| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-08-24 | |

| Add new links | Nisha | Feb-19-25 | |

| Infographic Update | Ranjeet Kumar | Apr-17-25 |

Read Next

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- How Do You Open a Demat Account Without a Broker?

- Lifetime Free Demat Account (AMC Free)

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

- Eligibility Criteria to Open a Demat Account

- Demat Account Nomination – How to Add a Nominee?

- How to Check Demat Account Status or Balance?

- What is a Minor Demat Account? Meaning, Features & Benefits

- When Bonus Shares Are Credited in Demat Account?

- How to Enable Two-factor Authentication in Demat Account?

BSDA – What is a Basic Service Demat Account?

A Basic Service Demat Account (BSDA) is a more affordable version of a regular demat account as it is designed for investors with limited trading activity. It also allows individuals to hold and manage their securities, such as stocks, mutual funds, and in electronic form. BSDA accounts have a lower annual maintenance, which makes them cost-effective for small investors.

To be classified as a BSDA, the value of securities held in the account must be below INR 10 lakhs. The limit was increased to INR 10 lakhs from INR 2 lakhs by SEBI on 28 June 2024. This account is ideal for new investors who want to start their journey in the stock market without incurring high fees while still enjoying the essential dematerialization services. In this blog, we will provide information about the BSDA Account, its features, associated charges, and the eligibility criteria for opening one.

What is a BSDA?

BSDA full form is Basic Service Demat Account, and it is a specialized type of demat account aimed at promoting the equity market participation among small investors. The BSDA was introduced in 2012 to allow individuals to hold their securities in an electronic format while keeping costs low. The BSDA focuses on providing basic services without the high fees associated with regular demat accounts.

One of the key features of a BSDA demat account is its low annual maintenance fee, which makes it ideal for new investors or those who trade infrequently. To qualify for this account, the investors must maintain a maximum balance of up to INR 10 lakhs in their demat account. The limit was set to ensure that the benefits of the BSDA scheme reach the target audience.

This account provides essential services such as holding the shares, mutual funds, and other securities and facilitates easy transfers. For those who are interested in opening a BSDA account, choosing the best stock broker is crucial. A reliable broker will offer user friendly platforms, competitive pricing, quality customer support and ensure a seamless investing experience for investors. Overall, the BSDA account encourages individuals to invest in the stock market while minimizing the costs.

Read Also: Demat Account Charges Comparison 2025

Features Of Basic Service Demat Account

The Basic Service Demat Account (BSDA) is designed to facilitate low-cost investment for small investors in the stock market. The BSDA account offers the several attractive features under the BSDA scheme, making it an appealing choice for the new investors.

- One of the primary features of a BSDA is its low annual maintenance, which is significantly lower than regular demat accounts. The investors don’t have to pay any charges if the holdings are worth less than INR 4,00,000 and are charged INR 100 + 18% GST if the holdings value is between INR 4,00,000 and INR 10,00,000. The BSDA encourages small investors by providing basic Demat services without excessive charges.

- Moreover, a BSDA account enables investors to enjoy essential services such as the transfer and pledge of securities and provides a secure and efficient way to manage investments.

For individuals looking to open a BSDA account, selecting the best stock broker is essential. A top broker will offer a user friendly platform, effective customer support, and reliable services to enhance the overall investing experience.

Who is eligible to open a BSDA?

To open a Basic Service Demat Account (BSDA), individuals must meet specific eligibility criteria.

- The applicant should be a resident of India and at least 18 years old.

- The BSDA scheme is designed for small investors, so to qualify, the total market value of securities held in the account should not exceed Rs 10 lakhs at any time.

- Additionally, an individual can open only one BSDA across all depositories. Moreover, the investor must not have any other Demat account.

What are the limitations of a BSDA?

The Basic Service Demat Account (BSDA) has specific limitations such as:

- To qualify for a BSDA account, the total market value of securities held should not exceed Rs 10 lakhs at any point in time. This limit ensures that the benefits of the BSDA scheme reach its intended audience and new small investors.

- Additionally, an individual can maintain only one BSDA account.

- If the market value of securities exceeds Rs 10 lakh, the account will be converted into a regular demat account and will be subject to standard fees and charges.

What are the Charges levied on BSDA?

The charges levied on a Basic Service Demat Account (BSDA) are generally lower than those on a regular demat account. This fee structure is as per the circular released by SEBI on 28 June 2024. The fee structure is as follows:

| Value of Holdings held in Demat Account | Maximum Annual Maintenance Charges (AMC) |

| Up to INR 4,00,000 | Nil |

| INR 4,00,001 to INR 10,00,000 | INR 100 + GST |

| More than INR 10,00,000 | Regular Demat Account charges |

Read Also: How to Use a Demat Account?

