| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-08-24 | |

| Update FAQs Formatting | Nisha | Feb-19-25 | |

| Update FAQs Formatting | Nisha | Feb-19-25 | |

| Update FAQs Formatting | Nisha | Feb-19-25 |

- Blog

- decoding credit risk funds in india

Decoding Credit Risk Funds In India

Do you know there is a category of mutual funds which specifically invests in junk bonds? If you’re not familiar with the word, Junk bonds, as the name suggests, are low quality bonds which have a high risk of default. But wait, high risk means high returns? Yes! To compensate for the high default risk, these bonds provide greater returns than other highly rated bonds.

If you’re new to the mutual fund world, check out our blog: Mutual Funds: Meaning, Types, Features, Benefits and How They Work.

What are credit risk funds?

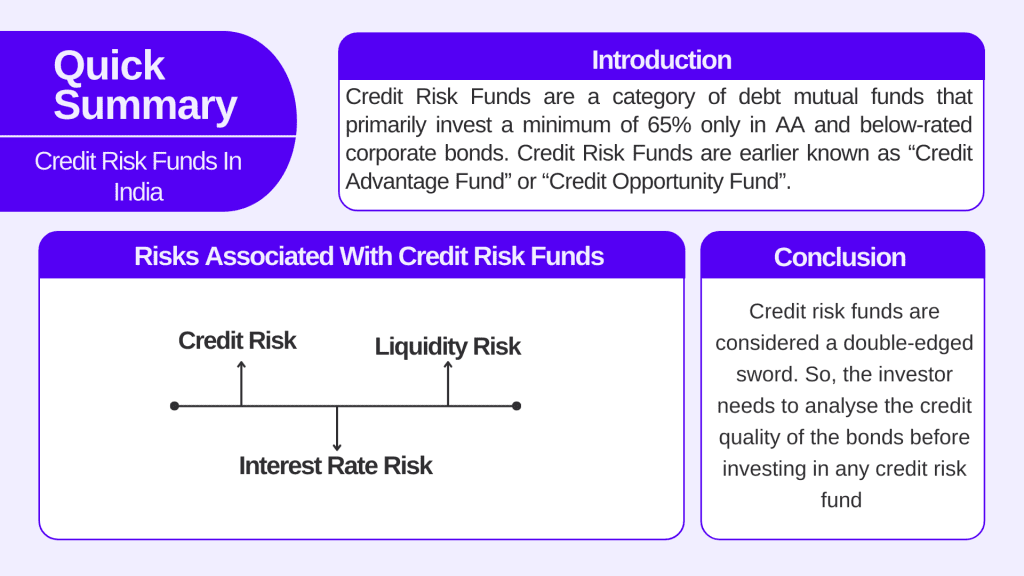

Credit Risk Funds are a category of debt mutual funds that primarily invest a minimum of 65% only in AA and below-rated corporate bonds.

Did you know?

Credit Risk Funds are earlier known as “Credit Advantage Fund” or “Credit Opportunity Fund”.

How do Credit Risk Funds work?

Fund managers seek out debt funds with credit ratings that generally range from BBB to C since these bonds offer higher interest rates to compensate for the risk of default.

To diversify the risk, the fund manager will invest across multiple bonds of different companies to avoid overexposure in a single issue or company.

Checkout our blog on debt mutual funds: What is Debt Mutual Funds: Invest in the Best Debt Funds in India

Readc Also: Types of Mutual Funds in India

Advantages of Credit Risk Funds

- High Yield

Credit risk funds offer investors high yields as compared to other debt funds. This can fascinate investors who wish to seek relatively higher returns.

- Diversification

Investors can get exposure to high-yield bonds, although with higher risk. Further, credit risk funds have investments across multiple companies and issues such that exposure to any sector or company is significantly reduced. For risk-seeker investors, this enhances the overall portfolio performance.

- Professionally Managed

Credit risk funds are managed by professional fund managers having specialisation in credit risk assessment. Their expertise helps the fund in generating good returns considering the risk profile.

Disadvantages of Credit Risk Funds

- Risk of Default

Junk bonds carry a high possibility of default. The lower credit quality of the bonds increases the chance that the issuer may fail to repay the principal amount.

- Volatility

Credit risk funds are highly volatile compared to other debt options, i.e., the fund’s net asset value (NAV) changes significantly which may not give positive returns to investors for a short period.

- Not Suitable for all Investors

These funds are a fit for investors with a high-risk tolerance and long-term investment horizon.

- Management Costs

Credit risk funds need active oversight and analysis. This leads to higher expense ratios and reduces the overall returns. Generally, the expense ratio of credit risk funds is more than other categories of debt mutual funds.

Read Also: Decoding Hedge Funds In India – Types, Advantages And Distinctions

Impact of Interest Rate Changes on Credit Risk Funds

- When interest rate rises, the value of existing bonds declines, since bond prices and interest rates share an inverse relationship. However, credit risk funds invest in low-quality bonds that have high coupon rates to compensate for the increased risk of default, i.e., a decline in the value of bonds may be less visible, and the higher coupon rates can still provide good returns even if the interest rates are rising.

- Credit risk funds are sensitive to changes in credit spreads. Credit spread is the additional yield that investors demand for holding riskier bonds over safe and secure government bonds.

- There is a thing called “Duration” in the bond universe, which is the measure of the sensitivity of price change of a bond for a change in the interest rate. The higher the duration, the more sensitive the bond is to the changes in interest rates. Investors should keep in mind the duration of the credit risk funds before investing as it can significantly impact the performance of funds in a short period.

Risks associated with Credit Risk Funds

Credit Risk

The primary risk that is involved in credit risk funds is “Credit Risk” or the “Risk of Default” by the bond issuers. Bonds with high coupon rates are more exposed to default risk and can lead to a decline in the fund’s value.

Liquidity Risk

Credit risk funds are generally less liquid when compared to other debt funds because these funds hold bonds that are of low credit quality, making it difficult to buy or sell them in the market.

Concentration Risk

Several credit risk funds have concentrated exposure to specific sectors, which can increase the risks if those sectors face any kind of economic downturn or challenge.

Interest Rate Risk

As we discussed above, just like other fixed-income securities, credit risk funds are sensitive to changes in interest rates. When interest rates rise, the prices of existing bonds in the portfolio may fall, leading to potential capital losses.

Credit Risk Funds vs. Other Mutual Funds

- Credit risk funds carry high risk and potential of high returns since they invest in lower-rated corporate bonds, whereas the risk and returns of other mutual funds vary depending on the category of investment (equity, debt, balanced, etc.)

- Compared to other mutual funds, credit risk funds are more volatile because of sensitivity to changes in credit ratings.

- Credit risk funds are less liquid due to low demand than other debt mutual funds like liquid funds, low-duration funds, etc.

- Credit risk funds are suitable for investors with high-risk tolerance and long-term investment horizons, and other mutual funds say liquid funds are suitable for a wide range of investors.

Historical Performance of Credit Risk Funds

Credit risk funds generally offer high returns as compared to other categories of debt funds, and annualised returns can range somewhere between 7% to 14% depending on the fund and the market conditions.

As of January 2024, there are more than 15 credit risk funds available in India from different Asset Management Companies. The table below shows the annualized performance of a few credit risk funds that we selected on a random basis:

| Funds | 1 Year Return (%) | 3 Year Return (%) | 5 Year Return (%) | 7 Year Return (%) |

|---|---|---|---|---|

| Aditya Birla Sun Life Credit Risk Fund – Direct Plan | 7.73 | 7.64 | 7.24 | 7.51 |

| Axis Credit Risk Fund – Direct Plan | 7.86 | 6.56 | 6.94 | 7.05 |

| HDFC Credit Risk Debt Fund – Direct Plan | 7.35 | 6.39 | 7.95 | 7.56 |

| ICICI Prudential Credit Risk Fund – Direct Plan | 8.03 | 6.86 | 8.25 | 8.06 |

Are Credit risk funds suitable for you?

Investments in credit risk funds expose your portfolio to high risk, and if your main purpose is to preserve your capital (assuming you are a risk-averse investor), then chances are likely that credit risk funds may not align with your financial goals.

However, if you are looking for diversification in your debt portfolio, can stay invested for a longer horizon, and are familiar with the risks involved, you can choose credit risk funds to diversify your portfolio and generate good returns.

But remember to seek advice from a financial advisor. A professional advisor will analyse your investment goals and curate your portfolio accordingly.

Read Also: What is Debt Mutual Funds: Invest in the Best Debt Funds in India

Conclusion

Credit risk funds are considered a double-edged sword. They offer high returns but at a cost of high risk. Although, the investor needs to analyse the credit quality of the bonds before investing in any credit risk fund and if in any case, the investors want to exit these funds, they need to assess and monitor the fund’s portfolio regularly.

If you are curious to learn more about the taxation of mutual funds in India, check our blog: Decoding Mutual Funds Taxation In India

Frequently Asked Questions (FAQs)

What are credit risk funds?

Credit Risk Funds are a category of debt mutual funds that primarily invest a minimum of 65% only in AA and below-rated corporate bonds.

Do credit risk funds offer higher returns as compared to other debt mutual funds?

Yes, they generally offer higher returns as compared to other categories of debt mutual funds such as liquid funds, money market funds, etc.

Credit risk funds are suitable for what kind of investors?

Credit risk funds are suitable for investors with a high-risk tolerance and long-term investment horizon.

Should you seek professional help while investing in credit risk funds?

It is recommended to seek professional advice before investing in Credit risk funds.

Credit Risk Funds are previously known as?

“Credit Opportunity Fund” & “Credit Advantage Fund”.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.