| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Oct-23-24 | |

| Add new links | Nisha | Feb-21-25 | |

| Add new links | Nisha | Feb-21-25 | |

| Infographic Update | Ranjeet Kumar | Apr-21-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2025 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2025

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

What is TPIN in Demat Account? Learn its Importance & How to Generate It

If you’re an active participant in the stock markets, then you probably know that your securities are kept in electronic form. You must be familiar with the buying process, but do you know the process of selling stocks? In order to ensure investor protection, CDSL has introduced e-DIS verification whenever one is trying to sell his stocks, and this verification must be authorized by the unique code known as TPIN.

In this blog, we will provide detailed information about TPIN, along with information on its importance and how it’s generated.

What is TPIN?

The Transaction Personal Identification Number, or TPIN, is a crucial security feature that was implemented by NSE, along with CDSL, in June 2020. Its purpose is to give investors an additional layer of protection while selling shares by permitting stock brokers to debit shares from their Demat accounts. The password, which is six digits long, is needed to approve sell transactions. Earlier, the investor signed a POA (Power of Attorney) form, allowing their broker to sell the investment without requiring a TPIN. This process required the POA document to be physically signed and sent to the broker for verification, which was inconsistent with the online Demat account opening process.

Read Also: What is the Difference Between CDSL and NSDL?

Features of TPIN

The various features of TPIN are as follows-

- TPIN is a unique 6-digit numerical code used to authorize sell transactions, allowing shares to be debited from your demat account.

- TPIN is generated and sent by CDSL to the client’s registered mobile number and email address.

- TPIN provides additional security by preventing transactions from being carried out without your consent.

- Previously, you had to give your broker a POA form before you could sell your shares, but with the TPIN, this is no longer necessary.

Why Do We Need TPIN?

While trading on the Indian Stock Market, an investor willing to make a transaction is unable to speak with the buyer or seller face-to-face. You must work through a broker who executes transactions at the exchange on behalf of clients based on their investment decisions. Previously, the broker was authorized to trade on behalf of the clients through a Power of Attorney (POA) document. However, according to rules established by market regulators, the POA must be signed in person and retained by the broker for their records. However, today, the account can be opened online using e-sign, which makes the PoA process time-consuming. The TPIN system was implemented by the authorities to avoid the physical documentation process and enhance investor protection.