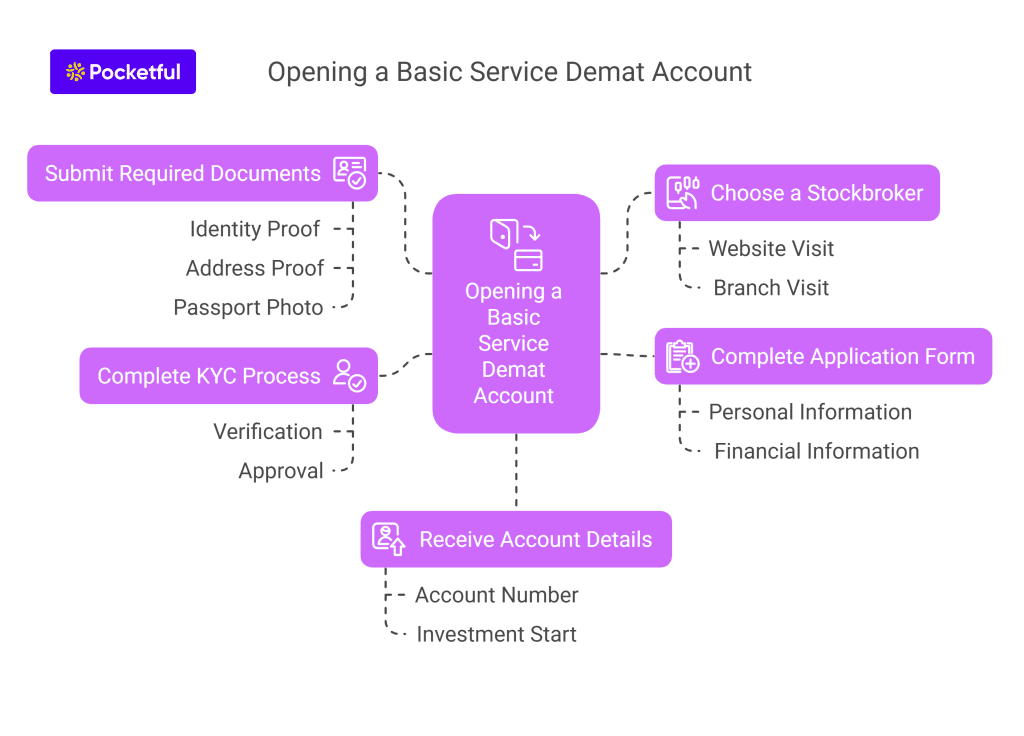

How to Open a Basic Service Demat Account?

Opening a Basic Service Demat Account (BSDA) is a straightforward process, as mentioned below:

- Choose a reliable stockbroker that offers BSDA services and visit their website or branch to obtain the application form.

- Complete the form with the necessary details, including personal and financial information.

- Along with the application, submit the required documents such as identity proof (Aadhar and PAN card), address proof, and a recent passport sized photograph.

- After submission, complete the Know Your Customer (KYC) process.

- Once approved, you will receive your BSDA account details, enabling you to start your investing journey.

How do I convert my Demat Account to a BSDA?

To convert your existing Demat Account to a Basic Service Demat Account (BSDA), follow the simple steps mentioned below.

- Check if your account meets the BSDA eligibility criteria, i.e., whether the total market value of your securities does not exceed Rs 10 lakhs.

- Contact your Depository Participant (DP) to understand the conversion process.

- You may need to fill out a conversion form provided by them. Provide necessary documents, such as a request letter, a declaration, and details of your existing Demat Account.

- Once your request is processed and approved, then your account will be converted to a BSDA. The investor receives a confirmation from the DP stating that the account has been successfully converted.

Read Also: Types of Demat Accounts in India

Conclusion

Converting your Demat Account to a Basic Service Demat Account (BSDA) is a beneficial step for small investors who are seeking to minimize costs while enjoying the essential dematerialization services. You can minimize costs by meeting the eligibility criteria and following the conversion process. The BSDA offers low annual maintenance fees, and it is designed to encourage participation in the stock market. As you transition to a BSDA, ensure you monitor your account’s market value to maintain compliance. This conversion to a BSDA can pave the way for a more cost-effective and efficient investment journey.

Frequently Asked Questions (FAQs)

What is a Basic Service Demat Account (BSDA)?

A BSDA is a specialized type of Demat account that is designed for small investors. It allows the individuals to hold securities in an electronic format with lower fees as compared to regular demat accounts and promotes participation in the stock market.

What are the eligibility criteria for opening a BSDA?

To open a BSDA, the investor must be a resident Indian, at least 18 years old, and the total market value of securities held should not exceed Rs 10 lakhs at any time. Additionally, an individual can maintain only one BSDA.

What charges are associated with a BSDA?

BSDA accounts generally have the lowest charges, with a maximum annual maintenance fee of Rs 100.

How can I convert my existing Demat Account to a BSDA?

To convert your Demat Account to a BSDA, contact your stockbroker and follow the conversion process. Ensure your account meets the eligibility criteria, fill out the required forms and submit any necessary documentation. The broker verifies and approves the request if the applicant meets the eligibility criteria.

Can I hold multiple BSDA accounts?

Individuals can only have one Basic Service Demat Account.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle