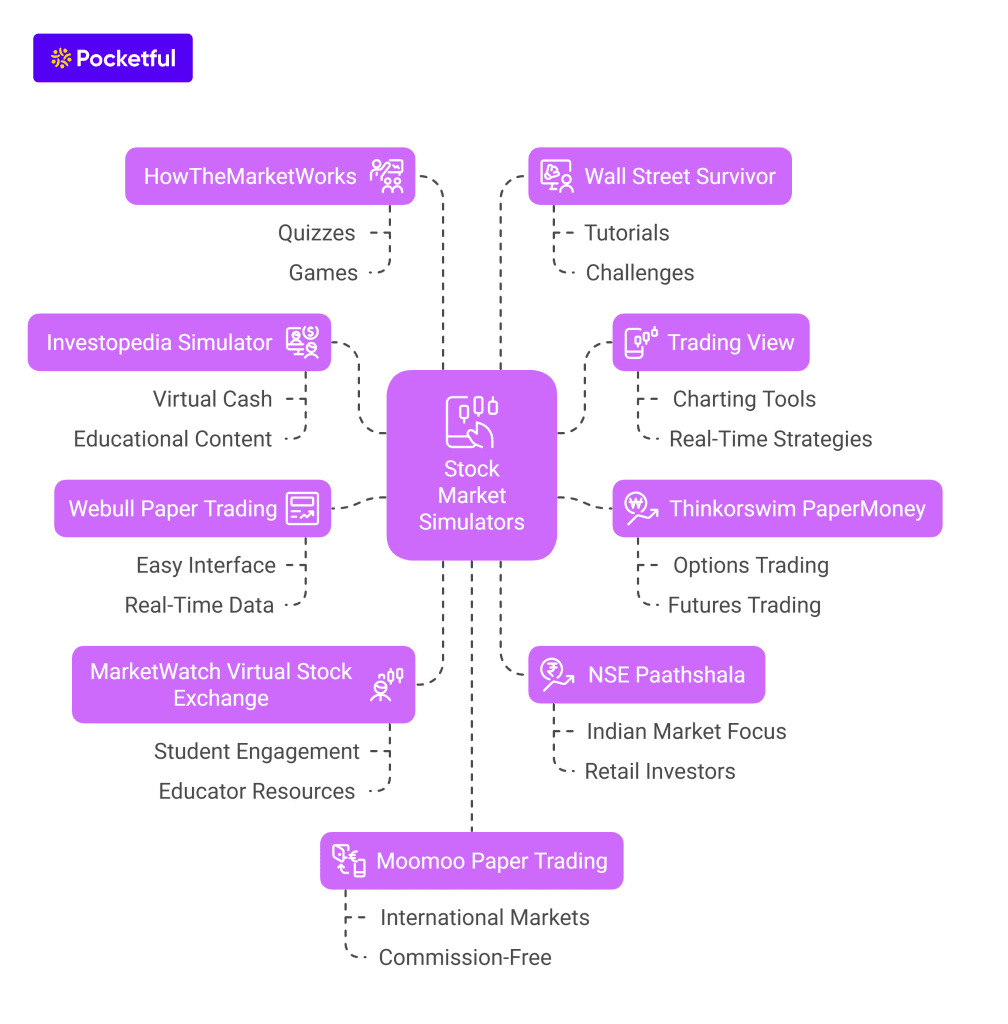

Before going into detail, let’s discuss the top 10 stock market simulators briefly:

- Investopedia Simulator – Offers $100,000 virtual cash to students and beginners and provides them with explainer content, making it one of the most loved simulators across the web.

- Trading View – TradingView’s paper trading feature is a great choice for technical traders who want to try out their strategies in real time, using powerful charting tools – without risking any actual money.

- Thinkorswim PaperMoney (TD Ameritrade) – Perfect for traders who are seasoned and wish to try their hand at trading derivatives such as options, futures, etc.

- Webull Paper Trading – Perfect for new traders due to its easy-to-use interface and real-time data features.

- MarketWatch Virtual Stock Exchange – MarketWatch’s Virtual Stock Exchange is perfect for students, educators, or traders looking to learn and compete in a simulated trading environment, all based on real market data.

