| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-21-24 | |

| Add new links | Nisha | Apr-11-25 |

- Blog

- grasim industries case study subsidiaries products financials and swot analysis

Grasim Industries Case Study: Subsidiaries, Products, Financials, and SWOT Analysis

Grasim Industries Limited is a flagship company of the global conglomerate Aditya Birla Group. The company started as a textiles manufacturer in India in 1947 and evolved into a leading diversified player with a strong presence across many sectors. Grasim Industries products include viscose staple fiber, filament yarn, cement (via UltraTech), chemicals like caustic soda and epoxy, textiles, insulators, fertilizers, and financial services. Today’s blog will dive into the company overview, business segments, market data, financial highlights, and SWOT analysis.

Grasim Industries Overview

Recognised as ET Sustainable Organization 2023, Grasim Industries has evolved into the true essence of the phrase “World first.” The company draws revenue from its three broad segments: Viscose Fibre and Yarn, Chemicals, and Others.

Of the 3 segments, Grasim Industries generates most of the revenue from the Viscose Fiber and Yarn segment.

| Company | Public |

| Founded at | 1947 |

| Headquarters | Mumbai, Maharashtra |

| Area served | Worldwide |

| Parent | Aditya Birla Group |

Recognition & Achievements

- 2018 – Forbes ranks Grasim Industries as a Growth Champion 2018.

- 2021 – Attains the 7th position on the Responsible Business Ranking.

- 2023 – Work Institute certified Grasim’s Domestic Textile Business.

Subsidiaries

- UltraTech Cement

UltraTech Cement holds an iconic position as a major cement manufacturer with an annual production capacity exceeding 100 million tonnes. It has expertise in ready-to-mix concrete, grey cement, and white cement. The business extended its geographical boundaries and expanded its operations to UAE, Bahrain, Bangladesh, and Sri Lanka, making it a global cement manufacturer.

- Aditya Birla Capital

Aditya Birla Capital is a financing and advisory solutions provider and has served more than 3.8 million customers. It provides the services of home loans, personal loans, securities against stocks, and much more. It has become an essential player as over 60% of its lending portfolio caters to SME customers and retailers. Aditya Birla ranks among the nation’s top five private life insurance providers.

Major Products

- Linen Yarn and Fabrics

The company has a strong brand reputation in linen yarn and fabrics for its elegance, quality, and comfort. The business is renowned for its sophisticated standards of clothing.

- Paints

The company is aiming to become the biggest player in the fast-growing decorative paints industry. It provides a variety of decorative and industrial paints known for their durability, quality, and eco-friendly attributes.

- Chlor-alkali and Epoxy Products

The company has created a strong footprint and brand reputation in the industry. In addition to offering caustic soda, it also produces chlorine derivatives and epoxy products and has become a market leader in the chlor-alkali industry. These products are essential in different sectors, meeting quality standards and demonstrating versatility.

- Birla Pivot

Birla Pivot is a thriving e-commerce platform that penetrates the country’s building materials segment. It is a B2B platform and is Grasim’s flagship. The business is expected to undergo rapid growth in the coming years and aims to overcome hurdles while providing seamless integration with other projects. This platform boasts consumer-friendly features and a complete track-and-trace system for every order.

- Viscose Staple Fiber (VSF)

VSF is a biodegradable and versatile fiber and is used for home textiles, dress materials, manufacturing apparel, knitted wear, and non-woven applications. Grasim has become the global leader in this industry by providing quality and sustainability.

Read Also: Ultratech Cement Case Study – Financials Statements, & Swot Analysis

Market Data

| Market Cap | ₹ 1,50,936 Cr. |

|---|---|

| TTM P/E | 26.84 |

| ROCE | 12.63 % |

| Book Value per share | ₹ 1,267.63 |

| ROE | 8.67 % |

| Dividend Yield | 0.44 % |

| Face Value | ₹ 2.00 |

Grasim Industries Financial Highlights

Income Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Operating Revenue | 1,17,627.08 | 95,701.13 | 76,404.29 | 75,269.48 |

| Total Income | 1,21,239.13 | 96,522.47 | 77,462.09 | 76,238.29 |

| Total Expenditure | 96,038.03 | 75,269.76 | 57,768.95 | 58,008.38 |

| Profit before Tax | 14,726.71 | 12,626.86 | 9,771.43 | 6,491.54 |

| Profit after Tax | 11,078.20 | 10,690.55 | 6,749.24 | 6,575.86 |

| Consolidated Profit | 6,827.26 | 7,549.78 | 4,304.82 | 4,411.74 |

Operating revenue has seen massive growth over the past years, fueled by a corresponding increase in total expenditure. The income jump, however, did not translate to a similar increase in net profit.

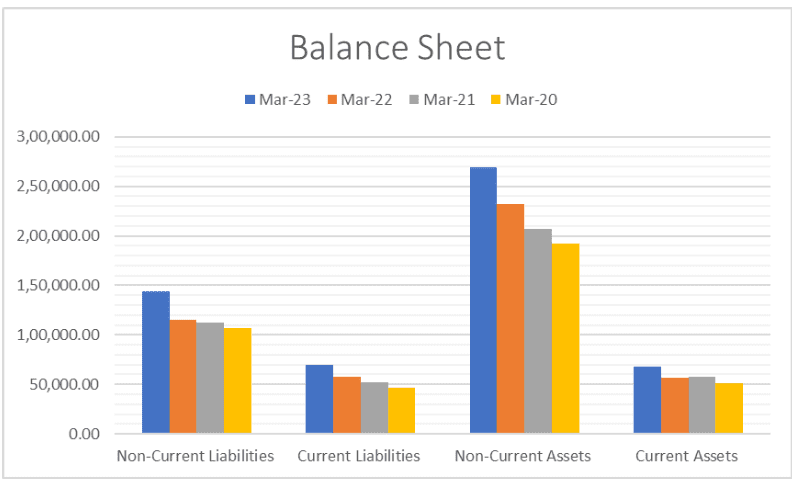

Balance Sheet

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Non-Current Liabilities | 1,44,376.96 | 1,15,089.61 | 1,12,279.37 | 1,06,625.41 |

| Current Liabilities | 69,532.99 | 57,884.47 | 51,921.84 | 46,379.50 |

| Non-Current Assets | 2,69,300.41 | 2,32,381.10 | 2,07,073.53 | 1,92,128.52 |

| Current Assets | 67,504.34 | 56,758.16 | 57,956.43 | 51,445.38 |

The Balance Sheet saw a massive but continuous increase in non-current assets while maintaining a much lower level of non-current liabilities. Such a consistent increase shows a positive trend for the company.

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | -12,685.14 | 7,037.65 | 15,075.08 | 16,803.43 |

| Cash Flow from Investing Activities | -13,686.71 | -3,543.18 | -9,229.49 | -11,547.64 |

| Cash from Financing Activities | 26,469.13 | -6,733.13 | -8,003.45 | -3,417.93 |

The Cash Flow Statement signifies a grim state. Operations have consistently declined inflows, with the latest FY witnessing a drastic dive. The investing and financing activities also show a lot of turbulence.

Profitability Ratios

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| ROCE (%) | 12.63 | 11.93 | 10.97 | 9.48 |

| ROE (%) | 14.41 | 15.21 | 11.10 | 11.52 |

| ROA (%) | 3.54 | 3.84 | 2.64 | 2.71 |

| EBIT Margin (%) | 14.48 | 17.00 | 19.11 | 17.61 |

| Net Margin (%) | 9.14 | 11.08 | 8.71 | 8.63 |

| Cash Profit Margin (%) | 12.35 | 14.35 | 12.93 | 12.87 |

The company’s profitability signifies a healthy state with ROCE seeing a consistent but slow increase in the past 4 years. The company has consistently been able to net a margin of around 9%.

Grasim Industries SWOT Analysis

Strengths

- Grasim enjoys an extensive dealer network that helps the company grow globally and deliver efficient services to its customers.

- The company enjoys the benefits of a stable brand value in the construction segment as it has a history of 75 years.

- The company is currently the largest producer of VSF in the country and is thus able to command significant control over the pricing.

Weaknesses

- Grasim industries operates in a cyclical industry and thus experiences volatility in downturns.

- The capex heavy business model can lead to increased leverage in the coming years.

Opportunities

- Grasim industries has forayed into the paints segment and plans to make a foothold in the industry.

- The Indian textile industry is estimated to continue growing in the coming years, and the Grasim industries can benefit heavily from this development.

Threats

- The VSF segment generates the majority of the revenue, and demand for this segment is expected to decline in the future.

- There is a growing number of global players interested in entering the Indian subcontinent and failure to keep them at bay can result in decreased margins.

Read Also: Asian Paints Case Study: Business Segments, KPIs, Financials, and SWOT Analysis

Conclusion

In the past few decades, Grasim Industries has become a major player in the Indian market. In addition to extensive dealer networks, the company has skilled employees, contributing to its growth and efficiency. Despite this, seasonality in the industry presents challenges.

FAQs

What is the full form of GRASIM?

The full form of GRASIM is Gwalior Rayon Silk Manufacturing (Weaving) Company Limited.

What does Grasim Industries Ltd do?

The company started as a textile manufacturer in 1947 but is now involved in various business segments, such as the production of Fabrics, Viscose, Diversified Chemicals, and Linen Yarn.

What are the Grasim industry’s products?

They offer a wide variety of products, such as viscose staple fiber, yarn, pulp, grey cement, white cement, caustic soda, allied chemicals, epoxy, linen, and wool.

What are the major risks faced by Grasim industries?

The company faces issues due to the capex heavy business and high level of seasonality.

When was the Grasim Industries established?

The company was established in 1947, in Mumbai, Maharashtra.

What are the products of GRASIM?

Grasim Industries produces viscose staple fiber, filament yarn, chemicals (caustic soda, epoxy), cement (via UltraTech), and textiles. It also operates in financial services, fertilizers, and power insulators.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.