| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Feb-26-25 |

How to Open an NRI Demat & Trading Account in India

India’s financial market has witnessed a bull run in the past few years, which is why many NRIs are trying to invest in the Indian stock market. An NRI needs a Demat account and a trading account to participate in the Indian stock market. Opening an NRI (Non Resident Indian) trading and Demat account is a straightforward process that helps the NRIs to invest in the Indian stock market. Whether you are looking to trade in equities, mutual funds, or bonds, having the right demat account is essential.

In this blog, we will talk about the steps to open the NRI trading and Demat account and also explain the documents you will need, and clarify the different types of accounts available including the NRE and NRO accounts.

Who is an NRI?

A Non-Resident Indian (NRI) is an Indian citizen who resides outside India for various reasons such as employment, business, or education and does not stay in India for more than 182 days in a financial year. NRIs are allowed to invest in Indian financial markets which is facilitated through NRI Demat and Trading account. The NRI Demat account holds shares and securities in electronic form and makes it easier to manage investments from abroad.

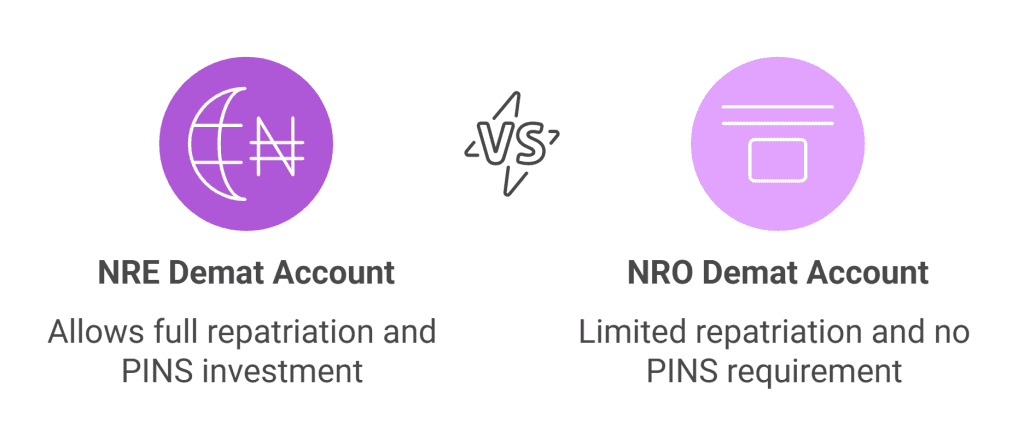

For NRIs, there are different types of accounts, including the NRE Demat account and NRO Demat account, which are used to store securities, and the NRI trading account that allows trading in securities in India. Understanding the features of these accounts is essential for NRIs looking to participate in the Indian stock market and maximize investment opportunities effectively.

What is an NRI Demat Account?

An NRI Demat account is a specialized account that allows the Non-Resident Indians (NRIs) to hold and manage their securities in electronic form. It is essential for NRIs who want to invest in the Indian stock market as it will simplify the process of buying, selling, and transferring shares. There are two main types of Demat accounts for NRIs:

- NRE Demat account: NRE or Non-Residential External Demat account allows NRIs to invest in Indian financial markets such as stocks, bonds, etc. Investors use this account to take advantage of the Portfolio Investment NRI scheme (PINS). The NRE demat account is linked with the NRE bank account. The advantage of using an NRE demat account is that both investments and profits earned on them can be repatriated to the NRI’s bank account in their country of residence.

- NRO Demat account: NRO or Non-Resident Ordinary Demat account also allows NRIs to invest in Indian securities. It is different from an NRE demat account as it doesn’t require NRIs to invest through the PINS route, and the NRIs can repatriate only up to $1 million of investment to their country of residence.

Can an NRI open a Demat Account in India?

Yes, a Non-Resident Indian (NRI) can open a Demat account in India as it enables them to invest in the Indian stock market. NRIs have the option to choose between an NRE Demat account and an NRO Demat account depending on your investment goals. An NRE Demat account is suitable for those who have a majority of earning sources abroad and want the advantage of repatriating funds freely. On the other hand, if an NRI has income sources in India and wants to claim exemptions on the interest earned, then a NRO demat account is more suitable.

What is the NRI Demat Account Opening Process?

The NRI Demat account opening process involves several key steps to ensure NRIs can effectively invest in the Indian stock market.

- Applicants need to select a reputable Depository Participant (DP) that offers NRI demat account services. They can choose between an NRE Demat account or an NRO Demat account based on their income sources.

- Get the NRI account opening form from DP’s website or nearest branch.

- Mention all the relevant details and attach all the required documents, such as proof of identity and proof of address. Documents required include a copy of passport, proof of overseas address, copy of PAN card, etc. Communicate with the DP to get a complete list of the documents required.

- Sign the agreement with the DP. The agreement lists the responsibilities of both the investor and DP.

