| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-03-24 | |

| Content Update | Harjyot Singh | Mar-10-25 | |

| Add new links | Nisha | Mar-28-25 | |

| Add new links | Nisha | Mar-28-25 | |

| Add new links | Nisha | Mar-28-25 | |

| Infographic Update | Ranjeet Kumar | Apr-03-25 |

- Blog

- boat case study business model product portfolio financials and swot analysis

Boat Case Study: Business Model, Product Portfolio, Financials, and SWOT Analysis

boAt has become a household name in less than a decade of operations, but very few know about its story. Today, we’ll be covering a very unique company called “boAt.” We’ll understand its business model, financials, and SWOT Analysis.

Boat Company Overview

boAt’s adventure began in 2014 when Sameer Mehta and Aman Gupta, the brand’s co-founders, decided to provide consumers with stylish, designer audio products at a fair price. The company saw a gap in the Indian wearable and audio markets and thus chose its target market as the youth of the nation.

Business Model of Boat

The boAt’s primary business is manufacturing and retailing audio gear. boAt offers a variety of products, such as wearable technology, speakers, headphones, earphones, cables, and chargers. The company designs its products while keeping in mind the tastes of the youth. The management appeals to customers who are on a tight budget by positioning itself as a value-for-money product in the market. In order to widen its distribution channel, the company sells its products on well-known e-commerce sites, including Amazon and Flipkart.

Product Portfolio of Boat

boAt provides customers with a large selection of products. Some of them are:

- Headphones and Earphones – The company manufactures both wired and wireless headphones and earphones.

- Speakers – Boat offers a range of speakers, from portable Bluetooth speakers to home theatres, sound bars, and party speakers.

- Wearable Devices – The company also offers smartwatches and fitness wearables, which offer facilities like heart rate monitoring, steps counter, and smartphone connectivity.

- Chargers – They offer a wide range of charging cables, adapters, power banks, and other types of electronic devices.

Marketing Strategy of BoAt

1. Targeting the Millennial & Gen Z Audience

- boAt designs products with a focus on millennial and Gen Z customers.

- Its marketing is focused on selling its products to music, fitness, and gaming enthusiasts, making its products aspirational.

2. Influencer & Celebrity Endorsements

- boAt collaborates with Bollywood actors, musicians, and sports personalities (e.g., Hardik Pandya, Kartik Aaryan, Kiara Advani), helping its products gain popularity.

- Strong partnerships with social media influencers and content creators help drive brand awareness.

3. Sports & Event Sponsorships

- Official audio partner for IPL teams, ensuring high visibility among cricket fans.

- Sponsored esports tournaments, tapping into India’s growing gaming market.

4. Digital-First Marketing Approach

- boAt primarily operates on a D2C (Direct-to-Consumer) business model, leveraging Amazon, Flipkart, and its official website.

- Innovative marketing campaigns on Instagram and YouTube that attract new customers.

5. Affordable Pricing & Premium Aesthetic

- Provides premium-looking products at budget-friendly prices.

- Focuses on design innovation, making products stylish and trendy.

6. Community Building & Engagement

- Uses the term “boAtheads” to create a community-driven brand experience.

- Encourages customers to share their experiences online, enhancing brand loyalty.

Awards and Achievements

1. As of 3Q23, boAt has become the 2nd largest wearable brand in the world and has surpassed tech giants such as Xiaomi and Samsung.

2. The company was growing at 76.6% on an annual basis in 2Q22, which was the fastest among the top 5

3. In 2024, boAt unveiled “Nirvana Eutopia,” India’s first headphones with head-tracking 3D audio and spatial sound features. It alters the audio with the movement of your head, enhancing the overall audio experience.

4. It served as an official audio partner for six Indian Premier League teams in 2021.

5. In Q3 of FY 21, it became the Number 1 brand for truly wireless and earwear in India.

6. Aman Gupta, the chief marketing officer and co-founder of boAt, was named the D2C Tycoon of the year 2023.

7. Founder Aman Gupta received the Businessworld Young Entrepreneur Award in 2019.

Read Also: Zaggle Case Study: Business Model, Financials, and SWOT Analysis

Financial Highlights

Balance Sheet

| Particulars | 31st March 2024 | 31st March 2023 | 31st March 2022 |

|---|---|---|---|

| Non-Current Assets | 4,951.30 | 4,455.42 | 2,801.54 |

| Current Assets | 12,103.06 | 16,579.03 | 15,940.47 |

| Total Assets | 17,054.36 | 21,034.45 | 18,742.01 |

| Equity | 4,715.47 | 5,129.78 | 6,101.50 |

| Non-Current Liabilities | 5,248.04 | 5,157.80 | 100.64 |

| Current Liabilities | 7,090.85 | 10,746.87 | 12,539.87 |

As can be seen from the above table, the company’s non-current assets increased significantly in 2023 and increased further in 2024. It was ₹2,801.54 million in FY 2022 and increased to ₹4,951.30 million in 2024. In addition, the company’s current liabilities decreased year over year, indicating a strong financial position.

Income Statement

| Particulars | 31st March 2024 | 31st March 2023 | 31st March 2022 |

|---|---|---|---|

| Revenue from operations | 31,037.78 | 32,584.04 | 28,729.01 |

| Total Income | 31,216.04 | 32,847.62 | 28,864.08 |

| Total Expenses | 31,924.04 | 34,206.44 | 27,773.66 |

| Profit before tax | (708) | (1,358.82) | 1,090.42 |

| Profit after tax | (535.93) | (1,010.46) | 788.20 |

Revenue for the company has climbed by about 8% between 2022 and 2024, while profit—both before and after taxes—has sharply declined. The company recorded a total net loss of ₹535.93 million, compared to a profit of ₹788.20 million for FY 2022.

Cash Flow Statement

| Particulars | 31st March 2024 | 31st March 2023 | 31st March 2022 |

|---|---|---|---|

| Cash flow from operating activities | 3,999 | (76.82) | (6,097.69) |

| Cash flow from investing activities | (397.97) | (1,181.69) | (3,983.53) |

| Cash flow from financing activities | (4,460.66) | 2,348.56 | 8,939.51 |

boAt cash flow from operating activities has improved drastically between FY 2022 and FY 2024. However, cash flow from investing activities has decreased from ₹3,983.53 million to ₹397.97 million between FY 2022 and FY 2024, showing a declining trend over the years.

Read Also: CAMS Case Study: Business Model, KPIs, and SWOT Analysis

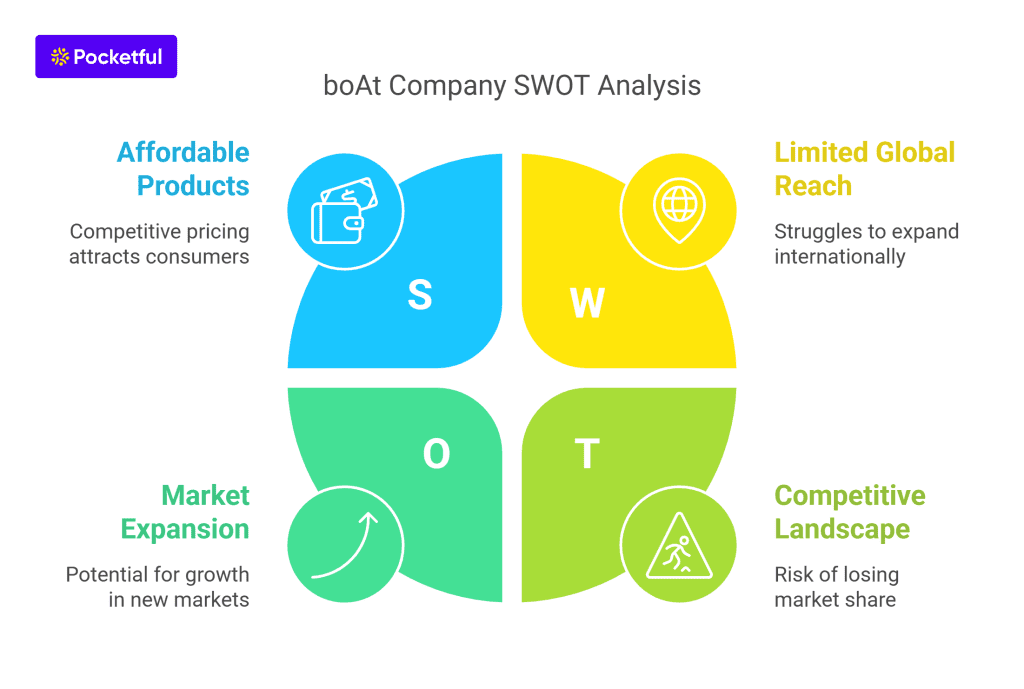

SWOT Analysis of boAt Company

This boAt SWOT analysis highlights the company’s strengths, weaknesses, opportunities, and threats, offering valuable insights into its market position and growth potential.

Strengths

- When compared to other brands in the business, the items from boAt are comparatively less expensive, making them more affordable for consumers.

- Customers in the electronic markets have significant brand awareness for the corporation, particularly in the audio sector.

- The company sells a variety of products, such as speakers, earbuds, headphones, and more.

- Their after-sales service brings consumer loyalty towards their brand, as they provide on-time service and have centers across the country.

Weaknesses

- boAt has captured the Indian market, but they were not able to expand its reach in other countries, which could be a hindrance to its growth potential.

- boAt depends heavily on outside parties to supply the components needed to make their goods.

- The corporation is diversifying into more market categories, which could dilute its brand identity and confuse customers.

- The boAt does not have control over its relationships with customers because it sells its products on well-known platforms.

Opportunities

- The company’s growth may be aided by its overseas market expansion.

- boAt has recently ventured into the smart wearable industry, which has the potential to grow its revenue in the long run, given how popular wearables are right now. In addition, they can investigate various tech accessories.

- E-commerce platforms are becoming more and more popular, which presents a chance to expand their audience.

- The company can sell its products by collaborating with well-known influencers and celebrities, which will raise awareness of the brand.

Threats

- boAt may lose market share if they don’t pay attention to their pricing and business strategy in the face of competition from several new companies.

- There are many different fake goods in the market; they must cease as soon as possible since this will damage the brand’s reputation and reduce its income.

- Any economic crisis may affect consumers’ purchasing habits, which will reduce the market for electronic goods.

Future Outlook

boAt’s future looks promising, driven by wearable tech expansion, global market entry, and product innovation. The brand is strengthening its D2C sales, offline presence, and premium audio segment to compete with global giants like JBL and Apple. Future products may feature AI integration, IoT connectivity, and eco-friendly materials. boAt also plans to launch an IPO for financial growth and expand beyond India into Southeast Asia and Europe. With a focus on affordability, technology, and marketing, boAt is well-positioned for sustained growth in the consumer electronics industry.

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Conclusion

In just eight years, boAt has become a leading brand in India and has taken control of the electronic audio gadget market. Their product quality, marketing tactics, and post-purchase assistance are all excellent. Due to their aggressive pricing, other industry titans like JBL and Bose are forced to cut their prices to make the products more accessible to consumers.

Given the dynamic nature of the consumer electronics market, the company ought to prioritize product innovation, international expansion, and distribution network optimization to sustain its growth pace.

Frequently Asked Questions (FAQs)

What is the boAt’s parent company’s name?

Imagine Marketing Ltd. is the parent company of the boAt.

Is the boAt operating in losses?

Despite reporting a profit in FY 22, the company recorded a net loss in FY 2023 and FY 2024.

What is the valuation of boAt?

As of December 2024, the valuation of boAt was around 10,500 crores.

Is boAt listed on the stock exchange?

boAt is not yet listed on any Indian exchange, although an initial public offering (IPO) is anticipated shortly.

Where is the headquarters of boAt ?

boAt has its headquarters in Mumbai, India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.