| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-31-24 | |

| Add new links | Nisha | Feb-25-25 |

- Blog

- hybrid mutual funds

Hybrid Mutual Funds – Definition, Types and Taxation

Have you ever been confused about whether to choose an equity fund or a debt fund? If you choose an equity fund, your portfolio will be subject to numerous risks, including market volatility; however, if you select a debt fund, you will only receive a limited return.

Is there a method to choose between the two? Yes! There is one category of mutual funds known as the Hybrid Category of Mutual Funds.

What is Hybrid Mutual Funds

Hybrid investing involves a combination of asset classes, such as equity and debt. Hybrid funds enable the investor to strike a balance between growth and stability, as exposure to stock allows them to develop wealth. In contrast, exposure to debt reduces the volatility in their portfolio.

A fund’s equity-to-debt ratio varies depending on its aim. Hybrid funds are based on three fundamental philosophies: asset allocation, correlation, and diversification. Asset allocation refers to distributing capital across various asset classes; correlation refers to the relationship between asset movement and return; and diversification refers to having multiple assets in your portfolios.

Hybrid Mutual Funds Features

- The portfolio of the hybrid category of mutual funds includes both equity and debt. Therefore, you can take benefit of both asset classes in a single fund.

- It is suitable for investors who can take moderate risks while investing in mutual funds.

- These funds manage their asset allocation based on market scenarios to take advantage of opportunities and manage risk.

- These funds fall between the debt and equity categories of mutual funds. They are less risky than pure equity funds because their portfolios have debt allocations.

Types Of Hybrid Mutual Funds

As per the SEBI guidelines on categorization of mutual fund schemes, there are seven types of hybrid mutual funds:

- Aggressive Hybrid Fund – These hybrid funds invest at least 65% and up to 80% in equity assets, with the remaining 35% to 20% invested in debt instruments. Because the equity allocation is higher, the fund has the potential for higher returns; nevertheless, the volatility of the portfolio is lowered by the debt portion. The gain from investing in this fund is taxed according to the equity-oriented system.

- Conservative Hybrid Fund—This category of hybrid fund invests 10% to 25% in the equity asset class with the remaining amount, which is around 90% to 75%, invested in debt instruments. Funds in this category provide a lesser but stable return because of the substantial allocation to fixed-income securities.

- Balanced Hybrid Fund – As the name suggests, they are in the middle of Aggressive and Conservative Hybrid Funds. These funds invest 40% to 60% in equity and equity related instruments and 40% to 60% in debt instruments.

- Multi-Asset Allocation Fund—These funds invest in at least three asset classes, with a minimum of 10% allocated to each asset class, while the remaining 70% of total capital can be invested in any asset class. In general, a multi-asset fund combines equity, debt, and gold as uncorrelated asset classes that assist in diversifying the portfolio.

- Dynamic Asset Allocation or Balanced Advantage Fund –As the name implies, these funds can dynamically transform their portfolio from 100% debt to 100% equity based on market conditions. The fund management decides on asset allocation using a financial model that they have constructed. It is suited for investors who want to automate their portfolio’s asset allocation.

- Equity Savings Fund – The fund manager of such funds invests capital in stock, debt, and derivatives. They invest 65% to 100% in equity assets and the remaining 0% to 35% in debt instruments. Investing in such funds decreases the risk by investing in derivatives (for hedging), which reduces direct equity exposure, resulting in lower volatility.

- Arbitrage Fund – The fund manager in this category uses an arbitrage strategy, which involves buying equities in one market and selling them in the other market at the same time to capture the spread. They generate a profit based on the price difference between the two markets. Because there is no directional call on the company, this fund has lower volatility than equity funds and provides returns similar to debt-oriented funds. This scheme’s portfolio invests 65% to 100% of its assets in equities, with the remainder invested in debt (0% to 35%).

Did you know?

Arbitrage mutual funds offer similar returns to and are taxed similarly to equity-oriented funds.

Points to consider before investing in Hybrid Mutual Funds

There are a few things that investors should consider before investing in Hybrid Funds:

- Returns of the hybrid mutual funds are not guaranteed; they will post returns based on the performance of underlying assets.

- Every hybrid fund has its ideal investment horizon. Hence, an investor should account for their investment horizon before making any investment decision.

- Choosing an appropriate hybrid fund for your financial goal is an essential factor to be considered.

- It is not true that hybrid funds are entirely risk-free. Therefore, investors are required to analyze their risk profile before making any investment.

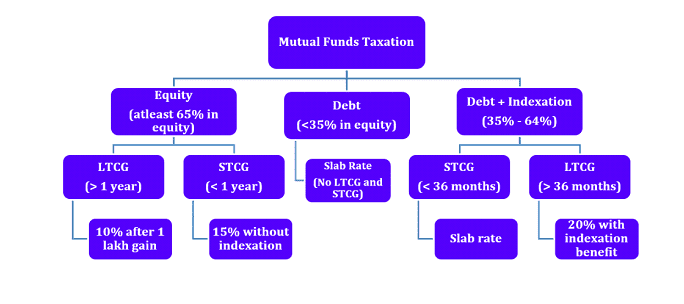

Taxation Of Hybrid Mutual Funds

As we know, hybrid funds are a blend of equity and debt. Thus, they are taxed based on their portfolio composition.

They can be either equity-focused or debt-focused. If equity-focused (at least 65% in equities), then equity taxation will apply else debt taxation. Further, tax rates are different for STCG and LTCG. Have a look at the below chart:

If you want to learn more about the taxation of mutual funds in India, check out our detailed blog on the same: Mutual Funds Taxation in India

Read Also: Types of Mutual Funds in India

Conclusion

On a concluding note, hybrid funds are the best of both equity and debt and a versatile, balanced investment option for investors.

When investors are unsure between equity and debt funds, they can choose hybrid mutual funds. But before investing in hybrid funds, you must align your financial goals according to your needs, after which you must analyze the fund on qualitative and quantitative parameters.

Along with this, we always suggest discussing this with your financial advisor before investing.

Frequently Asked Questions (FAQs)

How many types of Hybrid mutual funds are there?

There are seven types of hybrid funds: balanced hybrid funds, equity savings funds, arbitrage funds, conservative hybrid funds, aggressive hybrid funds, multi-asset funds, and dynamic asset allocation funds.

Which hybrid fund is suitable for me?

The suitability of a hybrid fund depends upon an individual’s risk tolerance, capacity, investment goal, and horizon.

Is hybrid fund equity or debt?

The portfolio composition of a hybrid fund consists of both equity and debt; the proportion depends upon the category of the hybrid fund.

How are hybrid funds taxed?

Hybrid funds are taxed based on the portfolio’s debt and equity composition.

How does an arbitrage fund work?

Arbitrage funds take advantage of the price difference between the two markets to generate profit. They provide returns similar to debt funds and taxed as equity-oriented funds.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.