| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-17-24 | |

| Add new links | Nisha | Feb-21-25 | |

| Add new links | Nisha | Feb-21-25 |

- Blog

- divis laboratories case study

Divi’s Laboratories Case Study: Business Model, Product Portfolio, And SWOT Analysis

A healthy population is necessary for a country to progress, and the pharmaceutical sector plays a major role in it. If you are a healthcare professional, industry expert, or just curious about pharmaceuticals, this blog is for you.

In this blog, we will explore Divi’s Laboratories, its business model, and its product range. We will also review the firm’s financial data and do a SWOT analysis.

Divi’s Laboratories Overview

Divi’s Laboratories stands out as a leading Indian multinational pharma powerhouse, renowned for its expertise in the production and distribution of Active Pharmaceutical Ingredients (APIs) and intermediates. It is based in Hyderabad, India, and operates in multiple countries. Established in 1990 as Divi’s Research Centre, the company originally concentrated on creating commercial processes for the production of APIs and intermediates. In 1995, the company inaugurated its manufacturing facility in Telangana. Divi’s Laboratories went public in 2003 via IPO. Over the years, the company has consistently expanded its product portfolio, manufacturing capabilities, and global reach.

Business Model & Product Range of Divi’s Laboratories

The company’s business model focuses on generating sustainable value for all shareholders, fostering responsible growth through strategic initiatives, and promoting social and environmental responsibility. It strongly believes that this approach is important for attaining long-term success in today’s rapidly changing business environment.

Divi concentrates on three different business segments:

- Generic APIs – The company is recognized as one of the world’s largest API manufacturers, offering a selective list of 30 Generic APIs commercially manufactured in huge volumes.

- Custom Synthesis – This segment offers contract manufacturing services of APIs and Intermediates for global innovator companies across a vast portfolio of products in diverse therapeutic areas.

- Nutraceuticals – Divi’s has a Nutraceutical Facility at its manufacturing site, which is an integrated facility for the production of active pharmaceutical ingredients and finished forms of Carotenoids. The company supplies most of the carotenoids to all the major food, dietary supplement, and feed manufacturers around the world.

Divi’s core value proposition is to provide high-quality, reliable, and cost-effective APIs to its customers worldwide.

Read Also: Case Study on Procter & Gamble Marketing Strategy

Financial Statements of Divi’s Laboratories

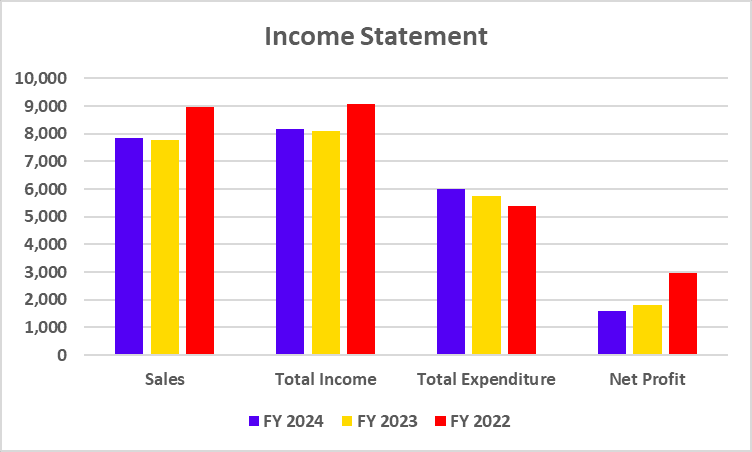

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 7,845 | 7,767 | 8,959 |

| Total Income | 8,184 | 8,112 | 9,073 |

| Total Expenditure | 6,018 | 5,742 | 5,389 |

| Net Profit | 1,600 | 1,823 | 2,960 |

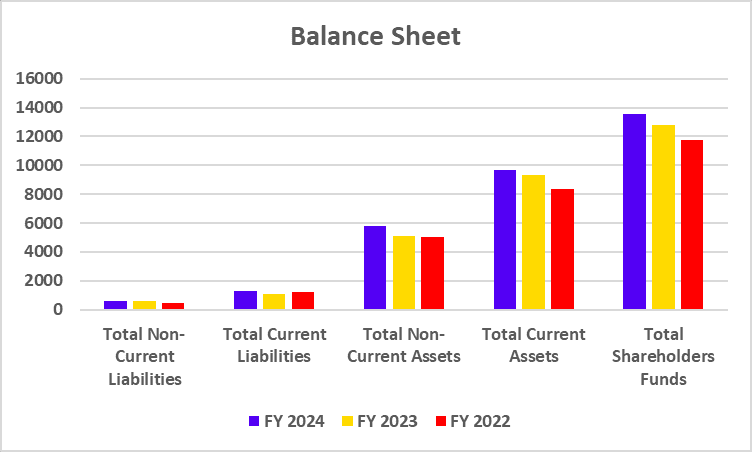

Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Total Non-Current Liabilities | 621 | 571 | 451 |

| Total Current Liabilities | 1,278 | 1,101 | 1,196 |

| Total Non-Current Assets | 5,795 | 5,127 | 5,023 |

| Total Current Assets | 9,675 | 9,312 | 8,352 |

| Total Shareholders Funds | 13,571 | 12,767 | 11,728 |

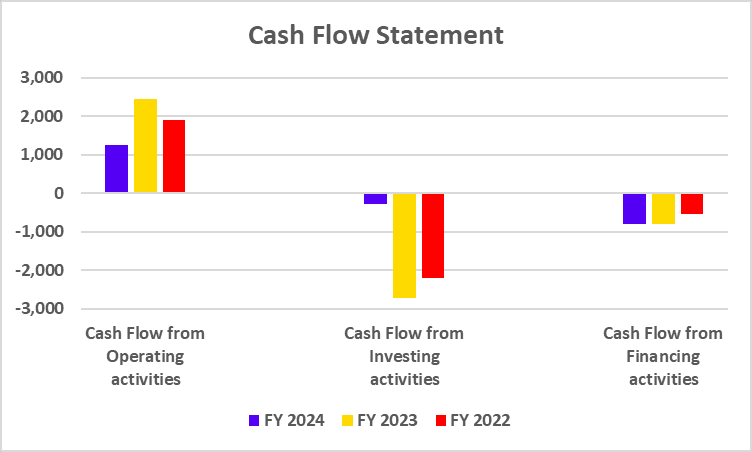

Cash Flow Statements

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating activities | 1,261 | 2,459 | 1,911 |

| Cash Flow from Investing activities | -269 | -2,707 | -2,194 |

| Cash Flow from Financing activities | -799 | -797 | -532 |

Key Performance Indicators

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| ROE (%) | 11.78 | 14.28 | 25.24 |

| ROCE (%) | 15.26 | 17.76 | 30.25 |

| Debt-to-Equity | 0.00 | 0.00 | 0.00 |

| P/E (x) | 57.16 | 41.10 | 39.47 |

| P/B (x) | 6.71 | 5.88 | 9.97 |

SWOT Analysis of Divi’s Laboratories

Strengths

- Divi’s laboratory boasts a robust global presence, catering to clients in more than 100 countries. This extensive reach enables them to access a variety of markets.

- The company is renowned for its unwavering dedication to quality. Their strict quality control protocols and adherence to regulatory standards guarantee that their products consistently uphold the highest benchmarks.

- It also provides various APIs and intermediates for different therapeutic areas.

Weaknesses

- A substantial amount of raw materials used in API production is sourced from imports, mainly from China. This exposes the company to disruptions in the supply chain due to changing trade policies.

- The API manufacturing industry needs significant capital investment, driven by the necessity for regular technology upgrades, expansion of production capacity, and adherence to international regulatory standards.

- The API market is highly competitive, with numerous players, both large and small. Divi’s laboratories must continuously invest in R&D to maintain its market position.

Opportunities

- Divi’s Laboratories is poised to increase its market share in emerging markets due to the rising demand for generic drugs and the outsourcing of API manufacturing.

- It can broaden its product portfolio by venturing into therapeutic areas, including biologics, oncologists, and high-potency active pharmaceutical ingredients (APIs).

- Collaborations with other pharmaceutical companies can provide access to new markets, technologies, and expertise.

Threats

- Changes in regulatory requirements can affect the company’s operations, making compliance costly and time-consuming.

- Since the company relies heavily on exports, it is vulnerable to currency fluctuations, particularly due to the USD-INR exchange rate.

- Fierce competition from generic medicine manufacturers often results in a decline in the prices of generic drugs and increased pressure on profit margins.

Read Also: GSK Pharma Case Study: Business Model, Product Portfolio, and SWOT Analysis

Conclusion

To summarise, Divi’s Laboratories is a top global player in API manufacturing. The company is known for its reliability and excellence due to its focus on quality, innovation, and customer satisfaction. The research and development have enabled it to expand its product offerings and enter new markets. Divi’s is strategically poised to sustain its growth and thrive in the pharmaceutical sector. As the demand for high-quality API rises, the company will likely expand its production capabilities and further enhance its competitive edge in the industry. It is advised to consult a financial advisor before investing.

Frequently Asked Questions

Where are the headquarters of Divi’s Laboratories?

The headquarters of Divi’s Laboratories is in Hyderabad, India.

What is the Divi’s Laboratories’ main business?

The company provides high-quality APIs and intermediates to pharmaceutical companies worldwide.

What are some of the therapeutic areas that the company offers?

It caters to various therapeutic areas, including cardiovascular, central nervous system, anti-inflammatory, oncology, etc.

What is the current market price and market capitalization of Divi’s Laboratories?

The company’s current market price is INR 5,459, and the market capitalization is INR 1,44,910 crores as of 13 September 2024.

Does Divi’s Laboratories have a global presence?

Yes, Divi’s Laboratories serves customers in over 100 countries worldwide.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.