| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-01-24 |

- Blog

- icici vs hdfc bank

ICICI Vs HDFC Bank: Which Has Larger Market Capitalization?

You save a lot of money and put in a lot of work, but you need help determining where to keep it. It is only possible to retain some of your hard-earned savings at home; opening a bank account is your only option. You might be surprised to hear that banks where you have accounts allow you to invest in their business.

If you’re wondering “ICICI or HDFC, which is better” for your investment and banking needs. This blog post will compare ICICI Bank and HDFC Bank.

ICICI Bank Overview

ICICI Bank is among the biggest banks in India’s private sector. The government of India established the Industrial Credit and Investment Corporation of India (ICICI) on 5 January 1955. As a division of ICICI Limited, ICICI Bank was founded in 1994. It made history by being the first Indian bank and firm to list on the New York Stock Exchange. ICICI and ICICI Bank combined to form a new financial organization to increase business efficiency. Following accusations against Chanda Kochhar, the managing director of ICICI Bank, in 2018 about inappropriate lending practices, Sandeep Bakhshi assumed the role of managing director. It was the first bank to provide contactless credit and debit cards.

HDFC Bank Overview

With its headquarters in Mumbai, HDFC Bank was established in 1994 as a subsidiary of HDFC Ltd. The Reserve Bank of India granted it a banking license in January 1995. In November 1995, the bank launched its Initial Public Offering (IPO) and became a listed company on the Bombay Stock Exchange and the National Stock Exchange. In 2000, the Times Bank merged with HDFC Bank. HDFC Bank acquired Centurion Bank of Punjab to increase its branch network and clientele. Aditya Puri was replaced as the bank’s CEO by Sashidhar Jagdishan.

Read Also: Axis Bank vs ICICI Bank

HDFC and ICICI Bank Comparative Study

| Particular | ICICI Bank | HDFC Bank |

|---|---|---|

| Current Share Price | 1,199.6 | 1,683.8 |

| Market Capitalization (Crores) | 8,44,061 | 12,81,055 |

| 52 Week High Price | 1,235 | 1,757.5 |

| 52-Week Low Price | 899 | 1,363.55 |

| FIIs Holdings (%) | 44.77 | 47.83 |

| DIIs Holdings (%) | 45.62 | 33.59 |

| Book Value per Share | 383.78 | 596.39 |

| PE Ratio (x) | 18.63 | 20 |

The table above indicates that HDFC Bank has a higher market capitalization than ICICI Bank and that FIIs own a larger interest in it. In contrast, DIIs own just 33.59% of HDFC Bank and 45.62% of ICICI Bank.

Read Also: HDFC Bank vs Axis Bank

HDFC and ICICI Bank Financial Statements Comparison

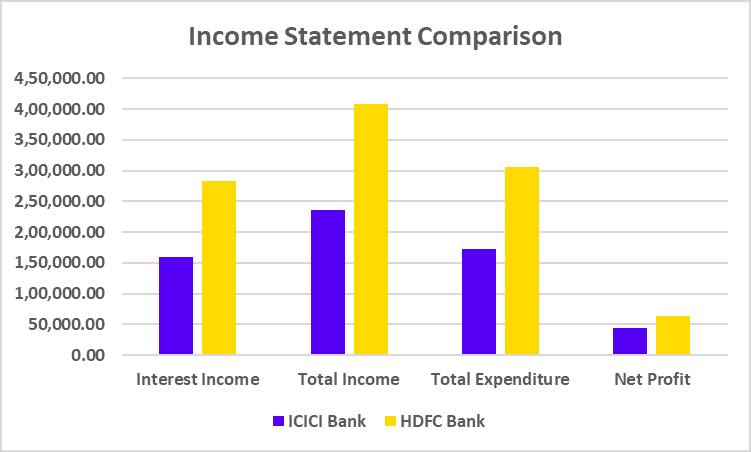

Income Statement Comparison (FY 2024)

| Particular | ICICI Bank | HDFC Bank |

|---|---|---|

| Particular | ICICI Bank | HDFC Bank |

| Interest Income | 1,59,515.92 | 2,83,649.02 |

| Total Income | 2,36,037.72 | 4,07,994.77 |

| Total Expenditure | 1,71,890.95 | 3,06,407.89 |

| Net Profit | 44,256.37 | 64,062.04 |

According to the above income statement, HDFC Bank has a larger interest income than ICICI Bank. It also reported a profit in the most recent fiscal year (2024) of 64062.04 crores, 44% more than ICICI Bank.

