| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-22-23 | |

| Add internal links | Nisha | Feb-25-25 |

Read Next

- Rakesh Jhunjhunwala Portfolio 2025: Top Holdings & Strategy

- BankBeES vs Bank Nifty – Key Differences

- Current Ratio vs Quick Ratio Key Differences

- Best REIT Stocks in India 2025

- Best Data Center Stocks in India 2025

- Best Rare Earth Stocks in India

- Top 10 investment banks in India

- What Is iNAV in ETFs?

- Best Investment Options in India 2025

- Best Energy ETFs in India 2025

- Radhakishan Damani Portfolio 2025: Stocks & Strategy Insights

- Best SEBI Registered Brokers in India

- Best Air Purifier Stocks in India

- Best Space Sector Stocks in India

- Gold Rate Prediction for Next 5 Years in India (2026–2030)

- Difference Between Equity Share and Preference Share

- Vijay Kedia Portfolio 2025: Latest Holdings, Strategy & Analysis

- Raj Kumar Lohia Portfolio 2025: Holdings, Strategy & Analysis

- How to Earn Passive Income Through Dividend-Paying Stocks in India

- Top 10 Richest Investors in the World 2025 – Net Worth, Key Investments & Strategies

- Blog

- how does the price of oil affect the stock market

How does the Price of Oil affect the Stock Market?

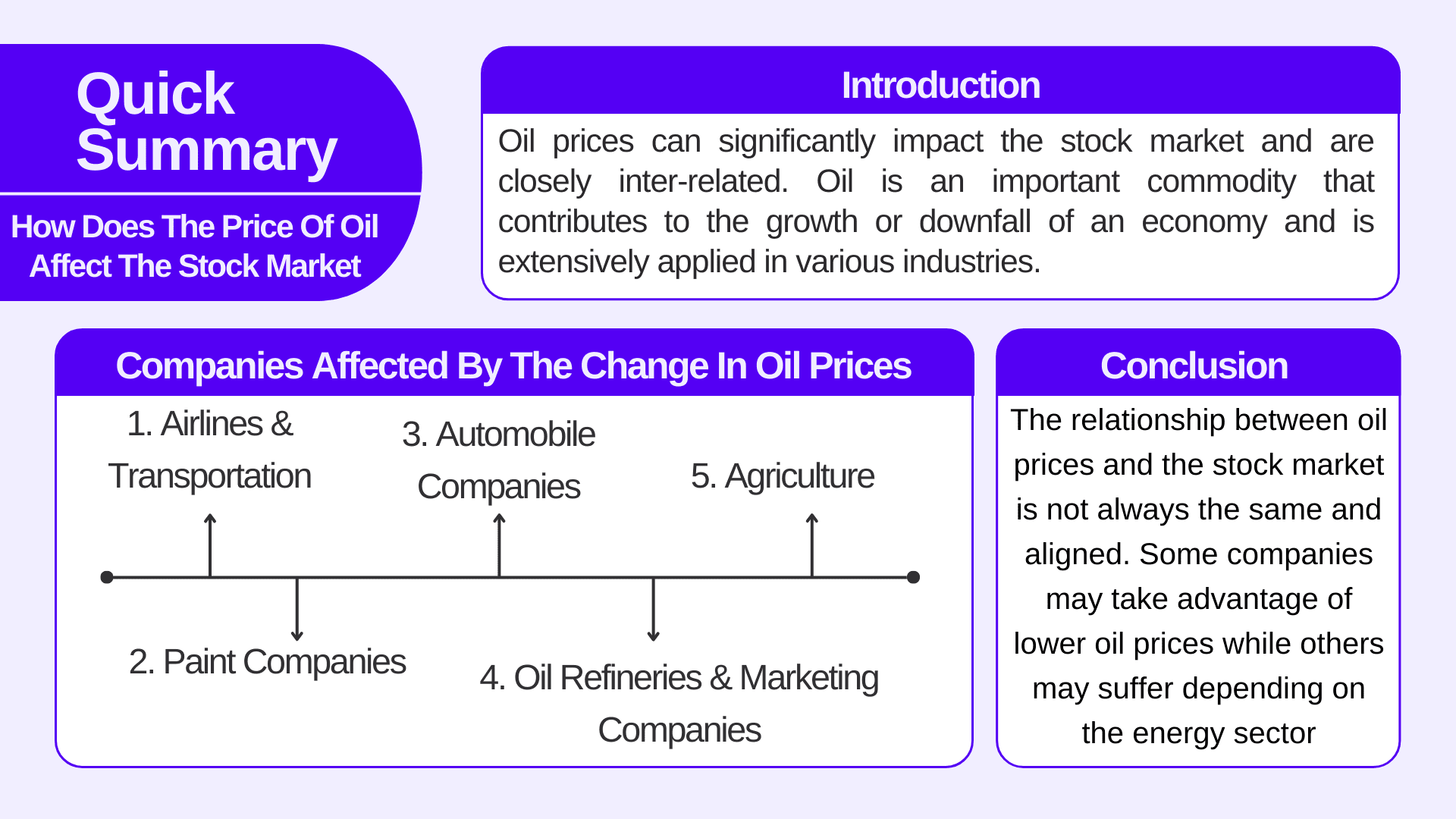

Oil prices can significantly impact the stock market and are closely inter-related. Oil is an important commodity that contributes to the growth or downfall of an economy and is extensively applied in various industries. Oil prices are defined by a complex interplay of supply and demand dynamics, geopolitical events, production decisions by major oil-producing countries, and changes in the global economy. When the price of oil rises or falls, it can cause various effects that leave footprints throughout the financial markets.

In today’s blog, we will be discovering the ways in which changes in the price of oil can affect the stock market. Whether you’re an investor, or simply interested in knowing about the theories of the financial world, understanding the relationship between oil prices and the stock market is crucial for making sound trading decisions and analyzing the current economic trends that are prevailing in the market. The relationship between oil prices and the stock market is complex and intricate.

Below listed are some of the key points which depict the relationship between the stock market and oil prices

- The direct impact of the change in oil prices is on the energy sector stocks which include oil producers and exploration companies. Increased oil prices will have a positive impact on the profitability of these companies. As a result, the stock prices of all the oil companies will soar high.

- Oil prices can have a noteworthy impact on inflation. An increase in the price of oil can lead to high production and transportation costs which will increase the general price level of the economy.

- Any kind of change in oil prices can also affect other sectors. For example, companies like manufacturing and chemicals that use oil as the key input can have negative effects on their production capacity and their profit margins will be reduced significantly.

- Changes in oil prices can also affect the spending capacity of consumers because they will have to pay more money for oil-related products and will be forced to think before buying.

- Geopolitical events in major oil-producing regions can disrupt oil supplies and lead to price spikes. These events can increase market uncertainty.

- Oil prices are generally denominated in foreign currency i.e., the U.S. dollar. Any kind of increase in the oil price will strengthen the dollar and weaken the Indian currency.

Read Also: How Interest Rate Changes Affect the Stock Market

Companies that are majorly affected by the change in oil prices

1. Airlines & Transportation

Fuel cost comprises one of the most important parts of the operating expenses of the aviation sector. If oil prices are low then the profit margin of these companies will automatically increase. Consumers, in such a case, may get a chance to enjoy lower airfares.

2. Paint companies

A fall in the price of oil can reduce the production costs of paint companies. Derivatives of crude oil are important in the production of paints.

3. Automobile companies

If there is a sustained increase in prices customers’ choice of fuel-efficient vehicles may change which in turn may affect the demand of some vehicles.

4. Oil refineries & Marketing Companies

Oil refineries are meant to convert crude oil into useful products like gasoline and diesel. A spike in oil prices can affect the input costs of these companies.

5. Agriculture

Geopolitical events in major oil-producing regions can disturb oil supplies and lead to an increase in prices of oil. These events can increase market uncertainty.

Oil Crisis

One of the most famous examples of oil crisis in history is the 1973 oil crisis. This had a deep impact on the global economy and energy policies. Here’s a brief overview of the 1973 oil crisis:

The oil crisis of 1973 was the end result of some geo-political events. In the year 1973, Egypt and Syria attacked Israel. The U.S. provided military aid to Israel which Arab countries did not like. In reaction, the OPEC countries applied an Oil Embargo on the United States. An Oil Embargo is defined as an economic situation where the transportation of petroleum is limited by some entities to or from an area). This led to a reduction in the global supply of oil. Oil prices at that time were at sky-highs and this caused inflation and higher energy costs. The crisis resulted in increased investment in the development of alternative energy sources, such as nuclear, solar, and wind energy. The purpose of giving the reference to the oil crisis in today’s blog was to give a historical example of how geopolitical conflicts can impact the energy sector. For our readers’ knowledge let us have some basic ideas about OPEC countries.

- OPEC stands for the Organisation of the Petroleum Exporting Countries. This organization was formed in the year 1960

- OPEC countries are a group of countries that collaborate to coordinate and control the pricing policies of petroleum products.

- Currently, there are 13 OPEC countries.

- India imports 84% crude oil to fulfill its requirements from countries like Saudi Arabia, Iraq, Iran, and UAE.

Read Also: How to Trade in the Commodity Market?

Conclusion

The relationship between oil prices and the stock market is not always the same and aligned. To conclude, some companies may take advantage of lower oil prices while others may suffer if their core business is dependent on the energy sector. The investor should take note of ongoing oil prices and news updates if any before investing in oil-related companies because chances are likely that oil prices may change and these fluctuations are unavoidable. By now you must have understood that oil prices do have a major impact on the stock market.

FAQs (Frequently Answered Questions)

How does the price of oil affect the stock market?

Oil prices affect sectors across the stock market in different ways energy company benefits if the stock prices increase and other companies might suffer losses.

What is the full form of OPEC?

OPEC stands for the Organisation of the Petroleum Exporting Countries.

From which country India imports maximum oil?

India imports 84% oil from U.A.E.

What affects the oil prices?

Any kind of change in supply-demand dynamics and geopolitical events can lead to a change in the price of oil.

How can investors navigate the impact of oil price changes?

Investors can lower their risk of loss by diversifying their portfolios and concentrating their investments in oil-related stocks.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle