| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-28-24 | |

| Add new links | Nisha | Feb-19-25 | |

| Infographic Update | Ranjeet Kumar | Apr-17-25 |

Read Next

- Benefits of HUF Account in India

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Rule, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2026 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2026

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

NSDL Demat Account: Open, Manage & Understand Charges

An NSDL Demat account allows investors to hold securities in electronic form. Managed by the National Securities Depository Limited (NSDL), a Demat account eliminates the need for physical share certificates and provides a more secure and efficient way to manage investments.

Opening an NSDL Demat account is a simple process that can be done through various depository participants (DPs) like banks and brokerage firms. The benefits include easy access to shareholdings, faster transactions, reduced paperwork, and enhanced security. In this blog, we will provide information about NSDL, opening an NSDL account, NSDL charges and the advantages of opening an NSDL account.

What is NSDL?

The National Securities Depository Limited (NSDL) was established in 1996 to allow investors to hold securities in electronic form. It revolutionized the Indian financial market by eliminating the physical share certificates when it introduced the NSDL Demat account, which securely holds shares, bonds, mutual funds, and other securities.

To open the NSDL Demat account, the investors must approach a depository participant (DP), which can be banks, financial institutions, or stockbrokers listed under the NSDL Depository Participant (DP) list. The NSDL Demat account opening process is straightforward and requires documents for identity and address verification.

The charges associated with a Demat account include annual maintenance, transaction fees and other related costs, but these charges vary across different DPs. With the digitalization of securities, investors benefit from faster transactions, reduced paperwork and improved security.

NSDL – The Mechanism

NSDL has a secure and well-established mechanism in place that is designed to simplify the management of securities in electronic form. When an investor opens an NSDL Demat account, their securities are held digitally, thereby removing the need for handling physical certificates. This electronic format ensures faster and more efficient transactions while reducing the risks associated with handling physical documents.

Investors must select a depository participant (DP) from the NSDL broker list, which includes banks, financial institutions, and brokerage firms. The NSDL Demat account opening process requires basic documentation such as identity and address proof. Usually, a trading account is also opened with a Demat account.

The transfer of securities happens when an investor buys or sells securities. The NSDL system instantly updates its records and ensures the secure and timely execution of transactions. The NSDL charges for Demat accounts, including the account maintenance and transaction fees, but it can vary depending on the DP chosen as NSDL collects these charges from the DP.

