| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-27-24 | |

| Add new links | Nisha | Feb-25-25 |

AWFIS Space Solutions Limited: IPO Analysis and Case Study

Do you aspire to become an entrepreneur but feel frustrated searching for an office that meets your needs? Whether you are a freelancer needing a quiet corner or a startup seeking a collaborative space, finding the right fit can be difficult. This was the exact problem that led to the birth of Awfis Solutions, a company that has now transformed the Indian workspace landscape. Let us explore the inspiring journey of Awfis Space Solutions and discover their upcoming IPO details.

AWFIS Space Overview

Awfis Solutions is a workspace provider in India focusing on flexible solutions. The company was established in 2015 by Amit Ramani. They cater to diverse clients, from individuals and startups to small and medium businesses (SMEs), and even large corporations. If you need a permanent office setup, Awfis can also provide customised solutions. This allows you to access workspaces in different locations as needed. It aims to create a professional and collaborative work environment through its tech-enabled platforms and premium infrastructure.

AWFIS Space Solutions Business Model

Awfis Solutions offers a variety of office solutions, from individual desks to custom offices, for different types of companies, including startups, small and medium enterprises, and large corporations. Clients can opt for these solutions for periods spanning from one hour to several years.

As of June 30, 2023, the company had 136 centres across 16 cities in India, offering a remarkable 81,433 seats.

Over a while, the company has successfully transformed from a mere co-working space into a highly sophisticated and comprehensive integrated workspace solutions platform.

Moreover, Awfis Solutions has expanded its offerings to include Awfis Connect, a networking and community engagement platform, to foster collaboration and connectivity among our clients. This comprehensive suite of services positions the company as a one-stop solution provider for all flexible workspace needs.

Additionally, the company offers a variety of ancillary services. These services include food and beverage options, IT support services, infrastructure services such as storage and customisation, and event hosting and meeting arrangements.

Workspace Formats

Awfis has two different workspace formats, each with its unique features, branding, target audience, and purpose. These two formats are:

Awfis Value Offerings: It is the company’s core standard format that targets the value customer segment, delivering high-quality designs and infrastructure across key micro-markets in Tier 1 and 2 cities.

Awfis Gold premium Offerings: It includes premium workspace solutions, designed for the company’s discerning customer segment. These workspaces are strategically located across Grade A buildings in the prime micro-markets of Tier 1 cities such as Mumbai, Bangalore, Hyderabad, Kolkata, and Chennai.

The company has implemented two distinct models for obtaining and maintaining workspaces: the Straight Lease (SL) and the Managed Aggregation (MA) Models.

Under the SL model, developers or space owners lease space to flexible workspace operators on traditional leases. These leases have specific market terms and conditions, such as a fixed monthly, rental, common area maintenance charges, security deposit, minimum lock-in period, lease tenure, and escalations.

In the MA model, developers or space owners usually pay for part or all of the fit-out costs, while the operator (if there is one) covers the rest. They might also give up fixed rent for a minimum guarantee and receive a share of the revenue or profit based on pre-arranged terms.

The MA arrangements are generally based on a profit or revenue-sharing model with the space owner and include a minimum guarantee payment, which usually starts between the 5th and 13th month of operations and continues until the end of the contract term.

The company is currently operating in all Tier 1 cities and seven Tier 2 cities, totalling 16 cities and 48 micro markets across India.

Read Also: Apply in IPO Through ASBA- IPO Application Method

AWFIS Space Solutions Key IPO Details

| IPO Date | May 22, 2024 to May 27, 2024 |

| Price Band | INR 364 to INR 383 per share |

| Lot Size | 39 Shares |

| Total Issue Size | 15,637,736 shares |

| Fresh Issue | 3,342,037 shares |

| Offer for Sale | 12,295,699 shares |

| IPO Type | Book Built Issue IPO |

| IPO Open Date | Wednesday, May 22, 2024 |

| IPO Close Date | Monday, May 27, 2024 |

| Basis of Allotment | Tuesday, May 28, 2024 |

| Initiation of Refunds | Wednesday, May 29, 2024 |

| Listing Date | Thursday, May 30, 2024 |

Objectives of the Issue

The Company aims to utilise the Net Proceeds towards funding capital expenditure (establishment of new centres), funding the working capital requirements, and general corporate purposes.

Consolidated Financial Statements

Let’s have a look at the financials of the company:

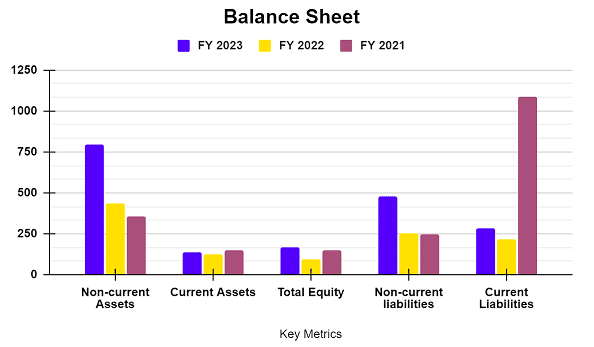

Balance Sheet (in INR crore)

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Non-current Assets | 791.97 | 437.56 | 357.7 |

| Current Assets | 138.62 | 122.12 | 150.87 |

| Total Equity | 169.36 | 94.72 | 150.75 |

| Non-current Liabilities | 480.78 | 251.91 | 248.82 |

| Current Liabilities | 280.45 | 213.05 | 1,089.46 |

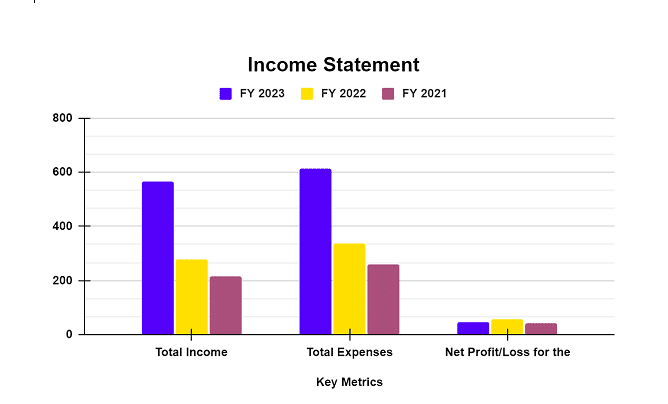

Income Statement (In INR Crore)

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Total Income | 565.78 | 278.71 | 216.02 |

| Total Expenses | 612.42 | 335.87 | 258.66 |

| Net Profit / (Loss) | -46.63 | -57.15 | -42.64 |

Cash Flow Statements

| Key Metrics | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Net cash flow from operating activities | 195.18 | 82.69 | 57.44 |

| Net cash flow used in investing activities | -170.1 | -7.21 | -37.73 |

| Net cash flow used in financing activities | -27.77 | -79.85 | -16.68 |

| Cash and cash equivalents at the end of the period/year | 2.61 | 5.3 | 9.68 |

Ratio Analysis

| Key Ratios | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| ROCE | 25.26% | 1.75% | 10.88% |

| EBITDA Margin | 42.01% | 32.29% | 31.12% |

| Return on Net worth | (28.29) % | (60.34) % | (27.54) % |

| Debt to equity ratio | 0.06 | 0.13 | 0.02 |

Real Also: What is Grey Market Premium (GMP) in IPOs?

Financial Statements – Key Insights

- The company’s revenue appears to be growing. However, it has not been profitable, with negative earnings per share for the past three years.

- ROCE has shown a significant improvement, going from 10.88% in March 2021 to 42% in FY 2023 which suggests that the company is getting better at generating returns on the capital it uses.

To sum it up, the company is in its growth stage, and focusing on market expansion over immediate profitability.

Conclusion

Awfis Solutions is committed to providing workspace solutions for all types of users through innovation and adaptation. From a single co-working space in Delhi to a nationwide network of premium offices, the company has achieved remarkable growth. The upcoming IPO and emphasis on expansion position the company to sustain its growth trajectory and play a pivotal role in shaping the future of workspaces in India.

FAQs (Frequently Asked Questions)

What are the benefits of using Awfis Space Solutions?

Benefits include flexibility, affordability, access to a professional work environment, and various other amenities like IT support, and meeting rooms.

Does the company offer anything besides workspace?

Yes, Awfis provides additional services like food and beverage, infrastructure management, IT support, and event hosting.

What is the minimum lot size for applying to the Awfis IPO?

The minimum lot size for applying to the Awfis IPO is 39 shares.

When will I know if my IPO application was successful?

The allotment of shares is expected to be finalised by May 28th, 2024. And, the listing date of the IPO is 30 May 2024.

Should I invest in Awfis Space Solutions IPO?

It entirely depends on your risk profile and investment style. Go through the company’s financials, and market conditions, and consult a financial advisor before making the investment decision.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.