| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-31-24 | |

| Add new links | Nisha | Feb-19-25 | |

| Infographic Update | Ranjeet Kumar | Apr-17-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

Features and Benefits of Demat Account

In today’s digital world, where almost every financial transaction happens online, a Demat account has become one of the most important requirements for every investor. Whether you’re an experienced trader or just entering the stock market, a Demat account makes holding securities quite easy. This article describes the benefits of a Demat account, outlines its key features, and gives some tips on how to pick the most suitable Demat account for your needs as an investor.

What is a Demat account?

A Demat account, short for “Dematerialized account,” is an account wherein financial securities, such as shares, bonds, and mutual funds, are stored in electronic format. Gone are the days when investors had to deal with all the hassle of physical share certificates, which could go missing or damaged. Instead, investors can now easily manage their portfolios and track their investments, all thanks to having an online Demat account. This electronic system not only adds security but also increases trading efficiency.

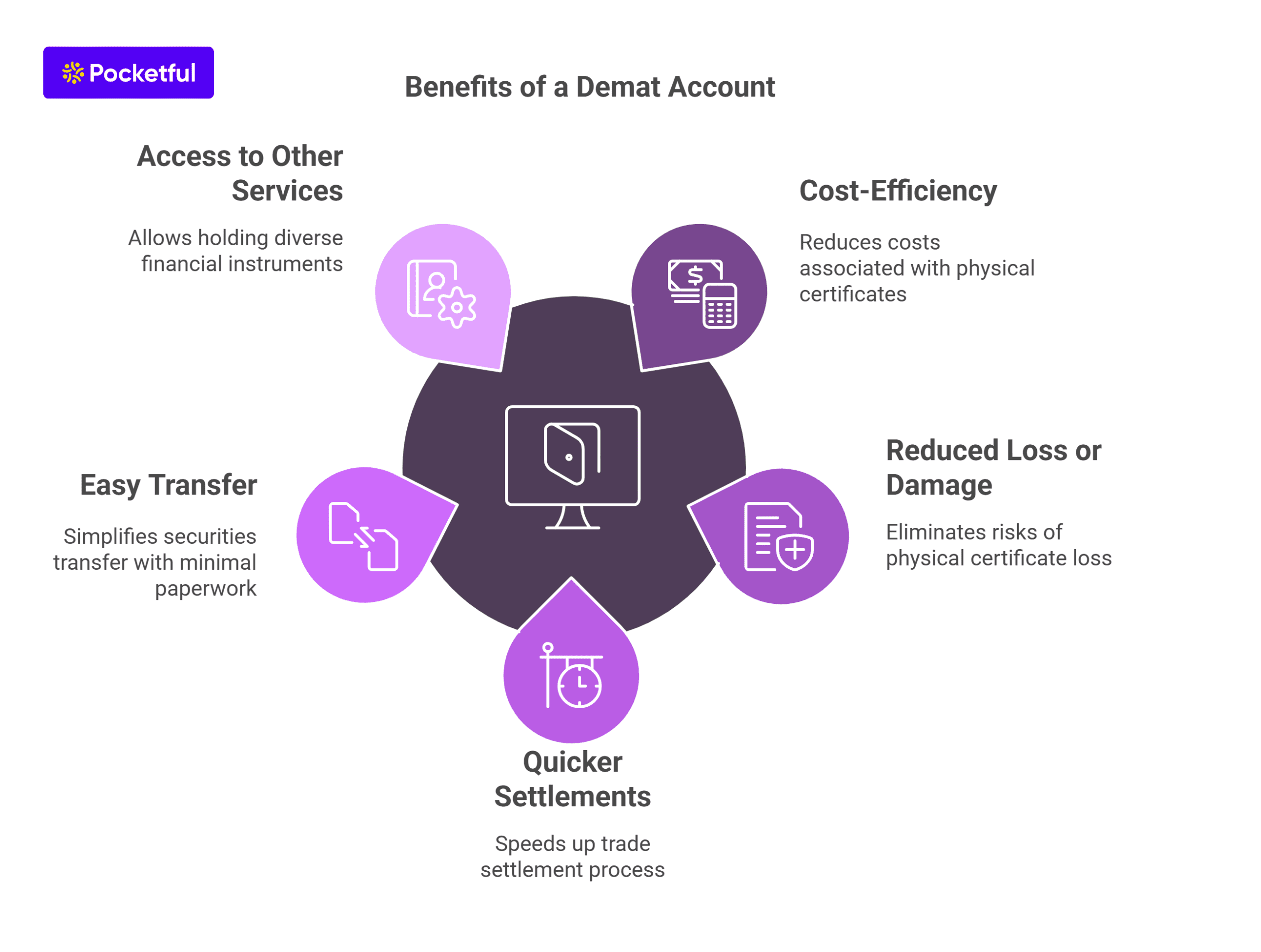

Benefits of a Demat Account

Demat account presents several important benefits to investors, which makes it indispensable in today’s digital world. Some of the significant benefits of a Demat account are as follows:

- Cost-Efficiency

The Demat account allows investors to convert physical securities into electronic form, reducing the costs related to the physical certificates, such as stamp duty, handling charges, and storage costs. The Demat account reduces paperwork and decreases the transaction cost, thus is a cost-effective option for investors.

- Reduced Loss or Damage

Physical share certificates pose a lot of risks, like loss, theft, and damage. On the other hand, the shares held in a Demat account do not pose such risks as securities stored electronically are much safer. Additionally, through electronic records, there are no issues of forgeries or duplication of certificates.

- Quicker Settlements

The other advantage of a Demat account is that the settlement process is more rapid compared to traditional trading with physical certificates. Trades are settled within two working days, hence improving liquidity and increasing the utilization of the funds used in investments.

- Easy Transfer and Management of Securities

The Demat account also provides a hassle-free securities transfer process. When you wish to transfer shares or any other financial instrument from one Demat account to another, it requires minimal paperwork. Also, portfolio management becomes easy as all the investments can be tracked and monitored online.

- Access to Other Services

Apart from holding shares, you can keep a wide range of financial instruments, such as bonds, government securities, or mutual funds, in a Demat account. Investors can use securities held in a Demat account to get a loan, which makes a Demat account an even more attractive proposition.

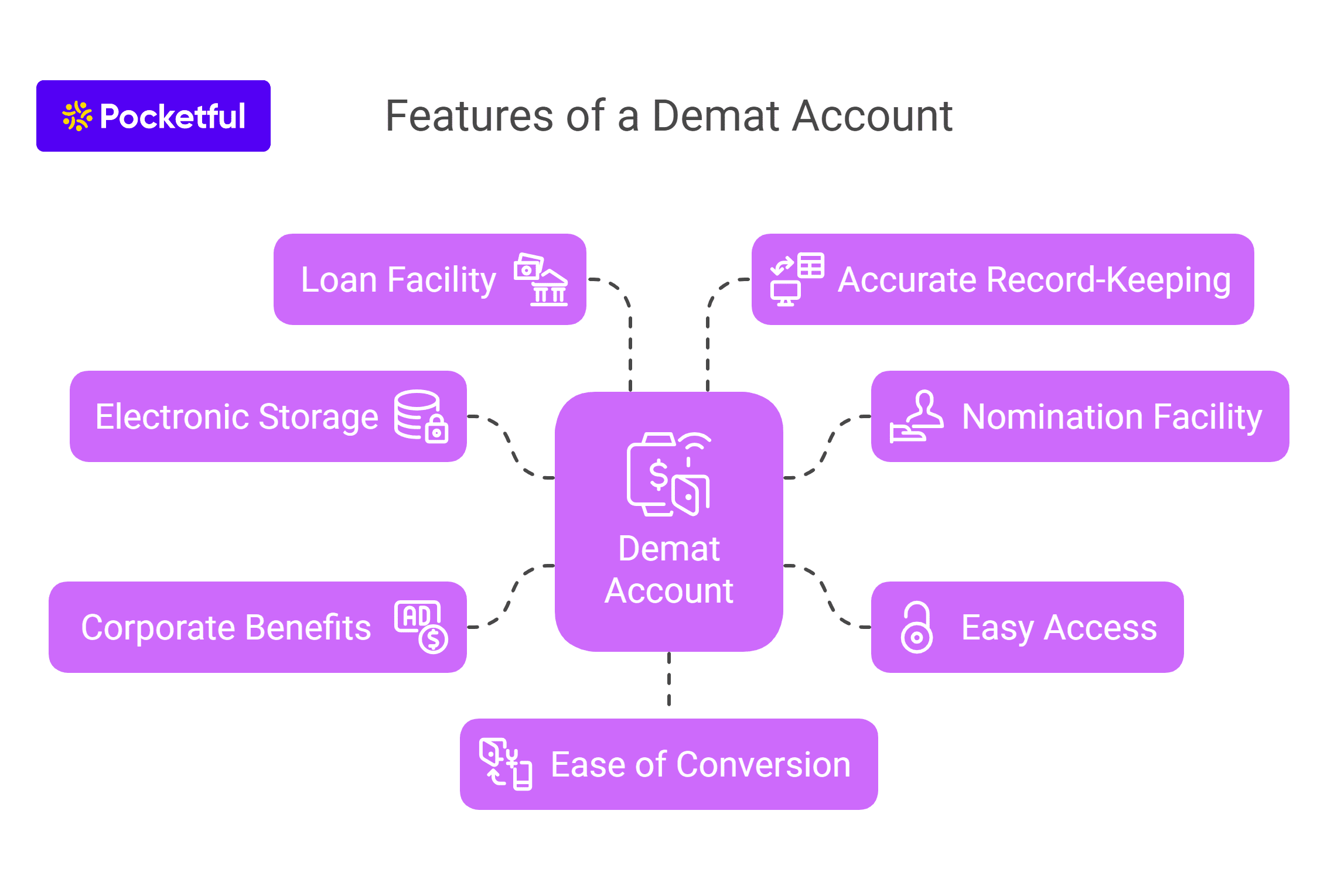

Features of a Demat Account

Understanding the key features of a Demat account will help you make the most of it. Some of the important features include:

- Electronic Storage of Securities

A Demat account holds the security in electronic format, which means you don’t have to carry those certificates in physical form, reducing the chances of losing them. And above all, your investments are pretty secure and accessible.

- Nomination Facility

Most Demat accounts offer the facility of nomination, whereby an investor can nominate an individual who can claim the securities in the investor’s account in the event of the investor’s death. The Demat account ensures that the ownership of the investments is safely transferred to the nominated beneficiary in the event of the account holder’s death.

- Easy Access

Demat accounts can be accessed anywhere – be it at home or on the go – using your computer or smartphone. This flexibility is one of the reasons online Demat accounts are a necessity in today’s world.

- Corporate Benefits and Actions

A Demat account allows you to receive dividends directly into your bank account. In addition, corporate actions such as bonus issues, stock splits, and rights issues are directly reflected in the Demat account, reducing human intervention and the chances of errors in these transactions.

- Loan Facility

Some banks and financial institutions also offer an option to borrow money by pledging some securities in your Demat account. This facility allows you to utilize the value of your stored securities to raise finances when you need it the most without having to sell your assets.

- Accurate Record-Keeping

Any transactions done using a trading account are reflected accurately in the Demat account. Hence, tracking your portfolio and keeping up with the market is very easy.

- Ease of Conversion

If you still hold physical shares, a Demat account lets you easily dematerialize or convert your physical securities into an electronic format. Similarly, you can likewise convert electronic shares back to a physical form through the process of rematerialization.

Tips on How to Choose the Best DP for Opening A Demat Account

A Demat account must be opened through a Depository Participant (DP), and selecting the right DP is highly important. These are a few tips to make the correct choice:

- Consider the Charges

The benefits associated with most Demat accounts also bring various costs in the form of charges for account opening, annual maintenance, transactions, and the list goes on. As such, you must compare the fees across different DPs to ensure you get a good deal.

- Features: Look for User-Friendly Platforms

The interface of the software provided by the DP must be user-friendly. An easy-to-use interface will make a huge difference in ensuring a smooth investment management process.

- Additional Features

Some DPs provide extra features, such as trading in various markets-equity, commodities, currencies, and even provide loans against securities, margin trading facilities along with the basic Demat account features.

- Customer Support

Be it a novice to the stock market or a veteran, good customer service will always be required. Ensure that the DP offers good customer support to guide you through the process and solve any issues that may come up.

- Brokerage and Transaction Fees

Different Demat account providers have different brokerage charges in trading. If you are an active trader, choose a DP that offers competitive brokerage rates to help lower your overall trading costs.

Read Also: Documents Required to Open a Demat Account

Conclusion

In recent times, a Demat account has become an inevitable tool for any investor. From electronic storage facilities to quicker settlements and secure transactions, it simplifies the entire investing process. Choose the right Depository Participant (DP) to open a Demat account by comparing all the available options to maximize the advantages of a Demat account for a smooth investment experience.

Frequently Asked Questions (FAQs)

What are the benefits of a Demat account?

A Demat account provides a safe place to store securities and reduces the risks associated with holding in physical form such as loss or damage. It ensures faster and cost-effective settlements, and even helps in easy management of your investment portfolio.

Can one open a Demat account online?

Most financial institutions provide the facilities to open a Demat account online.

Are there any Demat account charges?

Yes, a Demat account incurs costs such as an opening account fee, annual maintenance charges, etc. It is important to compare the cost while choosing a DP.

When was the Demat account first introduced in India?

The Demat account was first introduced in 1996 by NSDL.

Which depositories allow investors to open a Demat account?

NSDL and CDSL are the two depositories in India that partner with Depository Participants (DPs) to help investors open a Demat account.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle