| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Feb-27-25 | |

| Infographic Update | Default Author | Apr-03-25 |

How to Buy Shares through a Demat Account?

A Demat account is essential for holding shares and other securities in electronic format and eliminates the need for physical share certificates. To buy shares through a Demat account, you first need to open the account with a depository participant, usually a bank or financial institution. Once set up, you can link your Demat account with a trading account to trade in stocks, mutual funds, and other securities directly from your smartphone or computer.

In this blog, we will explain the steps involved in purchasing the shares through a Demat account, the eligibility and documents required, and the benefits of a Demat account.

What is a Demat account?

A Demat account, short for a Dematerialized account, is a digital account that allows investors to hold and manage their securities, such as shares and bonds, in an electronic format. After opening a Demat account, you can easily buy and sell the shares online without the hassle of physical certificates. This modern approach helps simplify the investment process, making it more convenient for both new and experienced investors.

To invest using a Demat account, you need to link it with a trading account, which enables you to execute buy and sell orders. Once your accounts are set up, you can begin purchasing the shares online. If you are wondering where to buy shares online in India, many brokers provide user-friendly interfaces for trading.

To buy a share, you simply log into your trading account, search for the desired stock, and place a buy order. The shares are credited to your Demat account after “T+1” days, where “T” is the transaction date. Learning how to buy shares online opens up a world of investment opportunities and allows you to grow your wealth efficiently. Whether you are just starting or looking to diversify your portfolio, a Demat account is an essential tool in the modern financial markets.

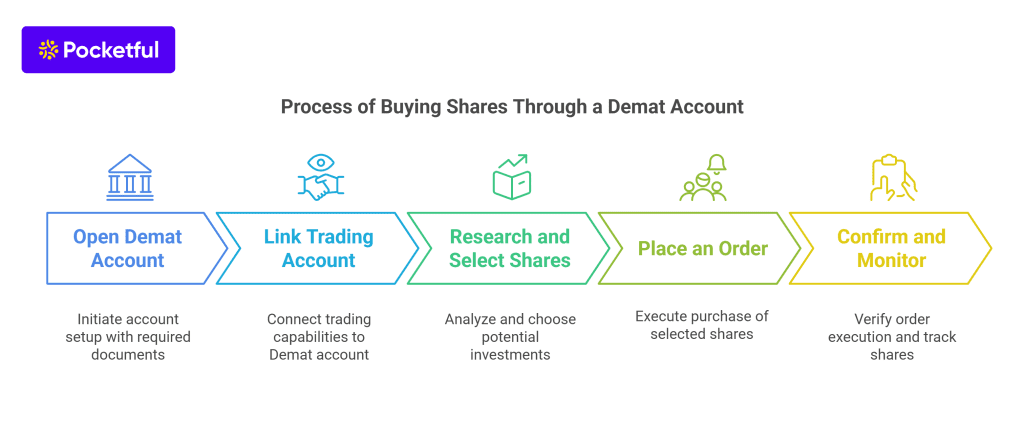

How to Buy Shares Through a Demat Account?

Buying shares through a Demat account is a straightforward process, making the investment process simple and more efficient. Here are the essential steps you need to follow:

- Open a Demat Account: The first step is to open a Demat account with a depository participant such as a bank or brokerage firm. You will need to provide identity verification documents and fill out the required forms. After successful verification, DP opens a Demat account for you.

- Link a Trading Account: After opening your Demat account, you should link it with a trading account, allowing you to seamlessly buy and sell shares online. However, many DPs open a Demat and a trading account simultaneously.

- Research and select Shares: Before investing, conduct a thorough financial analysis of various companies and identify the shares you wish to purchase. There are numerous resources available online to help you analyze potential investments.

- Place an Order: Once your accounts are set up and funded, log in to your trading account to buy a share. Search for the stock using its ticker symbol, select the quantity and place an order (market or limit).

- Confirm and Monitor: Confirm whether the order is executed. Once executed, the shares will be credited to your Demat account, where you can track your investments.

Best Strategies to Buy Shares

Investing in shares requires a strategic approach to maximize returns and minimize risks. Here are some of the best strategies to buy shares effectively:

- Conduct Thorough Research: Analyze a company’s financial health, market position, and growth potential. Understanding the fundamentals will guide you in making informed investment decisions.

- Use a Trading Plan: Develop a systematic trading plan that outlines your buying and selling criteria. This plan will help you stay disciplined and avoid emotional trading.

- Monitor Market Trends: Keep an eye on market trends and economic indicators. Understanding the market sentiment will assist you in timing your investments effectively.

- Start Small: If you’re new to investing, consider starting with smaller amounts. This helps you to learn how to buy shares online without exposing yourself to significant losses.

- Utilize Technical Analysis: Familiarize yourself with technical analysis tools to identify buying opportunities. These tools can help you determine the best entry and exit points for your investments.

Eligibility and Documents required to open a Demat Account

To open a Demat account, certain eligibility criteria and documents are required. Understanding these prerequisites is essential for a hassle-free demat account opening process.

Eligibility Criteria

The eligibility criteria for opening a Demat account are as follows:

- Age: You must be at least 18 years old to open a Demat account. Minors can open a demat account, but a guardian must manage until the minor is 18.

- Identity: Indian citizens and non-resident Indians (NRIs) can apply.

- Bank Account: A linked bank account is necessary for fund transfers.

Required Documents

Documents required for opening a demat account are:

- Identity Proof: Government-issued ID such as an Aadhar card, passport, or voter ID.

- Address Proof: Utility bills, rental agreements, etc., that confirm your residential address.

- PAN Card: A Permanent Account Number (PAN) is mandatory for tax purposes.

- Photographs: Recent passport-sized photographs may be required.

- Bank Details: A canceled cheque or bank statement for linking your bank account.

Once you gather these documents, you can approach a depository participant (DP) to complete the application process. Understanding these requirements ensures you are well-prepared to start your investment journey.

Open a Free Demat Account with Pocketful to Buy Shares Seamlessly

Opening a Demat account with Pocketful is free of cost and is an excellent way to manage your investments. Pocketful provides a user-friendly platform that simplifies the entire investment process for both beginners and investors.

To get started, simply download the Pocketful mobile application or visit their website. The account opening process is quick and straightforward. You will need to provide basic details, such as your identity proof, address proof, and a PAN card. Once your documents are verified, you can open your Demat account at no cost.

With your Demat account and trading account set up, you can easily buy shares online. Pocketful offers a comprehensive list of features and enables you to explore various investment opportunities. The platform’s intuitive interface allows you to track market trends, execute trades effortlessly, and manage your portfolio efficiently. Moreover, Pocketful ensures secure transactions, giving you peace of mind as an investor.

Benefits of a Demat Account

A Demat account offers several benefits mentioned below:

- Convenience: A Demat account eliminates the need for physical share certificates and makes it easier to buy, sell, and manage securities electronically. This digital approach streamlines the entire trading process.

- Reduced Risk of Loss: Physical share certificates can be lost, stolen or damaged. With a Demat account, your shares are stored securely in an electronic format, reducing the risk of loss.

- Quick Settlement: Settlement of transactions is quicker through a Demat account than traditional methods.

- Stores Multiple Securities Types: A Demat account allows you to hold the various securities including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), all in one place which simplifies portfolio management.

- Easier Record Keeping: Your Demat account provides a clear and comprehensive record of all your transactions and holdings, making it easier to track your investments and manage your portfolio effectively.

- Automatic Updates: Corporate actions such as dividends, bonus shares, and stock splits are automatically reflected in your demat account.

Conclusion

Buying or selling shares with the help of a trading account linked with a Demat account significantly enhances security and efficiency as compared to traditional methods. With the elimination of physical share certificates, investors can buy and sell securities quickly and securely. Moreover, a Demat account can store different types of securities and automatically adjust holdings for any corporate actions.

Frequently Asked Questions (FAQs)

What is a Demat account, and why do I need one to buy shares?

A Demat account is a digital account that holds your securities in electronic form. Investors can buy shares through a trading account but need a Demat account to store them.

How do I open a Demat account?

To open a Demat account, choose a depository participant (DP), such as a bank or brokerage firm. Fill out the demat account opening form and provide the required documents like identity proof, address proof, PAN card, etc. Once verified, your account will be activated.

How do I buy shares through my Demat account?

Investors can buy shares by opening a Demat account and linking it to a trading account. To buy shares, log in to your trading platform, search for the desired stock, and place an order. The shares will be credited to your Demat account upon successful transaction.

Are there any fees associated with a Demat account?

While opening a Demat account is usually free, there may be annual maintenance charges associated with it. Additionally, brokerage fees apply when buying the shares. It is advisable to review the fee structure of your chosen DP.

Can I sell shares directly from my Demat account?

Yes, you can sell shares directly from your Demat account by using your linked trading account. After logging in to your trading account, you can place a sell order for the shares you wish to sell, and the proceeds will be credited to your trading account after the transaction is completed.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.