| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-21-24 | |

| Update Formatting | Nisha | Feb-25-25 |

- Blog

- gsk pharma case study

GSK Pharma Case Study: Business Model, Product Portfolio, and SWOT Analysis

A healthy population is necessary for a nation to progress. Pharmaceutical companies are crucial in ensuring the country’s population remains healthy. But have you ever thought about investing in pharmaceutical companies? Have you ever wondered how pharmaceutical firms make money? What restrictions have the regulatory agencies put on them?

In this blog, we will focus on GlaxoSmithKline Pharmaceuticals Ltd. or GSK Pharma, discuss its beginnings, business model, and product portfolio and conduct a SWOT analysis.

GSK Pharma Company Overview

The company started operations in India in 1924 as H.J. Foster & Co. Ltd., later renamed Glaxo Laboratories. In 1930, a factory to manufacture essential medicines was set up in Mumbai. In the 1950s and 1960s, GSK expanded operations in India by setting up more manufacturing facilities and was listed on the Indian Stock Exchange in 1969. To increase its market share, the company launched several medications and vaccines in the Indian market. In 2000, Glaxo Wellcome and SmithKline Beecham merged to form a new company named Glaxo SmithKline Pharmaceuticals Ltd. The company has entered into strategic partnerships with various companies to expand its market share. The company’s headquarters is in Mumbai.

Business Model of GSK Pharma

GSK Pharma is a well-known brand in the Indian pharmaceutical sector. The company manufactures and provides high-quality medications to its customer base. It produces its goods in India to cut expenses and comply with national regulations. The business uses a robust distribution network to ensure that its goods reach every corner of the nation. For vaccine supply and immunization initiatives, the company has formed numerous strategic alliances with other NGOs and the Indian government.

Product Portfolio of GSK Pharma

Customers of GSK Pharma have access to a wide variety of products, including medications for respiratory conditions, dermatological conditions, bacterial and viral infections, and other ailments. Additionally, it provides vaccinations against influenza, chicken pox, etc. In 2019, GSK formed a joint venture with Pfizer to combine their consumer healthcare business. In 2022, the consumer healthcare business was spun off to form Haleon, which was listed on the London Stock Exchange. Some of the key products include Sensodyne toothpaste, ENO, Otrivin, etc.

Market Details of GlaxoSmithKline Pharmaceuticals Limited

| Current Market Price | INR 2,826 |

| Market Capitalization (In Crores) | INR 47,875 |

| 52 Week High | INR 3,088 |

| 52 Week Low | INR 1,385 |

| Book Value | INR 105 |

| P/E Ratio (x) | 62.2 |

Read Also: Case Study on Procter & Gamble Marketing Strategy

Financial Statement

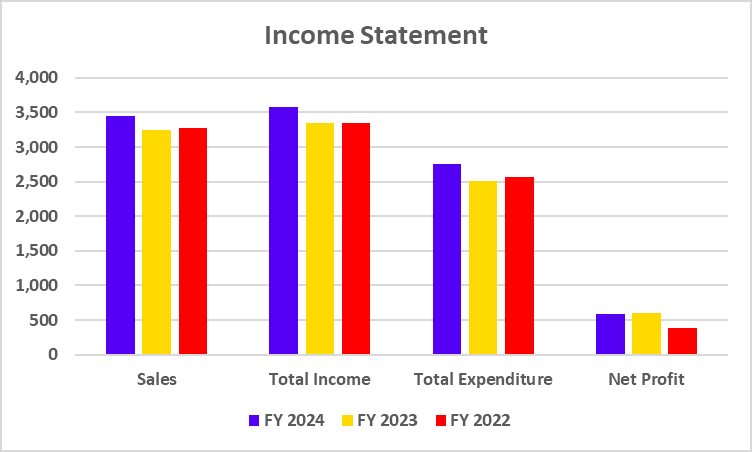

Income Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Sales | 3,453 | 3,251 | 3,278 |

| Total Income | 3,576 | 3,352 | 3,353 |

| Total Expenditure | 2,758 | 2,514 | 2,572 |

| Net Profit | 589 | 607 | 380 |

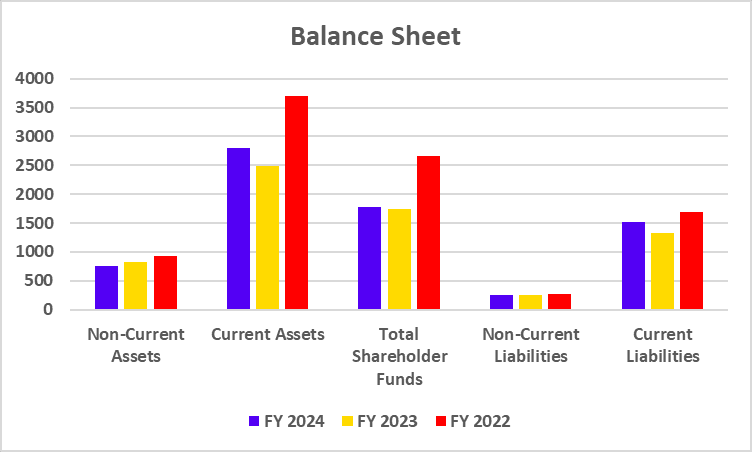

GSK Pharma Balance Sheet

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Non-Current Assets | 758 | 832 | 925 |

| Current Assets | 2,798 | 2,494 | 3,708 |

| Total Shareholder Funds | 1,778 | 1,741 | 2,663 |

| Non-Current Liabilities | 254 | 259 | 272 |

| Current Liabilities | 1,525 | 1,326 | 1,698 |

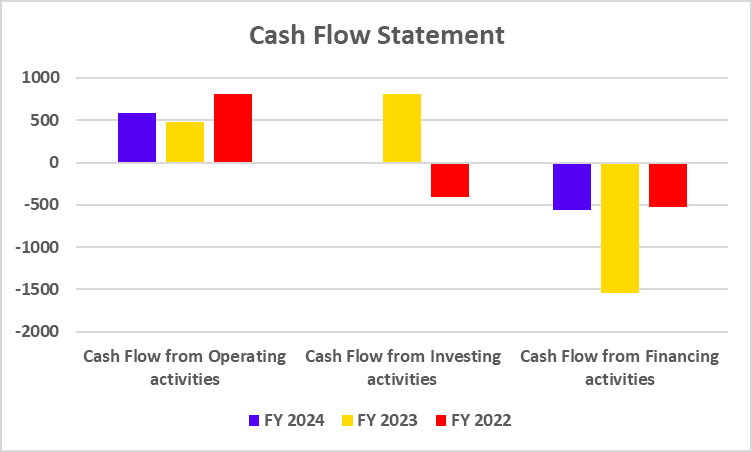

Cash Flow Statement

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Cash Flow from Operating activities | 582 | 484 | 810 |

| Cash Flow from Investing activities | 8 | 807 | -405 |

| Cash Flow from Financing activities | -561 | -1,543 | -524 |

Key Performance Indicators (KPIs)

| Particulars | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 27.84 | 25.80 | 23.47 |

| Net Profit Margin (%) | 17.08 | 18.78 | 51.69 |

| Return on Net Worth/Equity (%) | 33.42 | 35.41 | 63.64 |

| ROCE (%) | 47.33 | 41.95 | 26.21 |

| Current Ratio | 1.84 | 1.88 | 2.18 |

| Debt to Equity Ratio | 0 | 0 | 0 |

Read Also: Case Study on Starbucks Marketing Strategy

SWOT Analysis of GSK Pharma

Strengths

- Brand Reputation – The company has been a market leader and one of India’s top 5 pharmaceutical firms for a long time, with a strong brand reputation.

- Diversified Product Portfolio – The company’s product line consists of a wide range of medications.

- Invest in Research of Products – The company’s investment in the research and development division enables it to enhance its products consistently.

Weaknesses

- Regulations – The pharmaceutical industry is subject to stringent restrictions, and the company has encountered several obstacles imposed by the US FDA.

- Competition – The company’s market share may be impacted by competition from manufacturers of generic medications.

Opportunities

- Expansion – The company can grow its market share by developing better products.

- Vaccine – The company can take advantage of the increasing demand for vaccines in India.

- Partnership – The company can strategically partner with various healthcare companies to expand its market reach.

Threats

- Supply Chain – Any interruption to the company’s supply chain would immediately impact sales and earnings.

- Patents – The company owns multiple patents, and when these patents expire, generic drug producers become more competitive.

- Price Control – The Indian government has designed stringent regulations regarding the cost of vital medications, diminishing the profit margin of the pharmaceutical industry.

Conclusion

GlaxoSmithKline Pharmaceuticals (GSK Pharma) is a leader in the pharmaceutical sector. The company prioritizes drug research and development to pave a path for a healthier and more prosperous future. Despite the challenges it faces, the company effectively competes with its competitors. The USFDA and other regulatory bodies closely observed its activities. The company is in great financial standing and can be considered a good investment opportunity as it has been consistently profitable. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Who is the managing director of GlaxoSmithKline Pharmaceuticals Ltd.?

Bhushan Akshikar is the managing director of GlaxoSmithKline Pharmaceuticals Ltd.

What is the full form of GSK Pharma?

The full form of GSK Pharma is GlaxoSmithKline Pharmaceuticals Limited.

Who are GSK Pharma’s main competitors?

GSK Pharma Limited faces stiff competition from Sun Pharma, Cipla, Dr Reddy, Zydus Life Sciences, Divis Labs, etc.

Is GSK Pharma Ltd. a profitable company?

GSK Pharma is a profitable company as it has reported a profit of 589 crores in FY 2024 and 607 crores in FY 2023.

Is GSK Pharma a large-cap or mid-cap company?

GSK Pharma is a large-cap company with a market capitalization of 47,875 crores as of 18 September 2024.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.