| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-15-24 | |

| Infographic Updated | Ranjeet Kumar | Apr-12-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

- Eligibility Criteria to Open a Demat Account

How Do You Open a Demat Account Without a Broker?

With the wide range of investment options available in India today, a lot of people have chosen the stock market to secure their financial future. A Demat account is essential to participate in the stock market, and individuals usually open one by contacting a stockbroker who is a Depository Participant (DP). But can an investor open a Demat account without a broker? The answer is yes! It is possible to open a Demat account without a broker.

In this article, we will discuss how to open a demat account without a broker, the documents required to open a demat account in India, and its benefits.

What is a Demat Account?

A Demat account is a form of an electronic account that stores stocks and securities in the form of electronic records. This account provides a convenient location for the storage of stocks, bonds, and mutual funds, among other investment instruments. The Demat system in India was created to facilitate the storage and transfer of shares without the need for physical certificates. Some of the inherent features of a Demat account include the following:

- Secure Holdings: A demat account makes it convenient for investors to secure different types of securities in one account and eliminates the hassle of handling numerous physical certificates.

- Enhanced Efficiency in Share Trades: Buying and selling shares becomes simpler due to the short settlement period.

- Lesser Danger: Because the shares are in the Demat account, it eliminates potential dangers like theft, loss or damage to physical share certificates.

- Comprehensive Record of All Holdings: An investor has online access to information about his/her holdings, transaction details and his/her account balance within any given time frame.

You might be thinking, “Can I start trading without a Demat Account?” The answer to your question is yes. Investors can open a trading account with a broker to trade securities listed on the stock exchange.

Considering the advancements in technology and the rise of online trading platforms, questions arise regarding the relevance of a broker in the process of opening up a Demat account.

Read Also: HUF Demat Account: Benefits, Documents & How to Open

Is a Broker Necessary to Open a Demat Account?

First, we need to understand the difference between a Depository Participant (DP) and a broker. A DP acts as an intermediary between the investor and the depository, i.e., CDSL and NSDL. On the other hand, a broker acts as a link between the investor and the stock exchange. Some of the financial institutions in India offer services of both DP and a broker.

According to SEBI regulations, investors can only open a Demat account with the help of a DP. This makes it possible to open a Demat account with the help of a financial institution that is a DP but not a broker. However, you might think, “Can I buy shares without a broker?” The short answer is no. One must open a trading account with a broker to buy and sell shares.

Read Also: Can a Demat Account Be Opened Without a PAN Card?

