| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Feb-27-25 |

Can a Demat Account Be Opened Without a PAN Card?

A Permanent Account Number (PAN) is a crucial document for opening a Demat account in India. However, for individuals without a PAN card, there are alternative ways to open a Demat account, as there are some exemptions. Want to know if you fit the criteria? Read on.

This blog provides a comprehensive look at who can open a Demat account without a PAN card and its benefits. Moreover, we will discuss the process and documents required to open a Demat account.

What is a Demat Account?

A Demat account stands for “Dematerialized account”. It is an electronic storage account used to hold financial securities like stocks, bonds, and exchange-traded funds (ETFs). By digitizing securities, a Demat account eliminates the need for physical certificates, streamlining and securing the trading and investment process.

Opening a Demat account requires essential documents, particularly a PAN (Permanent Account Number) card, which helps investors during tax filing and track transactions. However, for individuals looking to invest or trade who do not possess a PAN card but are eligible for an exemption, it is possible to open a Demat account without a PAN card. The exemptions are discussed later in the blog.

Documents Required for Opening a Demat Account

To open a Demat account, certain essential documents are generally required to verify identity, address, and bank details. These documents ensure compliance with financial regulations. Key documentation includes:

- Identity Proof: Commonly accepted identity proofs are the Permanent Account Number (PAN) card, Aadhaar card, passport, or Voter ID. A PAN card is a mandatory document for opening a Demat account as it is used for tax filing purposes and tracking transactions.

- Address Proof: Documents like the Aadhaar card, passport, and driving license or utility bills (e.g. and electricity or telephone bill) are commonly accepted for verifying your address.

- Bank Details: Providing a canceled cheque or a bank statement with your name, account number, and IFSC code is crucial. This is needed to link your Demat account to your bank.

- Income Proof (Optional): Income proof is required for trading in the futures and options segment. A recent salary slip, ITR or six-month bank statement may be needed.

Opening An Online Demat Account

Opening an online Demat account is a quick and convenient process that allows you to manage and store your securities digitally. A Demat account or dematerialized account will securely hold assets like stocks, bonds, and ETFs, also eliminating the need for physical certificates. To open a Demat account online, start by choosing a reliable brokerage or financial institution that offers superior services and user friendly platforms.

The process typically begins by completing an online application form, where you must provide personal details such as your name, address, etc. Uploading essential documents like PAN card, Aadhaar card, bank statement and recent passport-sized photographs is part of the verification process. Some brokers may also require a digital copy of your signature. Upon submission, these documents undergo a Know Your Customer (KYC) verification, which is often completed within a day or couple of days. Once the DP verifies and approves your application, you receive your Demat account details and can begin trading through the broker’s application or website.

Is a PAN Card A Must For A Demat Account?

According to the Securities and Exchange Board of India (SEBI), a PAN card is a mandatory requirement for engaging in securities transactions in India, which makes it essential to open a Demat account. It serves as an identification proof and helps investors and authorities keep track of transactions occurring in a Demat account. Moreover, the PAN card helps regulators track transactions and prevent tax evasion.

However, if you are still wondering “Can I open a Demat account without a PAN card?”, the answer is yes. Investors can open a Demat account without a PAN card, but the applicant must fulfill certain criteria to take advantage of this exemption. Let’s look at the exemptions specified by the SEBI.

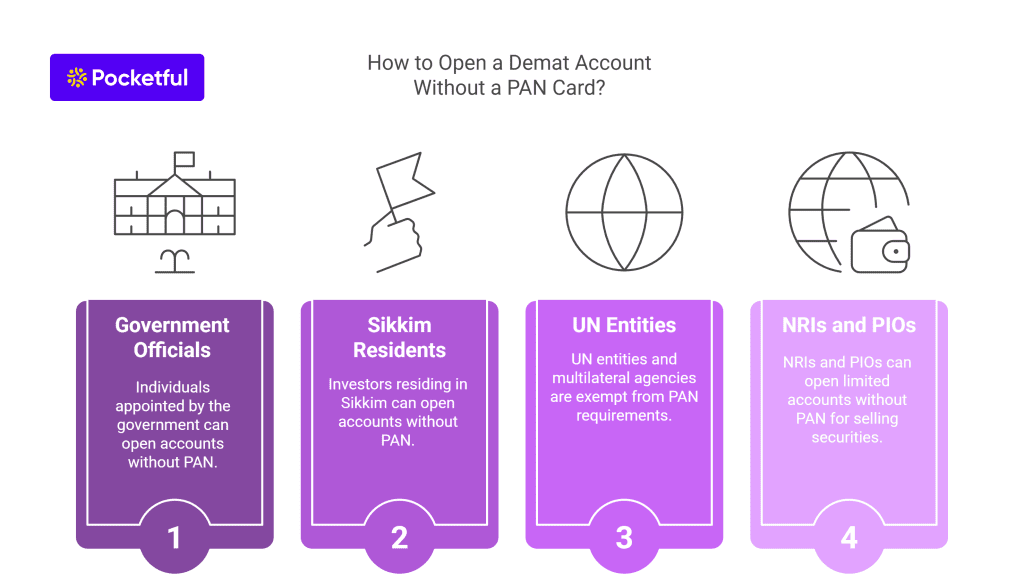

How to Open a Demat Account Without a PAN Card?

According to SEBI regulations, some individuals and entities can open Demat accounts without a PAN card. The exemptions are listed below:

- Officials appointed by Government: A PAN card is not required for transactions conducted by individuals appointed by the Central Government or State Governments. These individuals can be official liquidators, court receivers, etc.

- Investors in Sikkim: Investors residing in Sikkim can open a Demat account without a PAN card. DPs must verify the proof of address thoroughly to confirm that the investor is a resident of Sikkim.

- UN entities & Multilateral Agencies: These entities are not required to furnish a PAN card to open a Demat account if they are exempt from paying taxes or filing tax returns.

- NRIs or PIOs: Non-resident Indians (NRIs) or Persons of Indian Origin (PIO) are allowed to open a “limited purpose BO account” without a PAN card to sell any securities they currently own in the form of physical form. These accounts are suspended for credit from IPOs, off-market transactions or secondary market transactions. However, the investor continues to receive benefits arising out of corporate actions. Such accounts are valid for a period of 6 months, after which the investor must provide a PAN card to convert the limited-purpose BO account into a normal BO account.

Benefits of Having a PAN Card

A PAN (Permanent Account Number) card is an important financial document in India as it offers a range of benefits. Some of the benefits are listed below:

- Simplified Tax Filing: A PAN card serves as a unique identifier for all financial transactions and simplifies the process of filing income tax returns. It helps the government track taxable activities, reduce fraud, and maintain transparency in the financial system.

- Avoid Tax Deduction at higher rates: While making payments to NRIs or Indian residents, it is essential for the recipient to furnish their PAN card. If the recipient does not have a PAN card, then the sender must deduct TDS at a higher rate of 20% according to Section 206AA of the Income Tax Act.

- Easy Loan Approvals: A PAN card makes it easier to get a loan as it provides a reliable financial history.

- Demat Account: A PAN card is mandatory to open a Demat account, which helps investors manage investments easily.

- Identity Proof: The PAN card is also widely accepted as proof of identity.

Conclusion

A PAN card is essential for opening a Demat account in India. However, SEBI has specified certain exemptions under which some individuals or entities are not required to provide a PAN card to open a Demat account.

A PAN card tracks an individual’s financial history, helps enhance an individual’s credibility in financial institutions, and simplifies processes like loan applications and credit card approvals. Moreover, the PAN card serves as an ID across various domains. Overall, possessing a PAN card is invaluable for investors to track their transactions and simplify the tax filing process.

Frequently Asked Questions (FAQs)

Can I open a Demat account without a PAN card?

Investors can open a Demat account without a PAN card if they fulfill the criteria listed by the SEBI.

Which documents can be used as identity proof for opening a Demat account?

Identity proof documents include an Aadhaar card, Voter ID, passport, or driver’s license.

Which individuals and entities are not required to provide a PAN card to open a Demat account?

Individuals residing in Sikkim, UN agencies, multilateral agencies, officials appointed by the government, NRIs, and PIOs are not required to provide a PAN card when opening a Demat account.

What is a limited-purpose BO account?

A limited-purpose BO account is a type of Demat account that can be opened without a PAN card and remains active for a period of 6 months. NRIs and PIOs use this account to sell any securities held in the physical form. The account is restricted from receiving credits and requires investors to furnish a PAN card after 6 months to convert it into a regular demat account.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.