| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Feb-20-24 | |

| Add new links | Nisha | Feb-21-25 |

- Blog

- eicher motors case study business model swot analysis

Eicher Motors Case Study: Business Model & SWOT Analysis

The untold story of transformation into a powerhouse of iconic motorcycles and then venturing into the world of robust commercial vehicles. Shift your gears as we delve into the captivating case study of Eicher Motors, a name synonymous with innovation, brand loyalty and strategic partnerships.

Eicher Motors Overview

Eicher Motors is an Indian multinational automotive company with its headquarters in Delhi. The company was founded in the year 1948 as Good-earth Company, which imported and sold tractors in India. In the year 1959, the company partnered with German tractor manufacturer Eicher Tractor. The company has since then grown into a diversified automotive leader with a strong focus on innovation and brand building. The company was renamed Eicher Motors in the year 1982. 5,002 permanent employees

Eicher Motors is listed on the BSE & NSE and has been part of the NSE’s benchmark Nifty 50 Index since April 1, 2016.

Did you Know?

Eicher Tractors Ltd. was selected as ‘Company of the Year’ for 1990-91 in the four-wheeler category comprising commercial vehicles, passenger cars, jeeps, and tractors.

Eicher Motors Business Model

The Company operates two major manufacturing plants in Oragadam and Vallam Vadagal and one additional establishment in Thiruvottiyur (all 3 located in Chennai) and 69% procurement of the company for raw materials is from local vendors.

Eicher Motors Limited (EML) has subsidiaries in North America, Brazil, Thailand, United Kingdom, and Canada with a strong global sales network with accelerated customer service through dealership collaborations.

It is a parent company of two successful businesses.

1. Royal Enfield

The world’s oldest motorcycle brand in consistent production, dating back to 1901. It is a global leader in the mid-size motorcycle segment with a strong brand presence in India, over 60 countries. Royal Enfield’s motorcycles are sizzling than ever, with demand exploding by 17% annually for the past 5 years. Their Chennai plant is the key to keeping up, ensuring this growth trajectory continues.

Royal Enfield’s premium bikes include the stylish Hunter 350, the timeless Classic 350, the Meteor 350 cruiser, the 650 parallel twin motorcycles – Interceptor 650, Continental GT 650 and the all-new Super Meteor 650, the adventure motorcycles – Himalayan adventure tourer and the Scram 411 ADV Crossover, and the Iconic Bullet 350.

Additionally, it actively engages in organising and endorsing several motorcycling events and rides on a global scale notably including Rider Mania, an annual congregation that draws the attention of Royal Enfield enthusiasts from around the world to the scenic beaches of Goa.

From bustling Indian cities to iconic American highways, Royal Enfield’s motorcycles are seen crossing diverse terrains. With 18 company-owned stores and more than 850 dealers in India, it caters to its domestic crowd, while its presence in over 60 countries, including well-established markets like the U.S., UK, regions of Europe and Latin America, Middle East, and Southeast Asia, showcases its global appeal.

Did You Know?

In 1901, the First Royal Enfield motorcycle was produced which was designed by R. W. Smith and Frenchman Jules Gotiet.

2. VECV (Volvo Eicher Commercial Vehicle)

In operation since July 2008, VECV has been a joint venture with Sweden’s AB Volvo and is a leading manufacturer of commercial vehicles in India.

It includes the complete range of Eicher branded trucks and buses, VE Powertrain, Eicher’s components and engineering design services businesses, the sales and distribution business of Volvo Trucks as well as aftermarket services for Volvo Buses in India.

In the financial year 2022-23, VECV saw a 40% growth over the previous year and outperformed the Industry recording sales of 79,623 units. The growth has been robust and consistent during the year.

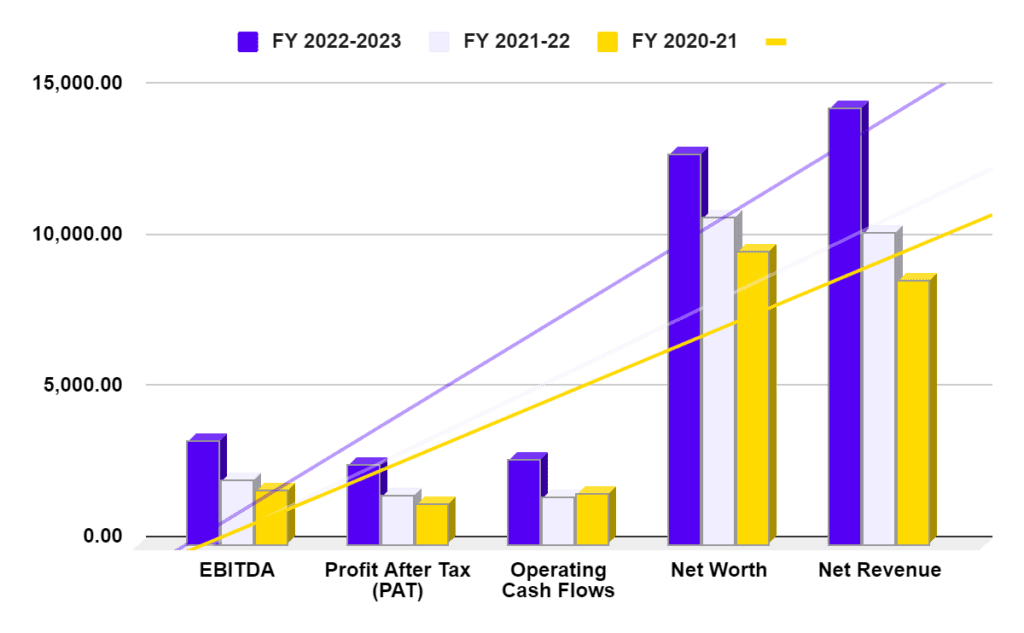

Financial Statements

Let us have a dive into the Eicher’s financial health.

| Key Metrics | FY 2022-2023 | FY 2021-22 | FY 2020-21 |

| EBITDA | 3,393.50 | 2,113.56 | 1,786.51 |

| Profit After Tax (PAT) | 2,622.59 | 1,586.22 | 1,329.70 |

| Operating Cash Flows | 2,807.11 | 1,570.00 | 1,674.31 |

| Net Worth | 12,886.90 | 10,794.57 | 9,705.00 |

| Net Revenue | 14,442 | 10,298 | 8,720 |

Read Also: Havells Case Study: Business Model and SWOT Analysis

Both revenue and profits have witnessed an impressive growth of 40% Y-o-Y, reflecting strong demand for both bikes and commercial vehicles, indicating financial stability and efficient operations.

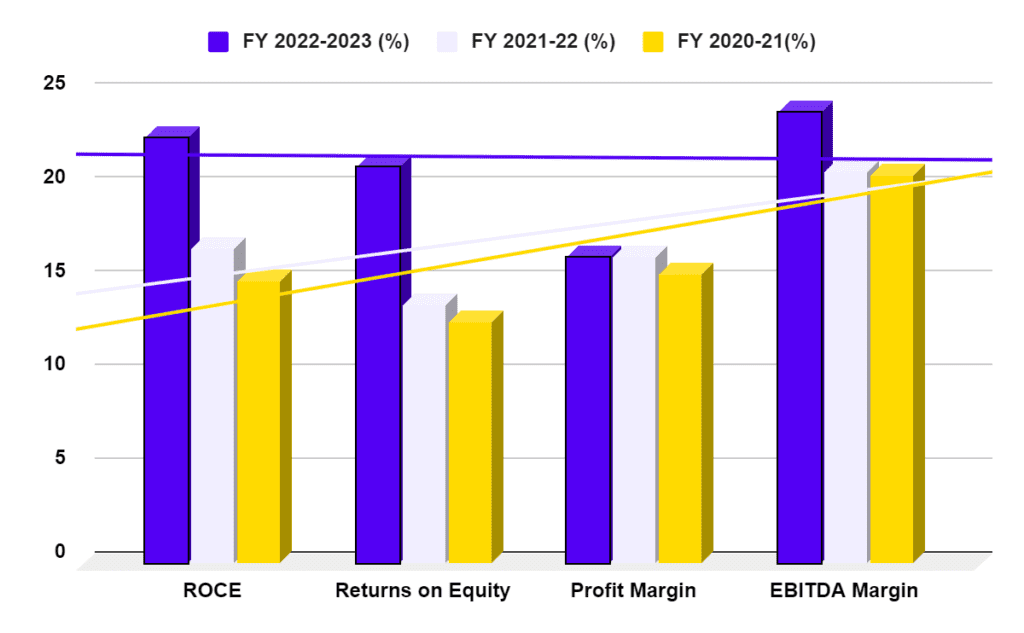

Financial Ratio Analysis

| Key Ratios | FY 2022-2023 (%) | FY 2021-22 (%) | FY 2020-21(%) |

| ROCE | 22.7 | 16.8 | 15.1 |

| Returns on Equity | 21.2 | 13.8 | 12.9 |

| Profit Margin | 16.3 | 16.3 | 15.4 |

| EBITDA Margin | 24.1 | 20.9 | 20.7 |

An ROE of 21.2 indicates good profitability and efficient use of shareholders’ funds along with a healthy profit margin over the years, demonstrating effective cost management and pricing strategies.

Interesting Facts

Performance in FY 2022-23

- 8,24,066 Motorcycles sold

- 88.2% Market share in India’s mid-size (250cc – 750cc) motorcycles segment

- 79,623 Commercial vehicles sold.

- Strong presence in the Bus segment with a 24.1% market share and 31.5% Market share in India’s light & medium duty (5 – 18.5 tonnes) CV segment.

Read Also: Paytm Case Study: Business Model and Marketing Strategy

SWOT Analysis

Strengths

- EML established itself as one of the finest brands in India, with an extensive distribution network.

- Focussed approach for international expansion and embarking on global launch of products in international destinations.

- Operating in two different segments of motorcycles and commercial vehicles reduces the company’s dependence on any single product and helps mitigate risks.

- Eicher Motors consistently invests in research and development, which keeps the company competitive and leads to technological advancements.

- The company boasts a strong and healthy financial position with consistent revenue growth and profitability.

Weakness

- Royal Enfield caters mainly to the mid-size motorcycle segment, which limits the market reach when compared to other strong players.

- A significant portion of the company’s revenue comes from India, making the company vulnerable to economic fluctuations.

- Both segments of the company face intense competition from domestic as well as international players, requiring constant innovation and brand differentiation.

Opportunities

- Royal Enfield could explore larger and smaller motorcycle segments to fulfil the needs of broader consumers, while VECV could tap into newer vehicle categories.

- Leveraging digital platforms for sales, marketing, and customer service can enhance the market reach and efficiency.

- Investing in electric vehicle technology could open new markets and cater to growing environmental concerns.

- Deepening collaboration with other brands could lead to further expansion of business operations and joint product development.

Threats

- Supply chain disruptions such as shortage of semiconductors and parts can delay production and increase input costs, which will eventually impact profitability.

- The Company faces the threat of the brand becoming outdated, and any change in consumer sentiment and market segmentation can impact the sales.

- Stringent emission regulations or shifts towards electric vehicles could lead to necessary adaptations for both the commercial and bike segments.

- New entrants in the automotive industry could pose unforeseen challenges.

- Environmental and legal regulations in India and International markets can impact the business and sales.

Conclusion

From its humble beginnings as an agricultural equipment importer to its current position as a leading player in the Indian automotive industry, Eicher Motors’ journey provides a compelling study of successful business transformation and sustained growth.

The company has capitalised on opportunities and navigated challenges. Furthermore, it is well-positioned to continue its growth trajectory and intensify its position as a leader in the global landscape.

Frequently Asked Questions (FAQs)

How did Eicher Motors start?

EML began its operations in the year 1948 as Goodearth Company. A partnership in the year 1959 with Eicher Tractor Company marked their shift to the automobile.

What is EML’s secret sauce?

The company holds a strong brand identity and continuous diversification through partnerships.

How many awards did EML win in the FY 22-23?

The company got 18 awards in the FY 22-23 for the new product launched.

How do you see EML evolving in the future?

The company has immense potential to lead the Indian automotive industry with a growing global presence and embracing new technologies.

Is Eicher Motor going electric?

They are levelling up for the future! Eicher is actively investing in EV technology with the intention of capturing the market.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.