| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-16-25 | |

| Update Meta Tags and H1 | Ranjeet Kumar | Feb-14-25 |

15 Best Demat Accounts Apps for Traders and Investors in India

A Demat account is necessary to participate in the stock market in India. Although many brokers in the market offer Demat account services, you should select one based on your needs.

In this blog, we will give you an overview of the best Demat account in India for 2025, along with the top three recommendations for traders and investors.

What is a Demat Account?

An investor can keep financial assets, including stocks, mutual funds, ETFs, bonds, and more, in an electronic demat account. Before 1996, securities were exchanged in physical certificates, which had several dangers, including damage from forgeries and theft. Demat accounts were created to remove these risks. If you wish to trade on the Indian Stock Market, you must have a Demat Account.

What to Look for in a Demat Account Apps?

The key considerations for selecting the best Demat Account:-

- Brokerage – Brokers typically charge a commission as a fee for using their platform to execute trades. You should choose the broker for opening a Demat account that offers you the lowest brokerage.

- Account Maintenance Fees – Customers are charged fees for maintaining their Demat accounts by the broker. Since these yearly maintenance charges differ from broker to broker, it is essential to consider brokers who offer lower annual maintenance fees.

- Account Opening Fees – A one-time fee is charged by some brokers while opening a demat account with them. However, the majority of brokers are offering zero account opening fees.

- Margin Interest – Brokers lend money to their clients and charge interest on it at a certain rate; therefore, if you wish to opt for a margin trading facility, then you must consider the broker who charges a minimum interest rate on this facility.

- Research Tools – There are various types of research tools offered by brokers; therefore, one must choose a broker who offers the most advanced trading tools.

- Customer Support – One of the most important things to consider when opening a Dement account is customer service. Customer service is crucial because you want any issue you encounter when managing a Demat account to be fixed as soon as possible.

The 15 Best Demat Accounts in India for 2025 – AMC Free/Paid

Detailed Comparison Table

| Broker | Account Opening Fee | Annual Maintenance Fee (AMC) | BrokerageCharges | Unique Features |

|---|---|---|---|---|

| Pocketful | ₹ 0 | ₹ 0 | Pocketful offers you 0 delivery charges. | Cutting-edge technology lets you invest in different asset classes in one place. |

| Zerodha | ₹ 0 | ₹300 + GST | ₹20 or 0.03% per executed order, whichever lower | User-friendly platform, educational tools |

| Angel One | ₹ 0 | ₹240 (1st year free) | ₹20 per order | Comprehensive research, versatile mobile app |

| ICICI Direct | ₹ 0 | ₹ 700 | 0.55% for equity delivery, 0.275% for intraday | 3-in-1 account, extensive research |

| Kotak Securities | ₹ 0 | ₹ 600 | 0.49% for equity delivery, 0.049% for intraday | Advanced trading tools, personalized advisory |

| Upstox | ₹ 0 | ₹ 150 | ₹20 or 0.05% per order | Low brokerage fees, intuitive platform |

| 5paisa | ₹ 0 | ₹ 300 | ₹20 per order | Flat brokerage rates, mutual fund investments |

| Sharekhan | ₹ 0 | ₹ 400 | 0.5% for equity delivery, 0.1% for intraday | Training programs, advanced trading platforms |

| Motilal Oswal | ₹ 0 | ₹ 199 | 0.5% for equity delivery, 0.05% for intraday | Personalized advisory, portfolio management |

| SBI Securities | ₹ 0 | ₹ 750 (1st year free) | 0.5% for equity delivery, 0.05% for intraday | 3-in-1 account, strong banking integration |

| Axis Direct | ₹ 0 | ₹ 750 | 0.5% for equity delivery, 0.05% for intraday | Seamless fund transfers, advanced research tools |

| IIFL Securities | ₹ 0 | ₹ 250 | 0.5% for equity delivery, 0.05% for intraday | Free research reports, advisory services |

| Edelweiss Broking | ₹ 0 | ₹ 500 | 0.5% for equity delivery, 0.05% for intraday | Research-driven advisory, diverse investment options |

| Groww | ₹ 0 | ₹ 0 | ₹20 or 0.01% per order | Zero AMC, a user-friendly platform |

| Paytm Money | ₹ 0 | ₹ 0 | ₹20 per intraday order, ₹20 for delivery | Integrated with the Paytm ecosystem, low transaction costs |

Overview of the Top 15 Demat Accounts App for Traders and Investors

An overview of 15 Best Demat Accounts for traders and investors is given below:-

1. Pocketful – Free Demat Account App

Pocketful is a new-age discount broking firm offering a wide range of investment options such as equity, commodity, derivatives, etc. Pocketful was launched in 2024 and is backed by Pace Financial Group. Pocketful is developed by professionals with more than 27 years of experience, which ensures enhanced user experience. Pocketful is different from other discount brokers as it offers one of the best trading platforms and does not charge any fees for equity delivery-based trades, account opening, or yearly maintenance fees. Therefore, it is the best option for both traders and investors.

Key Features

- Pocketful provides a free trading platform since there are no brokerage on equity delivery trades, zero account opening fees and zero annual maintenance fees for the first year.

- An online account can be opened with Pocketful within five minutes.

- You can create your trading strategies using free Pocketful APIs.

Best For: Because of its user-friendly design, zero brokerage on equity delivery transactions, and no annual maintenance fees for the first year, Pocketful is the best broker for traders and investors. Additionally, it offers advanced trading tools to analyze the market. Therefore, one can consider opening a Demat account with Pocketful.

2. Zerodha

Zerodha is one of the major players in the Indian stock broking industry. It was established in 2010 by the Kamath Brothers and offers a distinctive trading platform focusing on cutting-edge technology. It introduced a new pricing structure in the broking industry, which was known as flat brokerage for trading.

Key Features

- Zerodha is renowned for its user-friendly trading platform.

- It has a dedicated customer service team that assists its clients in resolving their queries.

- Varsity is a free education platform offered by Zerodha to enhance the knowledge of their client.

Best For: Investors who want to trade in the stock market with the broker that offers the lowest brokerage can opt for this platform.

3. Angel One

Angel One is one of India’s top full-service brokers. It was established in 1996. It offers trading and investing in a variety of assets such as equity, commodity, derivatives, etc., and investment advisory services. Their cutting-edge software platform prioritizes the requirements and desires of its customers.

Key Features

- The main advantage of opening a demat account with Angel One is their customer-focused approach.

- Advanced trading tools are available in Angel One’s application.

- The company has a strong offline presence across the nation.

Best For: Angel One is suitable for traders who prefer offline broking services.

4. ICICI Direct Securities

One of the top stockbrokers in India is ICICI Direct Securities. One of the biggest banks in India’s private sector, ICICI Bank, owns ICICI Direct as a subsidiary. It offers a three-in-one account, which combines savings, trading and a Demat account through which an investor can effortlessly move funds from their savings account to their trading account. They offer a large variety of investment products that are tailored to meet the customers’ requirements.

Key Features

- Through its local offices, the company maintains a strong national presence, assisting its investors with any questions they may have.

- ICICI Direct also provides its clients with consultancy and research services.

- Additionally, it provides its investors with individual or customized wealth management solutions.

Best For: ICICI Direct Securities is a good option for investors who need assistance from local branch offices.

5. Kotak Securities Limited

Kotak Securities is a division of Kotak Mahindra Bank, one of the largest private sector banks in India. It makes it simple for their customers to link their bank account to their trading and demat accounts. Kotak Securities provides its investors with a variety of investment products, such as equities, commodities, and derivatives. Kotak Securities’ desktop-focused Neo Web and the mobile application Kotak Neo both provide real-time market data to traders and investors.

Key Features

- Apart from trading in equity and commodities, it also offers a wide range of investment options, such as mutual funds.

- Kotak Securities educates investors through various educational initiatives.

- Because Kotak Bank supports the company, it enjoys a great reputation as a brand.

Best For: Kotak Securities is a good choice for investors who want to enhance their stock market knowledge through their online tutorials.

6. Upstox

Upstox offers a modern trading platform and technical tools that help investors predict the trend of a commodity or a stock price. Additionally, they provide an option chain with a strategy mode that allows you to formulate and carry out your trading plans.

Key Features

- The mobile application offered by Upstox makes it simple for a beginner to start trading.

- You can create several watchlists on the platform and add equities, commodities, etc., for intraday trading.

- There are no annual maintenance charges payable by the investor while keeping an Upstox account.

Best For: Upstox is suitable for traders who wish to utilize technical analysis as a tool for intraday and swing trading.

7. 5Paisa

One of the leading discount brokers in India, 5Paisa offers a variety of services, including commodity and equities trading. It was founded in 2016 with the main goal of providing broking services at low prices. 5Paisa is an AMFI-recognized distributor of mutual funds.

Key Features

- They offer user-friendly web-based and mobile-based trading platforms to investors that offer them a seamless trading experience.

- 5Paisa offers investment in mutual funds through its platform.

- Their FnO360 platform offers advanced tools so that investors can make informed decisions.

Best For: 5Paisa is an option for those who want to learn about the stock market through interactive workshops.

8. Sharekhan

Established in 2000, Sharekhan was among the first broking firms in India to provide online trading services to regular clients. By opening franchises around the nation, it expands its business at an exponential rate. It was purchased by the French investment banking company BNP Paribas later in 2016 and was then sold to Mirae Asset Financial Group in 2024.

Key Features

- They provide a smooth mobile application with advanced trading tools.

- Sharekhan offers an advanced training program for its investors through its online courses, popularly known as the Sharekhan Classroom.

- It has a dedicated customer support team that addresses its customers’ queries.

Best For: For people who want to learn about technical and fundamental analysis, Sharekhan is the ideal choice.

9. Motilal Oswal Financial Services Limited

Motilal was founded in 1987 and is regarded as a major participant in the Indian broking industry. It offers advisory services, portfolio management services and investment in various asset classes. With more than 30 years of experience and multiple awards in recent years, they offer research reports in addition to advanced trading tools through their website and their mobile application named RISE.

Key Features

- Motilal Oswal Financial Services Limited provides its clients with customized financial solutions.

- Their mobile application is one of the best in the industry due to its user-friendly interface.

- Loans against securities are also offered by the company.

Best For: Ideal for investors who wish to have access to a variety of specialized financial products in one location, including portfolio management services.

10. SBI Securities

It was incorporated in the year 2006, and initially, it was known as SBICap Securities Limited. It is a wholly-owned subsidiary of the State Bank of India, which is India’s largest public-sector bank. SBI Securities is known for its extensive branch network and trust among investors due to government support for SBI. Along with equity and commodity trading services, it also offers research and advisory services.

Key Features

- They have personalized relationship managers for their high-net-worth individual clients.

- SBI Securities can increase the purchasing power of existing customers by offering them margin trading facilities for intraday traders.

Best For: This platform is suitable for both new and experienced investors as it offers comprehensive services. However, the fees charged by them are comparatively higher than those of others.

11. Axis Direct

Axis Direct was founded in 2011 and is a division of Axis Securities Limited, which is a subsidiary of Axis Bank. The company used innovative technology and created the Axis Direct platform, which is now among the top trading platforms in the Indian broking industry. The customers of Axis Bank can easily link their bank account to their demat account. The company’s headquarters is situated in Mumbai.

Key Features

- It offers advanced trading and investing platforms to its customers.

- The Axis Direct provides regular, in-depth fundamental research reports on different stocks, sectors, and commodities.

- Margin funding is also an additional feature provided by Axis Direct to their investors.

Best For: Investors looking to use the margin trading facilities provided by the broker can consider Axis Direct as an option.

12. IIFL

In 1985, IIFL was established as a division of the India Infoline Group. Originally founded as an advisory firm, its primary focus was on research and related activities. In 2005, it changed its name to India Infoline and went public on the Indian Stock Exchange. The company offers an advanced trading platform and ensures that its investors make wise investment decisions through its research reports.

Key Features

- IIFL offers research and advisory services to its customers.

- It also offers a user-friendly trading platform.

- Various free educational sessions are also provided by IIFL to their customers to enhance their knowledge.

Best For: Investors may choose to open a demat account with IIFL if they would like research and advisory services in addition to quick trade execution.

13. Edelweiss Broking

The Edelweiss Group chose to expand their business in 2008, and decided to enter into the broking service industry, and established Edelweiss Broking Limited. From 2010 to 2015, the company focused on research and advisory services. Along with this, they offered their clients a cutting-edge investing platform. The company began to diversify its product portfolio and included mutual funds and portfolio management services in 2015.

Key Features

- It offers algorithmic trading services to its customers.

- They also suggest actively managed funds to their customers based on market conditions.

- Daily market updates are also provided by Edelweiss to their investors so that they stay updated about the market conditions.

Best For: Edelweiss broking is suitable for those investors who are looking for a comprehensive array of services, such as advisory, trading etc., in one place.

14. Groww

It was incorporated in 2016 by the four Flipkart employees. Over time, this platform has grown in popularity among beginners in trading because of its easy-to-use interface.

Key Features

- It charges minimal fees from its customers.

- They provide investment in stocks, ETFs, mutual funds, etc., along with credit and bill payment services.

Best For: It is suitable for investors who wish to have access to all their investments in one place or at a single application.

15. Paytm Money

When Paytm Money was launched in 2017, it started operations as a direct mutual fund investment platform. One97 Communications Limited, the parent firm of Paytm, gained popularity right away among individual investors looking to cut costs when investing in mutual funds. In 2019, the company decided to provide low-cost stock trading services. The company’s headquarters is situated in Bengaluru.

Key Features

- Paytm offers a user-friendly application to provide their investors with a hassle-free trading experience.

- It also offers access to direct mutual funds through which a customer can save costs.

- It offers various calculators, such as SIP, lumpsum, etc., on its platform.

Best For: It is suitable for investors who are looking for platforms that offer trading facilities at a lower cost and fulfill their investment needs.

Top 3 Recommendations for Traders

The 3 recommended brokers for the traders are as follows:-

- Zerodha: Due to their cost-effectiveness, investors adore Zerodha, which is regarded as the biggest broker in India with millions of customers, affordable pricing, and flat brokerage costs. Sensibull for sophisticated options trading, Streak for algo trading, KITE for web and mobile-based trading, and a tiny case for theme-based investment are some of its intelligent trading tools. Their trading tools make it easy to place orders, and Varsity, their educational program, is a special selling point.

- Pocketful: Another up-and-coming stock broking company that provides a variety of investing possibilities and has no equity delivery fees. The application is simple to use and navigate. The platform, which aims to make investing easier, is a relatively new fintech platform in India. Its goal is to offer a smooth trading experience. The Goel brothers, Rishabh and Sarvam, founded it. The Goel Brothers are differentiating Pocketful from other bargain brokers by using their family’s experience from the Pace Stock Broking company, which has been involved in financial services for more than 30 years.

- Upstox: In addition to offering slick trading interfaces, Upstox charges trading costs that are comparable to Zerodha’s flat rates. It has sophisticated charting capabilities, and Upstox has a special feature called Tick-by-Tick Engine that gives retail traders information regarding buy and sell orders. Previously, this capability was restricted to institutional and wealthy individual clients.

Top 3 Recommendations for Investors

The 3 recommended brokers for the investors are as follows:-

- Pocketful: The ideal alternative for those who want to make long-term investments is Pocketful. This finance platform is modern. There are no annual maintenance fees, account opening fees, or delivery fees with Pocketful. Their platform is built on state-of-the-art technology created by experts with over 27 years of experience. Through their site, one can invest in a wide range of assets, improving the user experience.

- Kotak Securities: One of the biggest private sector banks in India, Kotak Mahindra Bank, owns Kotak Securities as a subsidiary. Additionally, it provides its clients with bank accounts and integrated demat trading for simple money transfers. Kotak Securities offers a vast array of investing options, such as mutual funds, stocks, derivatives, fixed-income products, and more. It provides cutting-edge trading platforms like Kotak Stock Trader, a web-based trading platform, and KEAT Pro X, a desktop-based trading platform that gives active traders access to real-time market data. It also offers sophisticated charting tools.

- Motilal Oswal Financial Services Limited: Founded in 1987, it is one of the top broking organizations in India, providing a wide range of investment alternatives, portfolio management services, and consulting services. Their advanced trading systems include. It provides the desktop trading terminal in addition to the investor and trader apps. Motilal Oswal’s research and advising services are regarded as some of the best in the business. It provides customized consulting services for its HNI clientele and has thirty years of research knowledge. One of the best PMS services available in the market is their portfolio management platform.

Benefits of Good Demat Account

The benefits of good demat account follow as:-

- Cost Efficient – A good demat account must be cost-efficient, which means the brokerage and other kinds of fees levied by the broker are less.

- Ease of Tracking and Managing Investment – As securities are held in electronic form, the tracking and managing of investments is efficient and hassle-free.

- Enhanced Trading Experience with Advanced Platforms – The trading platform offered by the broker must be equipped with advanced trading tools to enhance the trading experience of a trader.

- Ease of Account Opening – The process of opening an account with a broker should be easy and convenient. Nowadays, a demat account can be opened in just 24 hours.

- Free Research Tools— Many brokers provide demat accounts for free. However, their trading and research tools are paid; for this reason, one should consider opening a demat account with a broker that provides free research resources.

- Reliability – The broker with whom you open your demat account must be credible and reliable.

- Transparent Pricing – The pricing offered by the broker must be transparent. There must be no hidden charges.

Importance of Demat Account in Trading and Investing

There are various of having demat accounts, a few of which are mentioned below-

- Holding Securities – A Demat Account allows you to hold securities electronically.

- Transactions – If you want to sell or buy any securities, a demat account makes the process simpler.

- Nomination – An investor can nominate their close ones who will inherit the securities held in their demat account in case of the holder’s unfortunate death.

- No Minimum Balance – You are not required to have any minimum balance in your demat account.

- Corporate Actions – The demat account manages all the corporate actions like right issues, bonus shares, etc.

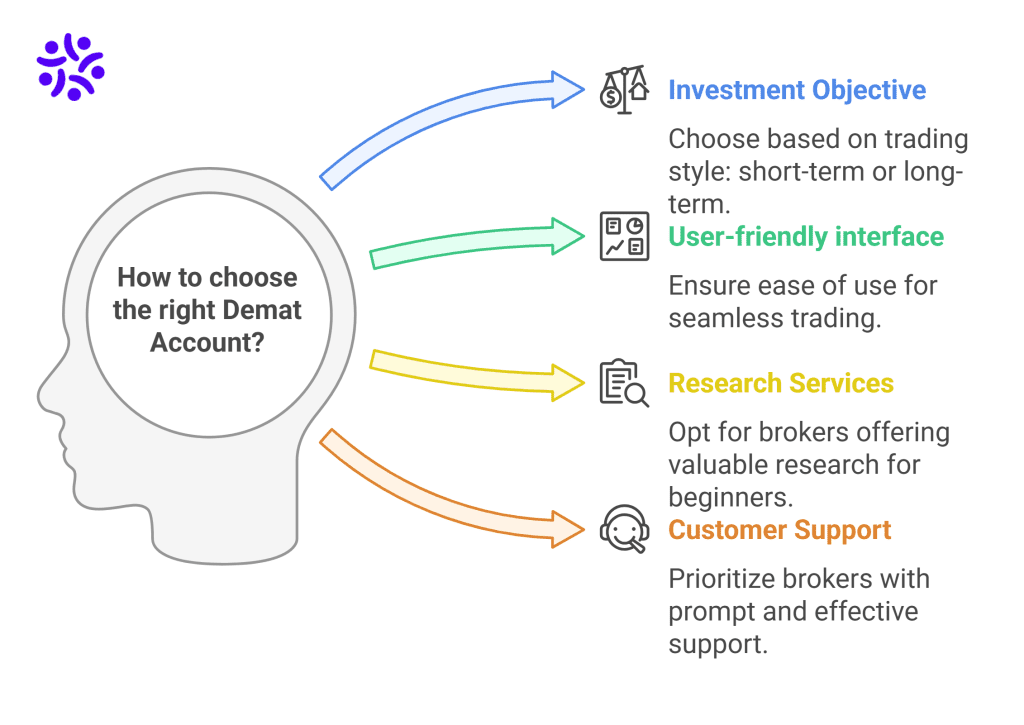

How to choose the right Demat Account for Your Needs

There are various factors one should consider before choosing the right demat account, a few of which are mentioned below:-

- Investment Objective: Selecting a platform that provides sophisticated trading tools and cheap transaction fees is essential if you are a short-term trader. However, you should search for a broker that offers cheap annual maintenance fees if you are a long-term investor.

- User-friendly interface: Before selecting a broker, you should confirm that the platform they provide is user-friendly and straightforward to use so that you can trade with ease.

- Research Services: If you are new to investing, then you must opt for a broker which offers you valuable research reports and research calls that can make your investments.

- Customer support: The customer support offered by the broker must be taken into consideration as Whenever you face any issues the queries must be resolved on an immediate basis.

- Hidden charges: Various brokers in the industry charge some kind of hidden fees from their customers; therefore, before choosing a broker, one must conduct proper research about the hidden charges.

- Trading Platform: Before choosing a broker, one must consider a trading platform which offers all the key features required by a trader or investor.

Conclusion

In conclusion, you should evaluate the services, fees, customer service, etc., that your broker offers if you intend to open a demat account. The investor’s investment goal also influences the broker’s choice. A Demat account, which provides the lowest brokerage and cutting-edge trading platforms, is something you should think about if you are a short-term investor. Choose a broker that offers the lowest or no annual maintenance fees, though, if you are a long-term investor. With its cutting-edge trading tools, lowest brokerage, lowest annual maintenance fees, and other features, Pocketful provides you with a demat and trading account. By clicking the link, you can open a demat account with us.

Frequently Asked Questions (FAQs)

Which Demat Account is Best for Beginners?

Depending on their investing goal, beginners should select a Demat account. When searching for short-term trading opportunities, a Demat account with the lowest brokerage is a requirement, but when seeking long-term investment, a Demat account with the lowest yearly maintenance expenses is a must. We at Pocketful provide you with the most affordable brokerage and yearly maintenance fees.

Is there a difference between a demat account and a trading account?

Indeed, the trading account allows you to buy or sell assets, whereas the Demat account just keeps them in electronic form.

Can I open a trading and demat account with the same broker?

Yes, you can open both trading and demat accounts with any broker that offers integrated account services.

Who can open a trading and demat account?

Any resident or non-resident person, corporate entity, or minor may open a Demat account; however, the legal guardian must be the only person able to manage the minor’s account.

What is the minimum amount required to open a demat account?

To start a demat account, you simply need to pay the opening fees, which are typically waived by brokers. There is no minimum amount needed.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.