- DP verifies the information, and upon successful verification, an NRI Demat account is opened, and the DP sends the credentials to your registered email ID.

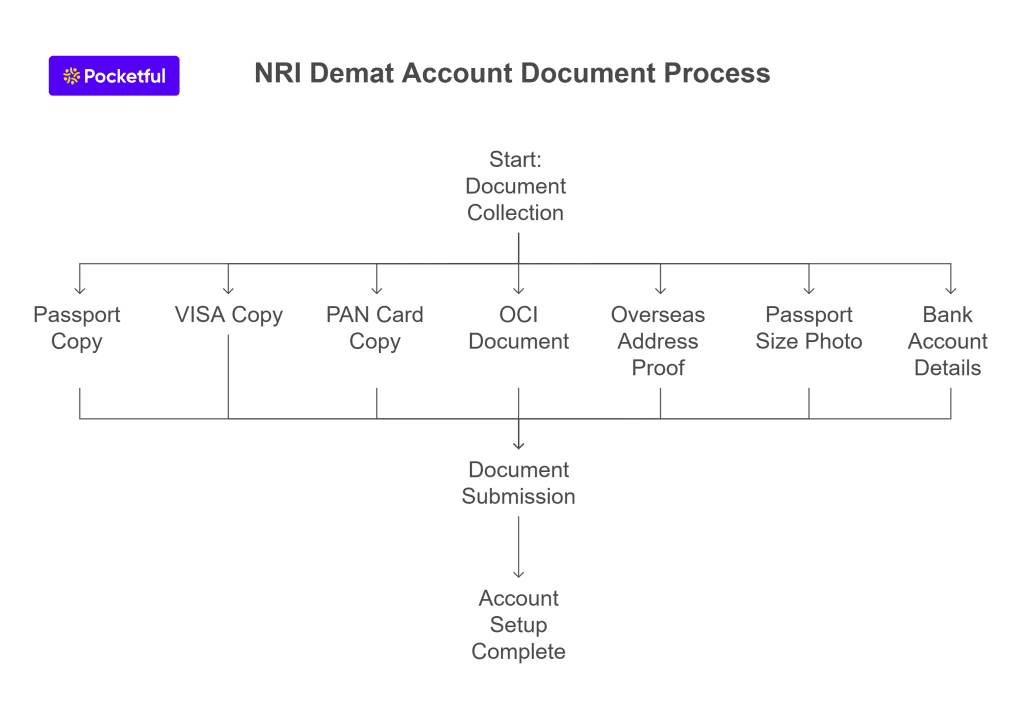

Documents Required for NRI Demat Accounts

Specific documents are required to comply with regulatory norms and ensure a smooth account opening process. The documents required for a NRI demat account are:

- Copy of passport as proof of identity

- Copy of valid VISA

- Copy of PAN card

- OCI (Overseas Citizenship of India)

- Overseas Address Proof

- Passport size photograph

- Bank Account Details

These documents ensure that the NRI trading account in India is set up correctly and facilitating efficient trading and investment management while adhering to legal requirements. Proper documentation helps streamline the process of opening a Demat account for NRIs.

NRI Demat Accounts: The Benefits

NRI Demat accounts offer several benefits that empower Non Resident Indians (NRIs) to invest in the Indian stock market.

- NRI demat account allows NRIs to hold securities in electronic form and simplifies the management of investments. With an NRI Demat account, transactions are quicker and more efficient, and the need for physical paperwork is eliminated.

- NRE demat account offers the investors the option to repatriate funds.

- NRO Demat account allows NRIs to manage the income generated in India while complying with tax regulations.

Conclusion

In conclusion, Demat accounts for NRI serve as essential tools for Non-Resident Indians looking to invest in the Indian stock market. With benefits like electronic storage of securities, seamless transactions, and compliance with tax regulations, these accounts simplify the investment process. However, investors must choose between the NRE and NRO demat accounts based on their investment goals and sources of income.

Frequently Asked Questions (FAQs)

What documents are required to open an NRI trading and Demat account?

To open an NRI trading and Demat account, you need to provide a copy of your valid passport, VISA, PAN card, OCI, proof of overseas address and a recent passport sized photograph.

Can I open both NRE Demat and NRO Demat accounts?

Yes, you can open both NRE and NRO accounts simultaneously.

Is it mandatory to have an NRI trading account to open a Demat account?

Yes, it is mandatory to have an NRI trading account linked to your Demat account. This trading account enables you to execute buy and sell transactions in the Indian stock market.

How long does it take to open an NRI trading and Demat account?

An NRI trading and demat account can be opened within a couple of days.

Can I manage my NRI trading and Demat account online?

Yes, most financial institutions, and brokerages offer online platforms for managing your NRI trading and demat accounts. You can access real-time market data, execute trades, and monitor your portfolio conveniently from anywhere in the world.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.