| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-28-24 | |

| Add new links | Nisha | Feb-19-25 | |

| Infographic Update | Ranjeet Kumar | Apr-17-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

Documents Required to Open a Demat Account

Opening a Demat account is essential for participating in the Indian stock market, as it enables the electronic storage of shares and securities. Before getting started, it is important to understand the necessary documents required for the process.

To ensure a smooth account opening experience, having the right documentation ready is the most important thing. These documents will include a PAN card, proof of address, bank details, and a passport sized photograph. This blog will walk you through the essential documents which are needed to open a Demat account successfully.

What is a Demat Account?

The Demat account is an account that holds your shares and other securities in an electronic format. It is essential for anyone who is looking to trade or invest in the stock market, as it will simplify the buying, selling and holding of the shares. CDSL and NSDL are the two depositories in India that provide the facility to open a Demat account through their network of Depository Participants (DP).

Eligibility to Open a Demat Account

To open a Demat account, an individual must meet certain eligibility criteria set by the regulatory authorities. Whether you are someone residing in India or a non-resident Indian (NRI), meeting the basic requirements ensures that you can start investing in the stock market.

Here is a detailed look at the eligibility criteria and the documents required for opening a Demat account.

- Age Requirement: There is no minimum or maximum age to open a Demat account. Even minors can open a Demat account under the guardianship of a parent or legal guardian.

- Nationality: Both resident Indians and NRIs can open a Demat account. NRIs must follow specific guidelines and provide additional documentation related to their NRI status.

- Valid Bank Account and PAN card: Having a bank account and a PAN card is necessary, as it will be linked to your Demat account.

Documents Required for Demat Account

To meet the eligibility criteria, you must provide the documents required for opening a Demat account, which include:

- Proof of Identity: Documents such as your PAN card (mandatory), Aadhaar card, voter ID, driving license or passport are accepted.

- Proof of Address: This includes an Aadhaar card, passport, or driving license.

- Bank Details: A canceled cheque or a copy of your bank statement is needed to link your bank account.

- Passport sized photograph: Recent photographs are required for verification.

- Income proof (for trade derivatives): Your last three-month salary slip, income tax return or a net worth certificate may be requested by the broker.

Today, it is easier than ever to open a Demat account online. You can apply through a DP’s website, fill out the form, upload the documents for the Demat account, and complete in-person verification. Once your details are verified, the Demat account will be activated, and you can begin investing.

Ensure all the documents required for the Demat account are ready as it can help in streamlining the account opening process and help you start investing quickly.

Read Also: Documents Required to Open a Demat Account

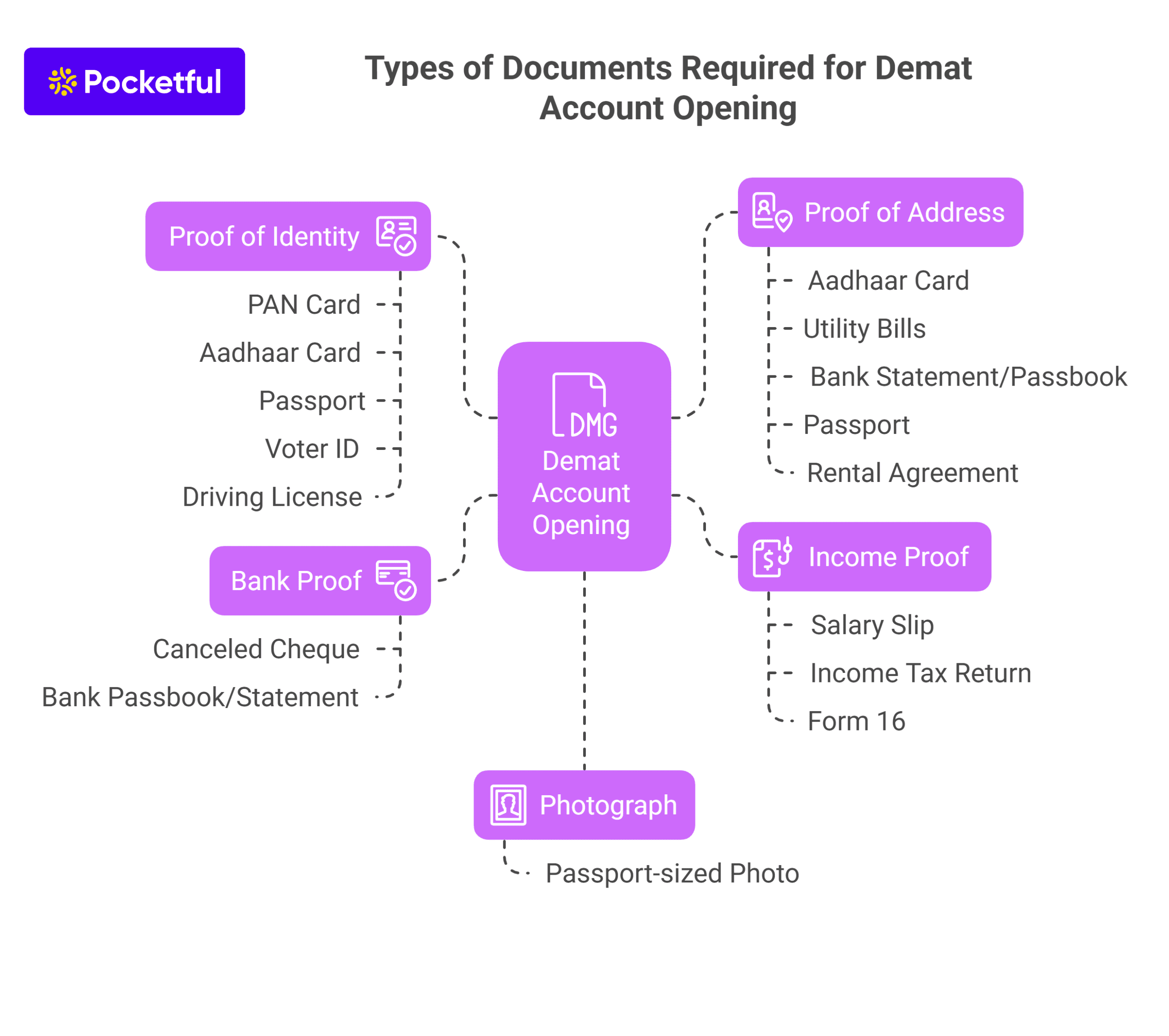

Types of Documents Required for Demat Account Opening

To open a Demat account, you need to submit specific documents for verification. These documents ensure your identity, address, and financial details are accurate and compliant with regulatory guidelines. Here аre the types of documents required for Demat account opening:

1. Proof of Identity: A valid ID is required to confirm your identity. The commonly accepted identity proofs include:

- PAN Card (mandatory)

- Aadhaar Card

- Passport

- Voter ID

- Driving License

2. Proof of Address: You must submit a document that verifies your current residential address. Common address proofs include:

- Aadhaar Card

- Utility Bills (electricity, gas, or water) not older than three months

- Bank Statement/Passbook

- Passport

- Rental Agreement

3. Bank Proof: To link your bank account with the Demat account you need:

- Canceled Cheque

- Bank Passbook/Statement

4. Income Proof (for derivatives trading): If you wish to trade in derivatives an income proof is necessary. Acceptable documents include:

- Salary Slip

- Income Tax Return (ITR)

- Form 16

5. Photograph: A recent passport-sized photograph is required for identification purposes.

Once these documents for the Demat account are ready; you can submit them online for a hassle free account opening process.

Documents Needed to Open a Demat Account for a Minor

Opening a Demat account for a minor (below 18 years of age) requires specific documentation to ensure the account is legally compliant. A minor’s Demat account is managed by a guardian, typically a parent or legal guardian until the minor reaches adulthood.

Here аre the documents needed to open a Demat account for a minor:

1. Proof of Identity of the Minor: Birth Certificate or Aadhaar Card of the applicant to verify the child’s identity and age.

2. Proof of Address: Aadhaar Card or Passport of the minor. Guardian’s proof of address such as utility bills, bank statements or rental agreement.

3. Proof of Guardian’s identity: Guardian’s PAN Card (mandatory) for identity verification.

Aadhaar Card, Passport, Voter ID, or Driving License of the guardian.

4. Bank Proof: A canceled cheque, bank passbook/statement of the minor.

5. Photographs: Passport sized photographs of both the minor and the guardian.

Once these documents for the Demat account are submitted, the account will be opened in the minor’s name, with the guardian managing it until the minor turns 18.

Attestation of Documents Needed to Open a Demat Account

When opening a Demat account, the attestation of documents is sometimes required to ensure their authenticity. Attestation involves verifying that the photocopies of the documents submitted are true copies of the originals.

Here’s what you need to know about the attestation of documents needed to open a Demat account:

1. Who Can Attest?

- Gazetted Officers: Government officials authorized to verify the stamp documents.

- Bank Managers: Your bank manager can attest to documents like your PAN card or bank statements.

- Notary Public: A notary provides legal attestation services and ensuring that documents are certified for official purposes.

2. Documents that May Require Attestation:

- Proof of identity: PAN card, Aadhaar card, passport, or voter ID.

- Proof of Address: Utility bills, bank statements, rental agreements, or Aadhaar card.

- Bank Proof: Canceled cheque or bank passbook.

3. Why is Attestation Important?

Attestation adds credibility and helps prevent the submission of fraudulent documents. Some brokers or financial institutions may require the attested documents if the account is opened remotely or if the applicant is an NRI (Non-Resident Indian).

Ensuring the proper attestation of documents required for opening a Demat account will help smooth the application process and guarantee compliance with regulatory standards.

Read Also: What are Account Maintenance Charges (AMC) for a Demat Account?

Conclusion

Having the knowledge about the documents required to open a Demat account ensures your account opening process goes smoothly. A PAN card is mandatory to open a Demat account, along with other documents required such as proof of identity, proof of address, bank details, etc. The attestation of the documents is needed to орen the Demat account as it is an important step that ensures the authenticity and credibility of the documents submitted and helps prevent fraud.

Frequently Asked Questions (FAQs)

What are the key documents required to open a Demat account?

To open a Demat account, you need:1. Proof of identity (PAN card (mandatory), Aadhaar card, passport, and voter ID)2. Proof of Address (Aadhaar card, utility bills, and bank statement)3. Bank Details (canceled cheque or bank passbook)4. Income Proof (for derivatives trading)5. Passport sized photograph

Is a PAN card mandatory for opening a Demat account?

Yes, a PAN card is mandatory for opening a Demat account as per regulatory requirements.

Can I open a Demat account online, and how do I submit the required documents?

Yes, you can open a Demat account online. You will need to submit the digital copies of the required documents by uploading them through the broker’s website or app.

Is attestation of documents necessary for a Demat account?

Attestation is not always mandatory but may be required for certain cases like remote applications or non-resident accounts. Documents can be attested by a gazetted officer, bank manager or notary.

What income proof is needed for trading in derivatives?

If you plan to trade in derivatives, you need to provide the income proof such as salary slips, income tax returns (ITR), or Form 16.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle