| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Mar-19-24 | |

| Add new links | Nisha | Apr-11-25 |

- Blog

- hdfc bank case study business model financial highlights and swot analysis

HDFC Bank Case Study: Business Model, Financial Highlights, and SWOT Analysis

HDFC, or Housing Development Finance Corporation Limited, was among the first financial institutions in the country to receive an “in principle” approval from the RBI (Reserve Bank of India) to set up a bank in the private sector in 1994.

This HDFC case study explores how HDFC became one of the most organized banks with a highly efficient digital services wing.

Overview of HDFC Bank

In 1997, the founder and chairman of HDFC Ltd, Shri HT Parekh, dreamt of millions of middle-class citizens of the country owning a home and not having to hold it till their retirement. The bank was registered as ‘HDFC Bank Limited’ in Mumbai, India in 1994. Let’s have a quick summary of the company:

| Company Type | Private |

| Industry | Financial services |

| Founding Year | August 1994 |

| Chairman (Part-time) | Atanu Chakraborty |

| Origin | Mumbai, Maharashtra, India |

Mission Statement

HDFC Bank’s mission is to be the nation’s most trusted and recommended financial service provider. The bank’s vision is to create an environment of possibilities for the customers and employees by implementing effective business processes through quality, responsiveness, and resourcefulness. The bank’s business is based on five key values:

- Operational Excellence

- Customer Focus

- Product Leadership

- People

- Sustainability.

Business Model of HDFC Bank

Services offered

HDFC offers a wide range of services to its clients:

- Commercial banking

- Finance and insurance

- Investment banking

- Private equity & wealth management

- Consumer & private banking

Competitors

The competitors are:

- Axis Bank

- ICICI Bank

- Kotak Mahindra Bank

- Bank of Baroda

- State Bank of India

Mergers and Acquisitions

- 2000 – HDFC Bank merged with Times Bank.

- 2008 – HDFC Bank acquired Centurion Bank of Punjab.

- 2021 – HDFC bank acquired a 9.99% stake in FERBINE, an entity promoted by Tata Group.

- 2021 – HDFC bank partnered with Paytm to launch a range of credit cards powered by Visa.

Awards and Recognitions

- 2018- Best Performing Private Bank

- 2019- Best Bank in India, by Global magazine Finance Asia

- 2019- Ranked 60th in 2019 by BrandZ Top.

- 2020- Best Bank in India, Euromoney Awards

- 2022- Euromoney Awards for Excellence 2022.

Market Data

Let’s have a look at the essential market data of the company.

| Market Cap | ₹ 11,02,384 Cr. |

| TTM Stock P/E | 18.68 |

| ROCE | 15.24 % |

| Current Price | ₹ 1,451 |

| Book Value | ₹ 574.18 |

| ROE | 17.24 % |

| 52 Week High / Low | ₹ 1,758 / 1,363 |

| Dividend Yield | 1.31 % |

| Face Value | ₹ 1.00 |

Read Also: Axis Bank Case Study: Business Model, Product Portfolio, and SWOT Analysis

Financial Highlights of HDFC Bank

Income Statement

| Metrics | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Metrics | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

| Interest Earned | 1,70,754.05 | 1,35,936.41 | 1,28,552.40 | 1,22,189.29 |

| Total Income | 2,04,666.10 | 1,67,695.40 | 1,55,885.28 | 1,47,068.27 |

| Operating Expenses | 51,533.69 | 40,312.43 | 35,001.26 | 33,036.06 |

| Profit Before Tax | 61,498.39 | 50,873.38 | 42,796.15 | 38,194.86 |

| Consolidated Profit | 45,997.11 | 38,052.75 | 31,833.21 | 27,253.95 |

The income statement highlights a consistent increase in topline and bottom line figures. The figures translate to better margins.

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | 20,813.70 | -11,959.58 | 42,476.45 | -16,869.09 |

| Cash Flow from Investing Activities | -3,423.89 | -2,216.33 | -1,680.87 | -1,616.92 |

| Cash from Financing Activities | 23,940.56 | 48,124.03 | -7,321.35 | 24,394.50 |

| Net Cash Inflow / Outflow | 41,330.37 | 33,948.12 | 33,474.23 | 5,908.48 |

Cash Flow Statement indicates a turbulent atmosphere as the company has experienced significant negative CFO twice in the past 4 years. The CFI has been consistently negative over the years, which indicates a higher-than-average investing habit of HDFC.

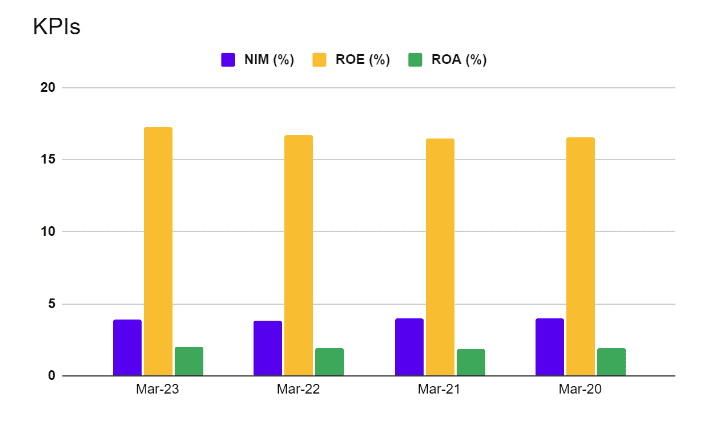

KPIs of HDFC Bank

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| NIM (%) | 3.92 | 3.82 | 3.97 | 3.95 |

| ROE (%) | 17.24 | 16.7 | 16.5 | 16.54 |

| ROA (%) | 1.98 | 1.95 | 1.88 | 1.9 |

The KPIs reflect consistency as ROA and NIM have remained largely unaffected by the company’s operations. However, over the years, the ROE has been massive as compared to ROA and NIM.

Peer Comparison

| Particulars | HDFC Bank | ICICI Bank | State Bank Of India | Kotak Mahindra Bank | Axis Bank |

|---|---|---|---|---|---|

| Market cap (₹ Cr) | 11,01,055 | 7,58,982 | 6,49,355 | 3,48,343 | 3,24,281 |

| Interest Income (₹ Cr) | 2,51,764 | 1,51,348 | 4,19,802 | 53,062 | 1,07,158 |

| Net Interest Income (₹ Cr) | 1,18,710.68 | 83,184.21 | 1,77,258.81 | 32,477.35 | 49,914.25 |

| RoA (%) | 3.09 | 2.10 | 1.06 | 2.79 | 1.00 |

| Price to Earnings | 18.65 | 17.88 | 10.18 | 19.97 | 24.15 |

| Price-To-Book | 2.51 | 3.17 | 1.72 | 2.80 | 2.19 |

SWOT Analysis of HDFC Bank

The HDFC SWOT Analysis highlights its strengths, weaknesses, opportunities, and threats, showcasing its market position and growth potential.”

Strengths

- HDFC Bank is well known for its impressive customer service because of its quick and efficient dedicated team that handles customer complaints and feedback. The company operates with a customer-centric initiative, focussing on 24×7 customer support, personalized banking solutions, and a user-friendly mobile app to enhance the overall customer experience.

- HDFC Bank is the largest bank in the nation because of its market capitalization and strong presence across the country. This bank’s strong market position is also supported by its extensive network of branches and ATMs nationwide, making it easily accessible to customers.

- HDFC Bank’s technological infrastructure focuses on improving its operational efficiency, reducing costs, and providing customers with faster and more convenient banking services.

Weaknesses

- HDFC Bank is facing challenges in establishing a strong presence in the rural areas of India.

- The bank faces stiff competition from other large banks such as ICICI, SBI, Kotak, etc.

- The bank has an inactive marketing strategy and markets less aggressively than some competitors, like Kotak Bank. However, this lack of effective marketing strategies has not affected the bank’s growth and expansion.

Opportunities

- HDFC Bank is expanding its market to foreign countries like Bangladesh, Nepal, and Sri Lanka and building strong partnerships with local players to establish a dominant position in these markets.

- Focusing on affordable housing is an important growth driver for HDFC, as it can help the company expand its customer base and maintain its position as a leading housing finance provider in India.

Threats

- As more and more client data and software systems are stored in the cloud, cybercriminals could use the vulnerability to perform cyber attacks. Cybersecurity has become a vital issue in banking. HDFC will need to ensure the safety of its IT infrastructures to avoid losses.

- The banking industry’s performance is closely attached to the health of the Indian economy. A slowdown in economic growth, high inflation, or other macroeconomic factors could impact the bank’s profitability and growth factors.

Read Also: Yes Bank Case Study: Business Model, Financial Statement, SWOT Analysis

Conclusion

HDFC Bank has established itself as a leading financial institution in India with a strong market presence and a focus on customer service and technological innovation. Although the company faces challenges in rural expansion and aggressive competition, the bank’s strategic partnerships and growth opportunities in neighboring countries position it well for continued success. The bank is well established to capitalize on India’s rapidly evolving financial landscape and deliver long-term value to its stakeholders.

Frequently Asked Questions (FAQs)

What is the full form of HDFC?

The full form of HDFC is Housing Development Finance Corporation Limited.

What is the market cap of HDFC Bank Ltd.?

As of 15-Mar-2024, HDFC Bank Ltd. has a market capitalization of ₹11,01,055 Cr.

What are the success factors of HDFC Bank?

The bank’s customer centric approach, reliability, and financial stability have earned it the trust and loyalty of a large customer base, enhancing its competitive advantage.

Who is the CEO of HDFC?

Sashidhar Jagdishan is the CEO of HDFC Bank.

Does HDFC have a presence in foreign countries?

HDFC has a presence in 7 international locations with branches in 4 nations and representative offices in 3 other cities.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.