| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-27-24 | |

| Add new links | Nisha | Feb-21-25 |

- Blog

- enfuse solutions limited ipo business model and swot analysis

Enfuse Solutions Limited: IPO, Business Model, And SWOT Analysis

The country’s digital sector is constantly evolving, and businesses need cutting-edge solutions to stay ahead. Enfuse Solutions Limited is built on innovation and helping businesses across industries leverage data, analytics, and AI to achieve transformative results.

In this blog, we will delve deeper into the SWOT analysis, business model, and key IPO details of Enfuse Solutions Limited.

About the Company

Enfuse Solutions Limited is an Indian company founded in 2017 that provides integrated digital solutions across various domains. The company works as a consultant for its clients.

Business Model

The company’s major source of revenue comes from providing digital services and integrated solutions. The company has a specialisation in:

1. Data Management & Analytics

The company helps businesses improve the quality and accuracy of their data to facilitate better decision-making. It ensures the highest standard of data integrity as well as availability with data management and data governance services.

key components in Data Management & Governance that Enfuse Solutions offer are as follows: Master Data Management, Data Stewardship, Data Quality, Data Governance, Product Information Management (PIM)

The company also partners with businesses to build and scale their analytics and AI capabilities, driving industry-wide transformation and analytics capabilities, including Product Analytics, Customer Analytics, Pricing Analytics, Campaign Analytics & Sales Analytics.

2. E-commerce & Digital Services

The company develops and manages custom e-commerce platforms to ensure a smooth online experience for businesses. E-commerce services cover a wide range of offerings designed to support and enhance online business activities, which include E-commerce Platform Management, Content Management, SEO and SEM Services, Digital Marketing, Web Analytics & Reporting, Customer Experience & Quality Assurance.

3. Edtech & Solutions

Enfuse Solutions also provides solutions in the education technology sector and other tech-related areas. Within Edtech, various solutions include Live Proctoring, Record & Review, Auto Proctoring, and artificial intelligence algorithms.

4. Machine Learning (ML) & Artificial Intelligence (AI)

The company offers AI and ML-enabled services, such as data tagging to improve content searchability and fuel other AI applications.

Additionally, the company gets diversified revenue from multiple geographical locations across India and places outside India, including the USA, Ireland, Netherlands, Canada, etc. The company boasts around more than 150 clients and has successfully delivered 1000+ projects.

Read Also: Exicom Tele-Systems IPO: Business Model, KPIs, SWOT Analysis, and FAQs

Business Process

The first step in the business process of Enfuse Solutions is identifying customers or prospects depending on their needs. This is a consistent process for generating new business.

The incoming leads through websites or digital campaigns organised by the company. One thing to note is that customer references are considered the most important sources.

After the customer identification, a detailed process to understand the requirement of the IT service required by the prospects in terms of efficacy, efficiency, and user interface is carried out. Once the needs of the customers are identified, the man hours required to achieve the requirement of the Client are estimated.

The documentation and execution process with the client is completed and kept for record purposes. After end-to-end negotiation, the contract will be signed, carrying the terms and conditions agreed upon.

Enfuse Solutions faces tough competition from several competitors offering similar products and services: Vertexplus Technologies Limited, Systango Technologies Limited, eClerx Services Limited, etc.

Key IPO Details

| IPO Date | March 15, 2024 to March 19, 2024 |

| Price Band | INR 91 to INR 96 per share |

| Lot Size | 1,200 Shares |

| Total Issue Size | 2,337,600 shares |

| Issue Type | Book Built Issue IPO |

| IPO Type | SME IPO |

| Basis of Allotment | Wednesday, March 20, 2024 |

| Initiation of Refunds | Thursday, March 21, 2024 |

| Listing Date | Friday, March 22, 2024 |

Objectives of the Issue

1. Repayment of certain borrowings availed by the company.

2. To meet working capital requirements.

3. For general corporate purposes.

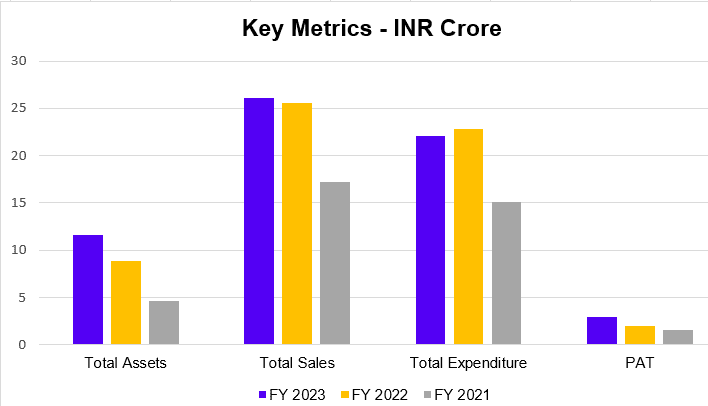

Enfuse Solutions Financial Statements

Have a look at the key metrics of the Enfuse Solutions Limited (in INR crore):

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

| Total Assets | 11.65 | 8.89 | 4.61 |

| Total Sales | 26.10 | 25.56 | 17.20 |

| Total Expenditure | 22.13 | 22.87 | 15.11 |

| PAT | 2.93 | 1.98 | 1.55 |

Cash Flow Statements

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Net cash flow from operating activities | 1.34 | 1.96 | 2.17 |

| Net cash flow from investing activities | (1.36) | (4.18) | (2.36) |

| Net cash flow from financing activities | (0.10) | 2.28 | (0.04) |

| Cash equivalents at the end of the year | 0.13 | 0.25 | 0.19 |

Read Also: AVP Infracon IPO: Overview, Key Details, Financials, Strengths, and Weaknesses

Enfuse Solutions SWOT Analysis

Strengths

- The company’s global presence as an IT solutions provider helps in the expansion of client-base across diverse geographical markets. Further, this international footprint keeps the company at the forefront of the technological innovation.

- A passionate leadership team and a highly skilled workforce have combined to drive impressive growth and a commitment to innovation.

- The company delivers a broad range of IT solutions to diverse industries by partnering with established players through subcontracting agreements.

Weaknesses

- High dependence on sub-contractors might limit control over project delivery and quality.

- The company is relatively new and might have lower brand recognition than established competitors.

- The IT solutions market is competitive in India and needs constant innovation and differentiation.

Opportunities

- Expanding into new geographical locations with high growth potential can be a significant opportunity.

- Emphasising on specific high-demand industry sectors can increase the company’s expertise and brand recognition.

- Staying informed about and capitalising on new technologies can lead to new service offerings and attract new clients.

Threats

- The current revenue streams are concentrated in the US and Netherlands, and any adverse developments in these markets can affect the business operations of the company.

- A competitive market for technology services can put pressure on pricing, which can reduce the share of business from clients and can have a significant impact on revenues and profitability.

- The business could also suffer substantial setbacks because of cyberattacks or security breaches within the company’s system, or of the clients can adversely affect the business.

Read Also: Ullu Digital Case Study: Business Model, Financials, and SWOT Analysis

Conclusion

To sum it up, Enfuse Solutions is positioned for impressive growth in the ever-evolving IT landscape. Their global presence, focus on innovation, and skilled workforce empowers them to offer exceptional value to clients across diverse industries. By making an effort to stay ahead of the curve on emerging technologies and geographic markets, the company is well-equipped to transform businesses.

Frequently Asked Questions (FAQs)

What does Enfuse Solutions do?

Enfuse Solutions is a leading provider of integrated digital solutions, including data management, e-commerce, AI &ML, and education technology solutions.

In which year the company was founded?

The company was founded in the year 2017.

Is Enfuse Solutions a good investment option?

This depends on the investor’s risk tolerance and investment goals. It is a relatively new company, so do your research and consult financial advisor before investing. Further, it is an SME company; one can buy its shares in a lot only, and the lot size is 1200 shares (app. INR 1.35 lakhs).

Where is Enfuse Solutions located?

The company is headquartered in Bombay, India but functions across multiple geographies.

How did the company’s share price perform on the listing date?

On the listing date, i.e., 21 March 2024, the share price of Enfuse closed at around INR 115, which is almost 20% up from its issue price (INR 96).

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.