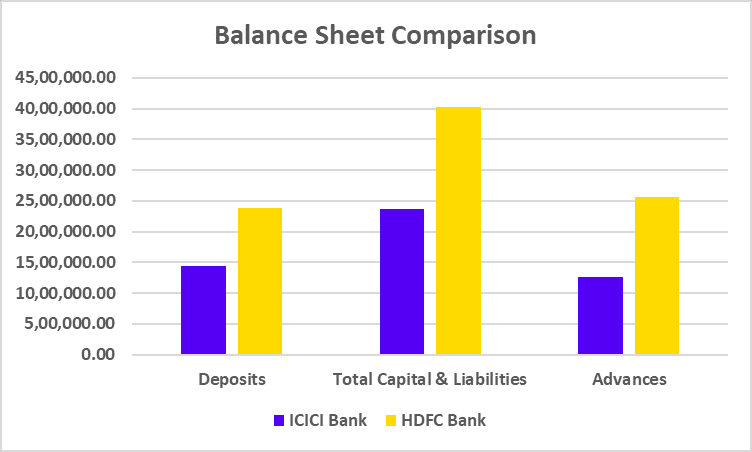

Balance Sheet Comparison

| Particular | ICICI Bank | HDFC Bank |

|---|---|---|

| Particular | ICICI Bank | HDFC Bank |

| Deposits | 14,43,579.95 | 23,76,887.28 |

| Total Capital & Liabilities | 23,64,063.03 | 40,30,194.26 |

| Advances | 12,60,776.20 | 25,65,891.41 |

The statistics above indicate that HDFC Bank outperforms ICICI Bank regarding deposits and advances.

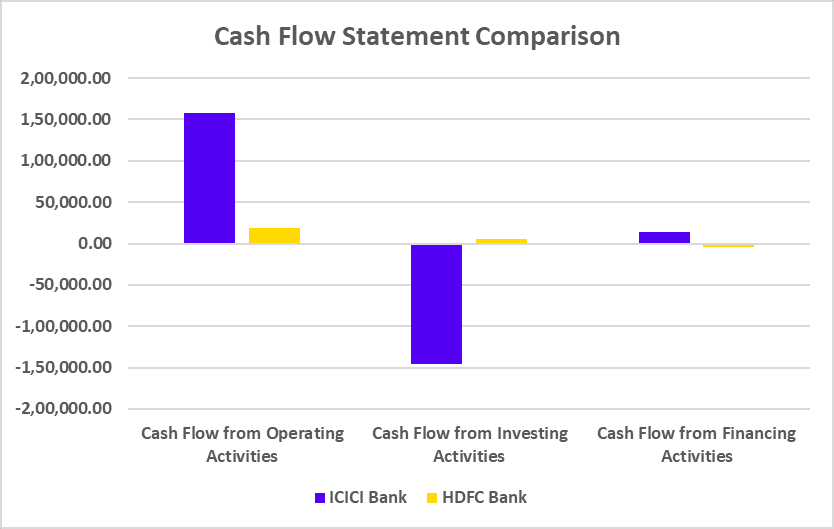

Cash Flow Statement Comparison

| Particular | ICICI Bank | HDFC Bank |

|---|---|---|

| Cash Flow from Operating Activities | 1,57,284.48 | 19,069.34 |

| Cash Flow from Investing Activities | (1,45,931.09) | 5,313.77 |

| Cash Flow from Financing Activities | 13,764.51 | (3,983.06) |

HDFC and ICICI Bank Key Performance Indicators

| Particular | ICICI Bank | HDFC Bank |

|---|---|---|

| Net Interest Margin (%) | 3.61 | 3.21 |

| Net Profit Margin (%) | 28.21 | 23.07 |

| ROCE (%) | 3.33 | 2.85 |

| Capital Adequacy Ratios (%) | 16.33 | 18.80 |

From the preceding table, we may infer that ICICI Bank has a bigger net profit margin than HDFC Bank and a higher net interest margin.

Read Also: HDFC vs SBI

Conclusion

The comparison of India’s biggest private sector banks presented above leads us to conclude that while HDFC Bank has more revenue and profits overall, ICICI Bank posts higher profit margins even with less revenue. Although every bank has something special to offer, we always advise speaking with an investment expert before making investment decisions.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | SBI vs ICICI Bank |

| 2 | PNB vs Bank of Baroda |

| 3 | Bank of Baroda vs SBI |

| 4 | Bank of Baroda vs Canara Bank |

| 5 | PNB vs SBI |

Frequently Asked Questions (FAQs)

ICICI Bank and HDFC Bank, which has the larger market capitalization?

Compared to ICICI Bank, HDFC Bank has a larger market capitalization.

After Chanda Kochhar, who becomes the MD of ICICI Bank?

After Chanda Kochhar left ICICI Bank, Sandeep Bakshi became the MD.

Which bank is more profitable than HDFC Bank or ICICI Bank?

ICICI Bank’s net profit margin is higher than that of HDFC Bank, even though HDFC Bank reported a profit of 64,062 crores, 19,806 crores more than that of ICICI Bank.

Which person oversees HDFC Bank as managing director?

The managing director of HDFC Bank at the moment is Mr Sashidhar Jagdishan.

In India, which private bank has the largest market capitalization?

HDFC Bank has the largest market capitalization of all the private banks in India.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.