| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-29-24 | |

| Add internal links | Nisha | Feb-17-25 | |

| Add internal links | Nisha | Feb-17-25 |

- Blog

- bikaji foods case study

Bikaji Foods Case Study – Product Portfolio, Financial Statements, & Swot Analysis

Have you ever had that insane flavour explosion when eating a perfectly spiced Bhujia or that amazing crunch of a savoury namkeen? You have probably heard of the famous Bikaji brand if you enjoy Indian snacks. The story is more than just tasty treats. It is about innovation, tradition, and a great understanding of what delights Indian taste buds.

In today’s blog, we will explore the world of Bikaji Foods International, a leading Indian snack company and learn about its history, product range, and what makes it a dominant player in the Indian FMCG market.

About Bikaji Foods

Bikaji Foods International Limited is a major Indian snack food company and one of India’s largest fast-moving consumer goods (FMCG) brands. The company manufactures a wide variety of snacks across various categories. Bikaji is the largest manufacturer of Bikaneri Bhujia. Their products are popular in India and exported to over 22 countries, including North America, Asia Pacific, the Middle East, the European Union, Africa, and the United Kingdom.

The history of Bikaji Foods International can be traced back to the late 1980s. Shivratan Agarwal founded it. The company was originally named Shivdeep Food Products, which was incorporated in 1986. It subsequently came up with the “Bikaji” brand in 1993. The brand name was inspired by Bika Rao, the founder of Bikaner, and the suffix “ji” was added as a sign of respect. In 2006, the company underwent a major consolidation of its four group companies.

Read Also: Gopal Snacks IPO: Segments, Financials, Key Details, Strengths, and Weaknesses

Bikaji Foods Product Portfolio

Bikaji offers various products, mainly categorized as,

- Namkeen (Savory snacks) include Bhujia, Aloo Bhujia, Sev mixtures, and other traditional Indian snacks.

- Indian sweets include Rasgulla, Gulab Jamun, Soan Papdi, and Bikaneri Papad, among other types of papad.

- Ready-to-eat snacks and meals.

- Western snacks include chips, cookies, and other contemporary snacks, which include gift packs, frozen food, etc.

The products are available in varied sizes, letting the customers pick from various options based on their needs and budget.

The company uses a strong distribution network to deliver its products to a wide customer base in India and overseas, including retail outlets, supermarkets, hypermarkets, and convenience stores.

It also focuses on efficient production and economies of scale to control costs and stay competitive.

Key Highlights of Bikaji Foods

- Pan-India Distribution Network: 25 states & 4 Union Territories.

- 250+ snacking choices spanning six key categories.

- 550 distributors.

- Leading manufacturer of packaged sweets (especially Rasgulla and Soan Papdi)

- Largest manufacturer of bikaneri bhujia.

Bikaji Foods Consolidated Financial Statements

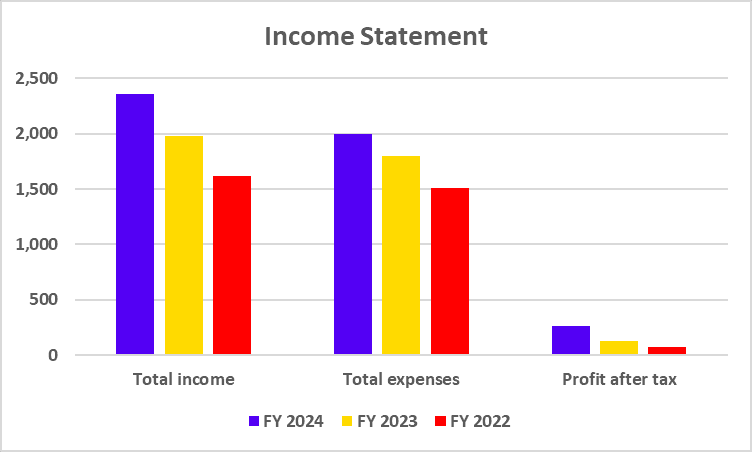

Bikaji Foods Income Statements

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total income | 2,356 | 1,980 | 1,621 |

| Total expenses | 1,998 | 1,799 | 1,509 |

| Profit after tax | 263 | 126 | 76 |

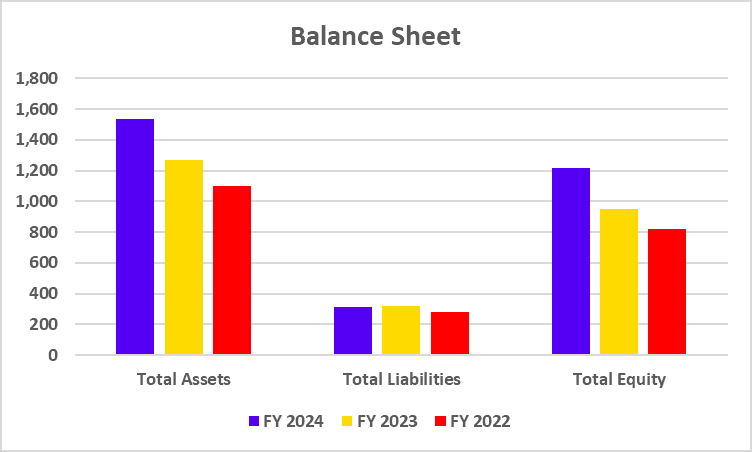

Bikaji Foods Balance Sheet

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Assets | 1,533 | 1,271 | 1,102 |

| Total Liabilities | 314 | 319 | 281 |

| Total Equity | 1,218 | 952 | 820 |

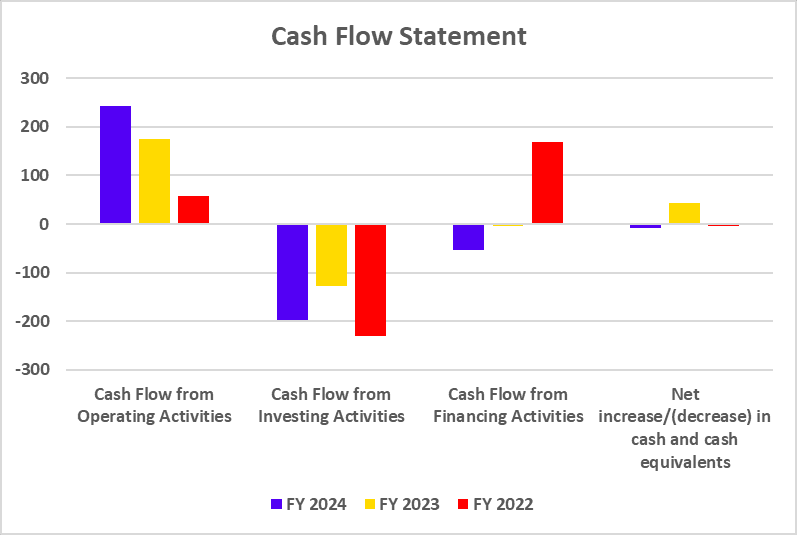

Bikaji Foods Cash Flow Statements

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | 244 | 176 | 57 |

| Cash Flow from Investing Activities | -198 | -128 | -231 |

| Cash Flow from Financing Activities | -53 | -4 | 168 |

| Net increase/(decrease) in cash and cash equivalents | -8 | 43 | -5 |

Bikaji Foods Ratio Analysis

| Key Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Debt Equity Ratio | 0.1 | 0.15 | 0.17 |

| Return on Equity (%) | 21.8% | 13.47% | 9.49% |

| ROCE (%) | 27.24% | 17.27% | 12.24% |

| Net Profit Margin (%) | 11.31% | 6.43% | 4.71% |

Inferences that can be drawn from the above financial statements are as follows,

- Bikaji has shown consistent revenue growth over the past few years, indicating a strong demand for its products.

- Profits have also increased over the past three years, which shows efficient operations and a healthy profit margin.

- Looking at ratios like ROCE, the company is healthy and indicates good returns for shareholders and efficient use of invested capital.

- Overall, Bikaji’s financial statements show that the company is growing and making profits. However, staying informed about the upcoming trends and possible challenges is important, such as increasing input costs and changing consumer preferences.

Read Also: Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

Bikaji Foods SWOT Analysis

Strengths

- Bikaji is a well-known brand with cultural and historical significance, originating from Bikaner, a region famous for its snacks.

- They have a wide selection of snacks in different categories to suit different preferences. The company consistently engages in innovation by introducing new products and flavours.

- The company is known for its high-quality and hygienic manufacturing processes, which build consumer trust and loyalty.

Weaknesses

- The company faces intense competition from other well-established snack brands such as Haldiram’s, Balaji Wafers, and ITC’s snack segment. The market share may be impacted by competitive pricing and marketing strategies employed by rivals.

- Although Bikaji is expanding internationally, its major market share is still concentrated in India.

- The absence of a healthy food segment is a missed opportunity, given consumer’s increasing demand for healthier snack options.

Opportunities

- The demand for ready-to-eat snacks and convenience foods is increasing, especially among urban and younger populations. Opportunity to introduce new product lines and flavours catering to changing consumer preferences.

- There is great potential to further increase exports and enhance brand presence in existing and new international markets.

- Utilizing the power of e-commerce and online platforms to expand the reach and foster direct engagement with consumers and investments in digital marketing and social media can greatly enhance brand visibility and improve customer interaction.

Threats

- The Indian FMCG market is highly competitive, with existing and new companies competing for market share. Price wars and promotional offers by competitors can impact profit margins.

- Both domestically and internationally, food safety and quality regulations require ongoing compliance and may involve extra expenses. Any negative publicity about food safety can damage the brand’s reputation.

- Price changes in raw materials such as pulses, vegetables, oils, and spices can impact Bikaji’s profit. Furthermore, fluctuations in raw material prices can affect Bikaji’s revenue.

Read Also: Dabur Case Study: Business Model and Swot Analysis

Conclusion

From its humble beginnings in Bikaner, Rajasthan, to becoming a globally recognised brand, Bikaji Foods has stayed true to its commitment to offering authentic flavours and high-quality snacks. Their constant innovation and dedication to preserving traditional recipes have made them a household name in the snack industry. They focus on quality, customer engagement and sustainable practices to strengthen their market position and drive growth. So next time, if you ever crave a tasty Indian snack, you must check out Bikaji’s offerings because “Amitji Loves Bikaji.”

FAQs (Frequently Asked Questions)

Is Bikaji popular outside India?

Yes, the company exports to over 22 countries.

How does Bikaji make money?

It manufactures and sells its snacks under the Bikaji brand through a vast distribution network across India and internationally.

Is Bikaji a publicly traded company?

Yes, it is a publicly-traded company.

What is the Bikaji’s current market price?

Bikaji’s current market price stands at INR 721.

What distinguishes the company from other snack brands?

Bikaji’s strong brand heritage, diverse product range, and commitment to quality distinguish it from other snack brands.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.