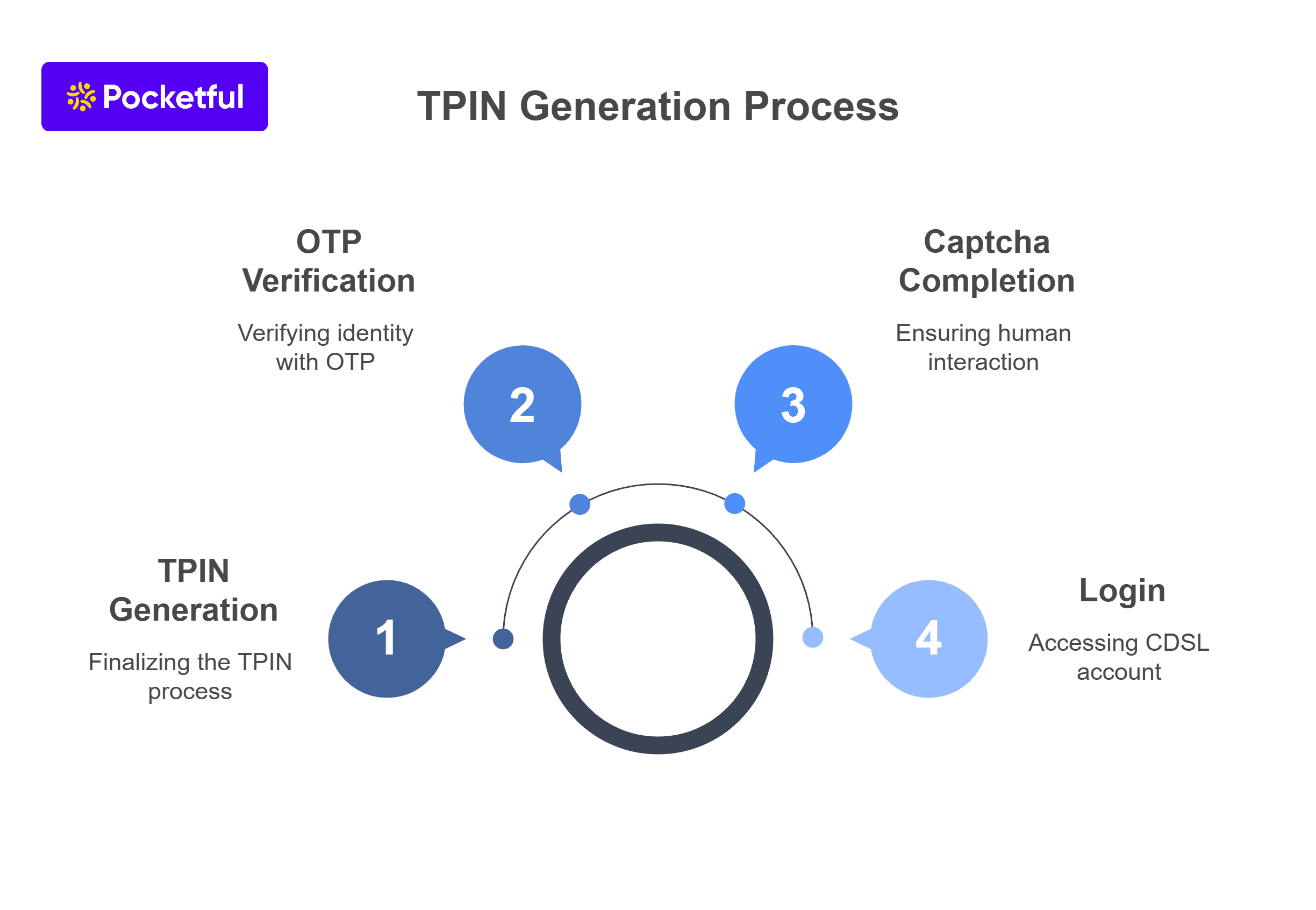

How to Generate TPIN?

Any investor can easily generate a TPIN by following the below-mentioned process:

- You must first go to the website of CDSL and log in with your credentials.

- Fill out the captcha and click on “Next.”

- Enter the OTP you receive on your registered mobile number. The OTP will be valid for 15 minutes only.

- Click on “Next,” and the TPIN will be sent to the customer’s registered email address and mobile number.

How Does TPIN work?

Here are the steps involved in executing a sell transaction using TPIN:

1. Choose the asset you wish to sell.

2. To authenticate the transaction, you will be required to enter your TPIN. TPIN is necessary to stop any fraudulent transactions in your account

3. The transaction gets executed once the TPIN is verified.

4. Regularly changing your T-Pin is recommended to secure your investments. However, if you forget yours, you can regenerate it by clicking the forgot TPIN button and going through the T-Pin creation process once again.

Importance of TPIN

TPIN serves a crucial role in ensuring security, and its significance is outlined below:

- Secure Financial Transactions – The implementation of TPIN limits illegal access and transactions in investor portfolios.

- Convenience: TPIN lets the investor manage investments online without the need for physical presence and extensive paperwork

- Compliance – The regulatory body has mandated that TPIN be implemented in the trading system.

- Ease of Access – A TPIN can be easily generated online.

- Sense of Security – Investors feel secure because their investments are shielded by several security layers.

Benefits of Having TPIN

There are numerous benefits of having a TPIN, a few of which are mentioned below-

- Safe Transaction – TPIN is used to ensure the authorized person has initiated the transaction.

- Convenience – You may quickly and conveniently authorize your transactions using TPIN.

- Saves Time – TPIN saves you time by removing the need for additional paperwork, such as physical signatures and PoAs delivered to brokers.

- User Friendly – Investors can have a user-friendly investing experience by generating their TPIN online.

How to Change TPIN?