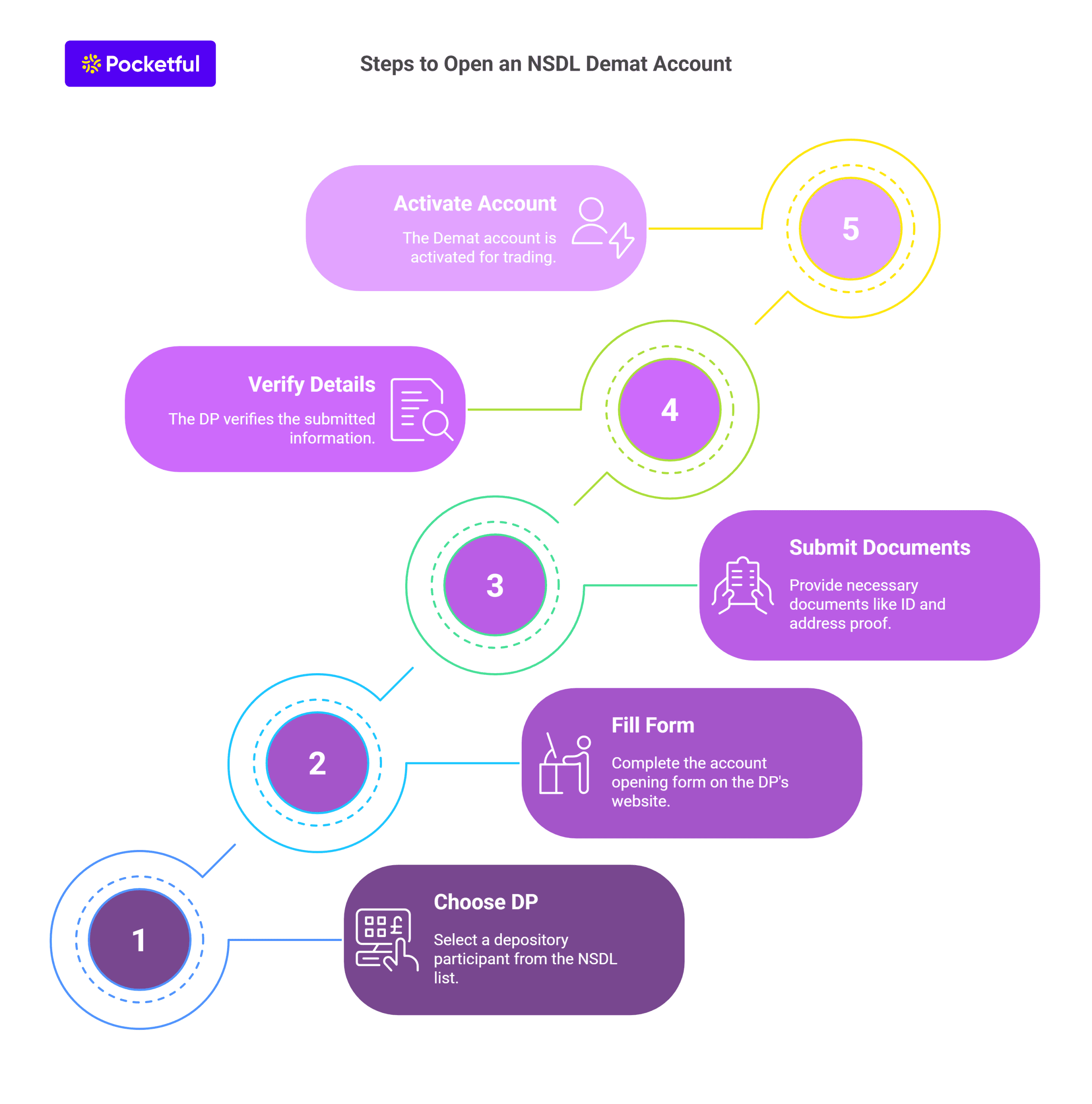

How To Open An NSDL Demat Account?

An investor can follow the below process to open an NSDL Demat account:

- Start by choosing a depository participant (DP) from the NSDL DP list, which includes banks, financial institutions, and brokerage firms. Once you have selected a DP, the NSDL Demat account opening procedure can begin.

- Fill out the account opening form available at your chosen DP’s website.

- Submit supporting documents like identity proof (such as Aadhaar or PAN), address proof, and a passport-size photograph.

- Submit income proof if you plan to trade in the derivatives market.

- After the paperwork is completed, the DP will verify your details, and upon successful verification, your Demat account will be activated, enabling you to hold and manage securities in electronic form.

Read Also: How to Open a Demat Account Online?

NSDL Account Charges

When opening an NSDL Demat account, it is important to understand the associated charges, which can vary depending on the depository participant (DP) you choose from the NSDL broker list. These charges include account maintenance, transaction fees, and other service related costs.

- Account Opening Fees: The NSDL Demat account opening fee is a one time fee charged by some brokers, although some DPs offer free account opening.

- Annual Maintenance Charges (AMC): Once the NSDL account opening procedure is completed, then the investors are subject to annual maintenance charges (AMC), which are levied to keep the account active.

- Transaction charges: For each transaction carried out through your trading account, transaction fees are levied. These charges are applied every time you buy or sell securities. However, these charges vary across different DPs.

- Rematerialization and Dematerialization charges: Additional fees may include charges for dematerialization (converting physical shares to electronic form) or rematerialization (converting electronic shares to physical form).

Understanding NSDL charges for Demat accounts helps the investors to plan their investments more effectively. Knowing what an NSDL Demat account is and its cost structure ensures that you can manage your investments in a cost-efficient manner and enjoy a hassle-free investing experience.

Types of Securities That Can Be Held in an NSDL Account

An NSDL Demat account allows the investors to hold a wide variety of securities in electronic form and offer greater convenience and security. Once you complete the NSDL Demat account opening process through a depository participant (DP) from the NSDL broker list, you can buy and store various types of financial instruments in the Demat account.

The most commonly held securities in an NSDL account are equity shares, which represent ownership in companies. Investors can buy, sell and manage their shares effortlessly using a trading account. Bonds and debentures, which are debt securities issued by corporations and governments, can also be stored electronically in your NSDL account.

Other securities include mutual funds, exchange traded funds (ETFs), government securities (G Secs), and commercial papers. The NSDL account also holds preference shares, certificates of deposit, and treasury bills.

