| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-19-24 |

- Blog

- bpcl case study

BPCL Case Study: Business Model, Product Portfolio and SWOT Analysis

Bharat Petroleum Corporation Ltd. (BPCL) uses two taglines, “Pure for Sure” and “Energizing Lives,” for its petroleum products and fuel station services. These taglines reflect the company’s mission to provide fuel and energy for the well-being of individuals, businesses, and communities and economic growth.

In this blog, we will discuss BPCL and its business model and products. We will also provide financial information and do a SWOT analysis.

Bharat Petroleum Corporation Ltd. (BPCL) Overview

BPCL, or Bharat Petroleum Corporation Limited, is a public-sector oil and gas enterprise in India. It is one of the biggest public-sector undertakings (PSUs) in India, involved in the exploration, refining, marketing, and distribution of petroleum products.

BPCL’s business model is woven around its integrated operations across the oil and gas value chain, from exploration and refining to marketing and distribution. The company provides a wide range of products and services, including fuels such as petrol, diesel, LPG, ATF, industrial lubricants, and renewable energy solutions. BPCL remains a key player in India’s energy sector due to its extensive infrastructure and customer-centric approach.

Bharat Petroleum Corporation Limited (BPCL) is one of the Maharatna companies in India. The Government of India grants Maharatna status to certain public-sector companies with good financial performance, significant market presence, and substantial contribution to the economy. This status allows these companies greater independence in decision-making and investments, helping them to compete globally.

BPCL, being one of the Maharatna companies, enjoys these privileges, which include:

- Greater Financial Autonomy: BPCL can make investments up to a certain limit without requiring government authorization, but it also has a greater social responsibility, ensuring that it has a positive impact on the community and environment.

- Enhanced Operational Flexibility: The company has more autonomy in forming joint ventures, mergers, and acquisitions because of its significant global presence.

- Increased Decision-Making Power: The Maharatna status allows BPCL’s board of directors to make significant decisions, such as investments in new ventures or expanding existing operations, without needing prior government approval within specified limits.

This status reflects BPCL’s importance in the Indian economy and its capability to deliver a high-quality performance.

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Business Model and Services of BPCL

Bharat Petroleum Corporation’s operations range from exploring and refining crude oil to marketing and distributing petroleum products.

BPCL business model offers a wide range of products and services, including:

- Fuels: Petrol, diesel, kerosene, and aviation turbine fuel (ATF).

- LPG: LPG gas (Bharat gas) for domestic, commercial, and industrial use.

- Lubricants: Lubricants for automotive, industrial, and marine applications.

- Industrial Products: Bitumen, furnace oil, and diesel oil.

- Gas Distribution: Compressed Natural Gas (CNG)& and Piped Natural Gas (PNG).

Financial Statements of Bharat Petroleum Corporation Ltd.

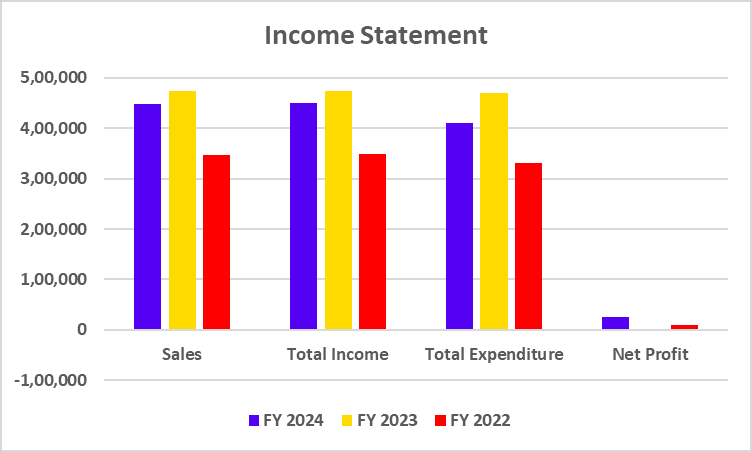

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 4,48,083 | 4,73,187 | 3,46,791 |

| Total Income | 4,50,317 | 4,74,685 | 3,49,059 |

| Total Expenditure | 4,11,039 | 4,70,310 | 3,31,952 |

| Net Profit | 25,793 | -60 | 10,145 |

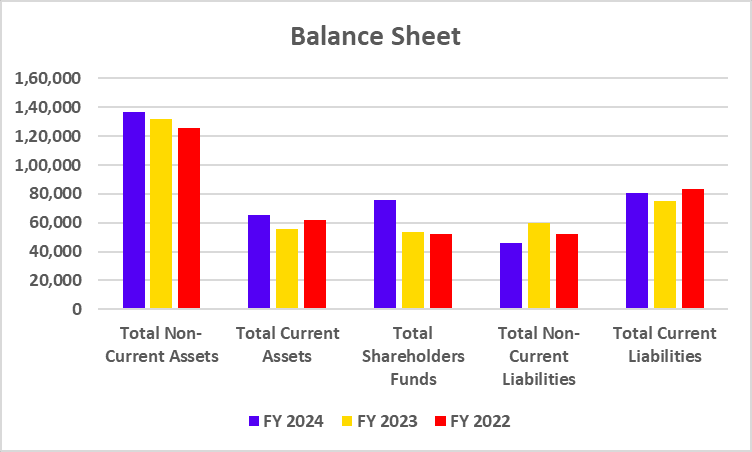

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Non-Current Assets | 1,36,723 | 1,32,095 | 1,25,529 |

