| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-29-23 | |

| Add internal links | Nisha | Feb-25-25 |

- Blog

- how to invest like warren buffett and charlie munger

How to invest like Warren Buffett and Charlie Munger?

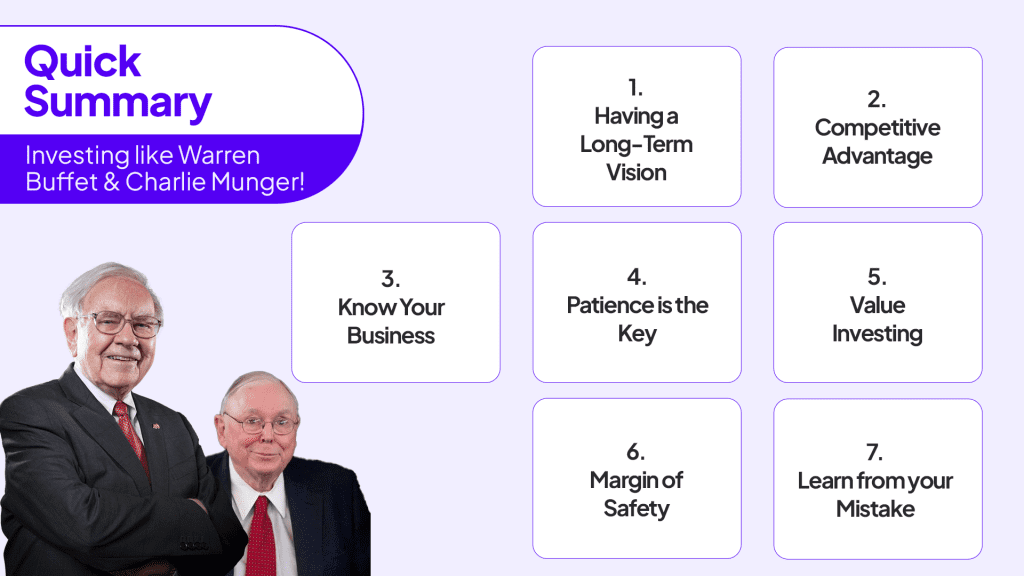

Investing in the stock market can be a daunting task. People who do not understand investing or the stock markets associate investing in the stock market with gambling. But having the insights of legends like Warren Buffet and Charlie Munger could be a relief. Warren Buffet and Charlie Munger are the iconic duo behind the success of Berkshire Hathway. Both are famous for their unique yet simple style of investing which has resulted in remarkable success.

So we have listed down seven tips or the ideologies followed by these legendary investors.

1. Having a long-term vision:

Warren Buffet always used to say that never invest in companies whose business you do not understand. There is this famous quote that goes like, “Invest in a wonderful company at a fair price than in a fair company at a wonderful price”.

It means that you should not buy the stock of a company just because you are getting it for cheap. Rather invest in a company that you believe in, understand its business, and has strong fundamentals with competitive management.

They say that think like a business owner and not a stakeholder. This mindset encourages you to focus on long-term value creation, aligning your interest with the company’s success. It also discourages short-term trading which often results in losses.

2. Competitive advantage:

The Buffet and Munger duo stresses investing in companies that have a competitive advantage in the market. Identify the company that stands out of the crowd. It could be anything, be it their business model, marketing strategies or technological proprietary. A company with a durable competitive advantage often results in consistent profits, making it an attractive investment opportunity.

Let’s try to understand this with the help of a real-world example. The differentiating factor for the retail giant Walmart is the lowest possible prices of the products they offer, which they have achieved through economies of scale. This is the competitive advantage in the case of Walmart that sets it aside from its competitors in the retail and wholesale business segments.

3. Know your business:

Warren Buffet always used to say that never invest in companies whose business you do not understand. There is this famous quote that goes like, “Invest in a wonderful company at a fair price than in a fair company at a wonderful price”.

It means that you should not buy the stock of a company just because you are getting it for cheap. Rather invest in a company that you believe in, understand its business, and has strong fundamentals with competitive management.

They say that think like a business owner and not a stakeholder. This mindset encourages you to focus on long-term value creation, aligning your interest with the company’s success. It also discourages short-term trading which often results in losses.

4. Patience is the key:

Patience is the most important ingredient in the recipe for investing. Trust me there is nothing called as overnight success or the get-quick-rich scheme. To see exceptional results in the stock market you need to have patience because great things are not built in one night.

Legendary investors like Warren Buffet and Charlie Munger are known for their patience and waiting for the right investment opportunities.

5. Value Investing:

Value investing refers to investing in the stock market when others are leaving. Buying the stocks of Underappreciated companies with strong fundamentals, and a simple enough business model for you to understand. The same strategy that helped Warren Buffet accumulate such great wealth.

Always try to invest in businesses and companies in your competence circle. Investing in companies whose business you do not understand or you are unfamiliar with can result in horrendous decision-making.

6. Margin of Safety:

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value. Intrinsic value is the anticipated value of any stock. Based on certain parameters the IV of any stock is computed. Taking into consideration both tangible and intangible factors.

Intrinsic value= Future cash flows(1+ discount rate)#of periods

It is very complicated to calculate the intrinsic value of any stock manually, and individuals can use the stock screeners available online to get the correct IV for any stock.

- If IV>current market price then the share is considered to be undervalued.

- If IV<current market price then the share is considered to be overvalued.

- If IV is almost equal to the market price of the share then we can say that the stock is fairly valued.

Remember, the market swings wildly from day to day and presents large changes in valuation over periods of euphoria and pessimism.

7. Learn from your mistake:

It is not like, that great investors like Warren Buffet and Charlie Munger do not lose money in the market. But the only thing that sets them apart from other investors is that they learn from their mistakes. They acknowledge their errors and view them as learning opportunities. Understand that learning is a continuous and never-ending process and there is no bigger fool than a person who thinks that they know it all.

Read Also: How to invest in dividend stocks in India?

Conclusion

So, concluding the above article we can say that reciprocating the investing style of Warren Buffet and Charlie Munger requires great discipline and patience. Having a long-term vision, and investing in the companies whose business you understand within the circle of your competence can fetch you the same results that you want.

FAQs (Frequently Asked Questions)

What is the stock market?

The stock market also known as the equity or the financial markets is an aggregation of buyers and sellers of financial securities. A person putting his/her money in the stock market could be a trader or an investor. There is no hard and fast rule to distinguish between the two. An investor is a person who generally holds their holding for more than a period of six months, on the other hand, a trader is someone who does not hold the securities for long.

How did Warren Buffet accumulate his wealth?

Warren Buffet has made a massive fortune by investing in the stock market. He has told in one of his interviews that he started his investing journey at the age of 11. Also, Warren Buffet owns the company Berkshire Hathaway which is an American multinational conglomerate holding company.

Are Warren Buffet and Charlie Munger related?

Charles Thomas Munger is the vice chairman of the American conglomerate Berkshire Hathaway. Whereas, Buffet is the chairman of the company and also the largest stakeholder. Buffet has described Munger as one of his closest friends.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.