| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-31-24 | |

| Add new links | Nisha | Feb-19-25 | |

| Infographic Update | Ranjeet Kumar | Apr-17-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

How to Use a Demat Account?

The introduction of demat accounts has made investing much easier and more accessible for people than ever before. Unlike traditional methods, you do not need to hold financial securities in physical formats such as paper certificates. All your investments are stored digitally, which is more convenient, safe, and easy to transact. In addition to this, you also get easy asset management, buying and selling stocks, cost savings, reduced risk, and lower transaction settlement time.

At the same time, many people are still wondering: What is a Demat Account, and what is the use of it? To answer that, it is essential to demystify the complexities of opening, maintaining and using a Demat account. In this blog, we will find answers to all your queries related to a Demat account.

What is a Demat Account?

In the simplest terms, a Demat account is very much similar to a bank account. The most basic difference between the two is that the former holds stocks, bonds, and other securities. Whereas, the latter one is used to park money.

It is a digital account where you store your financial securities in an electronic format. Until the Demat account was introduced, the standard practice was to hold securities in the form of physical certificates. With the emergence of this service, dealing with financial securities has become much easier. A demat account simplifies the process by securely holding all investments in electronic format. It has eliminated the hassle of extensive paperwork and various risks involved with physical certificates. Read further to understand the use of a demat account in detail.

Read Also: HUF Demat Account: Benefits, Documents & How to Open

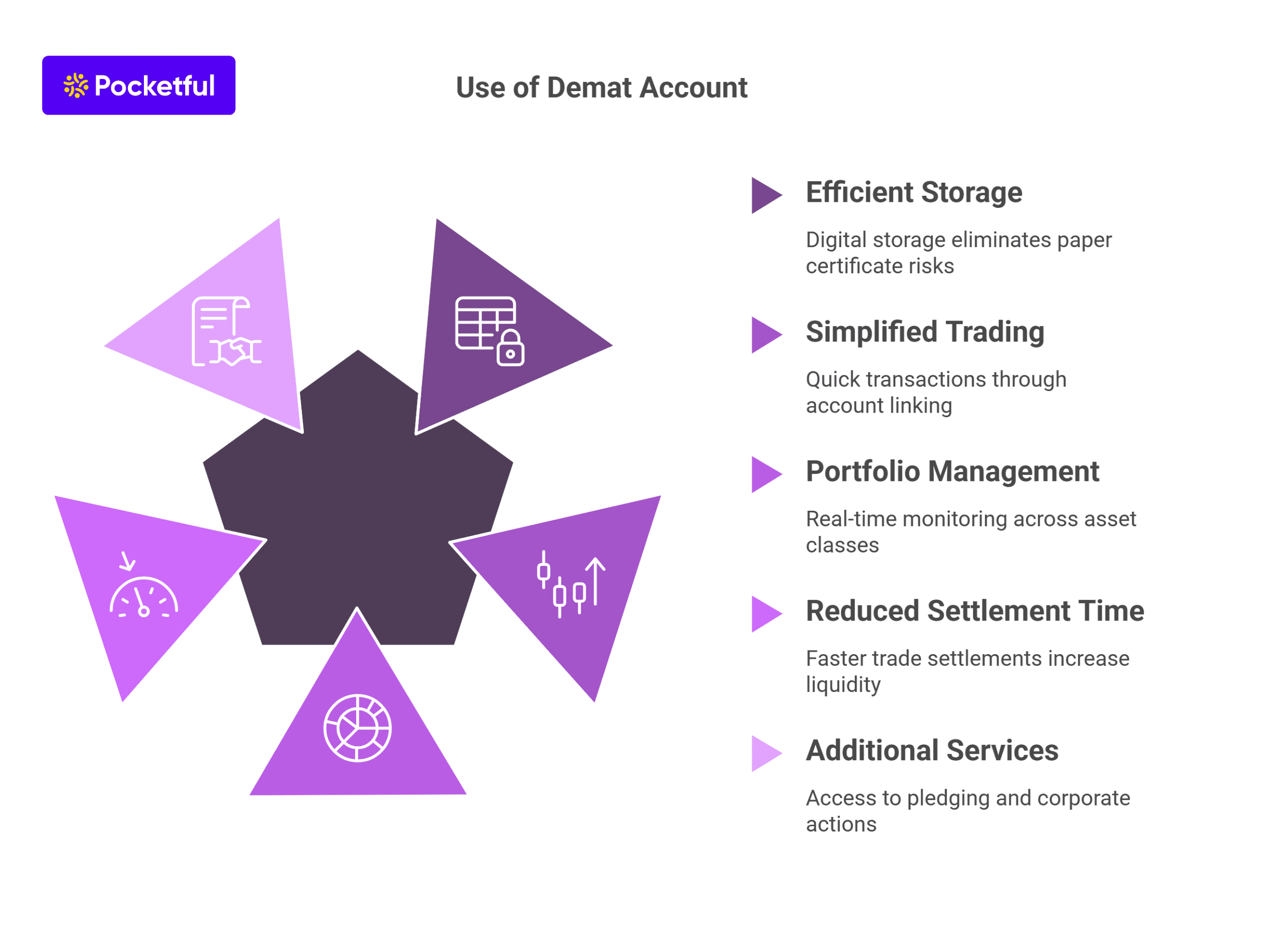

What is the Use of a Demat Account?

A Demat account is used to keep stocks, mutual funds, bonds, government securities, ETFs, and other financial securities in electronic format. Besides this fundamental feature, the demat account makes the lives of investors easier in the following ways:

1. Efficient Storage of Securities: Unlike the traditional method of paper certificates, your securities are safely kept in digital format. Thus, you do not have to worry about the loss, theft, or damage of the certificates.

2. Simplifies the Trading Process: Earlier investors had to deal with lengthy paperwork and complex procedures for the buying or selling of stocks. Now, you can execute these transactions within seconds by linking your trading account with your Demat account.

3. Portfolio Management: Another significant advantage of the demat is that it makes the portfolio management process easier. You can monitor your holdings across different asset classes with ease in real time. It gives you a better chance to be aligned with the market and make informed trading decisions.

4. Reduced Trade Settlement Time: Technology has eliminated the hassle of delayed transactions. With a demat account, you can buy or sell stocks in no time. Trade settlement times have reduced significantly, leading to increased liquidity.

5. Access to Additional Services: Besides basic benefits, you get additional services like pledging of shares. You can borrow funds to trade by pledging shares as collateral. Additionally, corporate actions, such as dividends, bonus shares, etc., are directly reflected in your account.

Read Also: Joint Demat Account: Meaning, Features, Benefits, and Steps

How to Use a Demat Account?