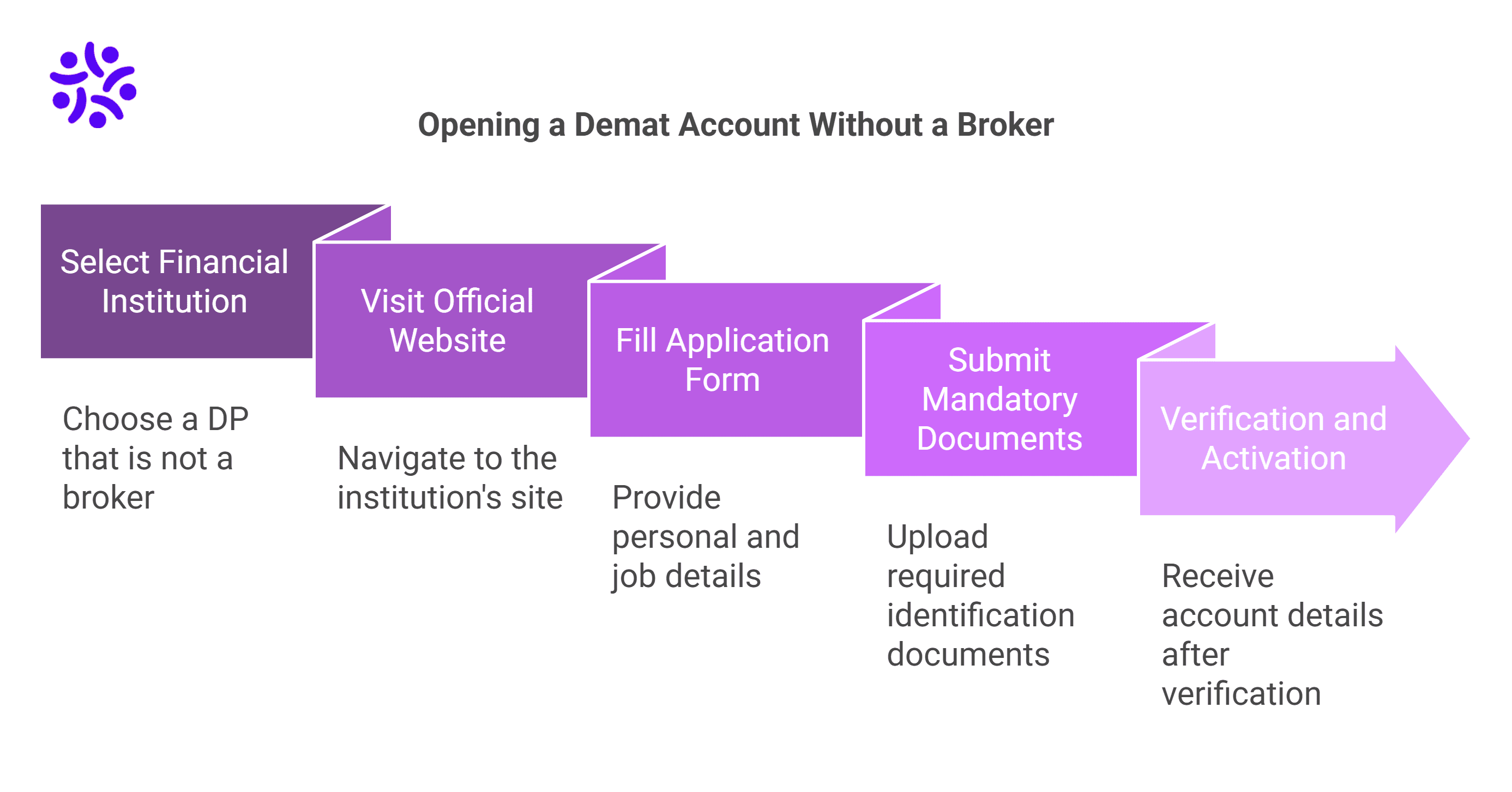

How Do You Open a Demat Account Without a Broker?

Opening a Demat account without a broker is an easy task. Below is the step-by-step procedure.

1. Select Financial Institution

First, choose a financial institution that is a Depository Participant (DP) but not a stockbroker. Many banks, financial services companies, and even fintech platforms offer Demat account opening facilities.

2. Official Website

Open the official website of the selected financial institution. Most of them have online account opening procedures in place. Click on a subsection for Demat Accounts entitled “Open a Demat Account” or “Account Opening.”

3. Fill the Application Form

Fill an application in which you provide the following details:

- Full name and address and mobile number/landline phone number, Email ID

- Source of income and job particulars.

4. Mandatory Documents

You will be asked to submit the following documents :

- Proof of Identity

- Proof of Address

- PAN Card

- Passport-sized Photographs

- Verification and Activation of Account

After submitting the application and the documents, the financial institution will verify the information. This can take some hours to a few days. Upon verification, you will receive the details of your Demat account, including your login credentials.

Read Also: Lifetime Free Demat Account (AMC Free)

Documents Required For Opening a Demat Account

The essential documents to open a Demat account are as follows:

1. Proof of Identity: The following documents can be submitted as a proof of identity:

- Aadhar card

- Passport

- Voter ID

- Driving License

2. Proof of Address: The following documents can be submitted as a proof of address:

- Utility bills: electricity, water, gas, etc.

- Bank statement

- Rental agreement

- Any government document with your address

- PAN Card: You cannot open a Demat account without a PAN Card, making it a mandatory document.

- Passport Size Photographs: Typically, two passport-sized photographs are required, not older than six months from the date of submission of the application.

- Bank Account Information: A canceled cheque or bank statement might be required to link your trading account with your bank account for smooth transactions.

All the documents must be accurate and complete, which will help in speeding up the process of opening an account.

Read Also: Joint Demat Account: Meaning, Features, Benefits, and Steps

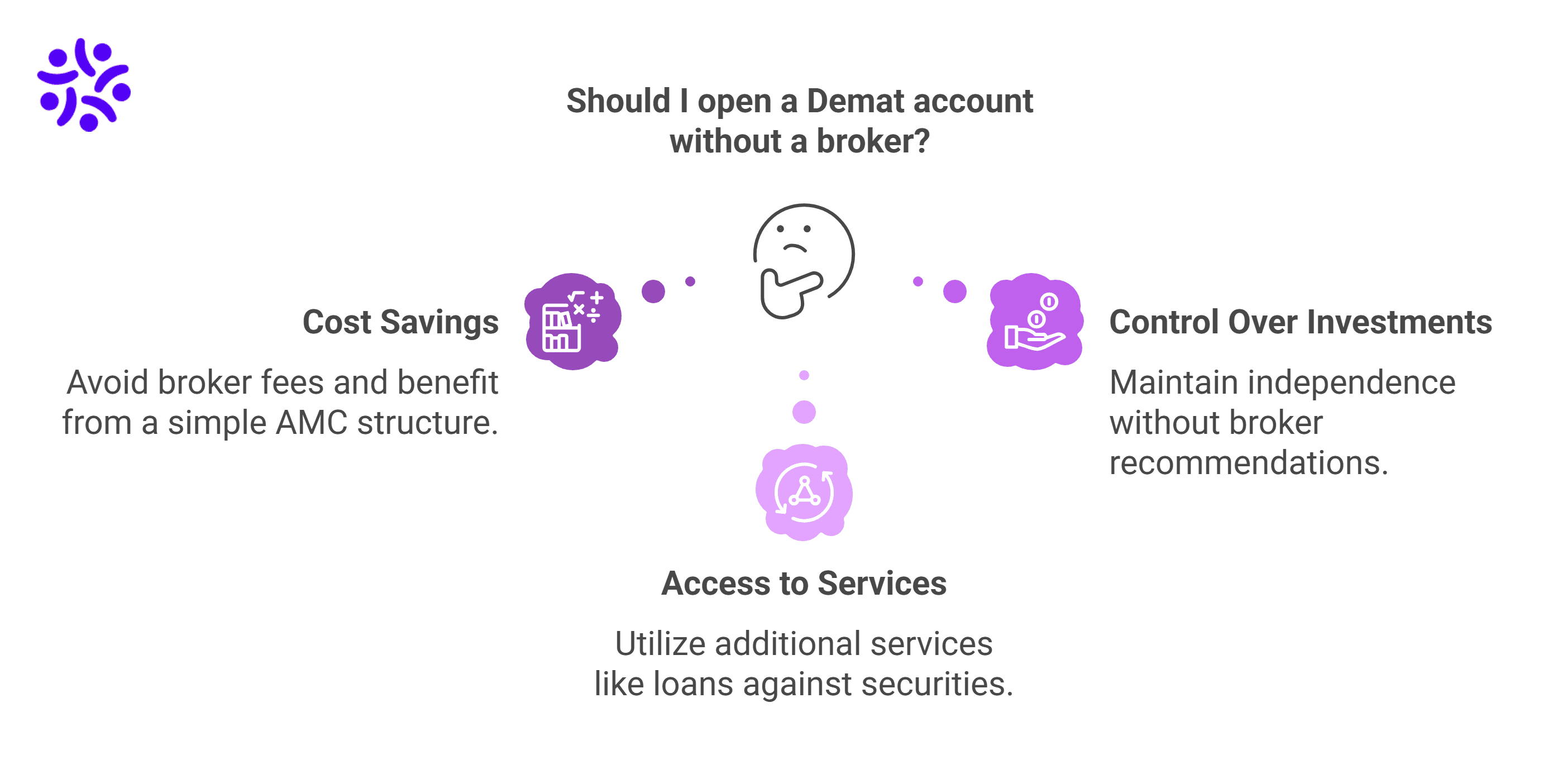

Advantages of Opening a Demat Account Without a Broker

There are many advantages to opening a Demat account without a broker. These are:

1. Cost Savings

Opening a Demat account without a broker helps investors avoid paying charges related to trading. DPs who are not stockbrokers offer a simple fee structure that consists of AMC.

2. Control Over Investments

Brokers usually give out trade recommendations to their clients. Due to the absence of brokers, investors can continue to hold investments without any distractions and have complete control over their investments.

3. Access to the Other Services

Investors opening only a Demat account are usually long-term investors. Investors can take advantage of other services provided by the non-broker DPs, such as loans against securities or other privileges for opening a Demat account with the DP.

Read Also: How to Check Demat Account Status or Balance?

Conclusion

The investors can open a Demat account without a broker, which enables the investor to focus on the safe storage of financial assets without worrying about trading. Using the procedure mentioned above, one can easily open a Demat account.

Opening a Demat account without a broker is ideal for investors who just want a safe storage facility for their investments and wish to hold them for a long time. However, if you are thinking, “Can I trade without a broker?” The answer is no, as you must have a trading account with a broker to execute buy and sell transactions.

Frequently Asked Questions (FAQs)

Can we buy shares in India without a broker?

It is not possible to buy shares listed on the stock exchange without a broker.

Can I trade without a Demat account?

You only need a trading account to buy and sell shares, and a Demat account is required to store them electronically.

What are the charges associated with opening a Demat account without a broker?

The charges vary across different DPs, but most of them don’t charge account opening fees. However, DPs charge account maintenance charges to keep your demat account active.

How long does it take to open a Demat account without a broker?

If all details and documents submitted are correct, then it may take a few hours to a few days to open a demat account, depending on the DP’s verification process.

Is it safe to open a Demat account without a broker?

It is safe to open a Demat account without a broker as these DPs are authorized by the depositories to offer Demat account services.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle