| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-27-24 | |

| Add new links | Nisha | Apr-10-25 |

- Blog

- colgate palmolive india case study

Colgate Palmolive India Case Study: Business Model, Product Portfolio, And SWOT Anlaysis

Taking care of your dental health is the first thing you do when you get up in the morning. As a user, you have probably heard of “Colgate” toothpaste. However, did you know that Colgate is more than just a toothpaste brand?

In this blog, we’ll discuss Colgate Palmolive India Ltd., one of the largest FMCG companies in India, gain insights into its business model and do a SWOT analysis.

Colgate Palmolive India Overview

Colgate Palmolive India was established in 1937 as a private limited company. It is a subsidiary of Colgate Palmolive Limited, an American multinational consumer products company. The firm introduced its first toothpaste product, called Colgate, which was a huge hit in the Indian market. The company expanded its product line to include personal care items, all the while concentrating on fortifying its distribution network. To lessen its carbon footprint, the corporation is incorporating cutting-edge technologies in manufacturing. The company has launched the “Keep India Smiling Foundation Scholarship Program” to provide financial support to more than 65,000 deserving students. The organization’s headquarters is in Mumbai.

Business Model of Colgate Palmolive India

The business has a product-centric approach and has four main categories: home care, personal care, dental care, and pet nutrition. Additionally, they have a robust distribution network that facilitates the sale of their goods in both urban and rural locations. It makes use of digital technologies by using e-commerce platforms to sell its goods. Due to their robust brand image, they have established trust with their customers.

Product Portfolio of Colgate Palmolive India

Oral care, personal care, home care and pet nutrition are the four categories in which the company sells its goods. In India, the company’s oral hygiene products—which include toothpaste, toothbrushes, mouthwash, and other items—have a 50% market share. They have body washes, liquid hand washes, and shampoos under the personal care product category. The company also manufactures surface cleansers and disinfectants under the home care product category. The company also provides Hill’s Pet Nutrition products.

Market Details of Colgate Palmolive (India) Limited

| Current Market Price | INR 3,672 |

| Market Capitalization (In Crores) | INR 99,872 |

| 52 Week High | INR 3,710 |

| 52 Week Low | INR 1,968 |

| Book Value | INR 68.9 |

| P/E Ratio (x) | 70.6 |

Read Also: Nestle India Case Study: Business Model, Financial Statement, SWOT Analysis

Financial Statements of Colgate Palmolive India

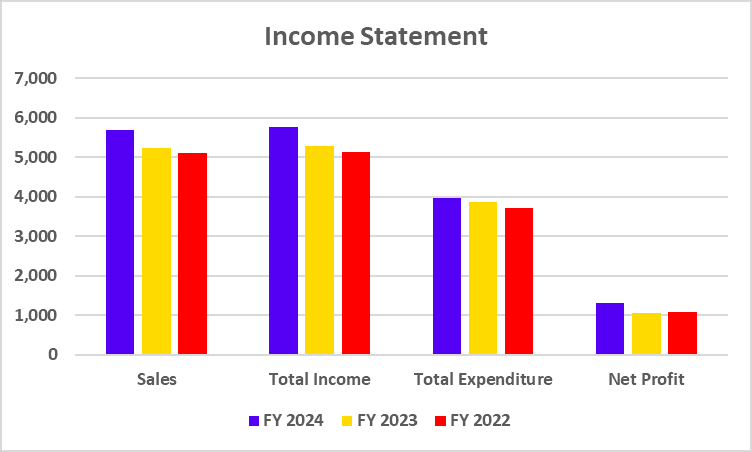

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 5,680 | 5,226 | 5,099 |

| Total Income | 5,756 | 5,279 | 5,126 |

| Total Expenditure | 3,970 | 3,865 | 3,711 |

| Net Profit | 1,323 | 1,047 | 1,078 |

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Non-Current Assets | 1,293 | 1,335 | 1,419 |

| Current Assets | 1,904 | 1,548 | 1,483 |

| Total Shareholder Funds | 1,874 | 1,716 | 1,735 |

| Non-Current Liabilities | 83 | 82 | 85 |

| Current Liabilities | 1,239 | 1,085 | 1,082 |

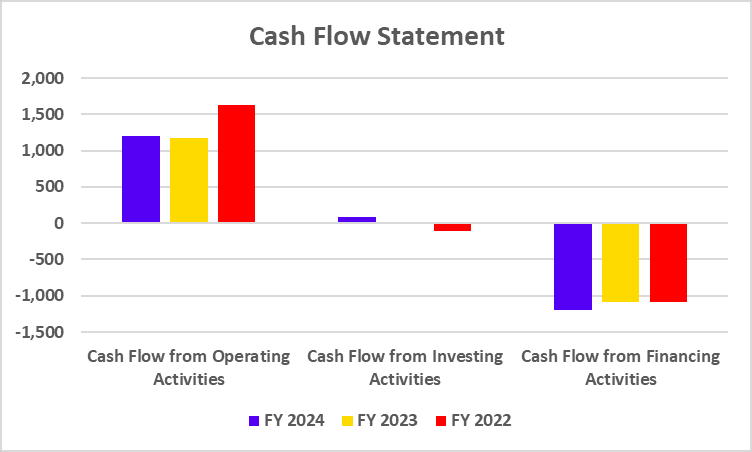

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating Activities | 1,198 | 1,176 | 1,625 |

| Cash Flow from Investing Activities | 79 | -7 | -107 |

| Cash Flow from Financing Activities | -1,195 | -1,086 | -1,090 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 31.79 | 27.28 | 27.74 |

| Net Profit Margin (%) | 23.30 | 20.03 | 21.14 |

| ROCE (%) | 92.26 | 79.28 | 77.76 |

| Current Ratio | 1.54 | 1.43 | 1.37 |

| Debt to Equity Ratio | 0.04 | 0.00 | 0.00 |

SWOT Analysis of Colgate Palmolive India

The Colgate Palmolive India SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.

Strength

- Brand Value – The company is a well-known name in the Indian FMCG sector, particularly in the oral healthcare sector.

- Distribution Network – The business has a robust distribution network that enables it to reach every region of the nation and ensures a steady supply of products.

- Quality of Product – Because the business has consistently produced high-quality goods, it has a stable customer base.

Weakness

- Limited Product Portfolio – The company’s revenue is reliant on a small number of products, such as oral healthcare products, which may pose a concern in the long run.

- High Advertising Cost – The company heavily invests in product advertising, which affects the company’s profitability.

- Slow Penetration – Sales of niche products such as medicated mouthwash and specialist oral healthcare products are growing slowly.

Opportunities

- Market Expansion – By concentrating on rural and semi-urban areas of the nation, the corporation can boost its market share and broaden its reach.

- Product Diversification – The business might expand the range of products it offers in order to boost sales.

- E-Commerce Platform – Colgate Palmolive India Limited can use e-commerce platforms to boost sales.

Threat

- Competition – The industry in which the company operates is extremely competitive, and due to globalization, many foreign businesses have gained a significant market share.

- Changing Consumer Preference – Consumer preferences can change, which can cause the company to lose market share if it doesn’t launch new products that cater to the needs of its customers.

Read Also: Gillette India Case Study: Business Model, SWOT Analysis, and Financial Overview

Conclusion

To sum up, Colgate Palmolive India Limited is a well-known FMCG company in India that offers a variety of goods, including oral and personal care products. The company’s main focus is to expand its product range and distribution system. The business has also been profitable for the previous three years. However, as an investor, you must speak with a financial advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Hindustan Unilever Case Study |

| 2 | Elcid Investments – India’s Costliest Stock |

| 3 | Reliance Power Case Study |

| 4 | Burger King Case Study |

| 5 | Zara Case Study |

Frequently Asked Questions (FAQs)

Who is the CEO of Colgate Palmolive India Limited?

Prabha Narasimhan is the company’s CEO as of 16 September 2024.

Where is the headquarters of Colgate Palmolive India Limited?

The headquarters of Colgate Palmolive India is situated in Mumbai.

Is Colgate Palmolive India a profitable company?

Colgate Palmolive India is profitable as the company has reported a net profit of INR 1,323 crores in FY 2024 and INR 1,047 crores in FY 2023.

Is Colgate Palmolive India a large-cap or mid-cap company?

Colgate Palmolive India Limited is classified as a large-cap company as it has a market capitalization of INR 99,872 crores as of 16 September 2024.

Which companies are the major competitors of Colgate Palmolive India Ltd.?

The main competitors of Colgate Palmolive India Ltd. are Patanjali Foods Ltd., Dabur India Ltd., and Hindustan Unilever Ltd.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.