| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-11-24 | |

| Heading Optimize | Nisha | Feb-18-25 | |

| Content Update | Harjyot Singh | Mar-10-25 | |

| Content Update | Harjyot Singh | Mar-10-25 | |

| Content Update | Harjyot Singh | Mar-10-25 | |

| Content Update | Harjyot Singh | Mar-10-25 | |

| Added Case Study PDF & PPT | Ranjeet Kumar | Apr-16-25 |

- Blog

- case study on trent limited financials business model marketing strategies and swot analysis

Case Study on Trent Limited: Financials, Business Model, Marketing Strategies, and SWOT Analysis

Download pdf

Download ppt

The retail industry is a dynamic and ever-evolving sector, constantly trying to enhance consumer experiences through innovation. In India, Trent Ltd., a Tata Group subsidiary, has emerged as a retail powerhouse over the years. Founded in 1998, Trent operates leading brands like Westside, Zudio, and Star, offering fashion and essentials at competitive prices. With a focus on quality, affordability, and customer satisfaction, Trent Ltd continues to redefine the Indian shopping experience.

In this blog, we will focus on Trent Limited to better understand the business model and perform a SWOT analysis of the company.

Trent Limited Overview

Trent Limited is an arm of Tata Group and focuses on the fashion retail industry. Trent is one of the most renowned companies in India’s retail industry due to its pervasiveness and quality.

On 5th December 1952, the company was established as Lakme Limited (Lakme). The company was initially involved only in cosmetics, toiletry, and fragrance products. However, it was later decided that Lakme should diversify its business segment and enter the apparel retail field.

It was determined that Lakme would create a strong presence in the apparel field by opening a chain of sector-focused stores nationwide. In March 1998, Lakme purchased Littlewoods International (India) Private Limited from Littlewoods International Limited; LIPL was in readymade garments retail and related merchandise. Concurrently, Lakme Exports Limited, an arm of Lakme, was amalgamated with Lakme and renamed Trent Limited in 1998.

Now, we will be heading forward to the company overview.

| Company Type | Public |

| Industry Type | Retail, Apparel |

| Founded on | 1998 |

| Headquarters | Mumbai, Maharashtra, India |

| Parent | Tata Sons |

| Subsidiaries | Westside, Zudio, Landmark Bookstores, Zara (India), etc. |

Trent Limited Business Model

Trent manages and operates a list of apparel subsidiaries. The list is provided below:

1. Westside

This retail company serves branded fashion apparel, footwear, home decor items, and accessories for all sections of society, namely men, women, and children. It has over 22 labels and exists in 200 retail stores measuring 8,000-34,000 sq. ft. in 82 major cities.

2. Utsa

This company provides products in the field of Indian lifestyle while offering ethnic apparel, beauty products, and accessories. It is currently present in approximately 7 stores across 5 cities.

3. Zudio

This apparel company caters to men, women, and kids while providing pocket-friendly clothes, footwear, perfumes, and much more. Zudio has successfully established more than 290 stores across the country.

4. Star

This store is incorporated under the TATA group and serves an assortment of products, including staples, beverages, health, and beauty products, with offerings in 10 hypermarkets and 26 supermarkets across the country.

5. Landmark

This store offers toys, books, stationery items, and sports merchandise from more than 16 stores nationwide.

Other subsidiaries and associates:

- ZARA

- Fiora Business Support Services Limited (FBSSL)

- Booker India Limited

- Trent Hypermarket Pvt Ltd

Trent Limited Key Metrics

Let’s see the key market data for Trent:

| Market Cap | ₹ 1,70,629 Cr. |

| Current Price | ₹ 4,800 |

| 52 Week High / Low | ₹ 8,346 / 3,801 |

| P/E | 115 |

| Book Value | ₹ 132 |

| Dividend Yield | 0.06 % |

| ROCE | 23.80 % |

| ROE | 27.20 % |

| Face Value | ₹ 1.00 |

Read Also: TCS Case Study: Business Model, Financial Statement, SWOT Analysis

Trent Limited Financial Highlights

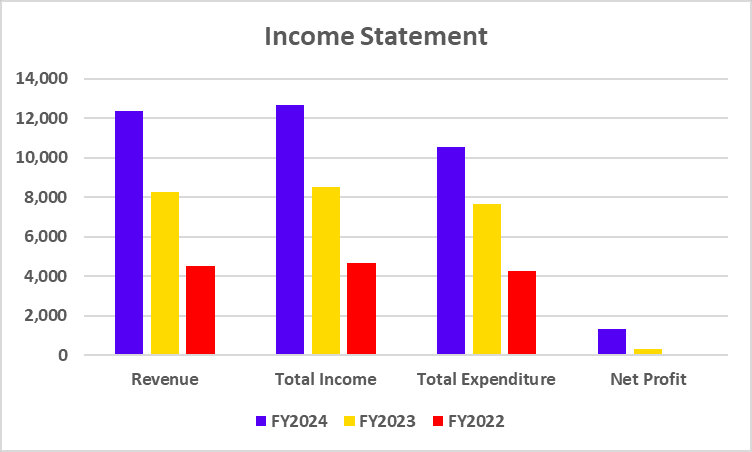

Income Statement

| Particulars | FY2024 | FY2023 | FY2022 |

|---|---|---|---|

| Revenue | 12,375 | 8,242 | 4,498 |

| Total Income | 12,664 | 8,502 | 4,673 |

| Total Expenditure | 10,548 | 7,665 | 4,262 |

| Net Profit | 1,353 | 310 | 29 |

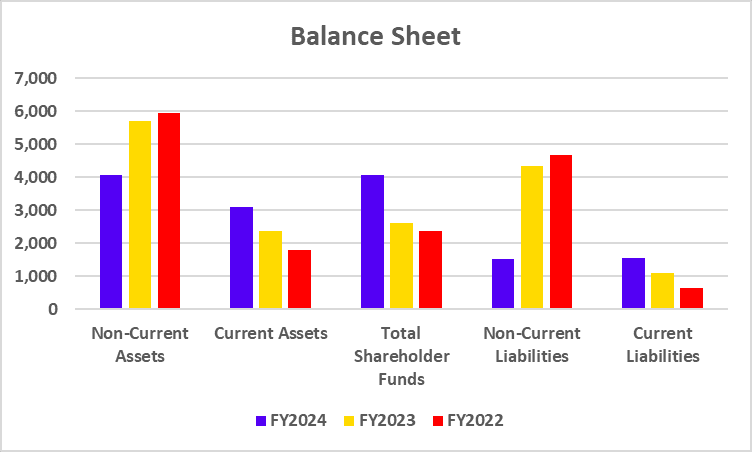

Balance Sheet

| Particulars | FY2024 | FY2023 | FY2022 |

|---|---|---|---|

| Non-Current Assets | 4,052 | 5,704 | 5,943 |

| Current Assets | 3,110 | 2,378 | 1,783 |

| Total Shareholder Funds | 4,068 | 2,595 | 2,364 |

| Non-Current Liabilities | 1,518 | 4,325 | 4,663 |

| Current Liabilities | 1,541 | 1,094 | 653 |

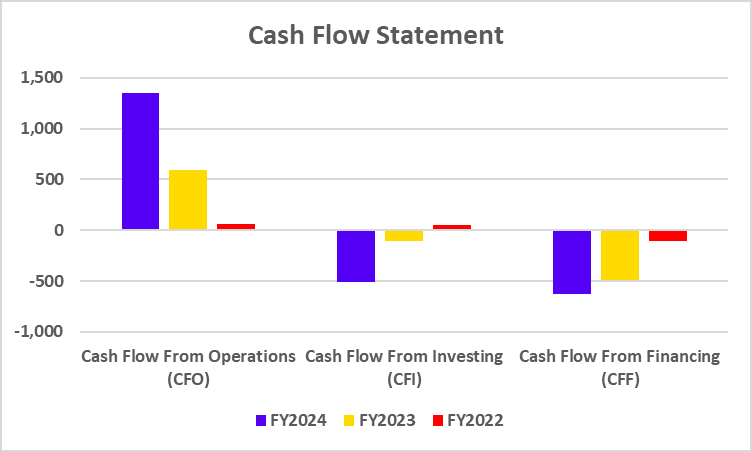

Cash Flow Statement

| Particulars | FY2024 | FY2023 | FY2022 |

|---|---|---|---|

| Cash Flow From Operations (CFO) | 1,348 | 594 | 58 |

| Cash Flow From Investing (CFI) | -508 | -102 | 56 |

| Cash Flow From Financing (CFF) | -629 | -491 | -107 |

Key Performance Indicators (KPI)

| Particulars | FY2024 | FY2023 | FY2022 |

|---|---|---|---|

| Operating Margin (%) | 12.44 | 10.20 | 9.74 |

| Net Profit Margin (%) | 10.94 | 3.76 | 0.65 |

| ROCE (%) | 27.40 | 12.03 | 6.19 |

| Current Ratio | 2.02 | 2.17 | 2.73 |

| Debt to Equity Ratio | 0.12 | 0.19 | 0.21 |

Trent Limited Marketing Strategy

The company’s business model completely depends on its consumers because of the B2C nature of business. This nature allows the movement of goods through their offline channels and online stores. The company does not employ any intermediary for distribution purposes. This is made possible due to Trent’s complete dominance in logistics. Now, let’s have a look at the marketing strategies of Trent Ltd that directly led to their success:

Segmentation

This company has two segments i.e. contemporary and modern. These segments map the whole audience segment and retain the customers while providing the utmost quality and customer service.

Targeting

Trent has successfully placed brands for all sections of society (tier 1, 2, and 3). Each separate brand targets one of the three tiers. While Zara targets tier 1 customers, Westside captures tier 2 customers, and Zudio focuses on tier 3. By differentiating brands into each tier, they can serve all sections of society while maintaining their brand image.

Positioning

By focusing the brands’ efforts to further differentiate into genders, they are able to capture an even deeper market share. Each brand presents a unique value proposition that the other brands under the umbrella do not. This allows the consumers to choose one brand as their favourite and provide unrivalled loyalty in the long run.

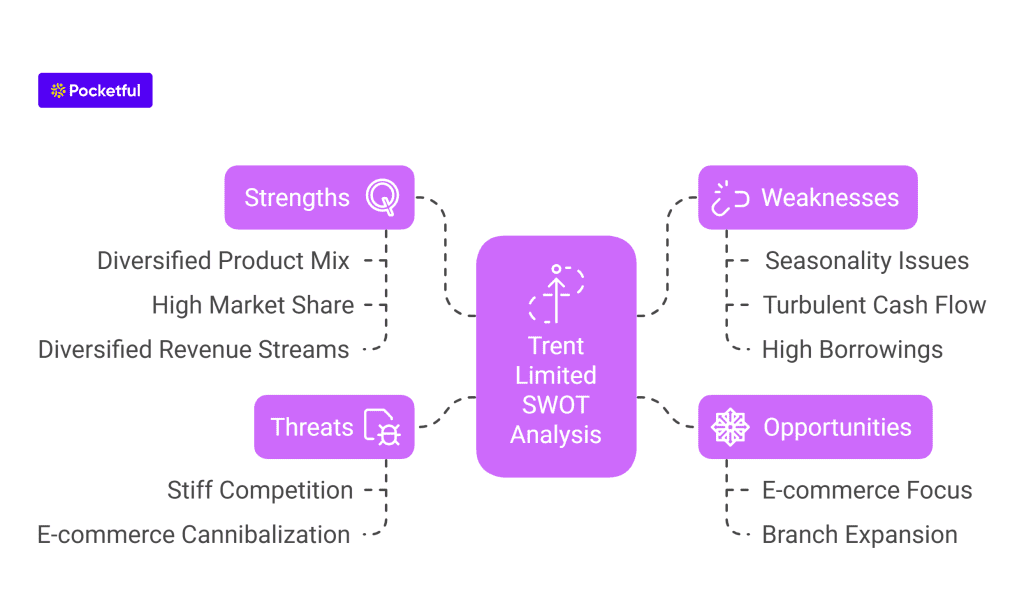

Trent Limited SWOT Analysis

Strengths

- Trent Ltd. provides a large number of product mixes to their customers.

- Due to Trent’s differentiation and high market share, any new player would face immense barriers to entry.

- Over time, Trent has ventured into various businesses outside the services sector. This has enabled the company to develop a diversified revenue stream beyond the Services and Retail (Apparel) segments. Thus further diversifying the business.

Weaknesses

- The industry faces issues during economic downturns due to the seasonality of business. This became evident during the Covid 19 pandemic, as the topline figures took massive hits.

- The Cash flow position of the business is not pleasant, which is visible by its turbulent cash flow graph shown earlier.

- The balance sheet indicates an immense increase in borrowings. This could prove fatal in the long run if the management does not tackle this in the upcoming years.

- The business operates in a field of low margins and high capital expenditure. This may affect their already distressed financial position.

Opportunities

- The industry is very dynamic and evolves very quickly. This is evident from the recent uptrend in e-commerce websites entering the apparel industry. Trent could focus their efforts on this domain to maintain market share.

- Financially, the company must focus on decreasing its borrowings while increasing its branches. This will facilitate capturing more outstanding market share.

Threats

- Trent faces stiff challenges from international and local competitors. Most of this competition exists due to Trent’s low presence in online domains.

- E-commerce websites such as Myntra, Ajio, and Meesho have increased consumer activity because of the ease of ordering clothes from home. These organizations can cannibalise the market share of Trent in the long run.

Read Also: Zara Case Study: Business Model and Pricing Strategies

Future Outlook

Trent Ltd’s future looks promising as it continues to expand its operations in India’s booming retail sector. With a focus on affordable fashion (Zudio), premium lifestyle (Westside), and grocery retail (Star), the company is set to capitalize on opportunities in various sectors. As India’s consumption increases, Trent’s agile business model and strong brand portfolio position it for sustained growth and dominance in the retail landscape.

Conclusion

Trent Limited, a subsidiary of Tata Sons, has established a strong presence in India’s retail industry through brands like Westside, Zara, and Zudio. The company’s business model focuses on direct-to-customer channels, while its marketing strategy targets youth and families in tier 1, tier 2, and tier 3 cities. Despite facing strong headwinds, Trent Limited continues to evolve and expand in the digital sector.

Frequently Asked Questions (FAQs)

Does Tata own Trent?

Yes, it is incorporated under Tata Group.

What is the full form of Trent?

Trent Limited (a portmanteau of Tata Retail Enterprise).

What was the old name of Trent Ltd?

rent Limited was initially incorporated as Lakme Limited (“Lakme”) on December 5, 1952.

What are the products of Trent Ltd?

Trent caters to an audience of all groups via its vast products, such as Women’s wear, Footwear, Men’s wear, lingerie, cosmetics, perfumes, accessories, and home furniture.

What is the latest brand of Trent?

Trent recently launched an occasion wear brand called ‘Samoh’.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.