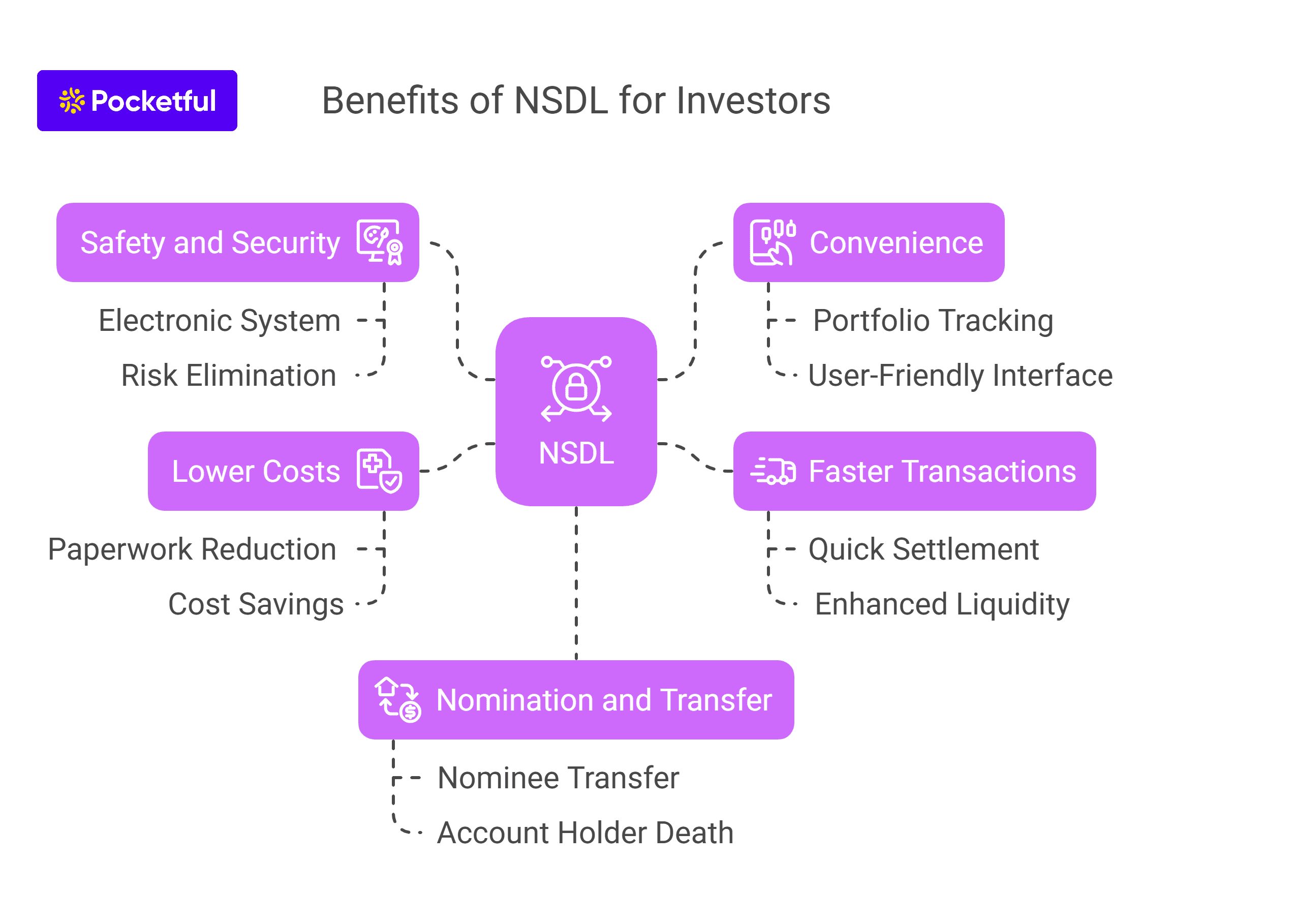

Benefits of NSDL for Investors

The National Securities Depository Limited (NSDL) offers several advantages for investors in India and streamlines the process of holding and trading securities. Here are some key benefits:

- Safety and Security: NSDL eliminates the risk of loss, theft, or damage to physical certificates by providing an electronic system for holding the securities.

- Convenience: Investors can easily track their portfolios.

- Faster Transactions: NSDL enables quick settlement of trades and reducing the time taken for securities transfers. This quick turnaround enhances liquidity for investors.

- Lower Costs: By eliminating the need for extensive paperwork for physical certificates, NSDL reduces the costs associated with transactions. This helps the brokers reduce their fees and pass this benefit to their customers.

- Nomination and Transfer: NSDL facilitates smooth transfer of securities to the nominee in case of the account holder’s death.

Overall, NSDL has significantly enhanced the efficiency, security, and convenience of investing in the Indian financial markets.

Read Also: BSDA – What is a Basic Service Demat Account?

Conclusion

In conclusion, NSDL has revolutionized the way investors in India manage their securities. By offering a secure, paperless, and cost-effective system, it eliminates the risks associated with physical certificates and enhances the overall efficiency of trading and holding investments. With faster settlements, lower costs, and convenient access to portfolios, the NSDL simplifies the investment process. Overall, NSDL plays a crucial role in making the Indian financial market more accessible, transparent, and investor friendly.

Frequently Asked Questions (FAQs)

What is the NSDL Demat Account?

An NSDL Demat Account is an electronic account provided by the National Securities Depository Limited (NSDL) where investors can hold securities such as stocks, bonds, and mutual funds in a dematerialized (paperless) format. It eliminates the need for physical certificates and simplifies the process of managing the investments.

How can I open an NSDL Demat Account?

To open an NSDL Demat Account, you need to approach a Depository Participant (DP), typically a bank or brokerage firm affiliated with NSDL. You will need to fill out an account opening form and submit the required documents to complete the KYC (Know Your Customer) process.

What are the benefits of holding a Demat Account with NSDL?

An NSDL Demat Account offers several benefits including secure storage of securities, faster transaction settlements, reduced paperwork, lower costs and easy access to your investment portfolio online.

Is there a minimum balance requirement for an NSDL Demat Account?

There is no minimum balance requirement for maintaining an NSDL Demat account.

Can I hold multiple types of securities in an NSDL Demat Account?

Yes, an NSDL Demat Account allows you to hold a variety of securities including stocks, bonds, mutual funds, exchange traded funds (ETFs), and government securities all in one account for easy tracking.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle