| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-29-23 |

- Blog

- how to invest in dividend stocks in india

How to invest in dividend stocks in India?

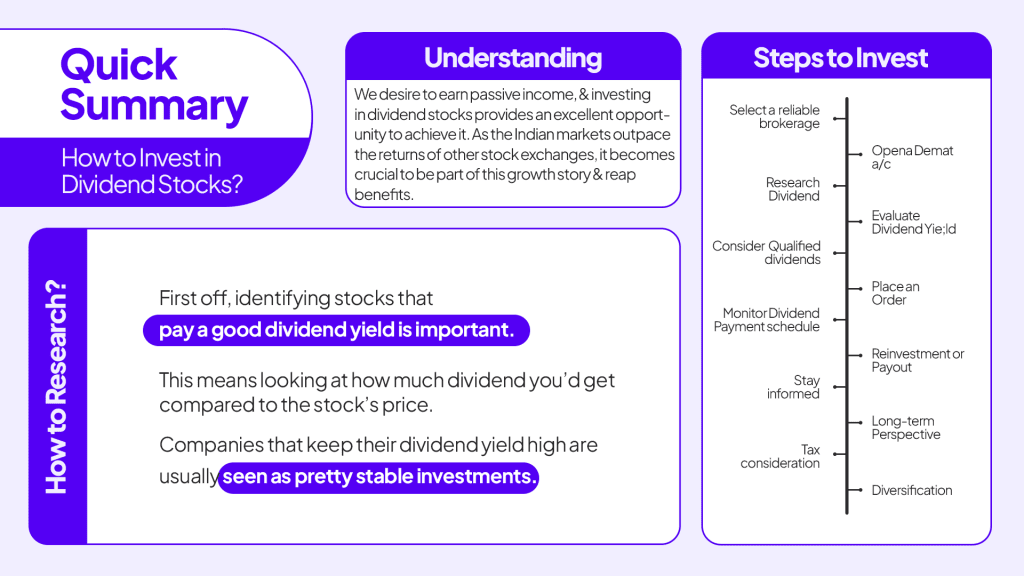

We all desire to earn passive income, and investing in dividend stocks provides an excellent opportunity to achieve it. As the Indian markets outpace the returns of other stock exchanges, it becomes crucial to be part of this growth story and reap its benefits. Investing in dividend stocks in India offers a steady income stream & holds the potential for long-term growth. These stocks, often called “cash cows,” allocate a portion of their earnings as dividends to shareholders.

Investing in dividend stocks is as simple as your usual stock investments –

1. Select a Reliable Brokerage: Choose a reputable brokerage firm with the necessary tools and resources for stock trading.

2. Open a Demat Account: Sign up for a trading and Demat account with the chosen brokerage. Provide the required documents and complete the account setup process.

3. Research Dividend: Paying Companies: Identify companies listed on Indian stock exchanges that have a history of paying dividends consistently. Look for stable companies with good financial standing. We’ll be discussing this point in detail.

4. Evaluate Dividend Yield: Review the dividend yield of potential stocks. It can be calculated by dividing the annual dividend per share by the current stock price. This helps gauge the potential income.

5. Consider Qualified Dividends: Understand the concept of qualified dividends and their tax implications. Qualified dividends are usually subject to lower tax rates, making them a tax-efficient choice for investors.

Read Also: What is a Dividend?

6. Place an Order: Once you’ve identified a suitable dividend stock, place an order through your brokerage’s trading platform. Choose between market orders (immediate execution) and limit orders (set a specific price).

7. Monitor Dividend Payment Schedule: Keep track of the company’s dividend payment schedule. Dividends are often paid out quarterly, but the timing can vary. Stay informed to ensure you receive your dividend income.

8. Reinvestment or Payout: Decide whether you want to reinvest your income or receive them as cash payouts. Reinvestment can lead to compounding returns over time.

9. Stay Informed: Continuously monitor the performance and news related to the companies you’ve invested in. Stay informed about any changes in the company’s financial health or dividend policies.

10. Long-Term Perspective: Approach dividend stock investing with a long-term perspective. The goal is to build a portfolio that generates a steady stream of income over time, while potentially benefiting from capital appreciation.

11. Tax Considerations: Be aware of the tax implications of dividend income in India. Understand the applicable tax rates and reporting requirements for dividends received.

12. Diversification: With any investment strategy, diversification is the key. Avoid putting all your funds into a single dividend stock; consider building a diversified portfolio across different sectors.

Now, you’ll be all set to start your journey of investing in dividend stocks in India. The goal is to create a steady income stream and see your investments grow over the long haul.

Read Also: 5 Highest Dividend Paying Stocks in India

Factors to see for identifying dividend-paying companies –

1. Financial Performance: Examine the company’s financial statements, including revenue growth, profitability, and cash flow. A strong financial foundation is essential for consistent dividend payments.

2. Dividend History: Check the company’s track record of dividend payments. Look for a history of regular and stable dividends over several years.

3. Dividend Yield: Evaluate the dividend yield, which is the ratio of annual dividends to the current stock price. Compare this yield with industry averages to gauge competitiveness.

4. Payout Ratio: Calculate the payout ratio by dividing dividends per share by earnings. A sustainable payout ratio indicates the company can comfortably afford its dividend commitments.

5. Earnings Growth: Assess the company’s earnings growth trajectory. Companies with steady and increasing earnings are more likely to maintain dividend payments.

6. Debt Levels: Analyze the company’s debt levels and debt-to-equity ratio. Excessive debt could impact its ability to sustain dividend payments during economic downturns.

7. Industry Trends: Consider the industry the company operates. Research industry trends and forecasts to ensure the company’s position is strong and its market share is sustainable.

8. Management and Governance– Evaluate the quality of the company’s management team. Transparent governance practices and a history of shareholder-friendly policies are positive indicators.

9. Competitive Landscape: Compare the company’s performance, dividends, and strategies with its competitors. A company that outperforms its peers is more likely to provide stable dividends.

10. Market Capitalization: Consider the company’s market capitalization. Larger, well-established companies often have the resources to maintain consistent dividends.

11. Future Prospects: Research the company’s growth potential and expansion plans. A company with a clear roadmap for growth is more likely to continue rewarding shareholders.

12. Dividend Growth: Assess the company’s history of increasing dividends over time. Consistent dividend growth demonstrates management’s commitment to shareholders.

13. Analyst Recommendations: Review recommendations from financial analysts and experts. While not definitive, these insights can offer valuable perspectives on the company’s prospects.

14. Industry Regulations: Be aware of any industry-specific regulations that could impact the company’s ability to maintain dividends.

15. News and Developments: Stay updated on recent news, events, and developments related to the company. Changes in leadership, acquisitions, or strategic shifts can influence dividend sustainability.

By following these steps, you can navigate the world of dividend stocks with confidence and make informed investment decisions.

Investment principles to swear by –

1. Focus on Regular Payouts: Look for companies that give out dividends often. They’re like your paycheck but from your investments!

2. Don’t Chase Just High Yields: Sure, big payouts are tempting, but make sure they’re sustainable. Sometimes a struggling company offers high yields, but that might not last.

3. Stability Matters: Pick companies that are strong and steady. You want them to keep making money so they can keep giving you dividends.

4. Diversify: Don’t put all your eggs in one basket. Invest in different companies and industries. If one isn’t doing well, others might make up for it.

5. Long-Term Thinking: Dividend stocks are like slow-cooking investments. Think long-term. Over time, your money can grow nicely.

6. Reinvest or Enjoy: Set your goals beforehand in terms of the yield you are targeting. Decide if you want to buy more shares with your dividends (like planting seeds) or just enjoy the extra cash.

7. Keep Learning: Keep an eye on the news about the companies you invested in. If there are big changes, it could affect your dividends.

8. Know the Tax Rules: Remember, dividends are taxed. Know how much you might need to give back to the government.

9. Look at Dividend Growth: Companies that increase their dividends over time are a good sign. It means they’re getting better at making money.

10. Stay Calm: Don’t freak out if the stock price goes up and down. Focus on the dividends and the company’s overall health.

11. Patience Pays: Think of it like growing a garden. It takes time, but the rewards can be worth it. Hold on for the long haul.

12. Expert Help: If you’re unsure, get advice from experts or professionals. They can guide you based on their experience.

Remember, there’s no one-size-fits-all strategy. Your approach depends on your goals, risk tolerance, and how much you want to be involved. With the right strategy, dividend stocks can be a tasty addition to your investment plate!

Read Also: Highest Dividend Paying Penny Stocks List

How to research dividend-paying Companies?

First off, identifying stocks that pay a good dividend yield is important. This means looking at how much dividend you’d get compared to the stock’s price. Companies that keep their dividend yield high are usually seen as pretty stable investments. The screener can be used for this purpose. When you’re picking these dividend-paying stocks, it’s smart to know about “qualified dividends.” These are dividends that meet certain tax criteria and are usually taxed at a lower rate, which is a good thing for your pocket.

Now, when it comes to actually investing in these stocks, proper research needs to be undertaken. Look for companies that have a track record of sharing profits with their shareholders. They usually pay out dividends regularly, like every quarter. It’s a good idea to keep an eye on when they announce their dividend payouts.

Here’s the deal though: this kind of investing is like the slow-cooking of investing strategies. You’ve got to be in it for the long haul. Even big shots like Warren Buffett say they like to hold onto stocks “forever.” It’s all about being patient and letting your money grow over time.

Conclusion

But hey, remember that dividends in India are taxed. The rate depends on how much you earn, so it’s good to know what you’re in for tax-wise. If you’re not super into picking stocks yourself, no worries. There are mutual funds that focus on these dividend-paying stocks. That way, the experts handle the hard work and you still get the benefits.

The main goal here is to create a source of passive income. By choosing stocks that keep growing their dividends, you could have more cash coming in over the years. So there you go! Investing in dividend stocks in India is a smart way to get some cash flow going and let your investment bloom. Just remember to pick wisely, be patient, and let the magic of compounding do its thing.

Calculate Dividend Yield – Dividend Yield Calculator

FAQs (Frequently Asked Questions)

What are dividend-paying stocks?

The stocks of companies that pay a portion of their profits to their shareholders are called dividend-paying stocks. Investing in dividend-paying stocks acts as a passive source of income.

Which are the best dividend-paying stocks in India?

You can check out this link to find the top fundamentally strong stocks that dividend-paying in 2022 India. click here

Is investing in dividend-paying stocks good?

Yes, investing in dividend-paying stocks is good. Because it not only pays out dividends to its shareholders but the investor also benefits from capital appreciation.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.