| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Dec-19-23 | |

| Add new links | Nisha | Feb-19-25 | |

| Add new links | Nisha | Feb-19-25 |

- Blog

- credit score what is it and how it impacts you

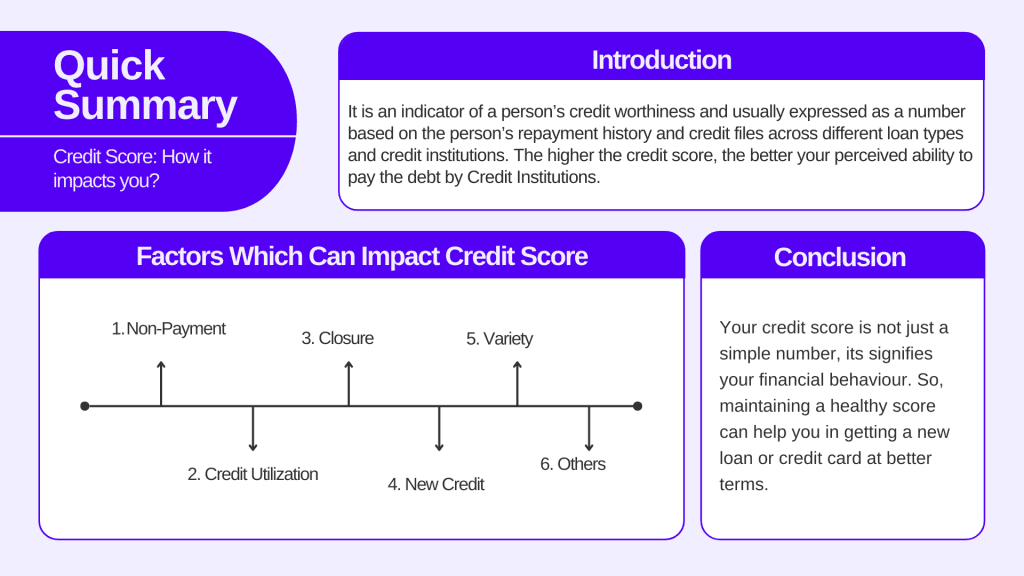

Credit Score: What Is It And How It Impacts You?

You must have heard the words – Credit score, Rating, Cibil, etc.

Confused what is it and how it impacts you? Keep reading; we will learn in detail about credit score in this blog.

What is a Credit Score?

A Credit score or Credit rating is an indicator of a person’s creditworthiness, in simple words, the ability to pay the debt.

It is usually expressed as a number based on the person’s repayment history and credit files across different loan types and credit institutions. The range of a credit score is generally between 300 and 900. It’s not a simple number; in fact, it can signify your past financial behaviour. The higher the credit score, the better your perceived ability to pay the debt by Credit Institutions.

If you’re looking for a home loan, car loan, or applying for a new credit card, your credit score will significantly impact the chances of approval, interest rate, repayment terms, credit limit, etc.

In India, Credit scores are issued by Credit Information Companies (CICs), also known as Credit Information Bureaus (CIBs). CIBs are different from Credit Rating Agencies (CRAs). CIBs provide credit data of borrowers and are licensed by the Reserve Bank of India (RBI), whereas CRAs evaluate the credit quality of debt instruments offered by companies, govt. and other institutions. CRAs are regulated by the Securities and Exchange Board of India (SEBI).

What is the need for a good Credit Score?

Before going into the details, let’s understand why we need a good credit score.

At the time of taking a loan or applying for a new credit card, Banks and lending institutions use credit scores to assess whether you are worthy of credit. The better your credit score, the higher the chances of getting your loan approved or vice versa.

Further, you are likely to get additional benefits if you are maintaining a healthy credit score, such as low interest rates, better repayment terms, higher credit limit, etc.

How is Credit Score calculated?

There are numerous Credit Information Companies (CICs), a.k.a. Credit Information Bureaus (CIBs), and the calculation method of credit score is different for each company.

There are multiple factors considered in calculating credit score, and their weightage can be different across CIBs. In India, there are four Credit Card Information Companies licensed by the Reserve Bank of India (RBI). These are:

1. TransUnion CIBIL: Credit Information Bureau India Limited (CIBIL) is a part of TransUnion, an American multinational group. Incorporated in 2000, it is the most popular Credit Information Company. The CIBIL credit score is a three-digit number that ranges from 300 to 900, with 900 being the best score. Above 750 is considered to be a good score.

2. Experian: Experian PLC, incorporated in 1996, is a multinational data analytics and consumer credit reporting company headquartered in Ireland. The Experian credit score is a three-digit number that ranges from 300 to 850, with 850 being the best score.

3. Equifax: Equifax Inc., founded in 1899, is an American multinational consumer Credit Reporting Agency. The Equifax credit score is a three-digit number that ranges from 300 to 900, with 900 being the best score.

4. CRIF: CRIF High Mark Credit Information Services Private Limited, incorporated in 2005, is a credit bureau headquartered in Mumbai, India. The CRIF credit score is a three-digit number that ranges from 300 to 900, with 900 being the best score.

Read Also: Understanding the Difference Between Credit and Debt

Factors which can impact Credit Score

1. Non-Payment

It is considered to be the most important factor which can significantly impact your credit score. Whether it is a payment of your credit card bill or an instalment of your home loan, never miss the due date.

Tips to improve – Always pay on time: Never forget to pay your bills or better, enable auto pay on your credit card payments and loan instalments.

2. Credit Utilization

Over-utilisation of the limit offered to you can signify that you are credit-hungry. It is calculated on the basis of your overall credit limit.

Consider a situation: You have two credit cards, and their aggregate limit is INR 1 lakh. Now, during Diwali, you did shopping worth INR 90,000 via credit cards. Here, your utilisation rate is 90%, which is on the higher side. It will have a negative impact on your credit score.

Tips to improve: Do not over utilize your credit limit, keep it below 30% of your overall credit limit.

3. Closure

Closing your active credit cards and loans can temporarily affect your credit score as it reduces your credit history. The older the card or loan, the higher the impact on your credit score.

Tips to improve: Keep your old cards active, even if you don’t use them. It increases your average credit age and helps you maintain a healthy credit score.

4. New Credit

Taking more credit in the form of credit cards or loans signifies that you are credit hungry, and it can have a negative impact on your credit score.

Tips to improve: If you are applying for a new credit card or loan, consider taking a gap in the new applications, as simultaneously opening multiple new credit cards and loans can significantly lower your credit score.

5. Variety

Although not significantly, but having a mix of credit instruments can positively impact your credit score.

Tips to improve: Based on your needs, consider taking a variety of credit account types in your portfolio. For example – You have a credit card and are in need of a personal loan, instead of taking a loan against your credit card limit, consider taking a personal loan which will improve the variety of your credit account type and generally personal loans from Banks are cheaper than loan against credit cards.

However, keep in mind that it is not a major factor in determining your credit card score.

6. Others

There are a few other factors as well that can impact your credit score. Although, the impact of these factors is less as compared to other factors. These are:

1. New Inquiries: If you apply for a new loan or credit card, the lending institution will assess your credit score first, which means it will go to the CICs and make an inquiry. The higher the number of inquiries, the higher the impact on your credit score. However, the impact is temporary.

2. Incorrect address: If your address or any personal details are not consistent across loans or credit cards, then it can impact your credit score.

Tips to improve: Never apply for too many credit cards or loans at one time. Further, keep checking your credit reports frequently; if you identify any discrepancies, then take a proactive approach and rectify them.

How to check Credit Score?

In India, as we discussed above, there are four Credit Information Companies (CICs) licensed by the RBI. There are multiple ways to check your credit score:

- Website of CICs: You can visit the website of the CICs and check your credit score. Generally, it requires registration and one report is free to check.

- Bank: Nowadays, banks or credit card companies provide the facility of credit score check without any cost.

- Third parties: There are multiple third parties in India, including payment aggregators and Fin-techs, which provide a free credit score check facility.

Read Also: How to Improve Your Credit Score?

Conclusion

Your credit score is not just a simple number; in fact, it signifies your financial behaviour. It significantly impacts your loan approval chances and lending terms such as interest rate, repayment terms, etc.

Considering how important it is, maintaining a healthy score can help you in getting a new loan or credit card at better terms. It’s not difficult to maintain a healthy credit score; all you need to do is follow a few easy steps mentioned above.

Further, it is suggested to keep an eye on your credit score at-least once a month and proactively act on things or any discrepancies in reports.

Frequently Asked Questions (FAQs)

Which is the most widely accepted credit score in India?

CIBIL score

What is the ideal credit utilisation ratio?

Keep it below 30% to maintain a healthy credit score.

What is the impact of late payments on credit score?

If you have skipped payment of your credit card, you can still pay the bill within three days of the due date. There won’t be any penalty and most likely your credit score won’t be affected. However, if the due date + 3 days have passed, then you have to pay a penalty and interest charges, and your score can significantly go down.

Is the 810 CIBIL score considered to be good?

CIBIL score of 810 is considered to be an excellent score.

What is the full form of CIBIL?

CIBIL stands for Credit Information Bureau India Limited.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.