| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Apr-03-24 | |

| Add new links | Nisha | Feb-27-25 |

- Blog

- irfc case study business model kpis financials and swot analysis

IRFC Case Study: Business Model, KPIs, Financials, and SWOT Analysis

Indian Railway Finance Corporation (IRFC) was established on December 12, 1986, as the dedicated financing arm of the Indian Railways for mobilizing funds from domestic and overseas Capital Markets. Today’s blog will cover the business model, KPIs, financials, and SWOT analysis of IRFC.

IRFC Overview

Indian Railways (IR), with its 4th largest network in the world, has been the backbone of the transportation sector in India. It carries millions of passengers and cargo from one part of the country to the other. IRFC has played a strategic role in supporting the Indian Railways Infrastructure Development Plan.

IRFC was established on December 12, 1986. It mainly focuses on funding the acquisition of rolling stock assets, leasing of railway infrastructure assets and national projects of the Government of India, and financing other firms under the Ministry of Railways (MOR).

Vision

The vision of the company is to be an important and premier Financial Services Company for the growth of the Rail Transport Sector while maintaining a balanced relationship with the Ministry of Railways (MOR).

Objectives

The company’s primary objectives are as follows:

- To drive resources via market borrowings from domestic as well as Overseas Capital Markets at the most competitive rates & terms.

- To examine the possibility of funding CPSEs and other institutions for the development of rail infrastructure to ensure future growth and profitability.

- To ensure optimum utilization of resources.

- To make prudent use of derivatives and other acquiring products for risk mitigation at the right moment and cost.

Business Model

The company operates a low-risk, cost-plus business model, which helped them to record 0 GNPA (Gross Non-Performing Assets). It recorded low overheads, administrative costs, and high operational efficiency during the recent quarter. Furthermore, the Indian Railway Finance Corporation enjoys 0 tax liability as it is exempted from the RBI’s asset classification norms, provisioning norms, and exposure norms to the extent of direct access to the Ministry of Railways (MoR).

Outlook

In the future, the strategy initiatives of the company will revolve around diversifying its lending portfolio to broaden its horizons, venture further into financing the railway ecosystem, and maintain competitive borrowing costs. IRFC’s monopoly as the sole financier for the Indian Railways’ capital expenditure needs places it in a unique position to benefit from the sector’s growth. The Indian government’s ambitious plans for railway modernization and expansion, including dedicated freight corridors, high-speed rail projects, and station reconstruction, are likely to impact its growth substantially.

Market Details

| Market Cap | ₹ 189,885 Cr. |

| TTM P/E | 31.45 |

| ROCE | 5.32 % |

| Current Price | ₹ 145 |

| Book Value | ₹ 34.79 |

| ROE | 14.7 % |

| 52 Week High / Low | ₹ 192.8 / 26.7 |

| Dividend Yield | 1.03 % |

| Face Value | ₹ 10.0 |

Read Also: IRCTC Case Study: Business Model, Financials, and SWOT Analysis

Financial Highlights of IRFC

Income Statement

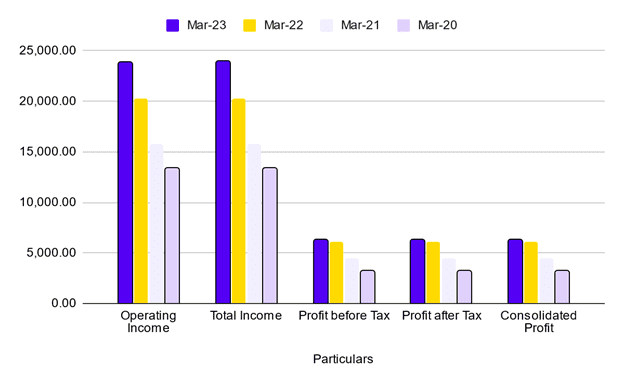

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Operating Income | 23,891.83 | 20,299.26 | 15,770.47 | 13,421.02 |

| Total Income | 23,932.63 | 20,301.60 | 15,770.86 | 13,421.09 |

| Profit before Tax | 6,337.01 | 6,090.16 | 4,416.13 | 3,192.10 |

| Profit after Tax | 6,337.01 | 6,089.84 | 4,416.13 | 3,192.10 |

| Consolidated Profit | 6,337.62 | 6,090.40 | 4,416.13 | 3,192.06 |

The graph indicates a substantial growth in operating income, which translated into a growing trend of consolidated profit.

Balance Sheet

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Non-Current Liabilities | 4,18,940.02 | 3,88,428.38 | 3,20,222.34 | 2,30,522.99 |

| Current Liabilities | 26,736.41 | 20,567.97 | 24,994.56 | 17,229.13 |

| Non-Current Assets | 7,455.42 | 1,373.1 | 702.3 | 1,828.8 |

| Current Assets | 4,83,691.33 | 4,48,619.56 | 3,80,427.98 | 2,76,223.08 |

The table indicates the concentration of assets in current assets and the concentration of liabilities in non-current liabilities. This could bring substantial issues in the long run.

Cash Flow Statement

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| Cash From Operating Activities | -28,583.83 | -64,412.28 | -89,906.65 | -62,700.61 |

| Cash Flow from Investing Activities | 0.09 | -4.72 | 0.42 | 1.47 |

| Cash from Financing Activities | 28,643.28 | 64,266.30 | 90,202.04 | 62,696.81 |

| Net Cash Inflow / Outflow | 59.54 | -150.7 | 295.81 | -2.33 |

The table above indicates a very dire situation for the organization. The company seems to be borrowing very heavily to meet its operational needs. This can lead to significant issues in the long run.

Profitability Ratio

| Particulars | Mar-23 | Mar-22 | Mar-21 | Mar-20 |

|---|---|---|---|---|

| ROCE (%) | 5.32 | 5.12 | 5.02 | 5.76 |

| ROE (%) | 14.66 | 15.84 | 13.34 | 11.54 |

| ROA (%) | 1.35 | 1.47 | 1.34 | 1.31 |

| Net Margin (%) | 26.48 | 30.00 | 28.00 | 23.78 |

| Cash Profit Margin (%) | 26.58 | 30.07 | 28.03 | 23.79 |

The company’s profitability situation has been consistent for the past 4 years. This can be seen from its consistent ROCE, Net Margin, and ROE.

Read Also: CAMS Case Study: Business Model, KPIs, and SWOT Analysis

SWOT Analysis of IRFC

Strengths

- The company has seen massive funding requests from Indian Railways, resulting in consistent revenue growth.

- IRFC’s low-cost business model helps the business to maintain effective operational efficiency.

Weaknesses

- The higher interest payment for borrowings can be concerning in coming years.

- The company’s cash flow situation is pretty dire as the majority of the inflow comes from financing activities, which is not a long-term source of funds.

Opportunities

- The company’s income potential is primarily reliant on the expanding infrastructure of Indian Railways.

- The current government’s policies for the sector’s growth may generate a strengthened business position in the upcoming time.

Threats

- The company’s debt position exposes it to the risk of financial burden. This can lead to stress on bottom line figures during periods of losses.

Conclusion

Indian Railway Finance Corporation (IRFC) is the dedicated financing arm of the Indian Railways (IR) for mobilizing funds. The company enjoys a healthy position on the outlook front as the current government encourages the sector. With a strong business model and government support, IRFC is well-positioned for growth and success in the future. However, its financials do not portray a healthy picture of the company.

Therefore, it is advised that you perform your analysis before investing your hard-earned money.

Frequently Asked Questions (FAQs)

What is the role of IRFC in the railway?

IRFC (Indian Railway Finance Corporation) is the dedicated funding arm of Indian Railways. The company was incorporated to mobilize funds from domestic and overseas markets to meet the extra budgetary resources requirement of Indian Railways.

What is the source of IRFC’s funds?

IRFC utilizes various sources, including taxable and tax-free bond issuances, capital gain bonds, term loans from banks/financial institutions, external commercial borrowings, internal accruals, asset securitization, and lease financing, to fulfil funding needs.

Is IRFC tax-free?

IRFC enjoys 0 tax liability as it is exempted from the RBI’s asset classification norms, provisioning norms, and exposure norms to the extent of direct access to the Ministry of Railways (MoR).

Is IRFC government-owned?

IRFC was incorporated as a public limited company on 12th December 1986 by the Ministry of Railways as a wholly owned government public financial institution to raise resources and funds to meet the development areas of the Indian Railways.

Who is the MD and CEO of IRFC?

Uma Ranade is the Chairman and Managing Director (Additional Charge) of IRFC.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.