- NSE Paathshala – This simulator focuses on the Indian market, making it essential for Indian retail investor students.

- HowTheMarketWorks – Great for classroom training, it provides free virtual trading, quizzes, and games with real-time data.

- Wall Street Survivor – Interactive programs with tutorials, quizzes, and challenges to help users learn the art of trading.

- Moomoo Paper Trading – Provides commission-free paper trades for most international markets.

- Stock Trainer Virtual Trading (Android) – An Android simulator for novice traders with over 20 supported exchanges.

Read Also: Best Stock Market Movies & Web Series to Watch

Overview of the Top 10 Stock Market Simulators

A detailed overview of the top 10 stock market simulators is given below:

1. Investopedia Simulator

Investopedia Stock Simulator is perfect for the traders and investors. It offers $100,000 in virtual currency along with real-time market-based trading. It is education-centric with a textbook style structure with integrated tutorials, trading contests, and group play features. Instructors use it in classrooms to teach the fundamentals of trading to pupils.

2. TradingView Paper Trading

TradingView is widely used by chartists and technical analysts because of its premium level-charting tools which integrates seamlessly with TradingView’s paper trading feature. With this, users can do simulated trading on interactive charts. Indicators and trading strategies can be tested as alerts are issued in real-time. Features in this are ideal for those traders wanting to develop advanced trading strategies using virtual money.

3. Thinkorswim PaperMoney (TD Ameritrade)

Thinkorswim by TD Ameritrade undoubtedly delivers the most professional-grade trading simulator. This tool lets you trade stocks, options, and futures in a simulated environment, making it ideal for traders who are trying to grasp an understanding of advanced tools and charts without taking real risk. Paper trading setup on this platform requires a TD Ameritrade account, but it’s free to operate.

4. Webull Paper Trading

Both advanced and novice traders can enjoy Webull’s clean and user-friendly interface for paper trading. The platform provides real-time market data and allows for the risk-free trading of stocks and options. Technical indicators and charting features are also included in Webull Paper Trading platform, allowing you to execute practice trades.

5. MarketWatch Virtual Stock Exchange

MarketWatch’s simulator is one of the most popular simulators in academic circles. It allows people to join public games as well as create private ones for group learning. The interface is convenient, and the simulator has the capacity for real-time pricing. This platform is well-suited for traders who want to gamify concepts of investment for their students.

6. NSE Paathshala

Indian investors can use this simulator developed by the National Stock Exchange (NSE), one of the prominent stock exchanges in India. It features trading of equity and derivatives on the actual NSE trading platform.

NSE Paathshala is completely free, making it a perfect fit for Indian students or retail traders who want to gain understanding of the domestic financial markets.

7. HowTheMarketWorks

This platform is aimed at students, offering simulated trading alongside prebuilt lessons, quizzes, and challenges. It enables educators to create contests or quizzes for learning and supports real-time data while gamifying structures that encourage active learning. Students can also use the platform with ease due to its simplistic design.

8. Wall Street Survivor

This platform revolutionizes the concept of trading simulation. It provides game elements which are more engaging and captivating. This platform offers virtual trading alongside badges, rewards, and elaborate tutorials.

One can also enjoy pursuing quizzes and challenges that test the knowledge on specific areas. In summary, it’s an excellent platform to cater for those looking to develop their trading skills.

9. Moomoo Paper Trader

Moomoo Paper Trader offers users an experience of the international markets including the US, Hong Kong, and China. Its paper trading system allows users to test their prowess on different asset classes with zero-commission simulated trades, advanced charting tools, and in-depth market analysis. This makes it a go-to platform for beginners and experienced traders alike.

10. Stock Trainer: Virtual Trading (Android)

This app is exclusive to Android users and provides realistic global market simulations. It supports over 20 stock exchanges worldwide. While less sophisticated than some other options, the interface of this simulator makes it much easier for total beginners to start paper stock trading. It has a user-friendly mobile application for those interested in learning trading on a global level.

Read Also: Best YouTube Channels for Stock Market in India

Factors to Consider Before Using a Stock Market Simulator

In India, here are some of the factors to keep in mind when selecting a stock market simulator:

- Simulators make use of live data streams to emulate market activities and conditions for trading. This enables one to hone their skills while learning how market changes impact trades.

- Beginners should look for a sophisticated but simple to navigate platform because novice traders require user-friendly simulators while professional traders would need advanced features.

- The simulator should assist you with informative video and article content on how to create effective trading plans, conduct technical analysis, follow the markets, and other relevant tips.

- If you are looking for trading on the go, a robust mobile version of the trading simulator will facilitate easy paper trading during travel without compromising on functionality.

- Select stock market simulators that present you with the ability to tailor and customize your portfolio, alter particular risks, and create scenarios according to your specific needs.

- Community engagement on trading platforms can help one learn from other fellow traders. The latest market information discussed in these communities can be used to create better trading strategies.

Advantages and Disadvantages of Stock Market Simulators

The advantages and disadvantages of stock market simulators are given below:

Advantages

- Practice with zero financial risk: Simulators permit users to practice trading with fake a.k.a. virtual money, thus enabling them to acquire experience in real markets without risking real money.

- Learn about market orders: Users can understand the mechanism of entering various orders (market, limit, stop-loss, etc.) and observe how they get executed under different market conditions.

- Compare different strategies: These websites allow users to try out various trading approaches and compare results without losing funds.

- Learn portfolio management: Simulators instruct users to create a balanced and diversified portfolio, monitor performance, and control risk successfully.

- Ideal for learning: Suitable for students and new traders, these tools offer hands-on learning in line with classroom theory, enhancing financial education through practical experience. Further, pro level traders can also use these platforms if they are testing new strategies or venturing into new asset segments such as commodity derivatives.

Disadvantages

- No emotional aspect involved (actual loss/gain): As there is no real money involved, users do not feel the emotional tension or self-control needed in real trading.

- No realistic slippage/brokerage fees: Most simulators fail to include actual trading expenses such as broker fees, local taxes such as STT or order slippage, resulting in unrealistic performance expectations.

- Performance might be different from actual situations: Simulated trades typically execute at perfect prices that are not representative of the uncertainty and latency of real-world markets.

- Overconfidence builds on virtual success: Repeated success in simulations can lead to overconfidence bias and overestimation of one’s abilities, and thus increases risky behavior when dealing with real money.

Conclusion

No matter if you are looking at trading for the very first time or trying out complex trading strategies, paper trading with the stock market simulator provides you the liberty to explore trading risk-free as no real money is involved. From smartphone apps to top-of-the-line platforms, you can find one that suits you the best.

So, are you ready to dive into the universe of stock market simulators? Select a stock trading simulator application that aligns with your learning goals and begin your trading journey today.

However, remember that practice does not make you perfect in trading – but it definitely takes you closer and refine your trading game. All the best!

Frequently Asked Questions (FAQs)

What is a Stock Market Simulator?

A stock market simulator enables you to trade assets like stocks, bonds, and options with virtual cash. It provides a controlled environment that replicates genuine trading conditions, making it a safe space to learn trading and test decision-making strategies without any financial risk.

What are the Benefits of Using a Stock Market Simulator?

Using a simulator eliminates financial risk, lets you test strategies in real market conditions, and builds confidence, skills, and better judgment—preparing you to make smarter decisions when trading with real money.

Do Stock Market Simulators Help Beginners?

Stock market simulators help beginners by allowing them to experience real market conditions without a risk of losing cash. More specifically, you are able to grasp on how the market works, its fluctuations and prices change.

Can I Make Real Money with a Stock Market Simulator?

A stock market simulator cannot be used to make real money as these simulators work with virtual money to create a risk-free environment to practice trading.

Is Real-Time Data Used in Stock Market Simulators?

Yes, several stock market simulators such as TradingView Paper Trading or Investopedia Simulator offer real-time market data. This allows users to simulate trading with situations in real-time, similar to how it’s done in the actual stock market.

Are Stock Market Simulators Free to Use?

Most stock market simulators do offer a free version of the simulator. However, accessing certain more advanced features, premium tools, or in-depth market data may require subscription fees.

How Reliable Are Stock Market Simulators?

Generally, stock market simulators provide accurate information, especially those that incorporate real-time market feeds. However, as you are trading with virtual money, certain aspects of emotional decision-making may be absent.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.