| Total Current Assets | 65,694 | 56,012 | 61,999 |

| Total Shareholders Funds | 75,635 | 53,522 | 51,905 |

| Total Non-Current Liabilities | 45,899 | 59,744 | 52,554 |

| Total Current Liabilities | 80,883 | 74,841 | 83,068 |

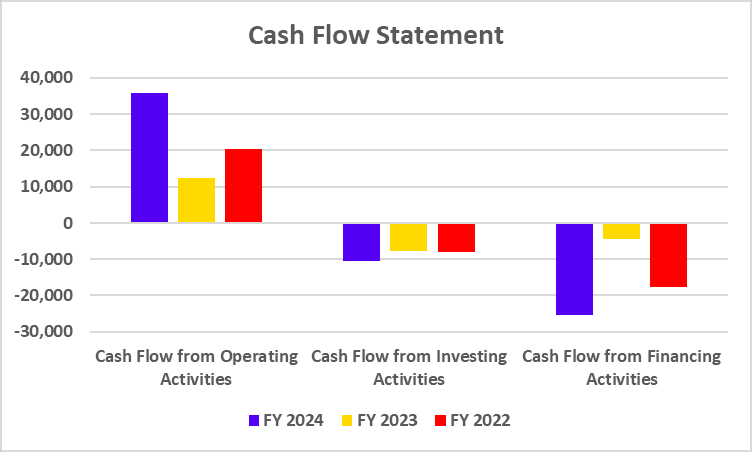

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash flow from Operating activities | 35,935 | 12,465 | 20,335 |

| Cash flow from Investing activities | -10,520 | -7,806 | -8,137 |

| Cash flow from Financing activities | -25,427 | -4,402 | -17,671 |

Key Performance Indicators

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Net Profit Margin (%) | 5.75 | -0.01 | 2.92 |

| ROE (%) | 35.51 | 3.98 | 22.50 |

| ROCE (%) | 32.53 | 5.31 | 15.28 |

| Debt to Equity | 0.60 | 1.13 | 1.08 |

| P/E (X) | 2.39 | 17.20 | 3.27 |

| P/B (X) | 1.70 | 1.37 | 1.47 |

Read Also: Boat Case Study: Business Model, Product Portfolio, Financials, and SWOT Analysis

Swot Analysis of Bharat Petroleum Corporation Ltd. (BPCL)

The SWOT analysis of BPCL reveals the company’s strengths, weaknesses, opportunities, and threats in the highly competitive petroleum industry, outlining its market position, growth potential, and challenges.

Strengths

- BPCL has a significant market share in the petroleum sector and is one of India’s leading oil and gas companies.

- BPCL has a wide network of fuel stations, pipelines, and distribution points across the country.

- BPCL is a state-owned enterprise that receives government support in the form of policies, subsidies, and financial assistance, which enhances its stability.

- It has integrated operations across the entire petroleum value chain, from refining to distribution, hence has better control over supply and pricing.

- BPCL continuously invests in research and innovation to reduce carbon emissions and to become energy efficient.

Weaknesses

- BPCL is heavily dependent on imported crude oil, making it vulnerable to fluctuations in global oil prices and currency exchange rates.

- BPCL’s profitability is affected as it has to work under a government-regulated price structure.

- BPCL regularly invests in infrastructure and technological upgrades, which results in high capital expenditure (CAPEX).

- BPCL’s operations are exposed to political risks.

Opportunities

- India’s energy demand is rising due to various economic and demographic factors, including population growth, urbanization, and economic development. This presents opportunities for BPCL to expand its product range and increase sales growth.

- Renewable energy is an emerging theme, and BPCL has been focused on clean energy and other sources of renewable energy sources such as solar, wind, and biofuels.

- Privatization plans of BPCL could bring in more capital and enhance efficiency.

- BPCL could explore overseas markets to expand its footprint and reduce reliance on the domestic market.

Threats

- Global price volatility in crude oil prices directly impacts BPCL’s margins, as it deals with thin refining spreads and the pressure of maintaining competitive retail pricing.

- Strict regulatory norms regarding emissions can result in increased operational costs for BPCL.

- BPCL faces intense competition from competitors like Indian Oil Corporation Ltd. (IOCL) and private players like Reliance.

- Shift towards electric vehicles in India could reduce the demand for traditional fuels like petrol and diesel, affecting BPCL’s core business.

Conclusion

BPCL is a diversified and customer-centric company, offering a wide range of products and services across the oil and gas value chain. BPCL’s business model is built around its integrated operations across the oil and gas value chain, from exploration and refining to marketing and distribution. The company provides a wide range of products and services, including petrol, diesel, LPG, ATF, industrial products, lubricants, and renewable energy solutions. However, it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Is the government thinking of privatization of BPCL?

The government has been considering selling its stake in BPCL for the past four years, but as per the recent developments, Union Minister for Petroleum & Natural Gas Hardeep Singh Puri said that the plans to privatize state-owned BPCL have been shelved for now as BPCL has made more money in the first three quarters than the stake sale amount.

How does BPCL contribute to renewable energy and sustainability?

BPCL is reducing its carbon footprint as a responsible company by enhancing its operational efficiency. It invests in renewable energy projects, including solar and wind power, and develops infrastructure for electric vehicle (EV) charging stations.

How does BPCL contribute to the Indian Energy sector?

BPCL plays an important role in India’s energy sector by maintaining a steady supply of petroleum products nationwide. The company’s extensive refining and distribution network helps it meet the growing energy demand.

How can I invest in BPCL shares?

One can invest in BPCL shares by purchasing them through a stockbroker or an online trading platform. BPCL is listed on both the stock exchanges, BSE and NSE, under the ticker symbol “BPCL.”

Is BPCL a Maharatna company?

Bharat Petroleum Corporation Ltd. (BPCL) is a Maharatna company.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.