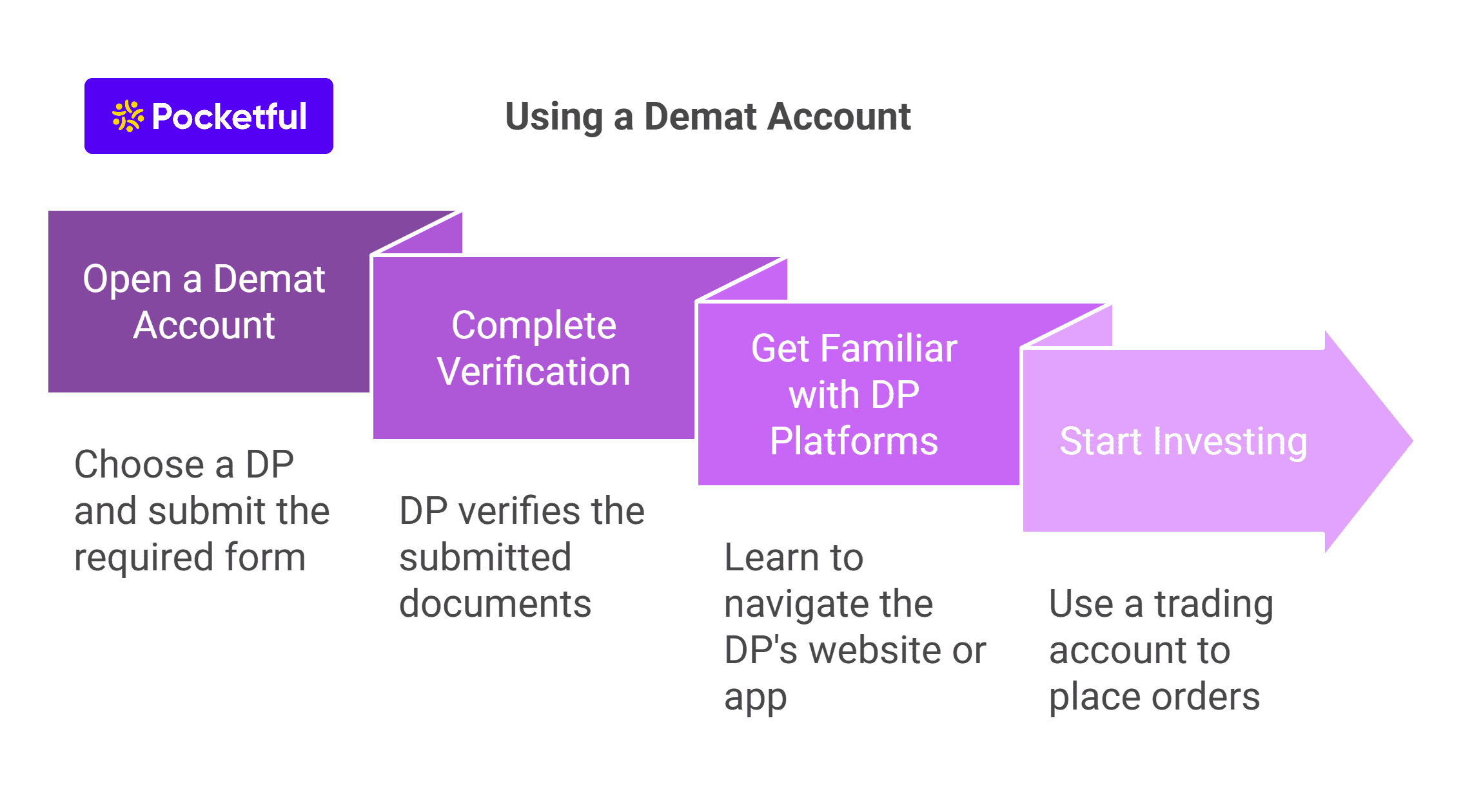

Using a demat account is effortless. However, those unfamiliar with the procedure might find it a little tricky. So, here are the steps that will demonstrate how you can use a demat account easily.

Step 1: Open an Account: To use it, first you will have to open a demat account. You will need to choose a Depository Participant (DP) and fill out and submit a demat account opening form along with all the required documents. The form will require you to provide basic information like personal details, bank details, and other mandatory details.

Step 2: Complete the Verification: Once you have submitted the form and other documents, the DP will verify it. Upon successful verification, the Demat account is activated, and you get your credentials. It is your identification number as an investor. After these procedures, you can simply log in to your account. You should remember that the Annual Maintenance Cost (AMC) must be paid to DP to maintain a Demat account.

Step 3: Get Familiar With the DP platforms: You can access the holdings in your Demat account through the DP’s website or mobile application. Usually, DPs provide basic guidelines to help investors navigate their platforms. You should go through those manuals to get familiar with the user interface and functioning of the platform.

Step 4: Start Investing: You are just one step away from starting your investing journey. In this regard, you will require a trading account and your demat account. Usually, a trading account and a demat account are created simultaneously. Investors can place orders on the exchange using their trading account. Upon successful execution of the orders, the shares or securities are either credited or debited from the Demat account.

Can I Trade Shares Without a Demat Account?

The standard market practices have turned digital now, and today, it is not possible to trade without a demat account. The securities are held in a Demat account digitally, making it easier to buy and sell securities. Also, it is difficult to find buyers and sellers willing to deal with physical certificates. However, there are some exceptions. Many government-backed securities do not require a demat account if they are bought directly from the issuing authority. Additionally, trading commodities, derivatives, and currency do not mandatorily require you to have a demat account as these asset classes don’t require you to take delivery and are cash-settled.

Read Also: How to Check Demat Account Status or Balance?

Cost Involved with a Demat Account

There are certain charges associated with demat accounts. The costs can vary across institutions or brokers. Here are a few points that you can consider before choosing a platform:

Account Opening Fees

Similar to any standard account opening process, some brokers charge some amount as an account opening fee. However, many brokers waive it to attract more customers.

Annual Maintenance Fees

DPs usually charge an annual maintenance fee to keep your account active and provide other services. This fee can vary based on the DP.

Transaction Charges

These charges depend on the type of transaction and vary across different DPs.

Pledging Fees

If an investor decides to pledge shares as collateral for a loan, some brokers may charge a fee for the process.

Read Also: Joint Demat Account: Meaning, Features, Benefits, and Steps

Why is a Demat Account Necessary?

To align with the modern stock market pace, having a demat account is necessary. It not only gives you ease of transaction but also provides security to the securities. Electronic storage eliminates the risk of loss or damage to physical certificates, ensuring a secure, long-term holding.

Also, you do not have to rely on human intervention to fulfill the transaction. It eliminates unnecessary delays and gives you an enhanced overall investing experience. Another impeccable feature of the Demat account is that you can manage all your investments through one platform. From stocks and bonds to mutual funds and government securities, a demat account supports various financial products, providing a safe storage to investor’s broad spectrum of asset classes.

Read Also: How to Find Demat Account Number from PAN?

Conclusion

Considering the technological advancement and continuous digitization of the financial world, a Demat account is definitely invaluable. It keeps you aligned with modern-day investment practices, gives you a real-time monitoring facility, and a smooth investing experience. With an accurate understanding of how to use a demat account, you can manage your investments without any hassle.

So, get yourself adequate knowledge, get comfortable with the Demat account, and start growing your money like never before.

Frequently Asked Questions (FAQs)

Can I open a Demat account without a trading account?

Yes. To hold securities only, a demat account is enough. However, if you want to trade, you will require a trading account.

How secure is a Demat account?

In comparison to holding paper-based physical certificates, a demat account is way more secure. Your securities are safe from theft, loss, or damage as they are stored digitally.

Can I open more than one Demat account?

You can have multiple demat accounts with different brokers. However, you should be aware that it will increase your costs as you will have to pay multiple annual maintenance fees and other charges.

Are there any hidden fees in a Demat account?

Although brokers disclose their fees in the beginning, there can be a few more charges. Some brokers may charge additional fees for services like dematerialization or pledging of shares.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle