| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-07-24 |

Aadhar Housing Finance: IPO And Key Insights

If you want to buy a house but don’t have enough money, you’ll go to a bank and ask for a loan. But what if they say no? Is there another way to secure a loan and buy the house of your dreams? Indeed, some businesses offer housing loans to individuals and are governed by the Reserve Bank of India.

In this blog, we will introduce you to Aadhar Housing Finance, a company that plans to go public this May 2024.

Company Overview

India’s largest housing finance company is Aadhar Housing Finance Limited, founded in 2010 by the Dewan Housing Finance Corporation Limited (DHFL). The company targets consumers with monthly incomes of INR 5,000 to INR 50,000 and higher. Its primary goal is to provide inexpensive solutions to the lower and middle classes. It offers house loans for various purposes, including home improvements, purchases, and extensions.

The company joined forces with DHFL Vysya in 2017, and on 4 December 2017, the combined entity was rebranded as Aadhar Housing Finance. This merger expanded the company’s reach throughout India.

A prominent investment business with an AUM of $991 billion, Blackstone, also known as BCP Topco VII Pte. Ltd., promotes Adhar Housing Finance Limited. They own around 98.72% of the company’s stock, and ICICI Bank holds 1.18%.

Aadhar Housing in Numbers (As per Prospectus)

- Total loan disbursement by the company is nearly INR 5,903 crores, with a total AUM of INR 17,233 crores.

- The company is present across 20 states and union territories and has more than 479 offices and branches.

- It has more than 2,33,000 active loan accounts.

- The company has 4700+ channel partners and 11600+ Aadhar Mitras, to whom they offer referral fees for sourcing customers.

- As of September 2023, the company had 3,695 employees, and its subsidiary, Aadhar Sales and Services Private Limited (ASSPL), had 1,851 employees.

Details of IPO

An initial public offering (IPO) of Aadhar Housing Finance will comprise an INR 2,000 crore offer for sale and an INR 1,000 crore new issue. The IPO price range is INR 300 to 315 per share, with a minimum lot size of 47 shares. The proceeds from the IPO issue will be used for general corporate purposes, lending, and future capital requirements.

Key Details

| Face Value of Share | INR 10 |

| Price Band | INR 300 to INR 315 per share |

| Employee Discount | INR 23 per share |

| Market Lot | 47 Shares |

| Total Fresh Issue Size (INR) | 1,000 crores |

| Total offer for sale (INR) | 2,000 crores |

Timeline

| IPO Open Date | 8th May 2024 |

| IPO Close Date | 10th May 2024 |

| Finalization of Allotment | 13th May 2024 |

| Refund and credit of shares | 14th May 2024 |

| Listing Date | 15th May 2024 |

Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50% of the issue |

| NII Shares | Not less than 15% of the issue |

| Retail Shares Offered | Not less than 35% of the issue |

| Total Shares Offered | 95,238,095 |

Financial Highlights

Let’s have a look at the financials of the company:

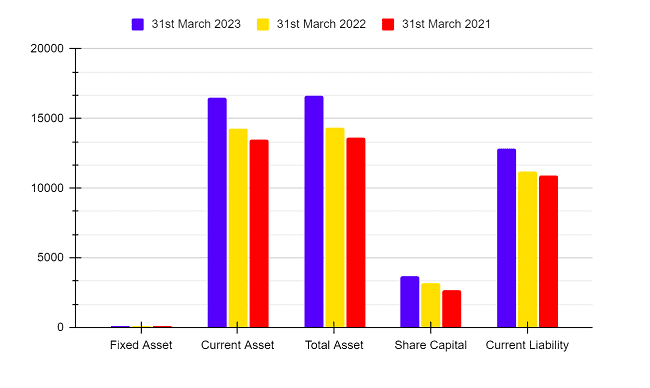

Balance Sheet (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Fixed Asset | 122.2 | 116.76 | 130.66 |

| Current Asset | 16,495.67 | 14,259.05 | 13,499.67 |

| Total Asset | 16,617.87 | 14,375.81 | 13,630.33 |

| Share Capital | 3,697.66 | 3,146.69 | 2,692.82 |

| Current Liability | 12,872.42 | 11,180.79 | 10,890.64 |

The above chart shows that while the company’s current liabilities are increasing at a rate of 15% on a year-over-year basis, its current assets are expanding. They were INR 14,259 crores in FY 2022 and climbed to INR 16,495 crores in FY 2023.

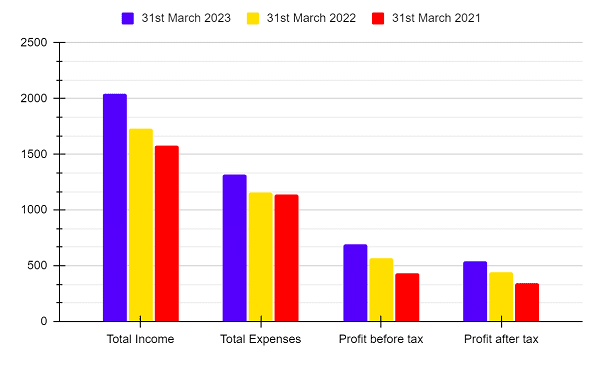

Income Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Total Income | 2,043.52 | 1,728.56 | 1,575.55 |

| Total Expenses | 1,322.70 | 1,161.20 | 1,143.04 |

| Profit before tax | 695.82 | 567.36 | 432.51 |

| Profit after tax | 544.76 | 444.85 | 340.13 |

The company’s overall income went from INR 1,728 crores in FY 2022 to INR 2,043 crores in FY 2023. In contrast, the company’s profit after taxes climbed at an average rate of 22% in FY 2023 and 30% in FY 2022 relative to their prior years.

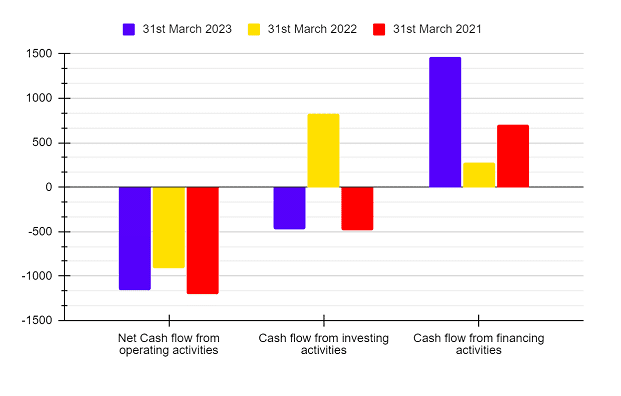

Cash Flow Statement (INR crore)

| Particulars | 31st March 2023 | 31st March 2022 | 31st March 2021 |

|---|---|---|---|

| Net Cash flow from operating activities | -1,155.69 | -906.75 | -1,202.29 |

| Cash flow from investing activities | -476.53 | 822.57 | -480.48 |

| Cash flow from financing activities | 1,463.19 | 274.85 | 701.39 |

Strength and Weakness of the Company

Strength

- The company has a solid and comprehensive process to track the underwriting, collections, and asset quality.

- A vast network of branches and sales channels also helps the company increase its loan growth rate.

- The company’s profit after tax has been increasing for the last three years, which indicates that the company has been performing well.

Weakness

- Any unfavourable change in interest rates by the regulator, i.e., RBI, can significantly impact their profit margin.

- If the company fails to effectively mitigate the risks associated with the loans it extends to the public, non-performing assets will rise, thus compromising the quality of its loan portfolio.

- The company has had negative cash flow from operating activities for the past three years. However, remember that most companies operating in the lending business have a negative operating cash flow because lending is the operational activity of such companies.

Awards and Recognitions

- The company has been awarded “Pradhan Mantri Awas Yojana – Empowering India 2022” for its significant contribution towards housing for all initiatives.

- It has also won the “Best Data Transformation” award by Elets Technomedia for being a data-driven organization.

- The Economic Times recognized Aadhar Housing Finance as one of the best brands of 2022.

- Synex Group awarded the company “Resilient Organisation of the Year” at the India Credit Risk Management Summit 2023.

Read Also: What is the IPO Cycle – Meaning, Processes and Different Stages

Conclusion

Aadhar Housing Finance, one of India’s biggest housing finance companies, is coming with an IPO. Along with its income, the company’s profitability is rising yearly, even though its net interest margin decreased in FY 2023 compared to FY 2022. If you are planning to apply for the IPO of this company, then you must go through all the risk factors and consult your investment advisor before making any investment decision.

Frequently Asked Questions (FAQs)

When will the Aadhar Housing Finance IPO open?

Aadhar Housing Finance IPO will open from May 8th, 2024, to May 10th, 2024, and an investor within these three days can apply for it.

When was Aadhar Housing Finance established?

The company was founded in 2010 by the Dewan Housing Finance Corporation Limited (DHFL).

Is Aadhar Housing Finance a profit-making company?

Indeed, the company has reported a profit for the previous three years. In FY 2023, it reported a profit of INR 544.76 crores, a 22% YoY increase.

What is the minimum lot size that retail investors can subscribe to?

A retail investor is required to subscribe to a minimum of 1 lot of 47 shares amounting to INR 14,805.

What is the tagline of Aadhar Housing Finance?

The tagline of the company is “Ghar Banega, Toh Desh Banega”.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.