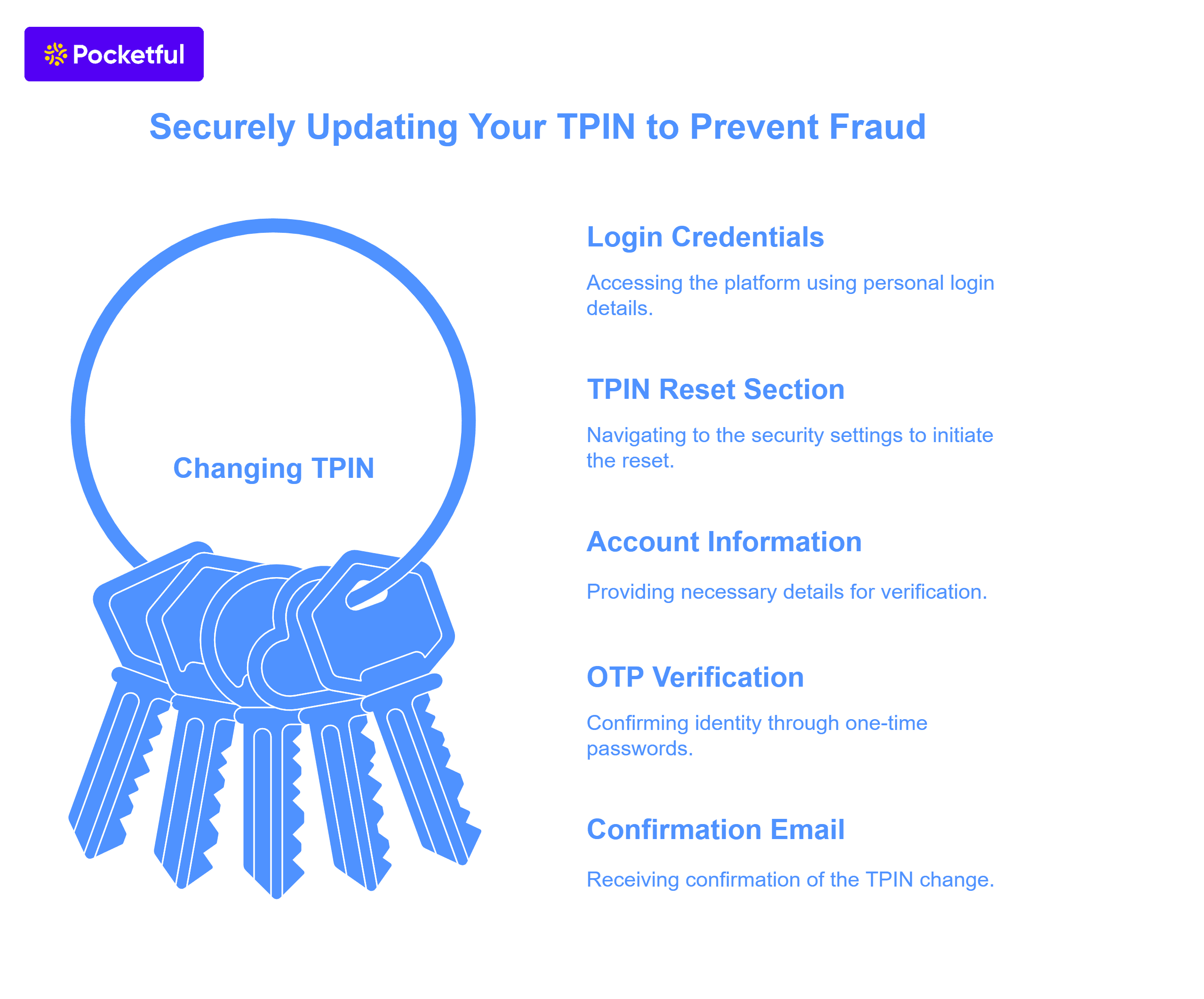

Changing TPIN regularly is essential to avoid fraud. The steps to change TPIN are mentioned below-

1. Go to your broker’s or Depository Participant’s platform and log in using your credentials.

2. Go to the TPIN generation or reset section, which is found in security or account settings.

3. You will be asked to provide information regarding your Demat account number, email address, and mobile number.

4. Following that, an OTP will be sent to the email address and registered mobile number you provided.

5. Enter the OTP and proceed to verify the details.

6. You will be asked to enter the new TPIN; you must choose a TPIN which you can easily remember but which is also not easy to guess.

7. After this step, you will receive a confirmation email on your registered mail ID, confirming that your TPIN has been changed.

Read Also: Features and Benefits of Demat Account

Conclusion

In conclusion, the authorities’ decision to introduce TPIN in the Indian Securities Market enhanced investor protection and simplified the documentation process while opening a Demat account. It gives investors peace of mind that their assets are secure and that no unauthorized person or organization can access them. Additionally, TPIN has eliminated the need for the PoA form to be sent to the brokers and physically signed.

Frequently Asked Questions (FAQs)

Is TPIN required for intraday trades?

No, TPIN is not required for intraday trades; it is only required for delivery-based trades.

Other than TPIN is there any other option to sell stocks?

If you don’t want to use TPIN, you can submit the DDPI (Demat Debit and Pledge Instruction) request to your broker, which authorizes your broker to debit securities from your account.

What is the full form of TPIN?

The TPIN refers to the Transaction Personal Identification Number.

Do I need TPIN to purchase shares?

TPIN is not required for purchasing shares; it is only required for selling your securities.

What is BO ID in the demat account?

BO ID refers to the Beneficial Owner Identification Number. It is a 16-digit Demat Account number.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle