| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-07-24 |

- Blog

- indigo vs spicejet

IndiGo vs SpiceJet: Which is Better?

IndiGo and SpiceJet have been important in shaping India’s aviation industry with their unique business models and operational strategies.

In today’s blog, we will take a closer look at their development and growth to gain valuable insights into the financial health of these two aviation giants.

IndiGo – An Overview

The largest and most popular passenger airline in India is InterGlobe Aviation Ltd., better known as IndiGo. Rakesh Gangwal, an Indian entrepreneur living in the US, and Rahul Bhatia of InterGlobe Enterprises established the business as a private company in 2006. The company was originally incorporated in Lucknow in 2004, and in 2006, it was converted into a public limited company, and the name was changed to InterGlobe Aviation Limited. It commenced operations in August 2006 with a fleet of 100 Airbus A320-200 aircraft. IndiGo has a strong record for punctuality, ensuring reliable travel experiences.

It operates over 2000 daily flights to 122 destinations, including 88 domestic and 34 international locations. With a fleet of over 370 aircraft, IndiGo ensures excellent connectivity and convenience for its passengers. The primary source of income for IndiGo is passenger fares.

The airline has the capability to attract a decent number of passengers through its competitive pricing and extensive network and maximizes its revenue by offering ancillary services such as baggage fees, seat selection, in-flight meals, and priority boarding. It also transports cargo, which contributes to its overall revenue.

SpiceJet – An Overview

SpiceJet is a prominent low-cost airline in India that is well-known for its affordable fares and extensive network. The airline was established in 2005 and has grown rapidly, becoming a major force in the Indian aviation sector. Originally founded as an air taxi provider in 1994, the company was known as ModiLuft. The business was bought and rebranded as SpiceJet by Indian businessman Ajay Singh in 2004.

The airline formally began operations with two Boeing 737-800 aircraft in May 2005. In terms of market share, it was ranked third among low-cost carriers in India by 2008, behind IndiGo and Air Deccan. SpiceJet provides various services, including discount coupons, travel insurance, tour packages, and flight reservations.

Read Also: Swiggy Vs Zomato

Comparative Analysis

| Particular | IndiGo | SpiceJet |

|---|---|---|

| Current Share Price | INR 4,830 | INR 62.6 |

| Market Capitalisation (in INR crore) | 1,86,551 | 4,964 |

| 52-Week High | INR 4,945 | INR 77.5 |

| 52-Week Low | INR 2,333 | INR 31 |

| FII Holdings (%) | 24.43 | 1.81 |

| DIIs Holdings (%) | 15.43 | 5.16 |

| Book Value per Share | INR 50 | INR -33 |

| PE Ratio (x) | 23.9 | -9.25 |

Financial Statements Analysis

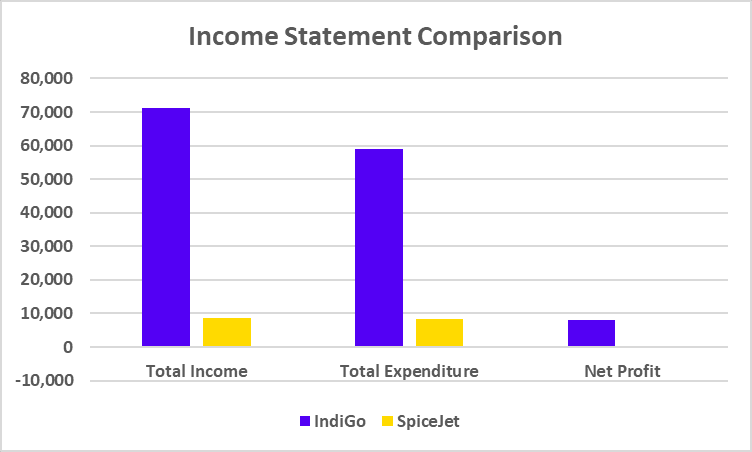

Income Statement

| Particulars | IndiGo | SpiceJet |

|---|---|---|

| Total Income | 71,231 | 8,524 |

| Total Expenditure | 59,012 | 8,482 |

| Net Profit | 8,172 | -423 |

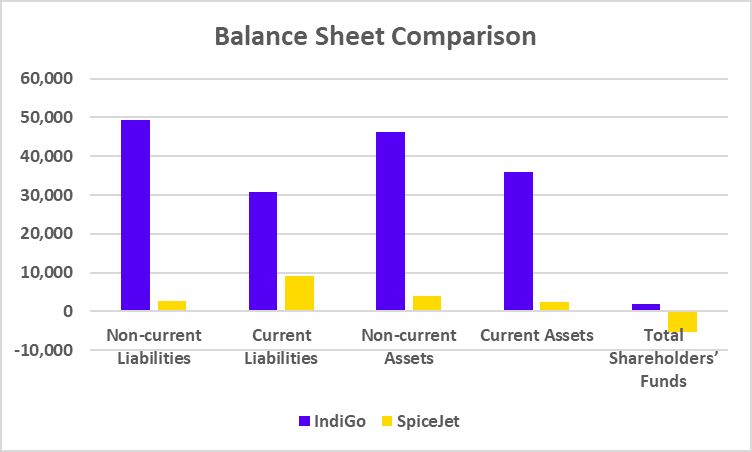

Balance Sheet

| Particulars | IndiGo | SpiceJet |

|---|---|---|

| Non-current Liabilities | 49,429 | 2,591 |

| Current Liabilities | 30,798 | 9,099 |

| Non-current Assets | 46,371 | 3,962 |

| Current Assets | 35,853 | 2,510 |

| Total Shareholders’ Funds | 1,996 | -5,217 |

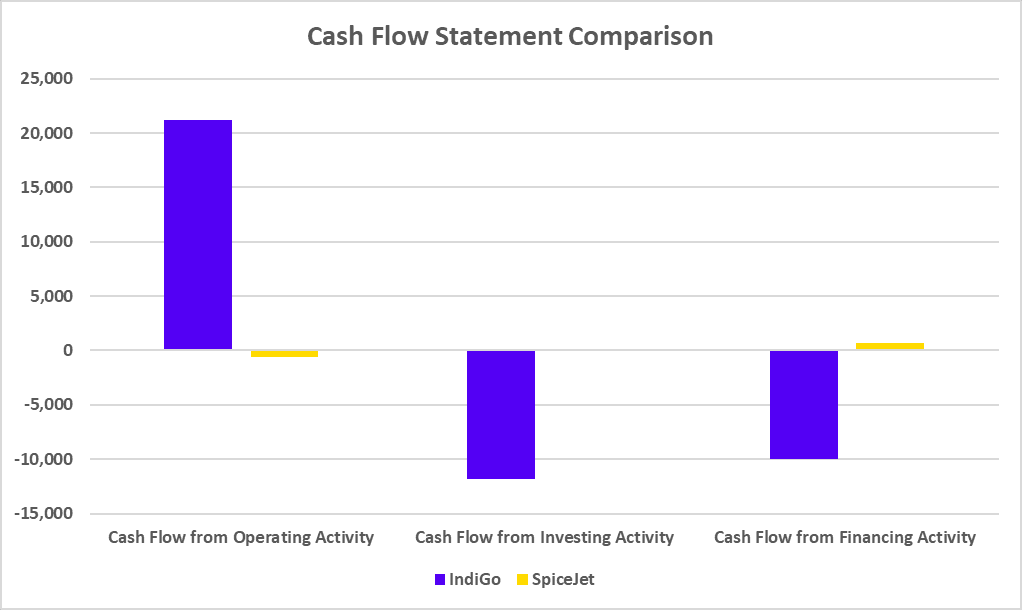

Cash Flow Statement

| Particulars | IndiGo | SpiceJet |

|---|---|---|

| Cash Flow from Operating Activity | 21,217 | -595 |

| Cash Flow from Investing Activity | -11,808 | 35 |

| Cash Flow from Financing Activity | -9,978 | 730 |

*(All Figures in INR crore unless stated otherwise).

Read Also: Flair Vs DOMS

Key Performance Indicators

| Particulars | IndiGo | SpiceJet |

|---|---|---|

| Net Profit Margin (%) | 11.86 | -5.98 |

| ROE | 409.35 | 0 |

| ROCE | 23.75 | -1.58 |

| Current Ratio | 1.16 | 0.28 |

| Debt-to-Equity | 0.95 | -0.22 |

Conclusion

IndiGo and SpiceJet are both major players in India’s aviation industry. However, there are differences in their strategies and operations. IndiGo is recognized as the dominant airline, with a strong focus on punctuality, customer service, and an extensive network. Standardizing its fleet to increase operational efficiency has been a key factor in its success. On the other hand, SpiceJet has followed a highly aggressive expansion strategy, capitalizing on its extensive network and competitive pricing to attract a significant customer base. While both airlines share a common goal of providing affordable air travel, their distinct approaches have led to different market positions. It is advised to consult a financial advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Bharat Petroleum vs Hindustan Petroleum |

| 2 | Apollo Hospitals vs Fortis Healthcare: |

| 3 | MRF vs Apollo Tyres |

| 4 | IndiGo vs SpiceJet |

| 5 | NHPC vs NTPC |

Frequently Asked Questions (FAQs)

Which airline is larger: IndiGo or SpiceJet?

IndiGo is considered the larger airline, with a broader customer base and a larger fleet.

Which airline, IndiGo and SpiceJet, covers more international destinations?

Both airlines have expanded their international operations, but IndiGo generally covers a wider range of international destinations.

How do IndiGo and SpiceJet maintain low fares?

They achieve low fares through efficient operations, fleet standardization, and cost-cutting measures.

How have IndiGo and SpiceJet affected India’s aviation industry?

They have made air travel more accessible and affordable for millions of people.

What can we expect from IndiGo and SpiceJet in the future?

Both airlines are likely to continue expanding their operations and improving their services to remain competitive in the Indian aviation sector.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.