| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-23-23 | |

| Add internal links | Nisha | Feb-25-25 | |

| Add internal links | Nisha | Feb-25-25 |

- Blog

- how to achieve financial freedom before retirement

How to achieve financial freedom before retirement

As financial guru Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving”.Have you ever wondered how some people retire early at a young age? Because they have achieved financial freedom before retirement.

So let us understand what is financial freedom. Financial freedom can be defined as a state where your monthly income from passive sources exceeds your monthly expenditure. Also, you do have an emergency fund for any type of contingent liability that may arise in future. Okay, let’s try to understand the few technical terms that were used above in the definition of financial freedom.

- Passive income- Passive income is the source of income where you are not actively working but your money is working for you. E.g. rental income, dividend income, interest from debt fund investments, etc.

- Emergency fund– A fixed amount of money set aside in liquid form for unforeseen future circumstances.

- Contingent liability– A contingent liability is a potential obligation that may arise from an event that has not yet occurred.

Now that we have understood what financial freedom is, the question arises how to achieve it?

Read Also: 10 Essential Financial Planning Tips for Military Members

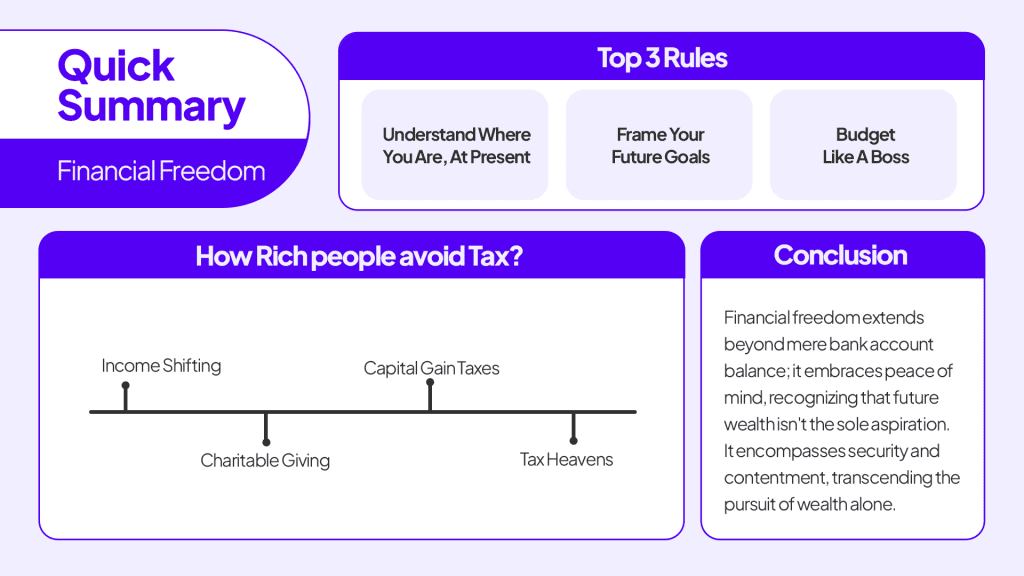

Here are 10 easy rules that you could opt for to achieve financial freedom before retirement :

1. Understand where you are at present-

The first and foremost step in the journey of financial freedom is understanding your present financial situation. Your expenses, income, assets, liabilities, debt and savings.

Sat down take a pen and paper and write down your expenses, income, assets, liabilities, debt and savings. So that you have your financial statement.

2. Frame your future goals-

Clearly define your future goals. It could be buying your dream car, clearing up your education loan, saving up children’s marriage and anything else. Write down your 1, 5, 10, and 20-year financial goals or whatever you want you want to achieve in your life in the following years. But make sure, that your goals are specific, measurable, realistic and time-bound.

3. Budget like a boss-

Make a budget and have a record so that you know where your money is going. Try to cut unnecessary expenses from your budget. Distinguish between your needs and wants. A need is something necessary to live and function. A want is something that can improve your quality of life. Using these criteria, a need includes food, clothing, shelter and medical care, while wants include everything else.

It’s not like you have completely ignored your needs but the motive is to spend your money in such a way that you can maximize the satisfaction derived from it so that your future is also not compromised.

4. Pay yourself first-

The financial rule of paying yourself first simply means that you put a certain amount aside for your savings or investment before paying for any of your bills.

This helps you to build a cushion, for your future on which you can rely in uncertain times.

This rule enables you to prioritize your savings and investments, even if that means compromising on your wants today. PYF rule helps you to achieve financial freedom early and also to accumulate wealth.

5. Invest early-

‘The earlier you start the more you earn’ is a saying that goes by. Starting your investing journey early gives you a competitive edge over others to achieve financial freedom. The earlier you start the more benefit you could get from compounding because it takes time to grow your money.

The compounding effect is the gathering of big rewards from a series of small and intelligent choices. Small, seemingly insignificant steps completed with discipline over a longer period can show exceptional results. An interesting fact is that Warren Buffet’s net worth graph closely resembles the graph of a compounding series.

To experience the power of the compounding effect yourself is to start investing early. Today with so much technological advancement anyone can start their investing journey with as little as 500 rupees per month.

6. Never put all your eggs in one basket-

When we say never put all your eggs in one basket it means nerve depends on one or two sources of income. Or never put all your savings in one type of investment rather diversify your portfolio.

During covid-19 we have seen how blue collar job people had to give up their jobs because of the situation at that time. Similarly recent mass layoffs by big companies forced us to realise the need of having multiple sources of income in such uncertain times to provide for the safety of our loved ones.

It is very important to diversify your risk and accordingly allocate your resources and efforts over different assets so that you can create multiple passive sources of income.

7. Understand how taxes work

It is very important to understand how the tax system works if you want to save your money. Rich don’t pay taxes or the CEO of XYZ company takes 0 salaries. We are sure you must have heard all those things.

There are so many legal ways in which rich people avoid paying taxes few are mentioned below:

- Income shifting-

Shifting your income from one person or entity to another to reduce taxes. - Charitable giving-

Donating large sums of money to charitable organisations to reduce your gross taxable income. - Capital gain taxes-

The tax rate on capital gains is less than the tax rate on personal income, so many times rich people invest their money in different asset classes. - Tax heavens-

Tax heavens are those countries where taxes are low or not at all. So many rich people just transfer their wealth to such countries.

8. Crush your debt-

It means that first arrange your debt in descending order i.e. first try to pay off the debt with the highest interest rate following the ones with lower interest rates. This way you will pay less for the interest and more for the principal amount itself.

Try to make extra payments when possible. Instead of paying 12 EMIs the whole month, you can simply start paying 13 EMIs a year. This year you will, be able to close your loan on time without taking extra financial burden.

9. Automate your savings-

There are so many ways in which you can automate your savings. One is setting up a direct deposit, wherein you simply give instructions to your bank to transfer a certain amount every month to another account or SIP account.

Apart from this, you could you budgeting apps that track all your daily expenditures and automatically invest the change amount to your desired asset classes.

10. Educate yourself-

This is by far the most important point that you should swear by in your financial journey. The journey to achieve financial freedom is full of ups and downs. And the only way to tackle them is by educating yourself and being updated on your surroundings.

Understanding money, finance and investing is a long-term journey that takes time, patience and discipline to complete.

Read Also: What is FIRE in Finance? Full Form, Features, Types, and Formula Explained

Conclusion

Hope that now you will have a clear understanding of how you can achieve financial freedom before retirement by just following these simple steps. Having financial freedom is not only about having enough money in your bank account to sustain you for your golden years. But also having peace of mind and understanding that having enough money for the future is not the ultimate goal.

But diversifying, allocating and churning your investments in such a way that it can sail you through the thick and thin market trends.

FAQs (Frequently Asked Questions)

What is financial freedom?

Financial freedom can be defined as the state where you have enough monthly income from passive sources to cover your monthly expenditures without working. Financial freedom is not about being rich or wealthy but about having enough resources to pay your bills.

How to achieve financial freedom?

It takes discipline and patience to achieve financial freedom. Achieving financial freedom is a long-term thing that takes time. First, you have to know about your monthly income and expenditure and then accordingly create passive sources of income.

How to plan early retirement in India?

In the above article, 10 simple yet very important steps are mentioned that if you follow you can achieve early retirement as compared to others.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.